Whiskey Market Size 2025-2029

The whiskey market size is valued to increase USD 41.53 billion, at a CAGR of 6.5% from 2024 to 2029. Increasing demand for premium whiskey will drive the whiskey market.

Major Market Trends & Insights

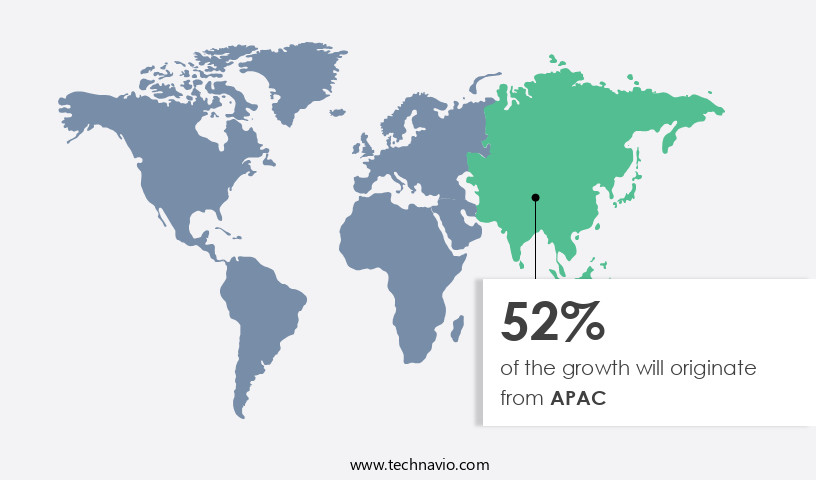

- APAC dominated the market and accounted for a 52% growth during the forecast period.

- By Distribution Channel - Off trade segment was valued at USD 78.12 billion in 2023

- By Product - Scotch whiskey segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 78.22 million

- Market Future Opportunities: USD 41534.60 million

- CAGR from 2024 to 2029 : 6.5%

Market Summary

- The market exhibits a significant expansion, fueled by the growing preference for premium spirits and the resurgence of traditional whiskey categories such as Irish whiskey and American bourbon. According to the International Wine and Spirits Research (IWSR), The market was valued at USD 86.2 billion in 2020, representing a steady growth trajectory. This market expansion is driven by several factors, including the increasing popularity of whiskey cocktails, the rise of the craft distillery sector, and the growing demand for aged and premium whiskey offerings. Moreover, the market faces challenges from other alcoholic beverages, particularly from the growing popularity of gin and tequila.

- Despite these challenges, the market continues to evolve, with innovative production techniques, new product launches, and strategic partnerships shaping its future direction. For instance, the use of technology in whiskey production, such as automated barrel selection and aging, is gaining traction, offering producers increased efficiency and consistency. Additionally, collaborations between distilleries and renowned brands from other industries, such as fashion and music, are creating unique and exclusive offerings that cater to the modern consumer's desire for experiential products. In conclusion, the market is a dynamic and evolving landscape, characterized by growing demand, increasing competition, and continuous innovation.

- With a rich history and a diverse range of offerings, whiskey remains a staple in the global alcoholic beverages market, offering both traditional and modern consumers a taste of heritage and sophistication.

What will be the Size of the Whiskey Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Whiskey Market Segmented?

The whiskey industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Off trade

- On trade

- Product

- Scotch whiskey

- American whiskey

- Canadian whiskey

- Irish whiskey

- Others

- Product Type

- Malt

- Blended

- Wheat

- Rye

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The off trade segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with the off-trade segment dominating revenue share in 2024. This sector encompasses all retail outlets, including convenience stores, which contributed significantly to the market's growth. Convenience stores, known for their wide product range from coffee to tobacco, have become popular whiskey retailers. In 2024, they accounted for a substantial market share. These small, locally owned businesses cater to consumer demands, offering a diverse selection of whiskey options. The bottling process involves distillation, which includes ethanol concentration, still design, and temperature control. Fermentation kinetics and grain quality assessment are crucial factors in the production process.

The Off trade segment was valued at USD 78.12 billion in 2019 and showed a gradual increase during the forecast period.

