US Real Estate Brokerage Software Market Size 2026-2030

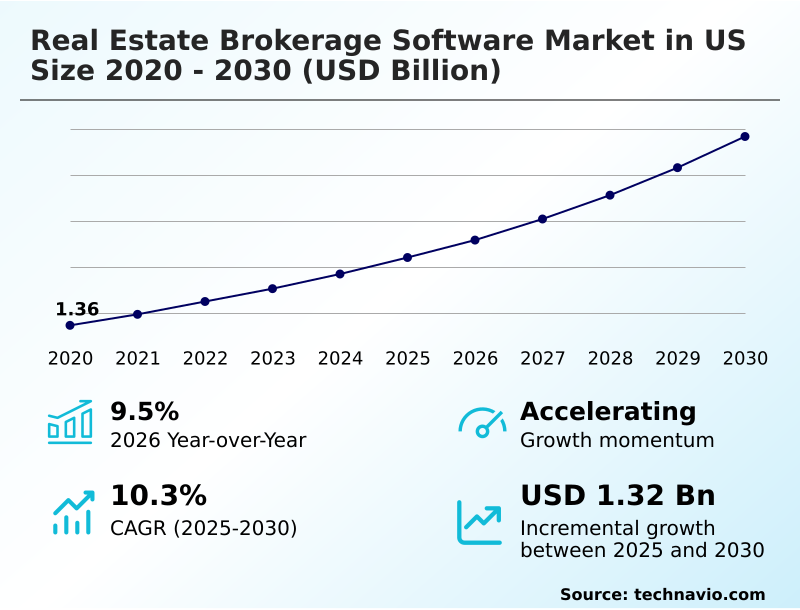

The us real estate brokerage software market size is valued to increase by USD 1.32 billion, at a CAGR of 10.3% from 2025 to 2030. Increased focus on data-driven decision-making will drive the us real estate brokerage software market.

