Pallet Market in US Size 2023-2027

The pallet market in US size is forecast to increase by USD 222.89 mn units at a CAGR of 2.86% between 2022 and 2027.

- The pallet market in the US is witnessing significant growth due to the high demand for pallets in shipping and load-handling sectors. This trend is driven by the increasing importance of efficient logistics and supply chain management in various industries. Additionally, the adoption of advanced pallet-tracking technologies is on the rise, enabling real-time monitoring and improved supply chain visibility. However, the market is also facing challenges such as fluctuations in global crude oil prices, which directly impact the cost of manufacturing pallets from wood and plastic. Despite these challenges, the pallet market in the US is expected to continue its growth trajectory, driven by the increasing need for cost-effective and efficient logistics solutions.

What will be the Size of the Pallet Market in US During the Forecast Period?

- The pallet market in the US is a dynamic and essential component of the logistics industry, facilitating the efficient flow of goods through the supply chain. Pallets come in various designs, including repairable and reusable options, and materials such as wood, metal, and composites. Automation and tracking technologies have revolutionized pallet management, enabling real-time supply chain visibility and optimization.

- Regulations governing the use of wooden pallets, particularly regarding regulations related to humidity and transportation, remain a significant consideration. The market is witnessing innovation in areas such as lightweight, durable, and sustainable pallet solutions, including the use of certification and maintenance programs for cost optimization and compliance.Experts predict continued growth in the pallet market, driven by the demand for efficient logistics systems, management software, and temperature-controlled handling solutions.

How is this US Pallet Industry segmented and which is the largest segment?

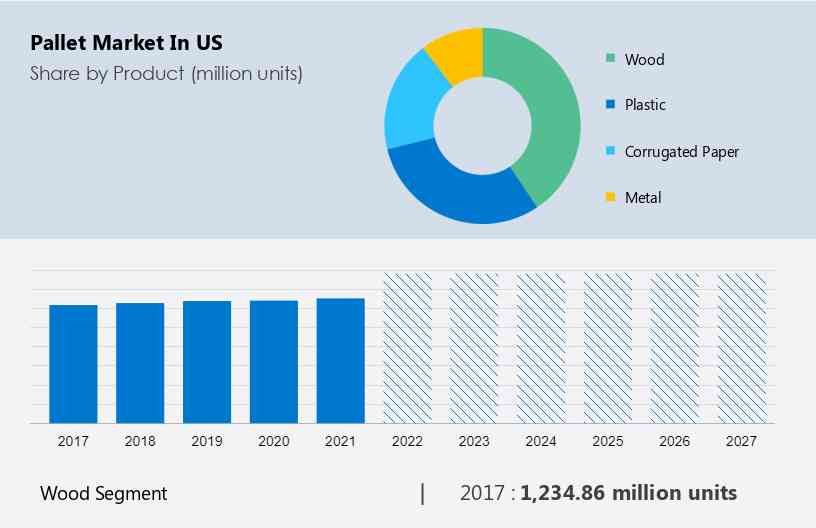

The US pallet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD mn units" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Product

- Wood

- Plastic

- Corrugated paper

- Metal

- End-user

- Food and beverages

- Chemicals and pharmaceuticals

- Retail

- Transportation and warehousing

- Others

- Geography

- US

By Product Insights

- The Wood segment is estimated to witness significant growth during the forecast period.

Wooden pallets, the most commonly used pallet type in the US market, offer superior price performance and reliability. Their ease of fabrication into various sizes makes them a popular choice for transportation and storage of goods. Composite wooden pallets, a cost-effective alternative, are available in various shapes, enhancing logistical efficiency. The durability of wooden pallets is notable, with recycled ones, despite being drier than new ones, maintaining almost the same strength. The affordability and cost-effectiveness of wooden pallets have made them a preferred choice for production units, distribution centers, and manufacturing units.

Get a glance at the pallet in US industry share of various segments Request Free Sample

The Wood segment accounted for USD 1234.86 mn units in 2017 and showed a gradual increase during the forecast period.

Market Dynamics

Our pallet market in US researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Pallet in US Industry?

High applications of pallets in shipping and load-handling sectors is the key driver of the market.

- The Pallet Market in the US is experiencing significant growth due to the increasing demand for waste recycling and innovative transit packaging solutions in various industries. Shipment companies are turning to pallets made from alternative materials, such as plastic wastes and composite wood, to reduce their carbon footprint and improve load-bearing structures. These pallets, equipped with RFID chips for tracing and tracking, offer enhanced durability and cost-effectiveness. Manufacturing processes like blow molding, injection molding, and corrugated production are used to create pallets in various material types, including plastic, metal, and wood. Lightweight yet strong pallets made from pine, hardwood, and southern yellow pine are popular choices for heavy loads in industries like food and beverage, automotive, and electrical and electronics.