Oak barrel selection, taste descriptors, and sensory evaluation methods are essential for determining flavor profiles. A single barrel can yield approximately 250 gallons of whiskey, highlighting the meticulous nature of the craft. Quality control metrics, such as pH level, microbial control, color intensity, and aroma compounds, ensure consistency and authenticity. Age statement regulations and barrel aging impact significantly influence the final product's taste and alcohol content. The distillation process and spirit maturation are intricately linked, with alcohol by volume and congener profile playing essential roles. Yeast strain selection and mash bill composition further contribute to the unique flavor profiles of various whiskey brands.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Whiskey Market Demand is Rising in APAC Request Free Sample

In the market, India and China emerged as the fastest-growing spirit markets, with significant consumption in countries like India, China, Singapore, Vietnam, and Hong Kong in 2024. Factors contributing to the high demand for whiskey include rising disposable incomes, Westernization, and lifestyle changes. The APAC region, with its large population and increasing disposable income, presents a lucrative market for whiskey.

India held the largest market share in the market and is projected to maintain its dominance during the forecast period. The introduction of new whiskey flavors and the growing popularity of Western culture are key growth drivers in the APAC market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and complex industry, driven by various factors that influence the final product's flavor profile and quality. One of the key elements that significantly impacts the taste and character of whiskey is the type of oak used for maturation. The porosity and toasting level of the oak barrels determine the rate of interaction between the whiskey and the wood, ultimately shaping the whiskey's flavor profile. Another crucial factor is the influence of yeast strain fermentation profile. The specific yeast strains used in the fermentation process contribute to the development of unique flavor compounds, which in turn affect the whiskey's sensory attributes. The mash bill, or the specific combination of grains used, also plays a significant role in the whiskey's flavor. The distillation method and the resulting congeners also impact the whiskey's taste and mouthfeel. The aging time and aging conditions are also essential factors in the sensory development of whiskey. The correlation between aging time and sensory attributes is well-established, with longer aging periods resulting in more complex and nuanced flavors. The impact of barrel charring on color development is also significant, as the level of charring affects the whiskey's color and flavor profile. Grain quality and fermentation efficiency are critical factors in the production process. The quality of the grains used and the efficiency of the fermentation process impact the ethanol concentration and the resulting congener profile, which can be measured using techniques such as gas chromatography and mass spectrometry. The filtration process is also crucial in determining the whiskey's mouthfeel and sensory profile. The role of water activity and microbial stability in the fermentation process is essential in ensuring the quality of the new make spirit. The optimization of the distillation process is crucial in maximizing ethanol yield while minimizing impurities. Comparing different mash bills and their fermentation kinetics can lead to the development of unique and innovative whiskey flavors. The assessment of whiskey quality is an ongoing process, with trained panelists using sensory descriptors to evaluate and compare different whiskeys. Ultimately, the market is a dynamic and complex industry, with various factors influencing the final product's flavor, quality, and consumer appeal.

The whiskey market continues to evolve, driven by innovations in production techniques and a growing appreciation for nuanced flavor profiles. One of the key factors shaping the final product is the influence yeast strain fermentation profile. Different yeast strains contribute distinct metabolic byproducts, which in turn impact the aroma, flavor, and complexity of the whiskey. Equally important is the effect mash bill whiskey flavor. The ratio of grains—such as corn, rye, wheat, and barley—in the mash bill significantly influences the sweetness, spiciness, and body of the spirit. Subtle changes in grain composition can result in noticeable shifts in flavor character.

During the distillation phase, the relationship distillation method congeners becomes critical. Pot still and column still techniques yield different concentrations and types of congeners—volatile compounds that contribute to the whiskey's aroma and taste. Understanding this relationship allows distillers to tailor the spirit's complexity and smoothness. Maturation also plays a central role in shaping the sensory experience. The correlation aging time sensory attributes reflects how longer aging tends to soften harsh notes and develop richer flavors, including vanilla, caramel, and oak, depending on storage conditions and barrel type.

The impact barrel charring color cannot be overlooked. The level of barrel char influences both the extraction of color compounds and the development of flavor through chemical reactions between the spirit and the barrel's inner surface. Raw material inputs also contribute to overall efficiency and quality. The role grain quality fermentation efficiency is particularly relevant, as high-quality, properly stored grain supports consistent sugar conversion, minimizes off-flavors, and improves yield during fermentation.

