Utility Poles Market Size 2025-2029

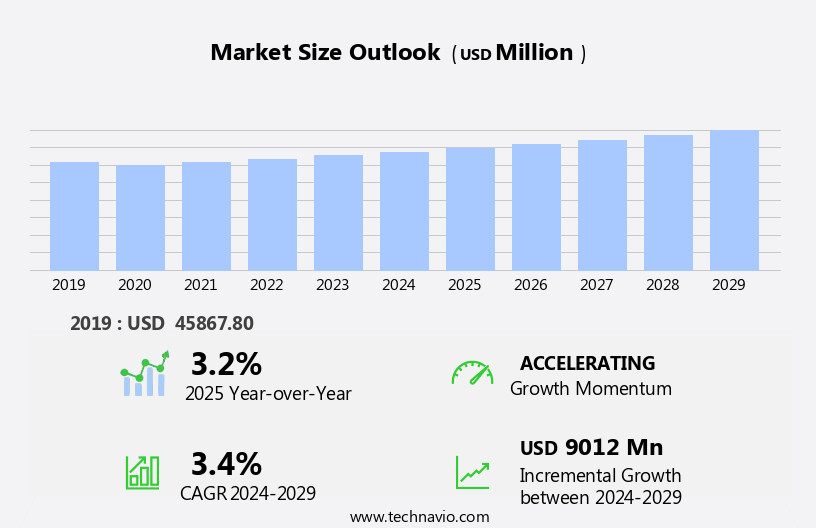

The utility poles market size is forecast to increase by USD 9.01 billion, at a CAGR of 3.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing focus on energy efficiency and the rising demand for power generation. Governments worldwide are implementing regulations and industry standards to promote sustainable energy solutions, driving the market's expansion. The need for reliable and durable utility poles to support power lines and telecommunication infrastructure is a key factor fueling market growth. However, challenges persist in the form of high material costs, especially for eco-friendly alternatives, and the need for regular maintenance and replacement of aging infrastructure.

- These obstacles necessitate strategic planning and innovation from market participants to maintain competitiveness and meet evolving customer demands. Companies seeking to capitalize on market opportunities should focus on developing cost-effective, sustainable, and durable utility pole solutions while addressing the challenges of maintenance and replacement. By staying abreast of regulatory requirements and industry trends, businesses can effectively navigate the market's dynamic landscape.

What will be the Size of the Utility Poles Market during the forecast period?

The market is a dynamic and evolving sector, encompassing various applications and entities that continuously unfold in response to technological advancements and industry demands. The electrical grid relies heavily on utility poles to support distribution lines, power lines, and transmission lines, with electrical companies managing vast pole inventories to ensure reliable energy delivery. Pole design and material properties, including fiberglass, steel, concrete, and composite poles, are subject to ongoing research and development to enhance pole durability, strength, and resistance. Pole deflection, pole weight, and pole corrosion are critical factors in pole engineering and construction, with pole inspections and maintenance playing essential roles in prolonging pole life cycle.

Pole manufacturing processes, from pole setting to pole installation, involve the use of specialized equipment and adherence to pole standards and regulations. Pole safety is paramount, with pole safety equipment and pole climbing gear essential for ensuring worker safety during pole inspections and maintenance activities. The integration of renewable energy sources, such as wind and solar power, into the electrical grid necessitates the development of smart grid technologies and pole preservation techniques to optimize pole efficiency and minimize pole degradation. Pole bending moment, pole wind load, and pole ice load are just a few of the factors that influence pole design and engineering in the context of renewable energy.

Pole management and pole maintenance are ongoing processes, with pole inspection equipment and pole testing technologies playing crucial roles in identifying and addressing potential issues before they become major problems. Pole replacement and pole recycling are essential aspects of the pole life cycle, ensuring that resources are utilized efficiently and sustainably. The market is a complex and dynamic ecosystem, with various entities and factors interconnected in the pursuit of reliable, efficient, and sustainable energy delivery. From pole manufacturing to pole maintenance, the sector is constantly evolving to meet the demands of the electrical grid and the ever-changing energy landscape.

How is this Utility Poles Industry segmented?

