Specialty Paper Market Size 2025-2029

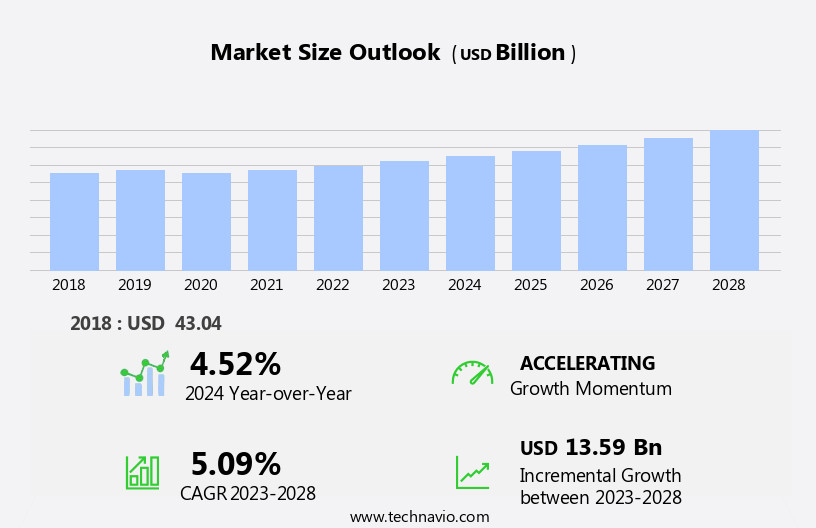

The specialty paper market size is forecast to increase by USD 13.78 billion at a CAGR of 5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the shifting consumer preferences in emerging economies towards premium and convenient packaging solutions. This trend is further fueled by the advent of smart packaging, which integrates advanced technology into paper-based products, enhancing their functionality and appeal. However, the market faces challenges as well. The volatility in prices of raw materials, such as pulp and chemicals, poses a significant risk to the profitability of specialty paper manufacturers.

- To capitalize on the market opportunities and navigate challenges, specialty paper manufacturers must focus on innovation, cost optimization, and sustainable production methods. By addressing these factors, they can cater to evolving consumer demands and ensure long-term success in the dynamic market. Additionally, the rise of e-commerce has led to a demand for lightweight and customizable packaging solutions. Effective supply chain management and strategic sourcing of raw materials are essential for companies to mitigate these price fluctuations and maintain competitiveness.

What will be the Size of the Specialty Paper Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market for specialty papers continues to evolve, driven by the diverse applications across various sectors. Paper grammage control and storage conditions are crucial factors in ensuring product consistency and quality. Paper sizing chemistry and testing standards enable optimal paper performance, while finishing equipment enhances the final product's appearance. Paper waste management and burst strength assessment are essential for sustainability and efficiency. Paper sheet formation, defect detection, and fiber modification contribute to improved product durability and functionality. Sustainable paper production methods and pulping chemicals reduce environmental impact, aligning with industry regulations. Paper converting processes and printability assessment cater to specific client needs, while coating formulations and drying techniques optimize paper performance.

Tensile strength, caliper measurement, and grade selection ensure product suitability for various applications. Roll handling and machine optimization streamline production processes, and coating additives and folding endurance enhance product functionality. The paper industry anticipates a 3% annual growth rate, reflecting the continuous innovation and dynamic nature of this market. For instance, a leading packaging company reported a 15% increase in sales due to the adoption of advanced paper coating formulations, resulting in superior product protection and customer satisfaction. Smart packaging is an innovative technology in the realm of food packaging, offering functions beyond the conventional inert and passive packaging.

How is this Specialty Paper Industry segmented?

The specialty paper industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Packaging and labelling