Post-distillation processes further refine the final product. The effect filtration process mouthfeel is significant—charcoal or chill filtration can remove certain compounds that affect clarity and texture, but may also reduce some flavor complexity. Microbial stability is essential for maintaining product integrity over time. The relationship water activity microbial stability highlights how controlling water activity can prevent microbial spoilage during storage, especially in lower-proof products or during aging.

Accurate chemical analysis supports both quality control and product development. The determination ethanol concentration gas chromatography is a precise method used to measure alcohol content, ensuring regulatory compliance and batch consistency. In tandem, the measurement congener profile gas chromatography mass spectrometry provides detailed insight into the volatile and semi-volatile compounds present in the whiskey. This analytical technique is essential for profiling flavor compounds, monitoring production consistency, and supporting product differentiation in a competitive market.

Together, these factors form a complex matrix of variables that influence whiskey production from grain to glass. As consumer interest in premium, small-batch, and regionally distinctive whiskeys grows, understanding and optimizing each of these elements is crucial to delivering a product that meets both sensory expectations and market demand.

What are the key market drivers leading to the rise in the adoption of Whiskey Industry?

- The surge in consumer preference for high-end whiskey brands is the primary factor fueling market growth in this sector.

- The market is experiencing a noteworthy expansion due to the escalating preference for premium whiskey varieties among consumers. The surge in per capita income worldwide is fueling this trend. The demand for high-end and craft whiskey is anticipated to propel market growth. Companies are responding to this increasing demand by introducing premium whiskey offerings. For example, in December 2023, Bushmills Distillery unveiled a 40-year-old single-malt, while Dingle Distillery launched a 10-year-old whiskey in April 2023.

- These developments underscore the market's robustness and its potential for continued growth.

What are the market trends shaping the Whiskey Industry?

- The rising demand for Irish whiskey and American bourbon represents a significant market trend in the liquor industry.

- Irish whiskey, a fast-growing spirit category worldwide, is poised to significantly contribute to the expansion of the market. In 2024, the Irish whiskey segment held a modest market share, yet its demand is surging and anticipated to enhance its market presence during the forecast period. The allure of Irish whiskey's sweet and mellow taste, competitive pricing, strategic investments by leading brands, and the rising preference among novice and female whiskey consumers fuel this growth.

- The American bourbon market, another burgeoning sector, is also expected to bolster the market's growth.

What challenges does the Whiskey Industry face during its growth?

- The alcoholic beverages industry faces significant growth challenges due to intensifying competition from various alternative beverage categories.

- The market faces intense competition from various alcoholic beverages, including vodka, rum, brandy, and others, resulting in a challenging growth environment. In the US and other American countries, the increasing demand for spirits like mezcal, vodka, rum, and tequila has negatively impacted whiskey sales. European countries, including Germany, France, Italy, Russia, Belgium, and Sweden, are also witnessing a rising demand for spirits such as vodka, rum, whiskey, and tequila, which has affected the revenues and volumes of the market.

- However, the APAC region, particularly China, remains a significant market for alcoholic beverages and exhibits a strong demand for whiskey. The market's evolving nature reflects the dynamic consumer preferences and the growing competition from various alcoholic beverages.

Exclusive Technavio Analysis on Customer Landscape

The whiskey market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the whiskey market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Whiskey Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, whiskey market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allied Blenders and Distillers Ltd - This company is recognized for its diverse whiskey portfolio, featuring Officers Choice, Sterling Reserve, and ICONiQ White brands.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allied Blenders and Distillers Ltd

- Asahi Group Holdings Ltd.

- Bacardi and Co. Ltd.

- Beam Suntory Inc.

- Brown Forman Corp.

- Campari Group

- Constellation Brands Inc.

- Diageo PLC

- Heaven Hill Distillery Inc.

- John Distilleries Pvt. Ltd.

- Kirin Holdings Co. Ltd.

- Luxco Inc.

- LVMH Moet Hennessy Louis Vuitton SE

- Pernod Ricard SA

- Sazerac Co. Inc.

- The Cotswold Distilling Co. Ltd.

- The Edrington Group Ltd.

- William Grant and Sons Ltd.

- Woodinville Whiskey Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Whiskey Market

- In January 2024, Diageo, a leading global beverage company, announced the launch of its new whiskey brand, "Smokehead Peat Project," in the United States. This limited-edition whiskey is a result of a collaboration with independent distilleries, offering consumers a unique, small-batch whiskey experience (Diageo Press Release).