- The US market for pallets is driven by the need for material handling and logistics solutions in industries with high demand for transportation. The growing consumer market, with its high per capita household income, fuels the demand for packaged products, further increasing the need for reusable packaging solutions. The use of stringer wooden pallets and block wooden pallets is expected to continue, as they offer the necessary strength and capacity expansion for various industries. In conclusion, the Pallet Market in the US is experiencing growth due to the increasing demand for waste recycling, innovative transit packaging solutions, and material handling in various industries. The use of alternative materials, such as plastic wastes and composite wood, is becoming more common as companies look to reduce their carbon footprint and improve load-bearing structures. The market is expected to continue growing as industries seek efficient and cost-effective solutions for their logistical needs.

What are the market trends shaping the Pallet in US Industry?

Rising popularity of pallet-tracking technologies is the upcoming trend in the market.

- In the US market, the demand for efficient and sustainable pallet solutions continues to grow as logistics and warehousing operations seek to minimize material handling and transportation costs. Manufacturers are responding by innovating with various pallet materials, such as plastic, composite wood, and metal, each offering unique benefits based on durability, material type, and carbon footprint. Logistics companies are increasingly utilizing RFID chips and tracking technologies to enhance pallet tracing and optimize container packaging and transit solutions. Blow molding, injection molding, and corrugated manufacturing processes are employed to create lightweight yet strong pallets, while drums are used for heavy load-bearing structures.

- The food and beverage industry, in particular, relies on reusable packaging solutions made from pine, hardwood, and alternative materials like Eastern white pine and southern yellow pine. The use of these materials, along with stringer wooden structures and block wooden structures, ensures the strength and capacity expansion needed for heavy food and beverage loads during transportation. The adoption of cost-effective and eco-friendly pallet solutions is a key trend in the US market, as businesses in various industries prioritize health and wellness and reduce their carbon footprint. The integration of RFID chips in pallets allows for seamless tracking and tracing, improving overall supply chain efficiency and transparency.

What challenges does Pallet in US Industry face during the growth?

Variations in global crude oil prices affecting pallet manufacturers is a key challenge affecting the market growth.

- The US pallet market is influenced by the volatility of global crude oil prices, as plastic, a primary material for pallet manufacturing, is derived from petroleum. The cost of plastic pallets, which are commonly used in various industries such as manufacturing, logistics, food and beverage, and transportation, is directly linked to the price of crude oil. Additionally, the cost of other raw materials like polypropylene, polyethylene, polyester, and high-density polyethylene, frequently used in pallet production, is also affected by crude oil prices. Consequently, fluctuations in crude oil prices significantly impact the pricing of these raw materials, ultimately influencing the pallet market in the US.

- Innovative solutions, such as RFID chips for tracing and tracking, are being adopted to enhance the durability and capacity expansion of pallets, including containers made of composite wood, blow-molded plastic, corrugated, injection-molded drums, and various types of wooden pallets like stringer and block styles. These alternative materials offer benefits such as lightweight strength, carbon footprint reduction, and cost-effectiveness, making them suitable for various industries and applications. The US pallet market is expected to grow as businesses prioritize health and wellness, sustainability, and efficient logistics, with a focus on reducing carbon footprints and utilizing eco-friendly, reusable packaging solutions.