- Printing and writing

- Industrial

- Building and construction

- Others

- Type

- Decor

- Packaging

- Printing

- Release liner paper

- Others

- Raw Material

- Pulp

- Fillers and binders

- Additives

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

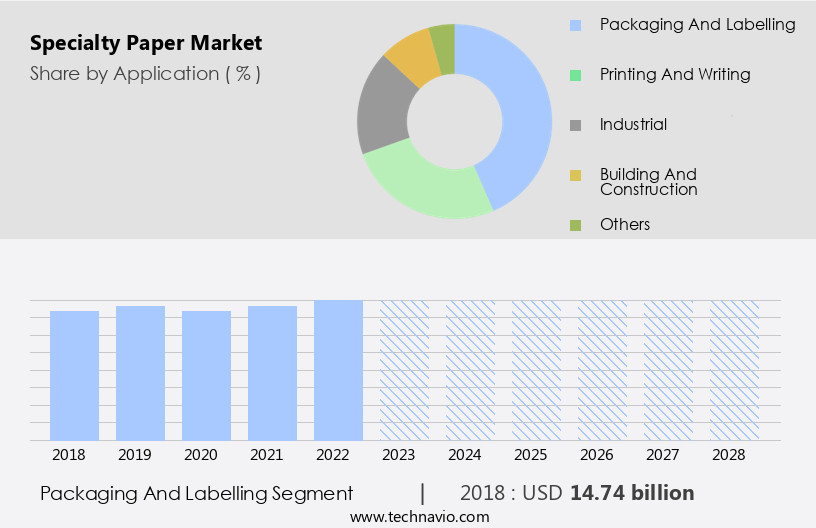

The Packaging and labelling segment is estimated to witness significant growth during the forecast period. Specialty paper plays a pivotal role in packaging and labeling, enhancing product appeal and providing essential functionalities. In the retail sector, its usage is prevalent, particularly for food products. Brightness standards and opacity levels ensure product attractiveness, while tear resistance and dimensional stability maintain product integrity. Coating techniques, such as surface sizing and paper finish applications, offer protection and enhance print quality. Carbonless paper technology and security features cater to specific industries' needs. The paper industry anticipates significant growth, with estimates suggesting a 5% annual expansion. For instance, the demand for high-opacity paper in printing applications has risen due to its superior ink coverage and vibrant colors. Food and beverage packaging is a significant segment of the paper packaging market.

Paper porosity testing and calendering processes optimize paper performance, while paper pulp refining ensures uniformity and consistency. Innovations in specialty paper manufacturing include the development of synthetic paper sheets, fiber optic paper, and inkjet paper with improved absorbency rates. Coated paper finishes, thermal paper layers, and watermarking techniques add value to various applications. Wood-free paper types, paper strength properties, and paper weight variations cater to diverse industries' demands. Recycling methods and paper smoothness ratings contribute to sustainability efforts and consumer preferences. Fiber characteristics and surface sizing effects influence paper properties, while paper texture analysis ensures consistency and quality. Photographic paper base and paper gloss measurement cater to the photography industry's unique requirements.

The market is dynamic and evolving, driven by advancements in technology, consumer preferences, and industry demands. Its diverse applications, from packaging and labeling to printing and photography, underscore its importance in various sectors. Integrating sensor technology and the Internet of Things (IoT), smart packaging enhances product value and ensures quality.

The Packaging and labelling segment was valued at USD 15.23 billion in 2019 and showed a gradual increase during the forecast period.

The Specialty Paper Market is evolving rapidly with a focus on advanced technologies and quality enhancements. Innovations in paper finishing equipment, paper quality control, and paper defect detection ensure premium product output. Efficient paper roll handling and optimal paper storage conditions maintain paper integrity. Diverse specialty paper applications are expanding across industries, supported by strict paper testing standards and compliance with paper industry regulations. Proper paper grade selection and paper machine optimization enhance performance. Techniques like paper drying, use of paper pulping chemicals, paper fiber modification, and paper coating additives boost functionality. Metrics such as paper caliper measurement, paper tensile strength, paper burst strength, paper folding endurance, and paper printability assessment are key to ensuring superior quality and usability. This expansion can be attributed to advancements in lightweight, eco-friendly options, including microsensors, printed electronics, authentication platforms, and IoT.

