Stadium Lighting Market Size 2025-2029

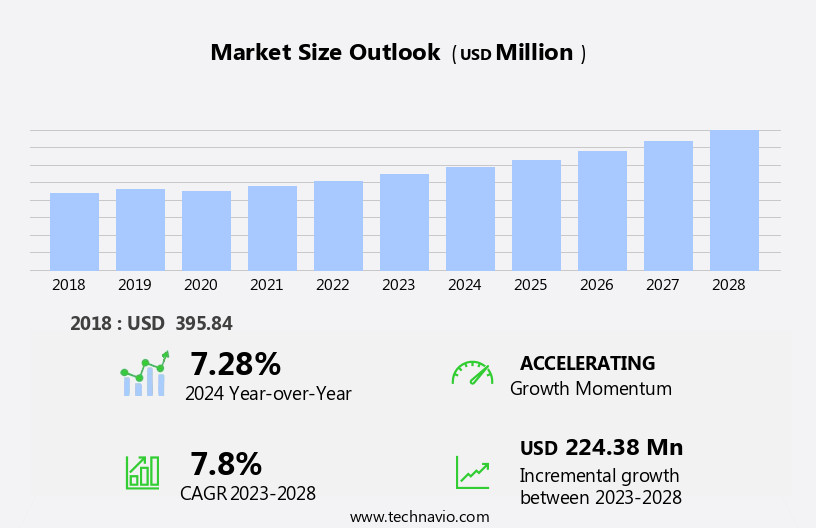

The stadium lighting market size is forecast to increase by USD 346.4 million, at a CAGR of 8.9% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing number of sports events worldwide. This trend is driven by the rise in fan interest and the proliferation of international competitions. A key factor fueling this growth is the adoption of LED stadium lighting, which offers energy efficiency, cost savings, and improved spectator experience. The environmental concerns associated with traditional stadium lighting are also leading to the shift towards LED solutions. However, challenges persist, including the high initial investment costs for LED systems and the need for regular maintenance to ensure optimal performance.

- Additionally, collaborating with sports organizations and event promoters to offer integrated lighting and event management solutions can help companies differentiate themselves and gain a competitive edge. Overall, the market presents significant opportunities for growth, driven by the increasing demand for energy-efficient and sustainable lighting solutions. Companies that effectively address the challenges and capitalize on these opportunities will be well-positioned to succeed in this dynamic market.

What will be the Size of the Stadium Lighting Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the demand for energy-efficient solutions and the need to meet visual comfort standards. Light trespass reduction and lighting infrastructure upgrades are key focus areas, with energy-efficient stadium lights gaining traction. Fixture thermal management and light pollution mitigation are essential considerations in stadium lighting design. Illuminance level control and compliance with visual comfort standards are crucial for enhancing the spectator experience. Emergency lighting systems and sports field illumination are integral parts of the market, with remote diagnostics systems enabling maintenance cost reduction. High mast lighting, digital lighting controls, and ambient light sensors are essential components of smart lighting networks.

Lighting energy audits and energy metering systems help in power consumption reduction. Spectator area lighting requires careful consideration, with light dimming capabilities and glare control techniques essential for optimal viewing conditions. LED lighting technology, daylight harvesting strategies, and wireless lighting networks are increasingly popular. Dynamic lighting effects and remote lighting control add to the excitement of stadium events. Fixture heat dissipation and light uniformity metrics are essential for ensuring the longevity of lighting systems. The market is expected to grow at a significant rate due to the increasing demand for advanced lighting solutions and the ongoing focus on energy efficiency and cost reduction.

For instance, a leading sports stadium in the US reported a 30% reduction in energy consumption after upgrading to energy-efficient LED lighting.

How is this Stadium Lighting Industry segmented?

The stadium lighting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- HID

- LED

- Others

- Type

- Retrofit installation

- New installation

- Application

- Outdoor stadium

- Indoor stadium

- Power Output

- 500W-1500W

- Above 1500W

- Below 500W

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

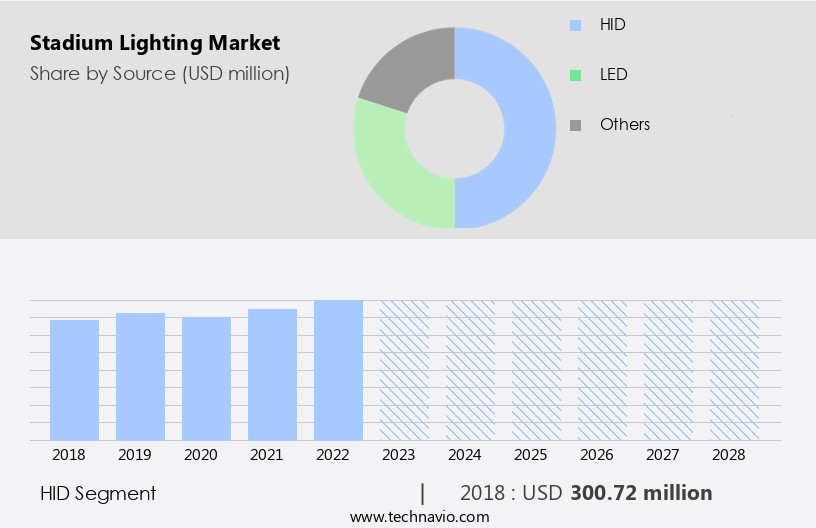

By Source Insights

The HID segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth, driven by the demand for energy-efficient solutions, infrastructure upgrades, and advanced lighting technologies. Energy-efficient stadium lights, such as LED, are becoming increasingly popular due to their power consumption reduction and longer lifespan. These lights offer features like remote diagnostics systems, digital lighting controls, and ambient light sensors, enabling smart lighting networks and maintenance cost reduction. Light pollution mitigation and illuminance level control are essential considerations for stadium lighting design, ensuring visual comfort standards are met while minimizing light trespass. High mast lighting and dynamic lighting effects add to the engaging spectator experience. Renewable energy integration and lighting system reliability are key considerations in stadium lighting retrofits.

Dedicated emergency lighting systems ensure safety during power outages. Lighting system integration and remote lighting control are crucial for efficient stadium operations. Fixture thermal management and glare control techniques are essential for optimizing lighting performance and spectator comfort. According to recent research, the market is expected to grow by over 15% in the next five years. For instance, the adoption of LED lighting technology in the NFL's Mercedes-Benz Stadium reduced power consumption by 40% compared to traditional HID lamps. The integration of advanced technologies, such as color temperature control, lighting simulation software, and smart lighting management, drives energy saving strategies and optimizes fixture lumen output.

The HID segment was valued at USD 398.70 million in 2019 and showed a gradual increase during the forecast period.

The Stadium Lighting Market is evolving with a strong emphasis on performance, efficiency, and sustainability. A key factor is the color rendering index (CRI), which ensures accurate visibility and color differentiation during events. Modern systems are adopting wireless lighting network solutions for real-time control and flexibility. Innovations in optical system design enhance beam precision and uniformity. Compliance with stadium lighting standards guarantees optimal illumination for both players and spectators. Facilities are increasingly investing in stadium lighting retrofit projects to upgrade legacy systems with energy-efficient technologies. A thorough environmental impact assessment is now standard practice, ensuring that lighting installations meet sustainability goals while reducing light pollution and energy consumption.

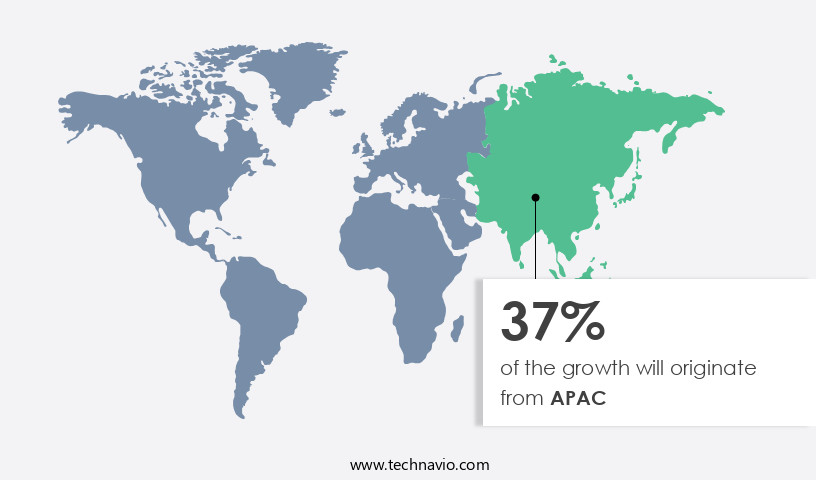

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia-Pacific region, due to increasing investments in sports infrastructure, urban development, and government initiatives. Advanced lighting solutions that meet international standards for visibility, energy efficiency, and broadcast compatibility are in high demand. Countries in the region are modernizing existing stadiums and constructing new multi-purpose facilities, necessitating the adoption of high-performance lighting systems. Technological advancements, such as LED and smart lighting, are being integrated into stadium projects to improve operational efficiency, reduce maintenance costs, and support sustainability goals. For instance, a recent stadium renovation project in China implemented LED lighting, resulting in a 50% reduction in energy consumption.

