Brazil Solar Power Market Size 2025-2029

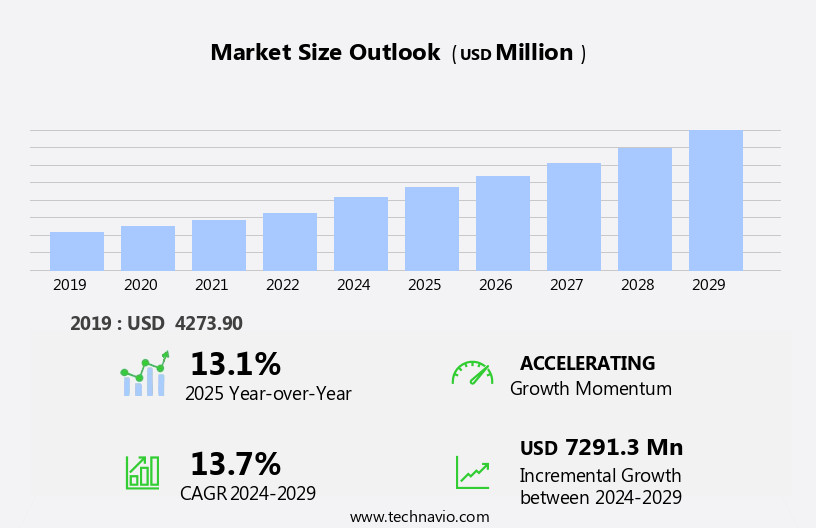

The Brazil solar power market size is forecast to increase by USD 7.29 billion at a CAGR of 13.7% between 2024 and 2029.

- The solar power market experiences robust growth, driven by favorable climatic conditions and the increasing adoption of floating solar power plants. This shift towards renewable energy sources is fueled by global efforts to reduce carbon emissions and combat climate change. However, regulatory hurdles and supply chain inconsistencies temper the market's growth potential. Regulatory frameworks significantly impact the solar power market's expansion, with various governments implementing policies to encourage or hinder adoption. For instance, some countries offer incentives for solar installations, while others impose taxes or restrict subsidies. Inconsistencies in these policies create uncertainty for market players and hinder the industry's growth. The market is witnessing a growing demand for the rising adoption of floating solar power plants and solar panels, advances in thin-film solar PV modules, and the growing application of concentrated solar power in buildings.

- Moreover, the solar power market faces challenges from the rising adoption of alternative energy sources, such as wind and hydroelectric power. While these sources also contribute to the renewable energy sector, they can outcompete solar power in certain regions due to their unique advantages. For instance, wind power is more suitable for areas with consistent wind patterns, while hydroelectric power can provide a more stable energy output. Despite these challenges, the solar power market offers significant opportunities for companies seeking to capitalize on its growth. Innovations in solar panel technology, such as thin-film and perovskite solar cells, can improve efficiency and reduce costs, making solar power a more attractive option for consumers and businesses. Additionally, the increasing demand for renewable energy and the growing awareness of climate change create a favorable market landscape for solar power providers. Companies that can navigate regulatory hurdles and supply chain inconsistencies while offering competitive pricing and innovative solutions will be well-positioned to succeed in this dynamic market.

What will be the size of the Brazil Solar Power Market during the forecast period?

- The solar power market is experiencing dynamic shifts, with battery storage playing a pivotal role in optimizing energy yield and enhancing grid stability. Module efficiency and cell efficiency continue to improve, driving down costs and increasing competitiveness. Solar insurance is gaining traction, offering protection against potential system malfunctions and weather-related damages. Quantum dot solar and perovskite solar are emerging technologies promising higher efficiency and lower production costs. Hybrid inverters, smart grids, and energy trading enable better integration of renewable energy into the power system. Floating solar, community solar, and solar roadways expand access to solar energy and reduce land usage.

- String inverters and utility-scale solar projects dominate the market, with project development and grid modernization being key focus areas. Operations and maintenance, performance monitoring, shading analysis, load shifting, and demand response are essential for maximizing system efficiency and profitability. Solar insolation, peak shaving, and energy management are critical factors in optimizing solar power output.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Grid-connected

- Off-grid

- End-user

- Utility

- Rooftop

- Technology

- Photovoltaic systems

- Concentrated solar power systems

- Geography

- South America

- Brazil

- South America

By Application Insights

The grid-connected segment is estimated to witness significant growth during the forecast period. The solar power market encompasses various components, including solar trackers, financing, batteries, grid-tied systems, distributed generation, residential solar, installation, passive solar design, net metering, incentives, charging, energy audits, ground-mount solar, regulations, pumps, energy, architecture, thermal storage, crystalline silicon, water heating, power systems, water purification, desalination, grid integration, refrigeration, life-cycle analysis, renewable energy, carbon footprint, farms, energy storage, thermal, rooftop solar, power electronics, commercial solar, cells, cooking, policy, lighting, intermittent energy, agriculture, panels, mounting systems, thermal power, collectors, energy storage, concentrated solar power, utility-scale solar, thin-film solar, energy generation, off-grid systems, feed-in tariffs, energy efficiency, thermal energy, active solar design, inverters, carbon emissions, drying, manufacturing, air conditioning, and green building.