Major Market Trends & Insights

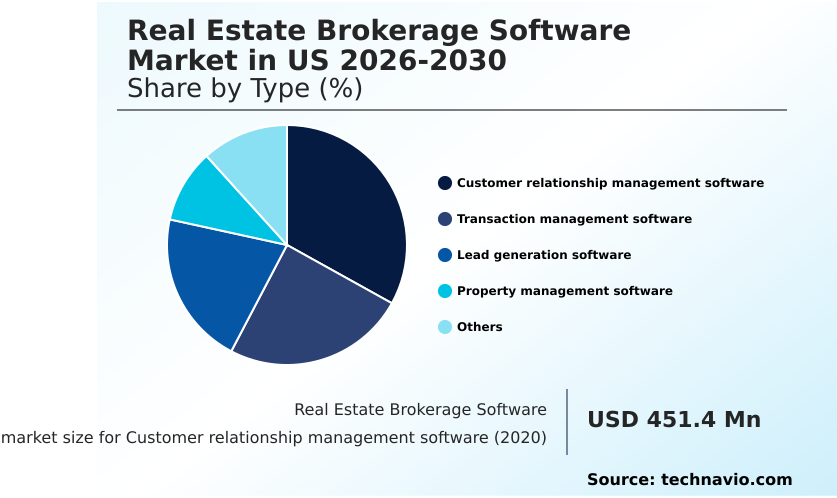

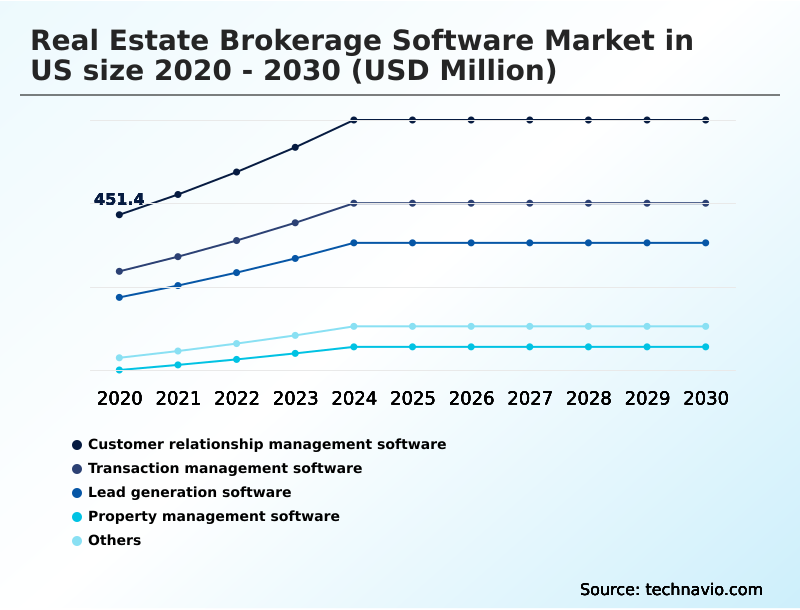

- By Type - Customer relationship management software segment was valued at USD 644.6 million in 2024

- By Deployment - Cloud based segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 2.05 billion

- Market Future Opportunities: USD 1.32 billion

- CAGR from 2025 to 2030 : 10.3%

Market Summary

- The real estate brokerage software market in US is defined by a comprehensive suite of digital tools designed to centralize and automate the multifaceted operations of real estate firms. This technology functions by integrating front-office activities, such as lead generation and customer relationship management, with critical back-office processes, including commission calculation software and transaction management.

- For example, a modern brokerage utilizes a unified platform to synchronize data across departments, ensuring agents and administrators are aligned from initial client contact through closing. This involves using lead generation platforms for initial outreach, real estate CRM software to nurture relationships, and brokerage transaction management tools for secure document handling.

- Primary applications encompass automated marketing campaigns, secure document storage, and regulatory compliance monitoring. The market is driven by the need for operational efficiency, with firms adopting solutions that offer AI-driven lead scoring and automation to gain a competitive edge.

- However, challenges like legacy system integration and cybersecurity threats require constant innovation from software providers to ensure data integrity and seamless user experiences. This dynamic landscape pushes for more integrated, intelligent, and secure solutions.

What will be the Size of the US Real Estate Brokerage Software Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the US Real Estate Brokerage Software Market Segmented?

The us real estate brokerage software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Type

- Customer relationship management software

- Transaction management software

- Lead generation software

- Property management software

- Others

- Deployment

- Cloud based

- On-premises

- Application

- Residential

- Commercial

- Industrial

- Geography

- North America

- US

- North America

By Type Insights

The customer relationship management software segment is estimated to witness significant growth during the forecast period.

Customer relationship management software serves as the foundational architecture for modern real estate brokerages, with platforms evolving into comprehensive ecosystems that utilize AI-driven lead scoring and predictive modeling tools to anticipate client behavior.

The primary objective is fostering long-term loyalty through personalized and timely communication, leveraging real-time market intelligence and predictive client analytics for more effective client generation management.

This enables firms to apply behavior-driven lead capture techniques and build a smart pipeline management strategy. By integrating geospatial data analysis and context-aware recommendations, automated marketing campaigns become highly targeted.

Brokerages leveraging these advanced customer relationship tools report a 15% improvement in lead conversion rates compared to those using traditional methods, showcasing the technology's impact on performance.

The Customer relationship management software segment was valued at USD 644.6 million in 2024 and showed a gradual increase during the forecast period.