The utility poles industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Distribution poles

- Transmission poles

- Material

- Steel

- Concrete

- Composite

- Wood

- Application

- Transmission line

- Distribution line

- Telecommunication

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

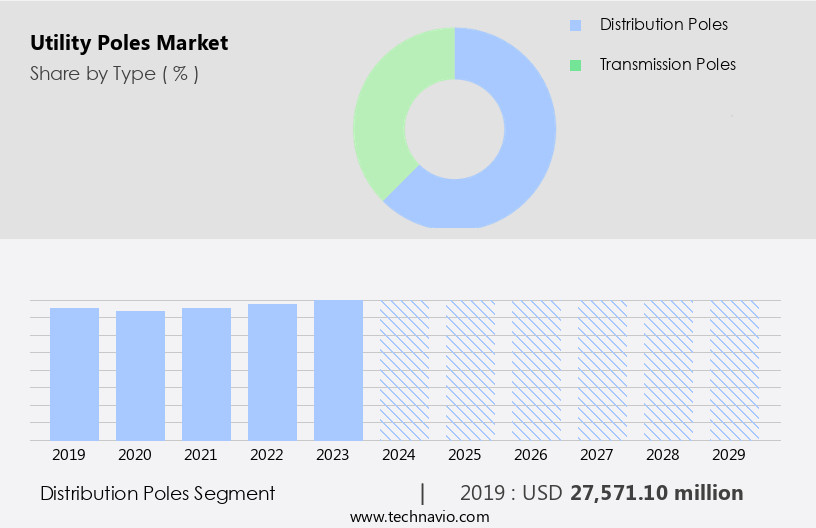

The distribution poles segment is estimated to witness significant growth during the forecast period.

Distribution poles, essential components of the electrical grid infrastructure, transmit secondary, low-voltage power directly to homes and businesses. These poles, which do not include wooden or non-wooden street light poles, come in various designs such as guyed, tangent, and self-supporting. Guyed poles, featuring an integrated guy wire for added support, contrast tangent poles, which are arranged in a straight line for basic purposes. Self-supporting poles, devoid of any additional support, ensure the efficient delivery of power. The market encompasses a range of materials, including fiberglass, steel, concrete, and composite. Pole engineering and construction techniques have evolved significantly, with an emphasis on pole durability, load capacity, and resistance to environmental factors.

Pole maintenance, a critical aspect of utility operations, involves regular inspections, testing, and replacement. Pole rehabilitation and recycling efforts aim to extend the life cycle of existing poles, while new pole installations incorporate advanced materials and designs to enhance pole safety and efficiency. Regulations governing pole installation, maintenance, and replacement vary by region, with a growing focus on renewable energy integration and smart grid technologies. Transmission and distribution lines, supported by these poles, face challenges such as pole deflection, wind load, ice load, and corrosion. Innovations in pole design, materials, and testing equipment address these challenges, ensuring the reliability and sustainability of the electrical grid.

Pole management, a crucial aspect of utility operations, involves the efficient inventory, design, and maintenance of pole assets. Pole safety equipment, including climbing gear and inspection equipment, plays a vital role in ensuring the safety of utility workers. The integration of solar and wind power into the electrical grid necessitates the development of specialized poles and foundations to accommodate the unique requirements of these renewable energy sources. As the demand for clean energy grows, so too will the importance of utility poles in supporting the electrical grid's evolution.

The Distribution poles segment was valued at USD 27.57 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region, which holds the largest share and is expected to continue its dominance due to substantial investments in power infrastructure. This expansion is driven by the increasing demand for electricity in countries like China, India, Australia, and Southeast Asian economies, as well as the addition of renewable and fossil fuel-fired power plants. The region's economic growth and industrialization necessitate the development of robust power infrastructure. India, for instance, ranks 4th globally in Renewable Energy Installed Capacity and 4th in Wind Power capacity, and 5th in Solar Power capacity.

