Subscriber Identification Module (SIM) Card Market Size 2025-2029

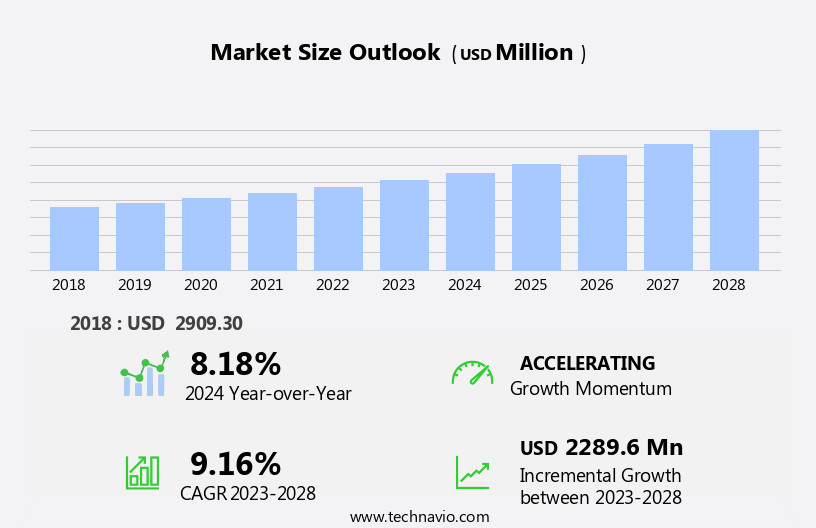

The subscriber identification module (SIM) card market size is forecast to increase by USD 2.65 billion at a CAGR of 9.7% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the widespread adoption of 5G networks and the introduction of e-SIMs in telecommunications. The transition to 5G is revolutionizing the mobile communication landscape, necessitating the replacement of older SIM cards with those compatible with the new technology. This presents both opportunities and challenges for market participants. On the one hand, the growing demand for 5G-enabled devices and services offers ample opportunities for SIM card manufacturers and providers.

- This digital alternative offers greater flexibility and convenience, potentially disrupting the market dynamics and requiring companies to adapt their strategies accordingly. To capitalize on the opportunities and navigate the challenges effectively, market participants must stay abreast of the latest trends and developments, and be prepared to innovate and differentiate their offerings. The need for registration of SIM cards to activate and utilize 5G services further strengthens the market's growth potential. On the other hand, the introduction of e-SIMs, which eliminate the need for physical SIM cards, poses a significant challenge to traditional SIM card players.

What will be the Size of the Subscriber Identification Module (SIM) Card Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market is experiencing significant evolution, driven by advances in technology and changing consumer needs. SIM card customization is gaining traction, enabling businesses to tailor services to specific customer segments. E-SIM adoption is on the rise, offering the convenience of remote SIM provisioning and seamless device connectivity. Multi-factor authentication and IoT connectivity are fueling demand for secure and reliable SIM solutions. In developed markets, the replacement cycle for mobile devices is less than two years, necessitating the need for frequent SIM card provisioning and validation. The Subscriber Identity Module (SIM) card market encompasses the production and sale of integrated circuits used in mobile telephony devices, including mobile phones, computers, and various handsets such as GSM, CDMA, LTE, and satellite phones.

- These trends underscore the dynamic nature of the SIM card market and the importance of staying abreast of emerging technologies and consumer demands. Network slicing and M2M communication are transforming industries, requiring scalable and efficient SIM card offerings. The 5G network deployment is set to revolutionize connectivity, necessitating advanced SIM card capabilities to support high-speed data transfer and low latency. This innovation caters to the varying needs of consumers and creates demand for SIM card customization and replacement. The lifecycle of SIM cards is another significant factor influencing the market

How is this Subscriber Identification Module (SIM) Card Industry segmented?

The subscriber identification module (SIM) card industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Hybrid SIM

- Micro SIM (3FF)

- Mini SIM (2FF)

- Nano SIM (4FF)

- Capacity

- 128KB

- 64KB

- 32KB

- 256KB

- 512KB

- Application

- Smartphones

- Tablets and laptops

- Wearables

- M2M communication

- IoT devices

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

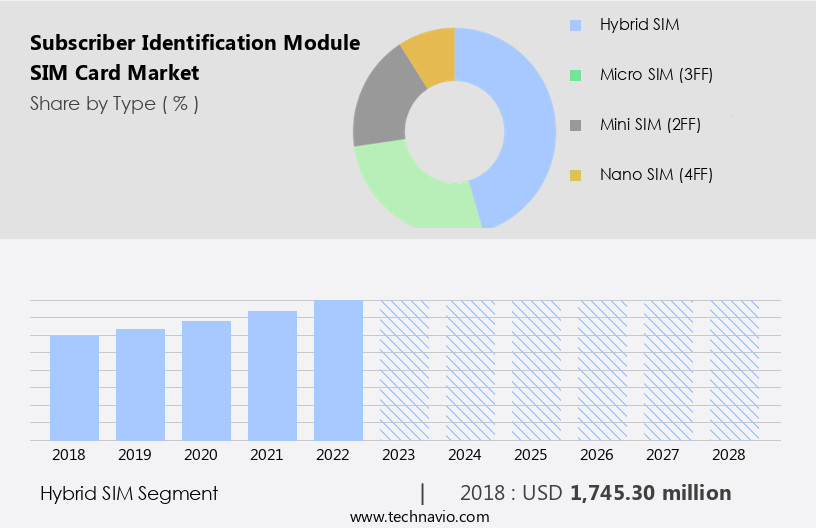

By Type Insights

The hybrid SIM segment is estimated to witness significant growth during the forecast period. Hybrid SIM cards, featuring a three-in-one design with adjustable sizes for 2FF, micro, and nano formats, have gained traction in the market. These cards eliminate the need for separate SIM card production and offer consumers the flexibility to switch devices without changing their SIM cards. The adoption of hybrid SIM cards is influenced by the advancement of cellular networks, including 3G, 4G, and 5G. The convenience and cost savings from this innovation have contributed to a steady increase in revenues within the SIM card market. SIM card manufacturing has evolved to accommodate this trend, with companies investing in advanced technology to produce hybrid cards. SIM card registrations remain a critical aspect of the telecommunications industry, influencing consumer behavior and national GDP.

SIM card distribution channels have also adapted to meet consumer demand, ensuring seamless delivery and activation. However, the market is not without challenges. SIM card fraud, cloning, and hacking pose significant threats, necessitating robust security measures such as encryption and authentication. The SIM card lifecycle includes provisioning, activation, customization, and disposal. Proper management of these stages is crucial to maintain network coverage and ensure a positive user experience. As the SIM card industry continues to innovate, we can expect further advancements, such as embedded SIMs and dual or triple SIM cards. These developments will shape the future of the SIM card market, offering more convenience and flexibility to users while addressing the evolving needs of the mobile network landscape.

The Hybrid SIM segment was valued at USD 1.87 billion in 2019 and showed a gradual increase during the forecast period.

The Subscriber Identification Module (SIM) Card Market is evolving with advancements in SIM card architecture and SIM card standards, shaping industry trends. Growing mobile operator networks drive demand for secure voice calls, facilitated by enhanced SIM card encryption and SIM card cryptography. Additionally, the integration of IoT enabled technologies, such as E-SIM, Triple SIM FF, Soft-SIM, and product pricing, are key factors influencing consumer behavior and market divisions. Innovations in SIM card management ensure seamless SIM card replacement, while SIM card validation strengthens security. Emerging threats like SIM card vulnerabilities, SIM card hacking, and SIM card malware prompt stronger SIM card blocking measures. Improved SIM card reader technology enhances device compatibility, supporting reliable SIM card slots. Convenient SIM card delivery and responsible SIM card disposal promote sustainability. As SIM card trends advance, the SIM card future integrates intelligent protections, enhancing digital security and user experience.

Regional Analysis

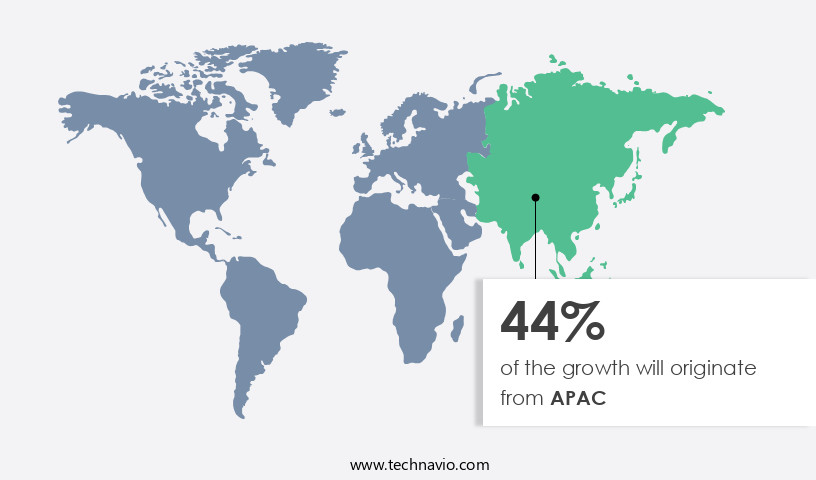

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The SIM card market in APAC is experiencing significant growth due to the increasing smartphone penetration and the presence of a vast population in the region. With the headquarters of several major SIM card manufacturers located in Japan, China, and India, APAC contributes a substantial market share to the global SIM card industry. The region's technological advancements and innovations in SIM card and mobile manufacturing technology have been instrumental in driving market growth. Improved network infrastructure and the adoption of next-generation communication protocols in APAC are expected to fuel the demand for SIM cards. Additionally, the rapid expansion of internet usage in the region is contributing to the market's growth.

SIM cards play a crucial role in mobile networks, enabling voice calls, data plans, and other communication services. SIM card innovation continues to evolve, with advancements such as Micro SIM, Nano SIM, Dual SIM, Triple SIM, and Embedded SIM. SIM card security is a significant concern, with encryption, authentication, and unlocking features becoming increasingly important. SIM card fraud and cloning are also major challenges for the industry, necessitating rigorous testing, validation, and management. SIM card recycling and disposal are essential aspects of the market's lifecycle, with companies implementing sustainable practices to minimize environmental impact. The SIM card market is subject to various trends, including the increasing popularity of data plans, network coverage expansion, and the integration of IoT devices.

The SIM card market in APAC is witnessing robust growth, driven by technological advancements, increasing smartphone penetration, and the expanding use of the internet. The market's future looks promising, with ongoing innovation and the integration of new technologies such as 5G and IoT expected to create new opportunities. Smartphones, technology developments, public awareness, and product pricing also play significant roles in shaping the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Subscriber Identification Module (SIM) Card market drivers leading to the rise in the adoption of Industry?

- The increasing shift towards 5G networks serves as the primary catalyst for market growth. The global SIM card market is experiencing significant growth due to the rollout of 5G technology. With 5G delivering faster data access and enabling higher bandwidth and low latency, mobile network operators are focusing on providing premium data services such as mobile video, gaming, and business apps to consumers in developed markets. In contrast, in developing markets, 5G presents an opportunity to bring mobile Internet access to previously unconnected areas.

- SIM card distribution and delivery methods are also evolving to meet the demands of the cellular network industry. SIM card recycling is gaining traction as a sustainable solution for reducing e-waste. Overall, the SIM card market is poised for continued growth as the world embraces the next generation of mobile connectivity. The increasing adoption of smartphones and tablets has fueled the demand for data retrieval from online applications, necessitating the development of advanced SIM card technology. SIM card innovation continues to prioritize security through cryptography and manufacturing processes to mitigate fraud.

What are the Subscriber Identification Module (SIM) Card market trends shaping the Industry?

- The introduction of e-SIMs in telecommunications represents a significant market trend, mandating a shift from traditional SIM cards. This innovation offers increased flexibility and convenience for users, allowing them to easily switch between mobile plans or connect multiple devices using a single e-SIM profile. The market is driven by several factors. With the increasing trend of smartphone usage and the growing popularity of dual SIM devices, the demand for SIM card solutions is on the rise. The introduction of e-SIM technology, which cannot be removed from devices, is leading smartphone companies to offer phones with both e-SIM and removable SIM cards.

- SIM card testing, cloning, and disposal are also essential aspects of the market, ensuring the security and functionality of these cards. The architecture and specifications of SIM cards continue to evolve, with advancements in data plan capabilities and SIM card logistics. The market dynamics also involve SIM card provisioning and validation, ensuring seamless integration with mobile networks and devices. As the market continues to grow, understanding the intricacies of SIM card technology and its applications will be crucial for businesses.

How does Subscriber Identification Module (SIM) Card market face challenges during its growth?

- The mandatory registration of SIM cards poses a significant challenge to the growth of the industry. This regulatory requirement introduces complexities and additional costs for telecommunications companies and consumers alike, potentially hindering the industry's expansion. SIM card regulation, a policy mandated in over 80 countries, requires consumers to provide proof of identity for the activation of prepaid mobile SIM cards. This measure aims to reduce criminal and anti-social behavior by ensuring that SIM cards are registered in the rightful owner's name.

- SIM cards come in various sizes, including Micro SIM, Nano SIM, and Triple SIM, which can be accommodated in devices with corresponding SIM card readers. In addition to activation, SIM cards can be blocked by mobile operators to prevent unauthorized use. The future of SIM cards is expected to involve advanced security features, such as biometric authentication, to further enhance security. However, the requirement for proof of ID varies from country to country, and an estimated billion people worldwide lack any form of identity, preventing them from registering for SIM cards. SIM card activation involves inserting the card into the SIM card tray of a mobile device. For personalization, consumers can request SIM card authentication and unlocking services from their mobile operators.