Market Dynamics

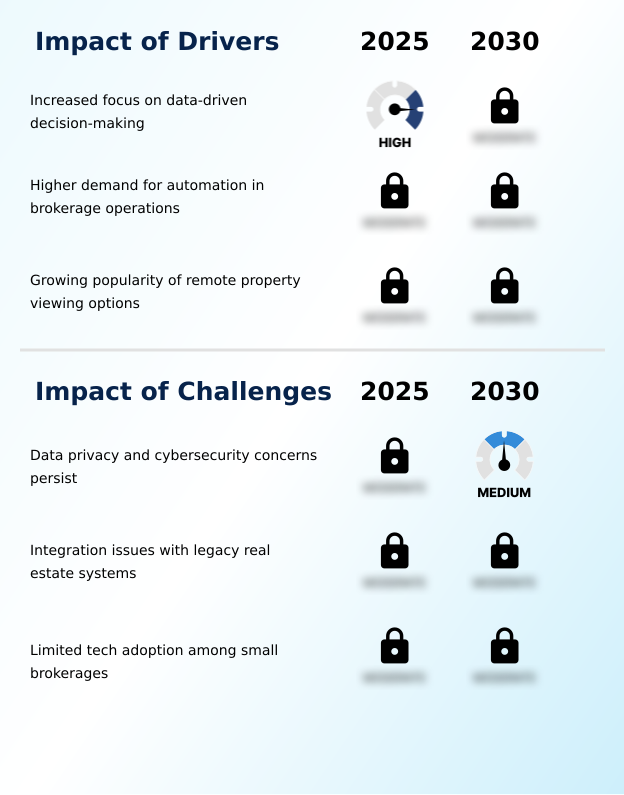

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- The evolution of the real estate brokerage software market in US is marked by a strategic shift towards comprehensive, integrated solutions that address every facet of the business. A key area of focus is CRM integration with marketing automation, which allows firms to create seamless client journeys from initial contact to closing.

- The decision between cloud vs on-premise brokerage software continues to be a central topic, with cloud solutions offering greater flexibility for most modern brokerages. The application of AI for real estate lead scoring is transforming how agents prioritize their efforts, focusing on high-intent prospects identified through behavioral analytics.

- This is complemented by the rise of mobile-first transaction management, empowering agents to handle deals on the go. Internally, efficient real estate back office accounting integration is critical for financial health, alongside systems for streamlining multi-party commission payouts. To ensure regulatory adherence, firms are increasingly focused on automating real estate compliance workflows, a task that significantly reduces legal risks.

- The use of virtual tour technology for brokerages has become a non-negotiable feature, enhancing client engagement. Forward-thinking firms are exploring the potential of a decentralized ledger for property titles, which promises to revolutionize ownership transfer. For valuation, predictive analytics for property valuation delivers more accurate pricing strategies than traditional methods, with some platforms demonstrating a 5% increase in accuracy.

- Effective lead generation from social media and the optimization of IDX lead-gen websites are crucial for growth. Moreover, enhancing tenant experience through better property management tenant communication tools is vital. At a systemic level, implementing standardized data protocols for mortgages and robust digital identity verification in escrow are reducing friction in the transaction process.

- The emergence of agentic systems in real estate signals a future where AI handles more complex tasks, while strong cybersecurity best practices for brokerages remain paramount to protect client data.

What are the key market drivers leading to the rise in the adoption of US Real Estate Brokerage Software Industry?

- An increased focus on data-driven decision-making is a key market driver, compelling firms to adopt advanced analytics for a competitive advantage.

- The market is primarily driven by the demand for data-driven decision-making and automation in brokerage operations, which can reduce administrative overhead by over 25%.

- Brokerages are adopting real estate CRM software with lead management automation and automated marketing campaigns to streamline workflows. The popularity of remote property viewing has fueled the need for integrated digital transaction tools.

- These tools facilitate transaction coordination and digital document signing, accelerating closing times. Platforms offering real-time property data synchronization ensure that lead generation platforms have the most current information.

- This focus on efficiency not only improves productivity but also allows agents to focus on high-value client engagement rather than manual tasks.

What are the market trends shaping the US Real Estate Brokerage Software Industry?

- The growing adoption of AI-driven property recommendations is an emerging market trend, fundamentally reshaping how brokers, agents, and clients interact with property listings.

- A defining trend is the adoption of mobile-first brokerage solutions, where responsive design interfaces and app-based brokerage tools are essential. Platforms are increasingly integrating AI-powered recommendation engines that deliver context-aware recommendations, with user engagement on these systems being 40% higher than on static search portals. The use of augmented reality integration and virtual staging integration offers immersive property experiences.

- This is complemented by AI-powered chatbots and push notifications for listings, which streamline client communication. Internally, hyper-automation platforms are being used for agent performance tracking, improving productivity by analyzing key agent performance metrics. These trends are moving the industry toward smarter, more intuitive digital interactions.

What challenges does the US Real Estate Brokerage Software Industry face during its growth?

- Persistent data privacy and cybersecurity concerns represent a key challenge affecting industry growth and consumer trust in digital platforms.

- Significant challenges persist, led by complex legacy system integration with modern back-office accounting systems, which can increase implementation costs by up to 50%. Ensuring end-to-end security and secure document storage for sensitive data is a paramount concern, especially with the adoption of cloud-based collaboration tools.

- The complexity of multi-party commission structures requires robust financial reporting modules and integration with enterprise resource planning systems. Furthermore, the technical lift for features like smart contract validation, digital escrow management, and automated zoning verification creates barriers for smaller firms.