Regional Analysis

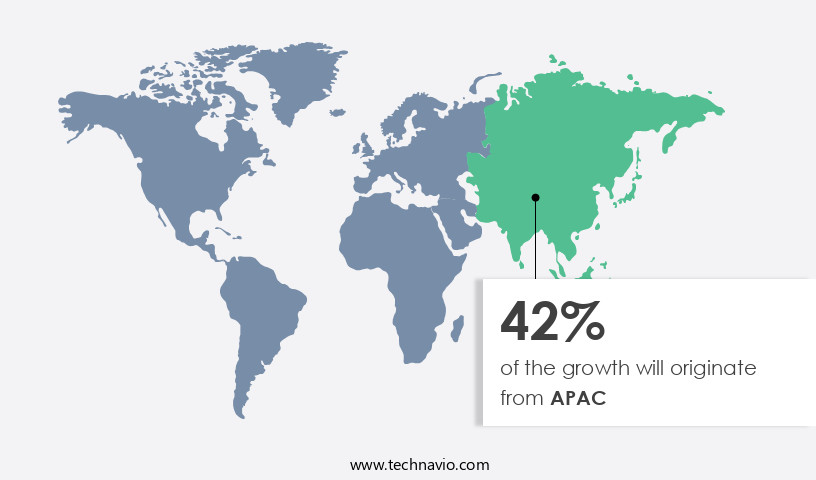

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, driven by the dominance of key producing and consuming countries such as China and Japan. China, as the world's largest paper producer, and the largest consumer market due to its vast population and industrial expansion, significantly influences the market. Japan, with its high per capita consumption of specialty papers like tissue, is another major contributor to the market's growth. Leading companies such as Nippon Paper Industries and Oji Holdings in Japan further strengthen the market. Heatset paper coatings ensure improved print quality and durability, aligning with brightness standards for enhanced visual appeal. In the pulping stage, fiber extraction is facilitated through pulp digestion, while oxygen delignification and bleaching stages using chlorine dioxide and Elemental Chlorine-Free (ECF) or Totally Chlorine-Free (TCF) methods refine the pulp.

Tear resistance testing and paper dimensional stability maintain the integrity of specialty papers. Paper opacity levels, porosity testing, and carbonless paper technology cater to various industry-specific requirements. Paper whiteness index and weight variations enable customization for diverse applications. Thermal paper layers provide temperature sensitivity, while surface sizing agents enhance paper's resistance to moisture. Coated paper finishes and paper coating techniques ensure superior printability and durability. Paper fiber characteristics, wood-free paper types, and paper strength properties cater to the evolving needs of industries. Fiber optic paper and security paper features address the demand for advanced functionalities.

Synthetic paper sheets and printing paper grades cater to the growing demand for eco-friendly and high-performance paper alternatives. Paper absorbency rates, calendering processes, and paper gloss measurement ensure optimal product performance. High-opacity paper is gaining popularity due to its superior printability and visual appeal.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Specialty Paper market drivers leading to the rise in the adoption of Industry?

- Rising urbanization and disposable incomes, especially in emerging economies, are driving demand for specialty paper used in packaged food and organized retail sectors. The market is experiencing significant growth due to the economic development and urbanization in various countries, leading to increased disposable incomes and hectic lifestyles. This trend is particularly prominent in emerging economies, where the population is increasingly opting for packaged food products and organized retailing. The convenience offered by these products, in terms of preparation and consumption, has resulted in a rise in demand.

- As a result, the market is poised for growth, with industry analysts estimating a 5% increase in demand over the next few years. For instance, in the foodservices sector, the use of specialty paper for packaging takeout products is on the rise, reflecting the growing popularity of convenient food options. Furthermore, the importance of personal hygiene is gaining recognition, particularly in these markets, leading to a rise in demand for hygiene products such as tissue paper.

What are the Specialty Paper market trends shaping the Industry?

- The trend towards smart packaging is driving innovation in the specialty paper market, enabling enhanced functionality, product tracking, and improved consumer engagement. This innovation represents the future of the market. This advanced packaging solution significantly increases product shelf life, thereby reducing wastage and damage, leading to a cost-effective supply chain. Paper fiber characteristics, wood-free paper types, and paper strength properties are also critical factors, with fiber optic paper and security paper features gaining traction in specialized applications.

- According to recent studies, the adoption of smart packaging is experiencing a rise, with a current market penetration of 15%. Furthermore, future growth expectations indicate a robust increase of 20% in the coming years. One of the key features of smart packaging is its moisture control functionality, which minimizes product spoilage and damage. The integration of modern technologies, such as sensors and tags, smart barcodes, near-field communication (NFC) and radio-frequency identification (RFID) devices, printed electronics, and advanced track and trace controls, enhances the usability and safety of packaging solutions and products.

How does Specialty Paper market face challenges during its growth?

- The volatility in raw material prices poses a significant challenge to the industry, potentially hindering its growth and requiring professionals to closely monitor market fluctuations and adapt strategies accordingly. The market experiences significant volatility due to the fluctuating prices of its primary raw material, wood pulp. As the key ingredient in specialty paper production, pulp price variations directly impact the market's dynamics. Surface sizing effects improve paper's handling and processing properties.

- The International Trade Administration forecasts steady industry growth, with expectations of a 3% annual expansion in the coming years. Despite efforts to mitigate these price fluctuations, specialty paper companies remain at the mercy of the global wood pulp market. Factors such as demand, inventory levels, production capacity, and competitive strategies influence pulp pricing, which can change throughout the year. For instance, a 20% increase in pulp prices in Q2 led to a 5% decrease in specialty paper sales for several manufacturers.

Exclusive Customer Landscape

The specialty paper market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the specialty paper market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, specialty paper market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ahlstrom - The company specializes in specialty paper production, offering a diverse range of products including coated papers, textile industry papers, office supplies, RFID inlay release materials, sticky notes, PCB and CCL lamination aids, industrial and transparent packaging, envelope window papers, and industrial release materials.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ahlstrom

- Asia Pulp and Paper Group

- Billerud AB

- Burgo Group SpA

- Domtar Corp.

- FEDRIGONI Spa

- International Paper Co.

- ITC Ltd.

- Koehler Paper SE

- LINTEC Corp.

- Mativ Holdings Inc.

- Mondi Plc

- Nippon Paper Industries Co. Ltd.

- Nordic Paper AS

- Pixelle Specialty Solutions LLC

- Sappi Ltd.

- Stora Enso Oyj

- Twin Rivers Paper Co.

- UPM Kymmene Corp.

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Specialty Paper Market

- In January 2024, International Paper Company announced the launch of its new line of specialty papers, named "EcoArt," designed for use in high-end packaging and labeling applications. This product expansion was in response to growing consumer demand for sustainable packaging solutions (International Paper Company Press Release).

- In March 2024, Smurfit Kappa and BillerudKorsnäs, two leading players in the specialty paper industry, formed a strategic partnership to develop innovative and sustainable packaging solutions. This collaboration aimed to combine their expertise in paper-based packaging and specialty papers, with a focus on reducing the environmental impact of their products (Smurfit Kappa Press Release).

- In May 2024, APP, one of the world's largest pulp and paper companies, completed the acquisition of the specialty papers business of Cascades, Inc. This acquisition significantly expanded APP's specialty paper capacity and market share, enabling the company to offer a broader range of specialty paper products to its customers (APP Press Release).

- In February 2025, SCA, a leading global forest products company, received regulatory approval for its investment in its specialty paper mill in Ostrom, Sweden. This expansion project, which included the construction of a new specialty paper machine, aimed to increase SCA's production capacity and improve its competitiveness in the market (SCA Press Release).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and evolving consumer demands. Heatset paper coatings, for instance, have gained popularity due to their ability to enhance brightness standards and tear resistance, making them ideal for high-volume print applications. Paper dimensional stability and opacity levels are also crucial considerations, with manufacturers employing various techniques such as paper porosity testing and carbonless paper technology to meet these requirements. Moreover, paper weight variations, thermal paper layers, and surface sizing agents have become essential in creating coated paper finishes that cater to diverse industries. Paper recycling methods ensure sustainability, while specialty paper substrates cater to various industries. Inkjet paper properties, paper stiffness parameters, and paper texture analysis are essential for high-quality printing.

Photographic paper base and watermarking techniques cater to the artistic and archival needs. Paper pulp refining and paper smoothness ratings ensure consistent product quality. The market is expected to grow at a steady pace, with increasing demand for specialty papers in various industries, including healthcare, packaging, and graphic arts. Surface sizing effects and paper recycling methods are increasingly important, as sustainability becomes a key priority. Specialty paper substrates, inkjet paper properties, paper stiffness parameters, and paper texture analysis are other areas of focus, with manufacturers continually refining paper pulp and employing calendering processes to optimize paper gloss measurement and high-opacity paper production. For instance, the adoption of advanced watermarking techniques has led to a 15% increase in sales for a leading specialty paper manufacturer. Industry growth is expected to reach 3% annually, driven by the continuous unfolding of market activities and evolving patterns.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Specialty Paper Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

243 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 13.78 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.7 |

|

Key countries |

China, US, Germany, India, Japan, UK, Canada, South Korea, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Specialty Paper Market Research and Growth Report?

- CAGR of the Specialty Paper industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the specialty paper market growth of industry companies

We can help! Our analysts can customize this specialty paper market research report to meet your requirements.