Exclusive Customer Landscape

The subscriber identification module (SIM) card market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the subscriber identification module (SIM) card market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, subscriber identification module (SIM) card market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bartronics India Ltd. - The company provides Subscriber Identity Module (SIM) cards, including GSM variants, for initial authentication and facilitating utility-based services.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bartronics India Ltd.

- dz Card International Ltd.

- Eastcompeace Technology Co. Ltd.

- Giesecke Devrient GmbH

- Hengbao Co. Ltd.

- IDEMIA France SAS

- KONA I

- STMicroelectronics NV

- Thales Group

- WATCHDATA TECHNOLOGIES Pte. Ltd.

- Workz Group

- Wuhan Tianyu Information Industry Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Subscriber Identification Module (SIM) Card Market

- In February 2024, Gemalto, a leading provider of digital security solutions, announced the launch of its new Contactless SIM card, offering enhanced security and convenience to customers. This innovative product integrates contactless technology, allowing users to make payments and perform other transactions directly from their SIM cards (Gemalto Press Release, 2024).

- In July 2024, NXP Semiconductors and STMicroelectronics, two major players in the Sim card market, announced a strategic collaboration to develop next-generation SIM cards with integrated secure elements. This partnership aims to combine NXP's expertise in secure connectivity and STMicroelectronics' advanced semiconductor technology, creating more secure and efficient SIM cards (NXP Semiconductors Press Release, 2024).

- In October 2024, Infineon Technologies AG, a leading provider of semiconductor solutions, completed the acquisition of Cypress Semiconductor Corporation for approximately USD10 billion. This acquisition strengthened Infineon's position in the Sim card market by expanding its portfolio of products and technologies, including Cypress's Wi-Fi and Bluetooth solutions (Infineon Technologies AG Press Release, 2024).

- In January 2025, the European Union (EU) introduced new regulations mandating the use of eSIMs (embedded SIMs) in all new mobile devices by 2026. This initiative aims to reduce electronic waste and promote a more circular economy, as eSIMs do not require physical SIM card replacements (European Commission Press Release, 2025).

Research Analyst Overview

The SIM card market continues to evolve, with dynamic market activities shaping its landscape. SIM card technology, an integral component of mobile communication, is subject to constant innovation. From the inception of standard SIM cards to the emergence of Micro, Nano, Triple, and Embedded SIM cards, each iteration brings new possibilities. SIM card personalization, a crucial aspect of the market, allows users to customize their cards with unique identifiers. SIM card activation, authentication, and unlocking facilitate seamless integration into mobile networks. Mobile Operators play a pivotal role in SIM card distribution, provisioning, and validation. SIM card manufacturing, logistics, and delivery are intricate processes that require stringent security measures to prevent SIM card fraud, cloning, and hacking.

SIM card recycling and disposal pose environmental challenges, necessitating sustainable solutions. Network coverage and data plans influence SIM card usage patterns. SIM card lifecycle management, including replacement and blockage, ensures optimal functionality. SIM card specifications, architecture, and cryptography continue to evolve, addressing security concerns and enhancing user experience. The integration of SIM cards into various devices, including mobile phones, computers, and IoT-enabled technologies, underscores their importance in the telecommunications industry. The SIM card market trends reflect the industry's ongoing commitment to addressing the demands of an increasingly connected world.

The Subscriber Identification Module (SIM) Card Market continues to evolve with advancements in security and connectivity. Reliable voice calls remain a crucial function, supported by durable SIM card slots that ensure seamless device compatibility. Concerns around SIM card cloning drive innovation in authentication measures, protecting user data from unauthorized duplication. Enhanced SIM card PIN security strengthens protection against unauthorized access, while SIM card lock features prevent misuse in case of theft or loss. The ease of SIM card unlock options allows users to regain control securely when needed. SIM card readers and SIM card tray solutions cater to diverse user needs. The future of SIM cards promises further advancements, integrating SIM card technology with emerging mobile technologies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Subscriber Identification Module (SIM) Card Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.7% |

|

Market growth 2025-2029 |

USD 2.65 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

8.6 |

|

Key countries |

US, India, UK, China, Canada, Japan, South Korea, Germany, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Subscriber Identification Module (SIM) Card Market Research and Growth Report?

- CAGR of the Subscriber Identification Module (SIM) Card industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the subscriber identification module (sim) card market growth of industry companies

We can help! Our analysts can customize this subscriber identification module (sim) card market research report to meet your requirements.