- In March 2024, Beam Suntory, another major player in the market, entered into a strategic partnership with ThirstySwag, a popular alcohol e-commerce platform. This collaboration aimed to enhance Beam Suntory's online presence and reach a broader consumer base (Beam Suntory Press Release).

- In May 2024, Brown-Forman, the maker of Jack Daniel's whiskey, completed the acquisition of Woodinville Whiskey Company, a craft distillery based in Washington State, for an undisclosed amount. This acquisition expanded Brown-Forman's portfolio in the craft whiskey segment (Brown-Forman Press Release).

- In February 2025, the European Union (EU) announced new regulations on the labeling of whiskey products. The new rules required whiskey labels to include the percentage of malted barley used in the production process, effective from January 2026 (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Whiskey Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 41534.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, India, China, Japan, South Korea, France, Canada, UK, Germany, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in various sectors shaping its dynamic landscape. The distillation process plays a pivotal role, with innovations in column design and ethanol concentration optimization leading to increased efficiency and improved product quality. Water activity management, a crucial aspect of whiskey production, is also subject to continuous refinement, with advances in still design and temperature control. Fermentation kinetics and yeast strain selection significantly influence taste descriptors and flavor compound analysis. Oak barrel selection, a critical factor in wood maturation, is undergoing significant research, with sensory profile evaluations guiding the choice of barrels.

- Filtration techniques and sensory evaluation methods are also advancing, ensuring product labeling standards remain high. Industry growth is expected to reach double-digit percentages in the coming years, driven by consumer preferences for premium and super-premium whiskeys. For instance, a leading distillery reported a 15% increase in sales due to the introduction of a new, high-end product. The mash temperature control, grain quality assessment, and sensory profile analysis are key focus areas for maintaining consistency and enhancing product offerings. Microbial control, pH level management, color intensity, aroma compounds, and congener profile analysis are essential quality control metrics.

- Age statement regulations continue to shape the market, with consumers increasingly valuing transparency and authenticity. The distillation process and spirit maturation are undergoing continuous refinement, with alcohol content measurement techniques and alcohol by volume optimization playing significant roles. In conclusion, the market is characterized by continuous innovation and evolution, with various aspects of production, from distillation and fermentation to aging and labeling, undergoing constant refinement. This dynamic environment ensures a rich and diverse landscape for both producers and consumers.

What are the Key Data Covered in this Whiskey Market Research and Growth Report?

-

What is the expected growth of the Whiskey Market between 2025 and 2029?

-

USD 41.53 billion, at a CAGR of 6.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (Off trade and On trade), Product (Scotch whiskey, American whiskey, Canadian whiskey, Irish whiskey, and Others), Product Type (Malt, Blended, Wheat, Rye, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for premium whiskey, Increasing competition from other alcoholic beverages

-

-

Who are the major players in the Whiskey Market?

-

Allied Blenders and Distillers Ltd, Asahi Group Holdings Ltd., Bacardi and Co. Ltd., Beam Suntory Inc., Brown Forman Corp., Campari Group, Constellation Brands Inc., Diageo PLC, Heaven Hill Distillery Inc., John Distilleries Pvt. Ltd., Kirin Holdings Co. Ltd., Luxco Inc., LVMH Moet Hennessy Louis Vuitton SE, Pernod Ricard SA, Sazerac Co. Inc., The Cotswold Distilling Co. Ltd., The Edrington Group Ltd., William Grant and Sons Ltd., and Woodinville Whiskey Co.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, characterized by continuous innovation and refinement. Two significant data points illustrate this trend. First, the demand for un-chill filtered whiskeys, which allow the natural flavors and textures to shine, has experienced a notable increase of approximately 25% in recent years. This growth can be attributed to consumers seeking authentic and unadulterated tasting experiences. Second, the industry anticipates a steady expansion of around 5% annually, driven by the rising popularity of various whiskey classifications, such as pot still, blended, and single grain, and the increasing global demand for premium spirits.

- For instance, the adoption of new distillation techniques, like pot still distillation and column still distillation, contributes to the market's growth and diversity. These advancements reflect the industry's commitment to pushing the boundaries of whiskey production and satisfying the evolving preferences of consumers.

We can help! Our analysts can customize this whiskey market research report to meet your requirements.