The market is expected to grow at a steady pace, with energy efficiency and cost savings being key drivers. Light trespass reduction, fixture thermal management, light pollution mitigation, illuminance level control, visual comfort standards, emergency lighting systems, sports field illumination, remote diagnostics systems, lighting system integration, high mast lighting, digital lighting controls, maintenance cost reduction, ambient light sensors, smart lighting networks, lighting energy audit, energy metering systems, spectator area lighting, light dimming capabilities, glare control techniques, lighting system lifespan, power consumption reduction, high-intensity discharge lamps, daylight harvesting strategies, and wireless lighting networks are all integral to this evolution.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The Stadium Lighting Market is rapidly advancing, driven by innovations in performance, energy efficiency, and spectator experience. A well-executed LED stadium lighting system design focuses on delivering uniform illumination with high lumen output LED fixtures and improved light uniformity design to enhance visibility and player performance. Venues are adopting energy efficient lighting upgrades and optimizing energy consumption LED solutions to lower operational costs and environmental impact. Evaluating stadium lighting installation costs is essential for budgeting and long-term planning.

Key features include remote monitoring lighting systems and advanced lighting control features, enabling real-time adjustments and operational efficiency. Integration of daylight harvesting system benefits further reduces energy usage. Attention to stadium lighting safety regulations and stadium lighting maintenance schedule ensures ongoing compliance and longevity. Lighting plays a crucial role in the impact of lighting on visibility, affecting both athletes and fans, while color rendering index for sports ensures accurate color perception for live and broadcast viewing. Reducing light pollution impact and minimizing light trespass issues are vital for surrounding communities, while effective glare control methods reduce visual discomfort. The adoption of cost effective lighting solutions and long lifespan lighting fixtures significantly lowers lifetime expenses.

The use of reliable stadium lighting systems not only supports performance but also enhances safety. Importantly, lighting contributes to enhancing spectator viewing experience, making it an essential component of modern stadium design. The market continues to grow as facilities prioritize sustainability, visibility, and user experience through advanced lighting technologies.

What are the key market drivers leading to the rise in the adoption of Stadium Lighting Industry?

- The market experiences significant growth, with an increasing number of events taking place around the world serving as the primary catalyst for this expansion. The market has experienced significant growth due to the increasing popularity of professional sports leagues and international tournaments. Developed economies in North America and Europe, home to elite leagues like the Premier League and NFL, have fueled this trend, with their transnational appeal attracting fans from emerging markets such as India. These tournaments have drawn millions of viewers and attendees, underscoring the global reach of sports.

- According to industry reports, the market is projected to grow by over 5% annually in the coming years, driven by advancements in LED technology and the increasing demand for energy-efficient solutions. For instance, the implementation of LED lighting systems in the Indian Super League stadiums has resulted in a 50% reduction in energy consumption, demonstrating the market's potential for sustainable growth. This expanding fan base has led governments and sports organizations to host international events, like the Paris 2024 Summer Olympics, UEFA Euro 2024, Copa America 2024, and the ICC Cricket World Cup 2025, to boost tourism, national pride, and economic activity.

What are the market trends shaping the Stadium Lighting Industry?

- The adoption of LED stadium lighting is becoming an increasingly prevalent trend in the market. This trend signifies a notable shift towards energy-efficient and cost-effective lighting solutions in sports venues. The market is experiencing robust growth due to the increasing adoption of LED technology. With energy efficiency being a top priority, LED lighting is replacing traditional metal halide and halogen systems in stadiums worldwide. This shift offers numerous benefits, including a longer lifespan, reduced energy consumption by up to 50%, and enhanced lighting quality.

- The market is expected to continue its rise, with an estimated 25% of stadiums worldwide expected to adopt LED lighting by 2025. This trend underscores the market's potential for continued growth and innovation. The integration of smart lighting systems with LEDs is further driving market growth. These advanced solutions enable dynamic lighting effects, remote monitoring, and automated scheduling, aligning with the digital transformation of sports venues.