Solar farms, which consist of large solar panel installations, are a significant contributor to the solar power market. Energy storage solutions, such as batteries, are essential for solar farms to provide a consistent power supply and manage energy fluctuations. Utility-scale solar projects require specialized equipment, including power electronics and inverters, to convert solar energy into usable electricity. Concentrated solar power, which uses mirrors or lenses to focus sunlight onto a small area, is an emerging technology in the solar power market. Solar manufacturing companies produce solar cells, panels, mounting systems, and other components. Solar cooking, water heating, refrigeration, and drying are applications of solar energy that offer cost savings and environmental benefits.

Solar policy and regulations play a crucial role in the growth of the solar power market, with governments implementing incentives and subsidies to promote renewable energy adoption. Solar lighting, agriculture, and desalination are other emerging applications of solar energy. The solar power market is a dynamic and evolving industry, with various components and applications. Grid-connected solar systems, solar financing, batteries, distributed generation, and passive solar design are key trends in the market. Renewable energy, carbon footprint reduction, and energy efficiency are driving factors for businesses and individuals to invest in solar power. Solar farms, solar manufacturing, and emerging applications, such as solar cooking and desalination, are expanding the market's potential. The solar power market is expected to continue growing as technology advances and governments implement policies to promote renewable energy adoption.

Get a glance at the market share of various segments Request Free Sample

The Grid-connected segment was valued at USD 3.69 billion in 2019 and showed a gradual increase during the forecast period. Grid-connected solar systems, which supply solar energy directly to the electrical grid, are experiencing significant growth. These systems can be connected to buildings or utility grids, allowing for energy exchange. In the case of a surplus, excess energy is fed back into the grid, while shortfalls are met by importing energy. By the end of 2024, Brazil had installed over 3 million distributed solar generation systems, according to the National Electric Energy Agency (ANEEL). Solar financing, such as loans and power purchase agreements, facilitates the adoption of solar power systems. Solar batteries provide energy storage solutions, ensuring a consistent power supply during peak usage hours and grid outages.

Distributed generation, which involves generating electricity at the point of consumption, is gaining popularity due to its cost-effectiveness and environmental benefits. Solar installation companies offer turnkey solutions, from design and engineering to installation and maintenance. Passive solar design incorporates architectural features that maximize solar energy usage, while net metering allows for bill credits for excess solar energy production. Solar incentives, such as tax credits and rebates, encourage businesses and homeowners to invest in solar power. Solar thermal storage systems use heat from the sun to generate electricity, providing an alternative to traditional power sources. Renewable energy, which includes solar power, is becoming increasingly important as businesses and individuals strive to reduce their carbon footprint.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Solar Power in Brazil Industry?

- The favorable climatic conditions significantly drive the market growth for solar power, making it a key factor in its expansion. Solar energy generation in Brazil has experienced significant growth due to the country's favorable geographical location and high solar radiation levels. In 2024, Brazil added 4,284 MW to its electricity generation capacity, with over 93% derived from renewable sources, primarily solar and wind energy. The solar power sector in Brazil has been expanding in parallel with the country's economic recovery since 2017. Concentrated solar power and utility-scale solar projects have gained traction, while thin-film solar technology is also being employed in off-grid systems. Advanced technologies like big data, IoT, artificial intelligence, and battery technologies are enhancing performance and efficiency. Energy efficiency measures, such as active solar design, solar inverters, and feed-in tariffs, have played a crucial role in the sector's growth.

- Solar thermal energy is increasingly being used for industrial applications, including solar drying and manufacturing processes. Furthermore, solar energy is being integrated into green building designs for solar air conditioning and other applications. The Brazilian government's commitment to reducing carbon emissions and promoting renewable energy sources has created a favorable regulatory environment for the solar power market. The market's growth is expected to continue as the country invests in renewable energy infrastructure and technology advancements.

What are the market trends shaping the Solar Power in Brazil Industry?

- The rising adoption of floating solar power plants represents a significant market trend in the renewable energy sector. This innovative solution allows solar panels to be installed on bodies of water, maximizing energy production while minimizing land use. Solar power is a growing market driven by advancements in technology and increasing focus on renewable energy sources. Solar trackers, which optimize solar panel efficiency by following the sun's movement, are becoming increasingly popular. Solar financing options, such as loans and power purchase agreements, make solar installation more accessible for businesses and homeowners. Solar batteries are another significant trend, enabling energy storage and grid independence. Grid-tied systems, which feed excess energy back into the grid through net metering, are common in distributed generation. Residential solar adoption is on the rise, with passive solar design and energy audits helping homeowners maximize their solar investment. The integration of smart devices, IoT, big data, and artificial intelligence enhances the efficiency and performance of solar systems.