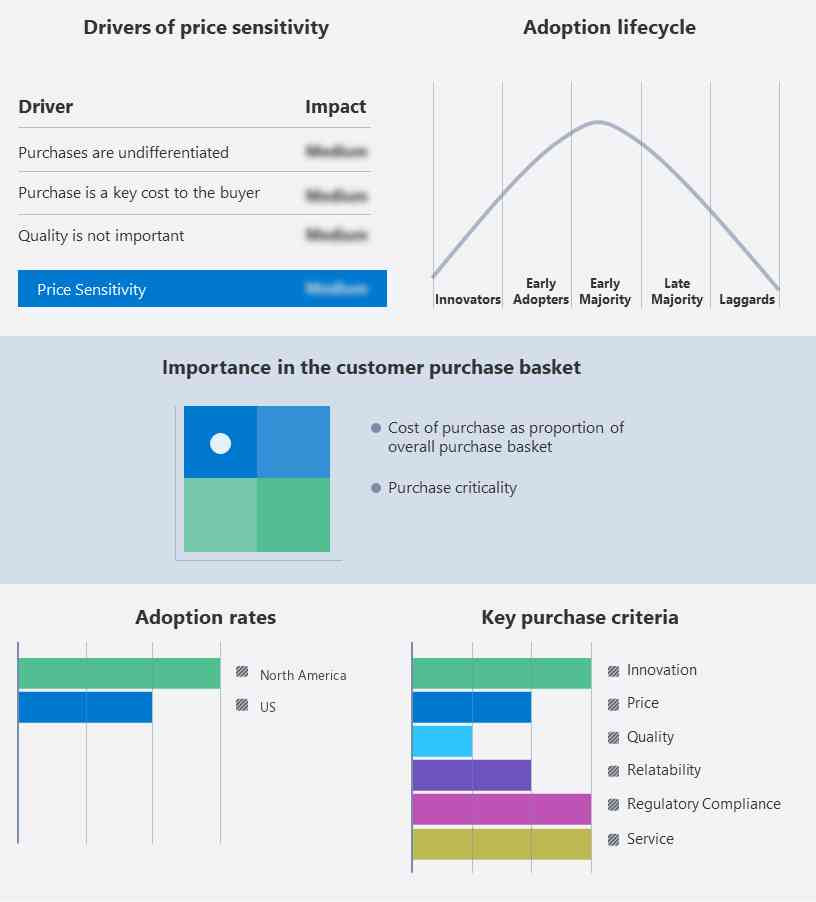

Exclusive Customer Landscape

The pallet market in US market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Arrington Lumber and Pallet Co. - The Pallet Market in the US presents an innovative solution by manufacturing pallets from recycled plastic waste. This eco-friendly approach reduces the need for virgin plastic and contributes to sustainable business practices. Our company is committed to this initiative, transforming discarded plastic into durable and functional pallets. This not only promotes waste reduction but also offers a cost-effective and efficient alternative to traditional wood pallets. Our recycled plastic pallets are of high quality, ensuring reliability and longevity for various industries. By choosing our recycled plastic pallets, you contribute to a greener future while optimizing your supply chain logistics.

The market research and growth report includes detailed analyses of the competitive landscape of the pallet market in US industry and information about key companies, including:

- Arrington Lumber and Pallet Co.

- Brambles Ltd.

- CABKA Group GmbH

- Edwards Wood Products

- General Pallets Inc.

- Greystone Logistics Inc.

- iGPS Logistics LLC

- Indoff Inc.

- Kamps Pallets Inc.

- Larson Packaging Co.

- Litco International Inc.

- Menasha Corp.

- Millwood Inc.

- Myers Industries Inc.

- Nelson Co.

- PECO Pallet

- Rehrig Pacific Co.

- Sonoco Products Co.

- UFP Industries Inc.

- Universal Package

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The pallet market is a vital component of the global logistics and transportation industry, playing a crucial role in the efficient movement of goods from one place to another. This market encompasses a wide range of products, including containers made from various materials such as plastic, composite wood, and metal. Manufacturing processes for pallets vary, with techniques like blow molding, corrugated construction, injection molding, and others used to create pallets with unique properties. For instance, plastic pallets offer lightweight yet robust solutions for transporting goods, while composite wood pallets combine the strength of wood with the durability of plastic.

The pallet market is driven by several factors, with one of the most significant being the need for cost-effective and sustainable solutions. As the focus on reducing carbon footprints grows, pallet manufacturers are increasingly turning to alternative materials and innovative manufacturing processes. For example, some companies are exploring the use of RFID chips for tracing and tracking pallets, improving the overall efficiency and accountability of the supply chain. Moreover, the demand for pallets is not limited to any specific industry. They are used extensively in manufacturing, food and beverage, health and wellness, and various other sectors. The versatility of pallets lies in their ability to handle a wide range of loads, from lightweight food products to heavy industrial components.

Pallets made from different materials offer distinct advantages. For instance, pine and hardwood pallets are popular choices for their natural strength and load-bearing capacity. On the other hand, plastic pallets are known for their durability and resistance to environmental factors. The pallet market is also witnessing capacity expansion, with companies investing in new technologies and processes to cater to the growing demand. For example, some logistics companies are focusing on developing stringer wooden pallets and block wooden pallets to meet the specific needs of various industries. In conclusion, the pallet market is a dynamic and evolving industry that plays a critical role in the global logistics landscape.

With a focus on cost-effectiveness, sustainability, and innovation, pallet manufacturers are continually pushing the boundaries to meet the diverse needs of their clients. Whether it's plastic, composite wood, or metal pallets, the market offers a wide range of solutions to help businesses move their goods efficiently and effectively.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.86% |

|

Market growth 2023-2027 |

222.89 mn units |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

2.31 |

|

Regional analysis |

US |

|

Performing market contribution |

North America at 100% |

|

Key countries |

US and North America |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Arrington Lumber and Pallet Co., Brambles Ltd., CABKA Group GmbH, Edwards Wood Products, General Pallets Inc., Greystone Logistics Inc., iGPS Logistics LLC, Indoff Inc., Kamps Pallets Inc., Larson Packaging Co., Litco International Inc., Menasha Corp., Millwood Inc., Myers Industries Inc., Nelson Co., PECO Pallet, Rehrig Pacific Co., Sonoco Products Co., UFP Industries Inc., and Universal Package |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the pallet market in US industry growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch