Socks Market Size 2025-2029

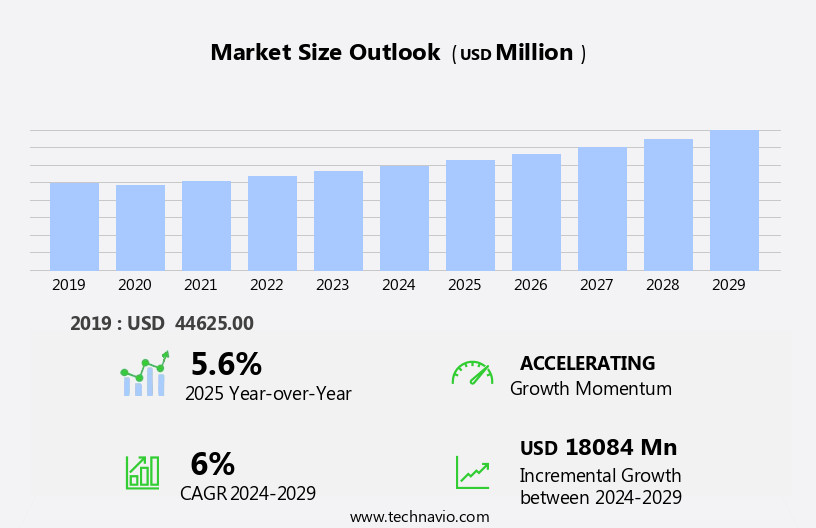

The socks market size is forecast to increase by USD 18.08 billion, at a CAGR of 6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for specialized sock products. Innovative offerings, such as temperature-tracking, movement-monitoring, and location-tracing socks for infants, are gaining popularity due to their unique features and benefits. Additionally, the preference for synthetic or manmade fibers is on the rise, primarily due to their affordability and versatility. However, the market faces challenges, including the increasing competition and the need for continuous innovation to cater to evolving consumer preferences. Furthermore, ensuring ethical sourcing and sustainable production practices is becoming increasingly important for companies to maintain their market reputation and appeal to socially-conscious consumers.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on developing innovative, high-quality products, investing in research and development, and adhering to ethical and sustainable production practices.

What will be the Size of the Socks Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, reflecting the dynamic nature of consumer preferences and advancements in technology. Athletic socks, with their focus on performance and comfort, have gained significant traction, integrating features such as arch support, ankle support, and moisture-wicking fabrics. Dress socks, meanwhile, have adopted fashion trends, offering various color options and seamless construction for a sleek appearance. Material sourcing plays a crucial role, with an increasing emphasis on ethical production and sustainability. Recycled materials and knitting techniques have emerged as popular solutions, alongside temperature regulation and blister prevention features. Health monitoring and wearable technology have also entered the scene, providing consumers with data on their foot health and performance.

Anti-microbial treatment and breathable materials are essential for maintaining foot health and odor control. Manufacturing processes have evolved, incorporating compression technology and smart sock innovations for enhanced comfort and support. Size and fit are no longer an issue with the availability of various options catering to diverse consumer needs. Fiber technology continues to advance, with bamboo socks offering natural benefits and synthetic socks providing durability and versatility. Hiking socks and sportswear brands have embraced these innovations, ensuring optimal performance in diverse conditions. Supply chain management and e-commerce platforms have streamlined distribution, enabling direct-to-consumer sales and convenience.

The market remains a vibrant and evolving landscape, with continuous unfolding of market activities and applications across various sectors. From athletic socks to dress socks, fashion trends to health monitoring, the industry continues to adapt and innovate, ensuring consumers have access to high-quality, functional, and stylish footwear solutions.

How is this Socks Industry segmented?

The socks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Plain knitted

- Rib knitted

- Terry knitted

- Type

- Casual socks

- Athletic

- Material

- Cotton

- Nylon

- Wool

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

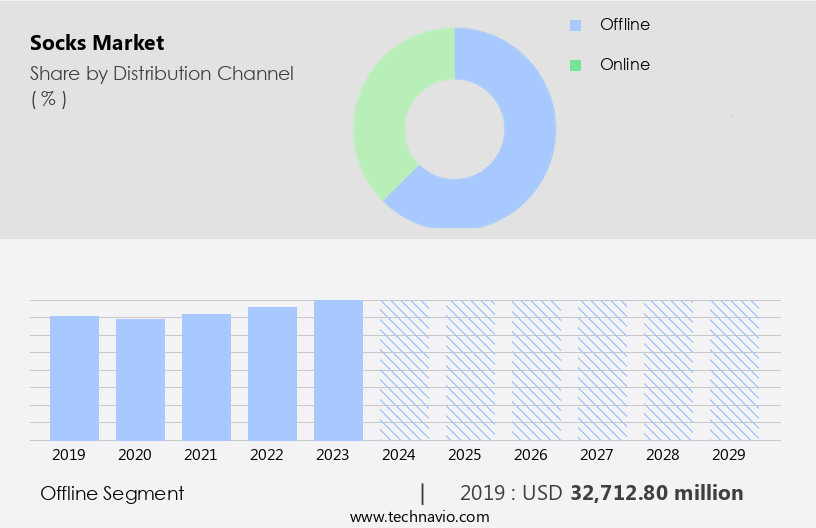

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, consumer preferences continue to shape trends. Quality control is paramount, with manufacturers employing advanced manufacturing processes and technology innovations to produce socks with superior comfort and performance. E-commerce platforms have become a significant distribution channel, enabling direct-to-consumer sales and seamless shopping experiences. Casual socks, padded heels, and ankle support remain popular choices for everyday wear. Performance tracking and fiber technology cater to the active lifestyle segment, with moisture-wicking fabrics, compression technology, and temperature regulation. Wool socks offer foot health benefits, while cotton and synthetic socks cater to diverse consumer needs. Ethical production and recycled materials are gaining traction, reflecting a growing concern for sustainability.

Wearable technology integration, such as smart socks with health monitoring and blister prevention features, is a burgeoning trend. Ankle support, toe protection, and arch support are essential features for various activities, including hiking and athletics. Style variations, color options, and anti-microbial treatment cater to fashion-conscious consumers. Manufacturers are focusing on supply chain management and material sourcing to optimize production costs and improve efficiency. Knitting techniques, dyeing processes, and packaging and labeling are essential aspects of production, ensuring consumer satisfaction. The footwear industry trends, including athleisure and footwear brand collaborations, influence sock design and marketing strategies. Sportswear brands and footwear brands expand their product lines to cater to diverse consumer segments.

Performance socks, running socks, and dress socks cater to specific consumer needs, with innovation in sock technology driving growth. Socks with seamless construction and size and fit customization offer enhanced comfort and convenience. In conclusion, the market is characterized by a diverse range of products, evolving consumer preferences, and innovative technology. Manufacturers and retailers must adapt to these trends to remain competitive and cater to the ever-changing needs of consumers.

The Offline segment was valued at USD 32.71 billion in 2019 and showed a gradual increase during the forecast period.

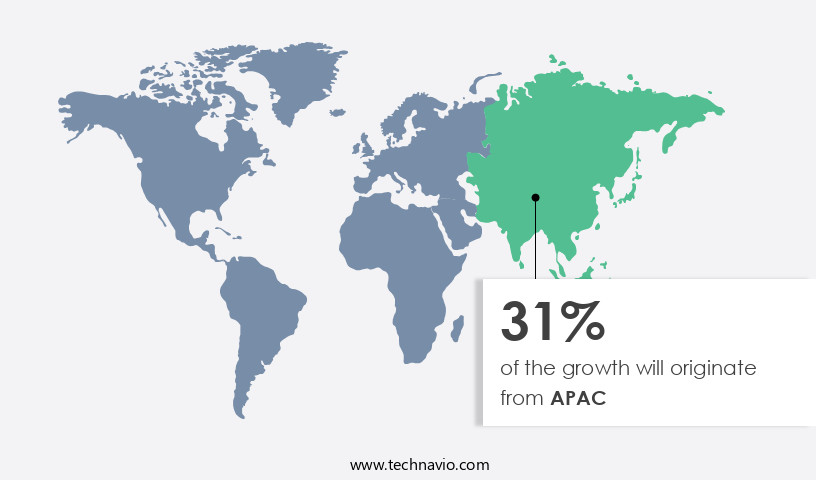

Regional Analysis

APAC is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic the market, casual socks remain a significant segment due to their widespread popularity. Yet, the focus is shifting towards athletic socks as consumers prioritize health and fitness. The adult demographic's increasing preference for quality shoes and sports accessories, coupled with the expansion of health clubs, fuels this segment's growth. Furthermore, rising disposable incomes, a burgeoning retail industry, and the growing importance of maintaining formal attire in corporate settings in countries like China, Bangladesh, Pakistan, and India contribute positively to market expansion in the Asia Pacific region. Manufacturing processes continue to evolve, with advancements in yarn spinning, fiber technology, and knitting techniques.

Consumer preferences lean towards performance-enhancing features such as moisture-wicking fabrics, compression technology, and arch support. Ethical production and foot health benefits, including circulation enhancement and blister prevention, are also becoming essential considerations. E-commerce platforms have revolutionized retail distribution, enabling direct-to-consumer sales and offering a vast array of color options, styles, and sizes. Wearable technology integration, including temperature regulation and health monitoring, adds value to performance socks, catering to the needs of runners and athletes. Cotton socks and synthetic socks each hold a substantial market share, with the latter gaining traction due to its versatility and durability. Wool socks continue to be popular for their insulation properties, while bamboo socks offer eco-conscious consumers an alternative, sustainable choice.

The footwear industry trends towards athleisure and fashion-forward designs, with sportswear brands and footwear brands collaborating to produce stylish, functional socks. Hiking socks and smart socks cater to specific consumer needs, with the latter incorporating features like anti-microbial treatment and seamless construction. Supply chain management and material sourcing are crucial aspects of the market, with recycled materials and sustainable production methods gaining traction due to consumer demand for ethical and eco-friendly products. The market is expected to continue innovating, with advancements in sock technology, such as size and fit customization, and the integration of wearable technology, set to redefine the industry landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and ever-evolving world of fashion accessories, the market stands out as a significant player. This market caters to diverse consumer preferences, offering a wide range of styles, materials, and designs. From merino wool to cotton, silk to spandex, the selection is vast. Socks come in various sizes, including children's, men's, and women's. They are available in different colors, patterns, and textures, such as argyle, striped, and solid. Sock trends include no-show, ankle-length, knee-high, and thigh-high. Sock brands focus on innovation, using technologies like moisture-wicking, arch support, and cushioning. The market also embraces sustainability, with eco-friendly and recycled materials. Socks are essential wardrobe staples, complementing outfits for various occasions, from casual to formal. They are not just functional but also fashionable, making them a must-have in every closet.

What are the key market drivers leading to the rise in the adoption of Socks Industry?

- The market is propelled forward by the increasing demand for specialized sock products.

- The market has experienced significant growth due to the increasing popularity of footwear brands and the athleisure trend. Seamless construction, moisture-wicking fabrics, and compression technology are among the key features driving the demand for performance socks, particularly in the running sock segment. Manufacturers are also focusing on foot odor control and style variations to cater to diverse consumer preferences. Sock technology innovations, such as dyeing processes, have led to an expansion of color options. The market's growth is further propelled by the importance of foot care, particularly for individuals with diabetes, leading to the development of specialized socks.

- Effective supply chain management is crucial in meeting the increasing demand for these specialized socks. In conclusion, the market is expected to continue its growth trajectory, driven by consumer preferences for comfort, functionality, and style.

What are the market trends shaping the Socks Industry?

- The upcoming market trend involves the launch of sophisticated socks for infants, equipped with temperature tracking, movement monitoring, and location technology. These advanced features ensure enhanced safety and comfort for infants.

- The footwear industry is witnessing notable trends, with a significant focus on innovative sock designs catering to various consumer preferences. Two popular sock categories are athletic and dress socks. Millennials, a large consumer demographic, are driving the demand for these socks due to their active lifestyles and fashion-consciousness. Athletic socks are increasingly incorporating advanced features such as material sourcing from recycled materials, blister prevention, and temperature regulation. These socks often employ knitting techniques to enhance comfort and breathability. Moreover, some brands are integrating health monitoring capabilities and anti-microbial treatments to cater to consumers' health-conscious needs. Dress socks, on the other hand, are undergoing a transformation with fashion trends favoring bold colors, patterns, and unique designs.

- Sustainability is also a growing concern, with some brands using recycled materials to create stylish and eco-friendly options. Size and fit are essential considerations for both categories, with brands offering a wide range of sizes and employing innovative technologies to ensure a perfect fit. Overall, the sock market is evolving to meet the diverse needs of consumers, offering innovative designs, advanced features, and sustainable materials.

What challenges does the Socks Industry face during its growth?

- The surge in demand for affordable synthetic fibers poses a significant challenge to the textile industry, threatening to hinder its growth.

- Synthetic fibers have gained significant traction in the market due to their superior properties compared to natural fibers like cotton, silk, and wool. These fibers offer advantages such as high strength, low absorption rate, and durability, making synthetic fiber socks long-lasting and quick-drying. Additionally, natural fibers have become increasingly expensive, particularly in their pure form. Synthetic fibers provide a cost-effective alternative as many synthetic fabrics mimic natural ones, such as wool and silk. Quality control is a crucial aspect of the market, with e-commerce platforms prioritizing performance tracking to ensure customer satisfaction. Manufacturing processes have evolved to incorporate advanced technologies, such as wearable technology, to enhance ankle support and improve overall comfort.

- Consumer preferences continue to shift towards synthetic fibers due to their performance benefits and affordability. Casual and performance socks, including padded heel and wool options, are popular categories in the market. Yarn spinning techniques have advanced, allowing for finer and more intricate designs. As the market continues to evolve, it is essential for retail distribution channels to adapt to consumer demands and technological advancements.

Exclusive Customer Landscape

The socks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the socks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, socks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - The company specializes in providing a range of high-quality socks for discerning consumers. Among the offerings are cushioned low-cut socks, designed for optimal comfort and support, and monogrammed thin crew socks, adding a personal touch to everyday attire. By utilizing advanced materials and manufacturing techniques, these socks deliver superior comfort, durability, and style. The company's commitment to innovation and customer satisfaction sets it apart in the market, ensuring a rewarding experience for those seeking premium sock solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- ASICS Corp.

- Drew Brady and Co Ltd.

- Drymax Technologies Inc.

- FALKE KGaA

- Glen Clyde Co.Ltd.

- Hanesbrands Inc.

- Implus Footcare LLC

- Jockey International Inc.

- John Smedley Ltd.

- Nike Inc.

- OEJBRO ENGROS AB

- Pantherella International Group Ltd.

- Patagonia Inc.

- PUMA SE

- Ralph Lauren Corp.

- Skechers USA Inc.

- Swedish Socks AB

- Thorlos

- Under Armour Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Socks Market

- In January 2024, StripeSocks, a leading socks manufacturer, announced the launch of its new eco-friendly sock line, made from recycled materials, in partnership with Patagonia, a renowned outdoor brand (StripeSocks Press Release, 2024). This collaboration aimed to cater to the growing demand for sustainable fashion and expand StripeSocks' product offerings.

- In March 2024, H&M Group, the global fashion retailer, acquired a minority stake in SockStar, a popular sock brand, to strengthen its footwear portfolio and improve its market presence in the socks category (H&M Press Release, 2024). The investment represented a significant strategic move for H&M to diversify its product offerings and cater to the increasing consumer demand for specialized sock brands.

- In May 2024, the European Union passed a new regulation mandating the labeling of socks based on their environmental impact. This regulation, known as the European Union Socks Eco-Labeling Regulation, was designed to encourage the production and sale of eco-friendly socks and promote transparency in the market (European Parliament Press Release, 2024).

- In February 2025, Foot Locker, the largest specialty athletic retailer, entered into a partnership with SockShop, a leading online socks retailer, to expand its footwear and accessories offerings. This collaboration allowed Foot Locker to provide a more comprehensive shopping experience for its customers and tap into the growing demand for specialized sock brands (Foot Locker Press Release, 2025).

Research Analyst Overview

- In the dynamic the market, product differentiation plays a pivotal role as consumers seek unique offerings. Sock subscription services cater to this demand, delivering personalized selections to customers' doors. Social media marketing and influencer partnerships have become essential strategies for brands to reach their audience. Proprietary fabric blends, such as those with ventilation zones and targeted cushioning, are driving innovation. Sock trends forecasts guide manufacturers in creating seasonal collections. Sizing charts, foot biomechanics, and footwear compatibility are crucial considerations for ensuring proper fit and foot health.

- Brand loyalty is fostered through marketing and advertising efforts, price points, and sock construction methods. Foot health research, in collaboration with sports medicine, informs the development of advanced features like odor control technologies, compression levels, and sock liners. Retail partnerships expand market reach, while seamless toe designs and reinforced stress points enhance durability. Customer reviews provide valuable insights into product performance and satisfaction.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Socks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 18084 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, China, Japan, Germany, India, South Korea, UK, Italy, France, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Socks Market Research and Growth Report?

- CAGR of the Socks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the socks market growth of industry companies

We can help! Our analysts can customize this socks market research report to meet your requirements.