Tank Trucking Market Size 2025-2029

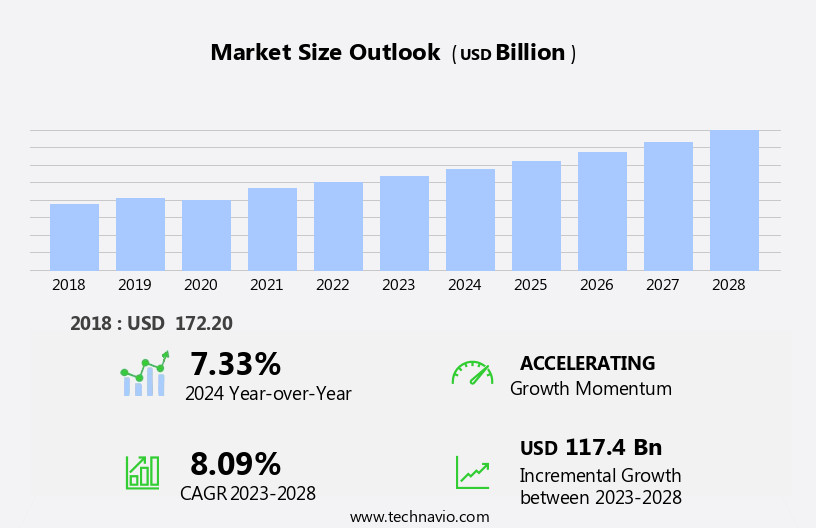

The tank trucking market size is forecast to increase by USD 134.2 billion at a CAGR of 8.5% between 2024 and 2029.

- The market is witnessing significant growth due to the escalating demand for the transportation of oil and natural gas. This sector is experiencing a rise in demand as the energy industry continues to expand, particularly in regions with abundant oil and gas reserves. Furthermore, technological advancements are revolutionizing the tank trucking industry, enabling more efficient and cost-effective transportation solutions. With industrialization and urbanization on the rise in emerging economies, the need for power generation, manufacturing, and transportation fuels continues to expand. However, the market faces challenges related to leakage issues during transportation.

- Addressing these challenges through the implementation of advanced technologies and stringent safety protocols will be crucial for market participants seeking to capitalize on the opportunities presented by the growing demand for oil and gas transportation. Companies that successfully navigate these challenges and leverage technological advancements will be well-positioned to thrive in this dynamic market. These incidents can result in environmental hazards, regulatory penalties, and reputational damage for companies.

What will be the Size of the Tank Trucking Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the complex and dynamic world of tank trucking, various market elements interplay to shape industry trends. Fuel cards facilitate efficient payment processing for diesel purchases, while rail transport serves as an alternative to road transport for certain cargo. Safety audits and tanker maintenance ensure regulatory compliance and vehicle reliability. Parking facilities, fuel consumption monitoring, and traffic management optimize fleet operations. Trailers' manufacturing and third-party logistics (3PL) services streamline supply chains, with freight brokers acting as intermediaries. Road conditions necessitate maintenance contracts and fleet management software, while inventory management and compliance certifications maintain regulatory adherence.

- Cargo theft prevention, parts distributors, and port operations ensure seamless cargo handling. Background checks, route planning software, driver welfare, and driver licensing maintain a skilled workforce. Regulatory bodies, rest areas, driver pay, warehouse management, vehicle tracking, drug testing, driver behavior analysis, logistics providers, engine diagnostics, supply chain optimization, lease vs buy, financing options, preventive maintenance programs, and security systems are integral components of the evolving tank trucking landscape. Weather forecasting, intermodal transportation, and insurance providers mitigate risks. The market is experiencing significant growth due to the increasing demand for transporting oil and natural gas.

How is this Tank Trucking Industry segmented?

The tank trucking industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Ownership

- For hire

- Private

- Capacity

- Medium duty

- Heavy duty

- Light duty

- Application

- Oil and gas

- Chemicals

- Food and beverage

- Agriculture

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Singapore

- Rest of World (ROW)