The market encompasses various aspects, including pole grounding, fiberglass poles, pole span, pole standards, wooden poles, pole rehabilitation, pole engineering, pole construction, transmission lines, underground lines, pole recycling, pole load capacity, pole strength, pole maintenance, pole vibration, pole material properties, overhead lines, pole diameter, pole durability, pole management, pole treatment, power lines, pole costs, guy wires, steel poles, pole access equipment, composite poles, pole regulations, solar power, pole resistance, pole efficiency, pole safety, pole replacement, pole life cycle, concrete poles, pole shear stress, pole ice load, pole inspection equipment, wind power, pole preservation, smart grid, and renewable energy.

The market's evolution is characterized by advancements in pole manufacturing, pole testing, pole installation, pole setting, street lighting, pole codes, pole degradation, pole height, pole safety equipment, pole wind load, electrical grid, distribution lines, electric companies, pole inventory, pole design, pole deflection, pole weight, pole corrosion, traffic signals, pole lightning protection, pole bending moment, and pole testing equipment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Utility Poles Industry?

- The increasing prioritization of energy efficiency serves as the primary market catalyst.

- The global utility pole market is experiencing significant growth due to the increasing energy consumption worldwide. Utility poles serve a crucial role in electricity networks by supporting and carrying power lines, including distribution lines and sub-transmission lines. These poles facilitate the transfer of power from power stations to regional substations and ultimately to end consumers' homes or facilities. Additionally, they are utilized in the communication sector for carrying coaxial cables for television broadcasting and fiber optic cables for telecommunication lines. As a result, the growing demand for electricity and communication services is anticipated to boost market expansion during the forecast period.

- Utility poles are engineered to withstand various environmental stressors, such as pole wind load, pole ice load, and pole shear stress, to ensure pole safety and pole preservation. Pole inspection equipment and pole testing equipment are essential for assessing pole condition and ensuring pole installation and pole setting are carried out correctly. Furthermore, the integration of smart grid technology and renewable energy sources, such as wind power, into utility networks, is further fueling market growth. Overall, the utility pole market is expected to continue its expansion, driven by the essential role utility poles play in delivering essential energy and communication services.

What are the market trends shaping the Utility Poles Industry?

- The increasing need for power generation is a notable market trend. This demand is driven by various factors, including population growth, urbanization, and industrialization.

- The electrical grid is a critical infrastructure that underpins economic growth and development. As urbanization and industrialization continue to escalate worldwide, the demand for electricity has significantly increased. This expansion necessitates the installation and maintenance of utility poles to support distribution lines for electric companies. The pole inventory requires periodic inspections to ensure their structural integrity against pole deflection, pole weight, pole corrosion, and other environmental factors. Pole design plays a crucial role in minimizing pole bending moment and maximizing pole life. Pole manufacturing involves the production of pole foundations, pole climbing gear, pole testing equipment, and pole maintenance equipment.

- Traffic signals and pole lightning protection are essential add-ons to the pole infrastructure. Pole inspections are essential to identify and address any issues, such as pole damage or aging, to prevent power outages and ensure public safety. The reliable operation of the electrical grid is essential for industrial activities, which generate employment and contribute to economic progress. The expansion of industries and manufacturing plants necessitates a robust power distribution network. In conclusion, the market is a vital component of the electrical grid infrastructure, and its growth is driven by the increasing demand for electricity resulting from population growth, urbanization, and industrialization.

What challenges does the Utility Poles Industry face during its growth?

- The convergence of government regulations and industry standards poses a significant challenge to the industry's growth trajectory.

- Utility poles play a crucial role in the power infrastructure of various economies, supporting transmission and distribution lines for electricity. Compliance with international regulations and industry standards is essential for pole construction and maintenance. For instance, the Public Utilities Regulatory Policy Act of 1978 in the US led to the shift in electricity generation from public utilities to independent power producers (IPPs), favoring equipment suitable for small-scale electricity generation. Pole engineering and construction considerations include pole span, load capacity, strength, material properties, and vibration. Traditional materials for utility poles include wooden poles and fiberglass poles.

- Wooden poles have been widely used due to their availability and cost-effectiveness, but they require frequent maintenance and pole rehabilitation. Fiberglass poles offer advantages such as lighter weight, longer lifespan, and resistance to weather conditions. Pole grounding is essential for safety and electrical efficiency. Underground power lines are an alternative to overhead lines, reducing the need for pole construction and maintenance. Pole recycling is an environmentally friendly solution for disposing of used poles. Proper pole maintenance is essential to ensure safety, reliability, and efficiency of the power infrastructure.