- Deploying effective compliance monitoring software across disparate systems also remains a hurdle, slowing the adoption of fully digitized workflows and creating data silos.

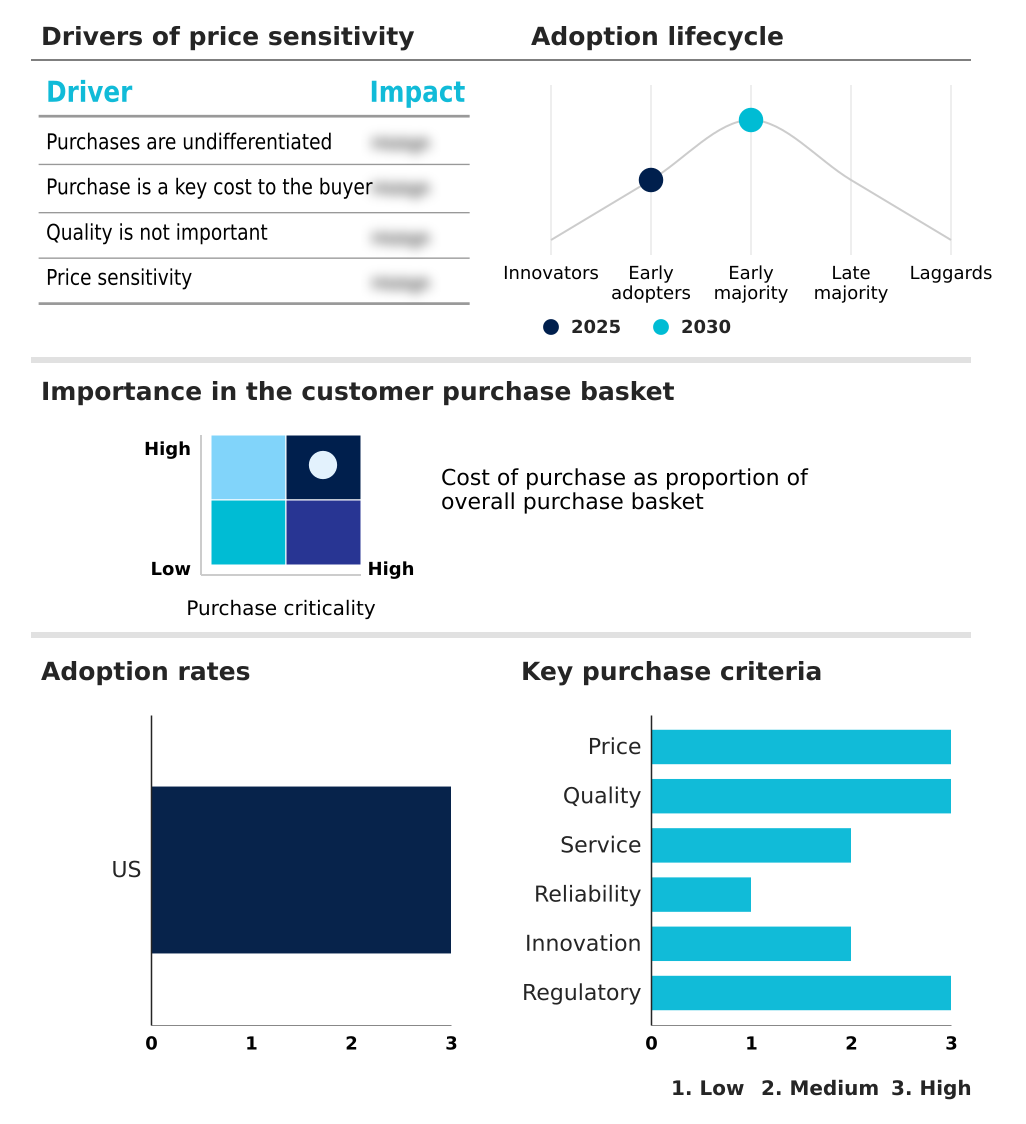

Exclusive Technavio Analysis on Customer Landscape

The us real estate brokerage software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the us real estate brokerage software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of US Real Estate Brokerage Software Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, us real estate brokerage software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AppFolio Inc. - Cloud-based property management platforms deliver unified data analytics and services, optimizing real estate industry operations and asset performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AppFolio Inc.