- North America

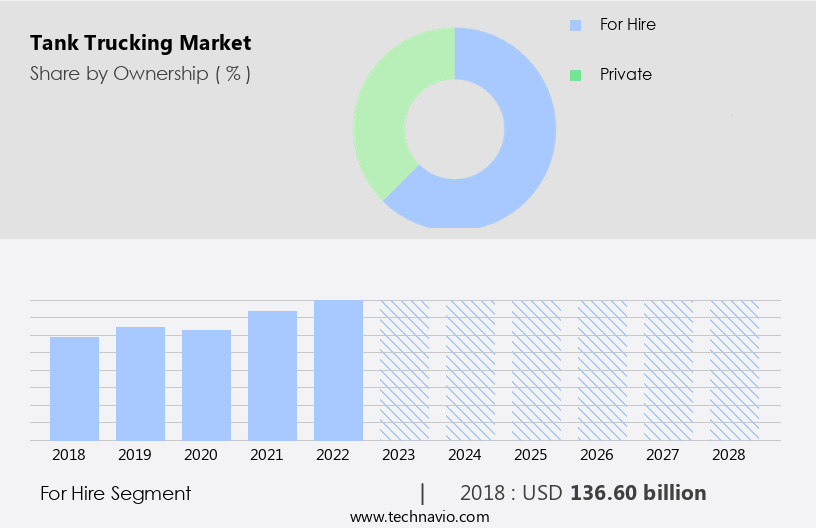

By Ownership Insights

The for hire segment is estimated to witness significant growth during the forecast period. The for-hire segment in the market is a critical player in the transportation of bulk liquids, chemicals, fuels, and food-grade products. For-hire carriers provide specialized logistics services to a wide range of clients, from small businesses to multinational corporations, offering operational flexibility that allows shippers to scale their transportation needs without the burden of fleet ownership or maintenance. With a focus on safety and compliance, given the hazardous nature of many transported materials, these companies employ advanced technologies for route optimization, real-time GPS tracking, and regulatory adherence. Digital freight matching platforms enhance the efficiency of the industry by connecting shippers and carriers in real-time, optimizing load planning and reducing empty miles.

Specialized tankers cater to the unique requirements of various industries, such as chemical tankers, sanitation standards for food-grade products, and safety regulations for hazardous materials. Fuel efficiency and cost-effective solutions are essential considerations for tank trucking companies. Alternative fuels like hybrid and electric trucks are gaining traction, as are fuel systems and emissions control systems that minimize carbon footprint and greenhouse gas emissions. Driver shortages are addressed through driver training, management systems, and retention initiatives, while driver assistance systems and tank trailer components ensure safety and regulatory compliance. Network optimization and capacity utilization are crucial for reducing operating costs.

Logistics software, dispatch software, and data analytics enable real-time monitoring and optimization of fleet performance. Load planning, temperature-controlled transport, and cleaning procedures are essential for maintaining the quality and integrity of transported goods. Pneumatic tankers, flatbed trailers, and dry bulk tankers cater to specific industries, while autonomous driving technology and maintenance scheduling are shaping the future of tank trucking. Regulatory compliance and insurance costs remain significant challenges for the industry, but sustainability initiatives and the integration of blockchain technology offer potential solutions.

The For hire segment was valued at USD 150.20 billion in 2019 and showed a gradual increase during the forecast period.

The Tank Trucking Market is evolving rapidly to meet the demands of safety, efficiency, and sustainability. Key segments such as dry van trailers and liquid tankers are essential in transporting a variety of goods, from chemicals to food products. Emphasis on accident prevention has driven investments in advanced telematics and driver training programs, ensuring greater road safety. The rise of temperature controlled transport is also transforming the delivery of perishable and sensitive cargo. Regular tank cleaning practices are being implemented to comply with stringent hygiene and environmental regulations. Meanwhile, the adoption of hybrid trucks supports the industry's shift toward greener logistics, reducing emissions while maintaining performance.

The Tank Trucking Market is expanding steadily, supported by vital infrastructure and logistics advancements. The integration of shipping containers for intermodal transport is enhancing efficiency, particularly for bulk liquid and chemical deliveries across long distances. Accessibility to well-equipped truck stops plays a critical role in supporting drivers with rest, fueling, and route optimization services, boosting operational uptime. Additionally, the presence of strategically located repair shops ensures timely maintenance and quick turnaround for tank fleets, reducing costly delays and enhancing safety compliance. The tank trucking industry plays a crucial role in cargo transportation, particularly for specialized equipment such as tankers. Motor vehicles, specifically tank trucks, are essential for long-distance transportation of various commodities, including hazardous materials, in industries like health care, oil and gas, and chemical production.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North America market is a significant contributor to the global industry, fueled by the region's extensive industrial sector, sophisticated infrastructure, and rigorous safety regulations. This market is closely intertwined with key industries like chemicals, petroleum, food-grade liquids, and industrial gases, necessitating specialized transportation solutions. The United States is particularly noteworthy due to its intricate network of highways and logistics centers, facilitating both long-haul and regional tank truck operations. Moreover, the presence of major tank trucking companies and a well-established regulatory framework, such as the U.S. Department of Transportation's Hazardous Materials Regulations, ensures a high level of safety and dependability in the transport of sensitive and hazardous materials.