What challenges does the Stadium Lighting Industry face during its growth?

- The growth of the sports industry is being significantly impacted by rising environmental concerns regarding the use of stadium lights. This issue poses a substantial challenge, necessitating the development and implementation of more energy-efficient and eco-friendly lighting solutions. The market caters to diverse requirements, influenced by factors such as the type of sport, stadium size, visual comfort, and color of sports equipment. According to a study, artificial light at night can lead to a 10% decrease in melatonin production, disrupting the natural sleep cycle.

- The market is expected to grow by over 15% in the coming years, driven by the demand for energy-efficient and eco-friendly lighting solutions. For instance, a medium-sized football stadium necessitates approximately 250-450 lux of illumination. To meet these requirements, LED lamps of approximately 40,000 watts or High-Intensity Discharge (HID) lamps of around 80,000 watts are typically employed. However, the increasing adoption of these lights contributes to global light pollution, which can negatively impact human, animal, and plant health.

Exclusive Customer Landscape

The stadium lighting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the stadium lighting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, stadium lighting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acuity Brands Inc. - The company specializes in providing advanced stadium lighting solutions, including High Lumen Flood Size 2, High Lumen Flood Size 1, and Floods ACP1 LED.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acuity Brands Inc.

- ams OSRAM AG

- Bajaj Electricals Ltd.

- Canara Lighting Industries Pvt. Ltd.

- Eaton Corp. plc

- Fagerhult Group AB

- Glamox AS

- GS LIGHT

- Hubbell Inc.

- KCL Engineering

- Musco Sports Lighting LLC

- Nila Inc.

- Panasonic Holdings Corp.

- Qualite Sports Lighting LLC

- SAVANT TECHNOLOGIES LLC.

- Signify NV

- SMART Global Holdings Inc.

- Techline Sports Lighting

- Wipro Ltd.

- Zumtobel Group AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Stadium Lighting Market

- In January 2024, Philips Hue, a leading lighting solutions provider, announced the launch of its new line of stadium-grade LED lights, called the Hue ArenaSystem. This innovative product line is designed to deliver superior brightness and energy efficiency for large-scale outdoor applications like sports venues (Philips Hue Press Release, 2024).

- In March 2024, Osram, a global lighting technology company, entered into a strategic partnership with the National Football League (NFL) to provide energy-efficient LED lighting solutions for select NFL stadiums. This collaboration aimed to reduce energy consumption and enhance the fan experience through improved lighting conditions (Osram Press Release, 2024).

- In April 2025, Cree, Inc., a leading manufacturer of lighting products, completed the acquisition of LEDVANCE, a global leader in the production and sale of LED lighting solutions. This strategic move expanded Cree's product portfolio and strengthened its presence in the market (Cree, Inc. SEC Filing, 2025).

- In May 2025, the European Union (EU) announced the approval of new regulations for energy-efficient public lighting, including stadiums. The new regulations set minimum energy efficiency standards and incentivize the adoption of LED lighting technologies, expected to drive market growth in the region (European Commission Press Release, 2025).

Research Analyst Overview

The market demonstrates continuous evolution, with applications spanning various sectors, including sports, entertainment, and public infrastructure. Operational cost analysis, lux level measurements, and lighting compliance codes are essential components of stadium lighting maintenance. LED lighting fixtures, with their superior light distribution patterns and energy efficiency, are increasingly preferred. Lighting design software, environmental impact assessments, and lighting project management are crucial for effective lighting system upgrades.

Lighting efficiency improvements, lighting system monitoring, and lighting safety regulations are ongoing priorities. Outdoor lighting standards, light level calculations, and lighting control systems are integral to ensuring optimal performance. Lighting installation services and sports lighting solutions employ advanced lighting controls, light source selection, and lighting power factor optimization. According to industry reports, The market is expected to grow by over 5% annually, driven by these evolving trends. For instance, a recent stadium retrofit project achieved a 60% energy savings through the implementation of advanced lighting technologies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Stadium Lighting Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.9% |

|

Market growth 2025-2029 |

USD 346.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, China, Germany, India, Japan, UK, France, Canada, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Stadium Lighting Market Research and Growth Report?

- CAGR of the Stadium Lighting industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the stadium lighting market growth of industry companies

We can help! Our analysts can customize this stadium lighting market research report to meet your requirements.