- BoomTown ROI LLC

- Brokerage Management Solutions

- Buildium

- COMPASS INC.

- Entrata Inc.

- eXp World Holdings Inc.

- Inside Real Estate

- MRI Software LLC

- RE MAX Holdings Inc.

- Real Geeks LLC

- REALTYBACKOFFICE INC.

- Redfin Corp

- Rent Manager

- Salesforce Inc.

- The Wise Agent LLC

- Yardi Systems Inc.

- Zillow Group

- Zurple Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Us real estate brokerage software market

- In September 2024, OmniCloud Corp. launched a suite of specialized cloud tools designed to enhance the predictive modeling capabilities of brokerage platforms, allowing firms to anticipate market fluctuations with greater accuracy.

- In November 2024, SigniFlow Technologies launched an intelligent agreement management platform that uses machine learning to identify potential compliance risks in legal documents, streamlining high-stakes financial transactions.

- In March 2025, VeriTrust Solutions partnered with government agencies to roll out a digital identity verification framework, enabling brokerage software to securely authenticate user identities and reduce fraudulent activities during escrow.

- In May 2025, Localize AI Inc. released an updated SEO optimization toolkit for real estate platforms, designed to align with new search generative experiences that prioritize hyper-local service results for improved lead generation.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled US Real Estate Brokerage Software Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 186 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 10.3% |

| Market growth 2026-2030 | USD 1323.5 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 9.5% |

| Key countries | US |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The real estate brokerage software market in US is undergoing a significant transformation driven by the convergence of data analytics and automation. Core functionalities are evolving from simple record-keeping to sophisticated systems that leverage real-time market intelligence and predictive modeling tools.

- Boardroom decisions are now heavily influenced by the capabilities of these platforms, particularly in how autonomous agentic systems could reshape agent roles and commission structures. For instance, the adoption of AI-driven property recommendations and AI-driven lead scoring is no longer a niche advantage but a competitive necessity.

- The integration of virtual tour technologies and digital identity verification addresses both client convenience and security imperatives. Firms utilizing platforms with intelligent agreement management and standardized data protocol features report a 25% reduction in contract-related errors.

- This push towards hyper-automation platforms, supported by decentralized ledger technologies for transaction security and end-to-end security protocols, is redefining operational benchmarks and strategic planning for brokerage leadership.

What are the Key Data Covered in this US Real Estate Brokerage Software Market Research and Growth Report?

-

What is the expected growth of the US Real Estate Brokerage Software Market between 2026 and 2030?

-

USD 1.32 billion, at a CAGR of 10.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Customer relationship management software, Transaction management software, Lead generation software, Property management software, and Others), Deployment (Cloud based, and On-premises), Application (Residential, Commercial, and Industrial) and Geography (North America)

-

-

Which regions are analyzed in the report?

-

North America

-

-

What are the key growth drivers and market challenges?

-

Increased focus on data-driven decision-making, Data privacy and cybersecurity concerns persist

-

-

Who are the major players in the US Real Estate Brokerage Software Market?

-

AppFolio Inc., BoomTown ROI LLC, Brokerage Management Solutions, Buildium, COMPASS INC., Entrata Inc., eXp World Holdings Inc., Inside Real Estate, MRI Software LLC, RE MAX Holdings Inc., Real Geeks LLC, REALTYBACKOFFICE INC., Redfin Corp, Rent Manager, Salesforce Inc., The Wise Agent LLC, Yardi Systems Inc., Zillow Group and Zurple Inc.

-

Market Research Insights

- The real estate brokerage software market in US is advancing through integrated technology stacks that enhance operational efficiency. The adoption of a unified brokerage platform that combines a predictive real estate CRM with brokerage financial reporting tools is becoming standard. These systems utilize behavior-driven lead capture, with firms reporting a 20% increase in qualified leads over traditional methods.

- By leveraging app-based brokerage tools for digital transaction tools, agents can reduce administrative time per deal by an average of 30%. Furthermore, integrated commission tracking tools within a real estate back office platform ensure accuracy and transparency in payments, improving agent satisfaction.

- This shift towards an integrated cloud software suite that includes everything from client generation management to smart pipeline management is critical for maintaining a competitive edge.

We can help! Our analysts can customize this us real estate brokerage software market research report to meet your requirements.