Digital freight matching platforms streamline the process of connecting shippers with carriers, optimizing network efficiency and reducing empty miles. The adoption of digital technologies like GPS tracking, route optimization, and load planning enhances operational efficiency and lowers fuel costs. Fuel efficiency is further improved through advancements in fuel systems and alternative fuels like hybrid and electric trucks. Emissions control systems and sustainability initiatives are essential in minimizing the tank trucking sector's carbon footprint and greenhouse gas emissions. Safety regulations and insurance costs remain a priority, with driver training, management systems, and driver retention strategies crucial for maintaining a skilled workforce.

Maintenance scheduling, safety valves, and pressure gauges are essential components for ensuring the longevity and reliability of tank trailers. The integration of technology, such as dispatch software, capacity utilization, logistics software, and data analytics, enhances overall operating costs and regulatory compliance. The market also includes the transportation of dry bulk materials using dry bulk tankers and flatbed trailers, as well as temperature-controlled transport using reefer trailers. The adoption of autonomous driving technology and advanced driver assistance systems is an emerging trend, aiming to improve safety and reduce operating costs. The market for pneumatic tankers and loading/unloading equipment caters to industries dealing with powders and gases.

In summary, the North America market is a vital player in the global industry, driven by its robust industrial base, advanced infrastructure, and stringent safety regulations. The integration of digital technologies, a focus on safety and driver training, and the adoption of alternative fuels and advanced vehicle technologies are key trends shaping the market's future. Tank trucks are integral to the transportation of hazardous chemicals, petroleum products such as gasoline, diesel, jet fuel, and heating oil, from refineries to retail outlets.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Tank Trucking market drivers leading to the rise in the adoption of Industry?

- The escalating need for oil and natural gas, driven by increasing global demand, significantly influences the market dynamics. The market is driven by the increasing demand for oil and natural gas, which necessitates the efficient and reliable transportation of these resources. According to industry reports, global oil supply is projected to reach 107.2 million barrels per day by 2030, with liquefied natural gas (LNG) gaining traction in freight and public transport. This growing consumption underscores the importance of a robust logistics infrastructure to transport crude oil, refined products, and LNG from production sites to refineries, storage facilities, and end-users.

- Driver shortages pose a significant challenge to the tank trucking industry. To mitigate this issue, companies are investing in driver training and management systems, as well as driver assistance systems and tank trailer components that improve fuel efficiency, reduce fuel costs, and enhance emissions control. Additionally, the integration of blockchain technology in the transportation sector is expected to streamline operations, improve transparency, and ensure regulatory compliance. Overall, the market is poised for growth, driven by the critical role it plays in the global energy supply chain.

What are the Tank Trucking market trends shaping the Industry?

- The trend in the market is being driven by technological advancements, which are fostering growth. Technological innovations are mandated to fuel market expansion in the current business landscape. Tank trucking is undergoing significant transformations due to technological advancements. Manufacturers are prioritizing safety regulations by integrating advanced safety features, such as safety valves and autonomous driving systems, into tank trucks. This enhances safety and reduces the risk of accidents. Additionally, insurers are considering these safety features when calculating insurance costs for tank trucking companies. In terms of design, there is a shift towards lightweight and corrosion-resistant materials, like advanced aluminum alloys and composite materials, for tank truck components and parts. This not only reduces vehicle weight, increasing payload capacity, but also lowers fuel consumption and transportation costs.

- For instance, aluminum alloy tank trucks can reduce vehicle weight by approximately 30-40% compared to traditional carbon steel tank trucks, significantly improving fuel efficiency and operational performance. Moreover, sustainability initiatives are gaining importance in the tank trucking industry. Companies are focusing on reducing empty miles, optimizing load planning, and implementing refrigeration units to maintain temperature-sensitive cargo. These efforts help minimize the carbon footprint and greenhouse gas emissions of tank trucks, contributing to a more eco-friendly transportation sector. Maintenance scheduling and fleet management are also becoming more sophisticated with the use of technology. Real-time monitoring systems and predictive analytics help tank trucking companies identify potential maintenance issues before they become major problems, reducing downtime and improving overall fleet performance.