- Ground-mount solar, where panels are installed on the ground, is a common installation method. Solar regulations vary by location, and understanding them is crucial for a successful solar project. Solar charging stations for electric vehicles are also gaining traction. Solar incentives, such as tax credits and rebates, can significantly reduce the cost of solar installation. Floating solar systems, which utilize water bodies for installation, offer higher efficiency due to cooling effects. Solar pumps, which use solar energy to power irrigation systems, are another application of solar power in agriculture. The solar market is dynamic, with various trends and technologies shaping its growth. Solar trackers, financing, batteries, grid-tied systems, distributed generation, residential solar, passive solar design, net metering, solar incentives, solar charging, energy audits, ground-mount solar, solar regulations, and solar pumps are some of the key elements driving the market forward.

What challenges does the Solar Power in Brazil Industry face during its growth?

- The expansion of alternative energy sources represents a significant challenge to the industry's growth trajectory, as an increasing number of these renewable options become economically viable and increasingly preferred by consumers and governments. Solar energy is a vital component of the renewable energy market, offering numerous benefits such as solar architecture, solar thermal storage, and various applications including solar water heating, solar power systems, solar water purification, solar desalination, and solar refrigeration. However, the market faces challenges, including the high upfront costs of establishing solar farms and the intermittency of solar power.

- The preference for non-renewable energy sources, driven by their reliability and lower initial costs, remains strong. Solar power competes with other renewable energy sources like hydropower, fuel cells, and wind power. Fuel cells, in particular, pose a significant challenge to the residential solar power market due to their ability to produce electricity without combustion and generate fewer pollutants than traditional power generation technologies. A life-cycle analysis of renewable energy sources, including solar power, is essential to understand their carbon footprint and overall environmental impact. Grid integration is another critical factor influencing the market dynamics, enabling the efficient use of renewable energy sources and improving energy storage solutions.

Exclusive Customer Landscape

The solar power market in Brazil forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the solar power market in Brazil report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, solar power market in Brazil forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Canadian Solar Inc. - The Canadian firm specializes in solar power maintenance, ensuring optimal system performance and longevity throughout the entire project lifespan.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Canadian Solar Inc.

- Cox Energy SAB de CV

- Enel Spa

- ENGIE SA

- First Solar Inc.

- Flex Ltd.

- JinkoSolar Holding Co. Ltd.

- Scatec ASA

- Sengi Solar

- Solaris Photovoltaic Technology

- Tata Power Co. Ltd.

- TotalEnergies SE

- Trina Solar Co. Ltd.

- Yingli Solar

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Solar Power Market In Brazil

- In February 2024, SunPower Corporation, a leading solar technology company, introduced the Maxeon 4 Series solar panels, boasting record-breaking efficiency levels of up to 22.8% [1]. This technological advancement sets a new standard in the solar industry, increasing the potential power output for solar installations.

- In July 2024, First Solar, a major solar panel manufacturer, and Tesla, the electric vehicle and energy storage company, announced a strategic partnership to collaborate on solar projects and energy storage systems [2]. This partnership aims to accelerate the adoption of renewable energy solutions, combining First Solar's expertise in solar panel manufacturing with Tesla's advanced energy storage technology.

- In March 2025, Canadian Solar, a leading solar panel manufacturer, completed the acquisition of Recurrent Energy, a leading independent power producer, for approximately USD1.1 billion [4]. This strategic move expands Canadian Solar's presence in the solar power market by adding a significant portfolio of solar projects in development, construction, and operation.

Research Analyst Overview

The solar power market continues to evolve, with various components such as solar trackers, financing, batteries, grid-tied systems, distributed generation, residential solar, solar installation, passive solar design, net metering, solar incentives, solar charging, energy audits, ground-mount solar, solar regulations, and solar pumps, playing integral roles. Solar energy's applications span across sectors, including architecture, thermal storage, water heating, power systems, water purification, desalination, grid integration, refrigeration, and agriculture. Solar energy's dynamism is evident in the ongoing advancements in technology, policy, and market trends. Crystalline silicon, solar thermal storage, and solar water heating are key components of solar power systems. Renewable energy sources, including solar, are increasingly adopted to reduce carbon footprints and promote energy efficiency. Floating plants provide the regions that have limited space on land to capture solar energy on water, driving the demand for solar energy storage.

Solar farms and utility-scale solar projects are gaining traction, while off-grid systems cater to remote areas. Grid integration and energy storage solutions address intermittent energy challenges. Solar policy and regulations shape market growth, with incentives and net metering schemes encouraging adoption. Solar manufacturing, from solar cells to mounting systems, is a critical aspect of the industry's development. Solar cooking, lighting, and air conditioning systems further expand solar's reach. The solar industry's continuous innovation and adaptation to market demands underscore its potential to shape the future of energy production. Moreover, the other benefits of floating plants and floating solar panels

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Solar Power Market in Brazil insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.7% |

|

Market growth 2025-2029 |

USD 7.29 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

13.1 |

|

Key countries |

Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Solar Power Market in Brazil Research and Growth Report?

- CAGR of the Solar Power in Brazil industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Brazil

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the solar power market in Brazil growth of industry companies

We can help! Our analysts can customize this solar power market in Brazil research report to meet your requirements.