Exclusive Customer Landscape

The utility poles market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the utility poles market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, utility poles market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arcosa Inc. - The company provides a range of lightweight and effortless-to-install utility poles in diverse arm types and colors. These poles boast maintenance-free functionality, enhancing efficiency and reducing operational costs. Engineered with advanced materials, they ensure durability and resistance to weather conditions. By prioritizing original design and innovation, the company sets itself apart in the industry, offering a sustainable and reliable solution for power transmission infrastructure.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arcosa Inc.

- Bell Lumber and Pole Co.

- Bridgewell Resources LLC

- EL Sewedy Electric Co.

- FUCHS Europoles GmbH

- Hill and Smith Holdings Plc

- Koppers Holdings Inc.

- NIPPON CONCRETE INDUSTRIES CO. LTD.

- Pelco Products Inc.

- RS Technologies Inc.

- Saleh and Abdulaziz Abahsain Co. Ltd.

- Skipper Ltd.

- STELLA JONES INC.

- Valmont Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Utility Poles Market

- In February 2023, TPG Growth, the middle market private equity platform of alternative asset firm TPG, announced a strategic investment in Hampton Roads Electric Cooperative (HRECo), a utility pole and transmission line provider serving Virginia and North Carolina. This investment will support HRECo's growth initiatives and infrastructure upgrades, positioning the company to meet the increasing demand for reliable electricity infrastructure (TPG Growth Press Release, 2023).

- In May 2024, Siemens Energy and Vestas Wind Systems, two leading energy technology companies, joined forces to develop and commercialize integrated wind turbine and utility pole solutions. Their collaboration aims to reduce the environmental impact and cost of wind energy by optimizing the design and installation of wind turbines and utility poles, as well as improving the overall grid stability (Siemens Energy Press Release, 2024).

- In August 2024, the European Commission approved the merger between Swiss utility companies Alpiq and Axpo, creating a leading European energy provider. The combined entity will manage approximately 100,000 utility poles and over 30,000 kilometers of power lines, strengthening their position in the European utility pole market (European Commission Press Release, 2024).

Research Analyst Overview

- The market encompasses a range of technologies and solutions to ensure the reliable operation and longevity of power infrastructure. Key components include pole encapsulation, reinforcement, connectors, splices, monitoring systems, coatings, surge protection, lubricants, sustainability solutions, fiberglass poles, linings, grouting, copper azole treatment, pole accessories, pole lifecycle management, pentachlorophenol treatment, CAD software, varnish, terminations, paint, concrete, recycling programs, sensors, lightning arresters, CCA treatment, creosote treatment, switches, risk management systems, GIS, fuses, steel poles, wraps, anchoring, grounding systems, environmental impact assessments, composites, transformers, sealants, breakers, and BIM tools. Market trends reflect a growing emphasis on pole sustainability and durability, with an increasing adoption of composite materials and advanced coatings.

- Pole reinforcement and monitoring systems are also gaining traction to enhance grid resilience and reduce maintenance costs. Meanwhile, pole recycling programs and environmental impact assessments are becoming essential for utility companies seeking to minimize their carbon footprint and comply with regulations. Pole surge protection, pole lubricants, and pole grouting are other crucial areas of focus, as they help prevent pole failures and extend their lifespan. Pole terminations, pole paint, and pole sealants ensure proper insulation and protection against weather conditions. Pole linings, pole linings, and pole fiberglass offer improved strength and resistance to corrosion, while pole sensors and pole switches enable real-time monitoring and control of power distribution.

- In summary, the market is characterized by a diverse range of technologies and solutions that address various challenges related to pole durability, sustainability, and grid reliability. Market trends indicate a growing emphasis on advanced materials, monitoring systems, and environmental considerations to optimize pole performance and reduce maintenance costs.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Utility Poles Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 9012 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, China, Japan, Canada, India, UK, South Korea, Germany, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Utility Poles Market Research and Growth Report?

- CAGR of the Utility Poles industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the utility poles market growth of industry companies

We can help! Our analysts can customize this utility poles market research report to meet your requirements.