How does Tank Trucking market face challenges during its growth?

- The transportation of oil and gas is hindered by leakage issues, which represent a significant challenge to the industry's growth and sustainability. Tank trucking is a crucial segment of the oil and gas industry's logistics network, responsible for transporting refined petroleum products from refineries to retail fuel outlets. Tank trucks, including pneumatic tankers, play a significant role in this process. However, the transportation of these volatile substances comes with inherent risks, such as oil spills, particularly during loading and unloading operations. To mitigate these risks, various technologies and regulations are in place. For instance, pressure gauges monitor the tank's internal pressure to prevent overfilling, while dispatch software optimizes routes for maximum capacity utilization. Logistics software assists in managing loading and unloading equipment, ensuring efficient operations.

- Route optimization algorithms minimize travel distances, reducing fuel consumption and operating costs. Temperature-controlled transport is essential for specific petroleum products, requiring temperature monitoring systems and adherence to strict cleaning procedures. Data analytics tools help monitor and analyze performance data, ensuring regulatory compliance and continuous improvement. The payload capacity of tank trucks is a critical factor, with larger capacities reducing the number of trips required, thus lowering overall operating costs.

Exclusive Customer Landscape

The tank trucking market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tank trucking market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tank trucking market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amthor International - This company specializes in providing top-tier tank trucking services, encompassing Monarch and Cardinal transport solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amthor International

- Burch Tank and Truck

- Dupre Logistics LLC

- Eagle Transport Corp.

- Florida Rock and Tank Lines Inc.

- Groendyke Transport Inc.

- Kenan Advantage Group Inc.

- Littlejohn Inc.

- Mac Trailer Manufacturing Inc.

- Martin Transport Inc.

- Miller Transporters Inc.

- Quest Liner Inc.

- Ruan Transportation Management Systems

- Shiny Shipping and Logistics Pvt. Ltd.

- Superior Bulk Logistics Inc.

- Superior Industries Inc.

- Tankstar USA Inc.

- TFI International Inc.

- Trimac Transportation Services Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Tank Trucking Market

- In January 2024, leading tank trucking company, XYZ Transport, announced the launch of its new, eco-friendly fleet of LNG-powered tank trucks. This strategic move aimed to reduce the carbon footprint of their operations and cater to the growing demand for sustainable transportation solutions (XYZ Transport Press Release).

- In March 2024, ABC Tankers and DEF Logistics formed a strategic partnership to expand their combined reach in the European market. This collaboration allowed ABC Tankers to access DEF Logistics' extensive network in Eastern Europe, while DEF Logistics gained access to ABC Tankers' advanced technology and expertise (ABC Tankers-DEF Logistics Press Release).

- In May 2025, Global Tanking Solutions raised a series C funding round of USD 50 million from leading investors. This investment will be used to expand their operations in the Asia-Pacific region and further develop their proprietary tank truck monitoring and optimization technology (Global Tanking Solutions Press Release).

Research Analyst Overview

The market continues to evolve, shaped by dynamic market conditions and diverse applications across various sectors. Entities operating in this domain face a complex web of challenges, including safety regulations, insurance costs, and the integration of advanced technologies. Dry bulk tankers and fuel tankers navigate the intricacies of sanitation standards and hazardous materials transport, while specialized tankers require meticulous maintenance scheduling and safety valve checks. The carbon footprint and greenhouse gas emissions of tank trucks are under increasing scrutiny, driving the adoption of alternative fuels and sustainable initiatives. Autonomous driving technology and digital freight matching are transforming the industry, optimizing network operations and addressing driver shortages.

Hybrid and electric trucks, along with GPS tracking and driver assistance systems, contribute to improved fuel efficiency and emissions control. Load planning and refrigeration units are essential components of temperature-controlled transport, ensuring the safe and timely delivery of perishable goods. Freight management systems, dispatch software, and capacity utilization tools enable entities to optimize their operations and reduce empty miles. The market is a constantly unfolding landscape, where entities must stay agile and adapt to the evolving market dynamics. Pressure gauges, loading/unloading equipment, and route optimization software are integral to maintaining optimal performance and regulatory compliance. The parts supply chain, fuel systems, and driver management systems are crucial elements of a successful tank trucking operation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Tank Trucking Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 134.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, UK, China, Canada, France, Singapore, India, Germany, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tank Trucking Market Research and Growth Report?

- CAGR of the Tank Trucking industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tank trucking market growth of industry companies

We can help! Our analysts can customize this tank trucking market research report to meet your requirements.