Shipping Container Liners Market Size 2025-2029

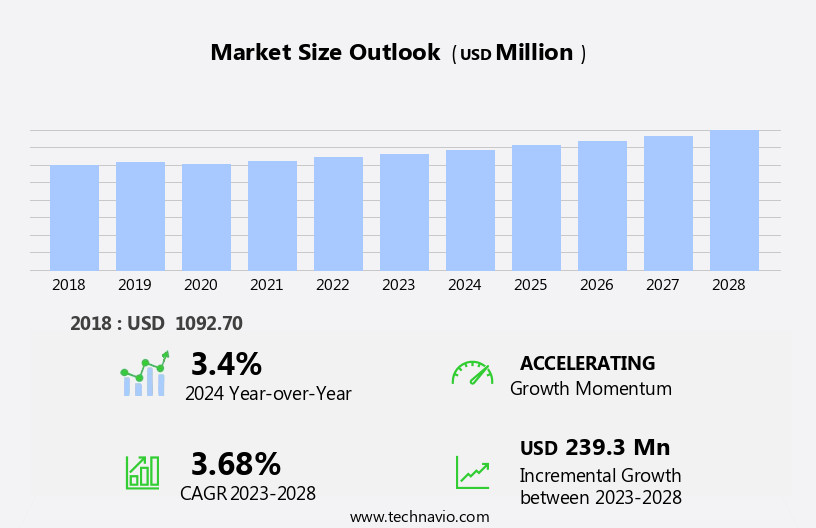

The shipping container liners market size is forecast to increase by USD 257.9 million, at a CAGR of 3.8% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing seaborne trade and the rising demand for cold chain logistics from the pharmaceutical sector. The expansion of international trade and globalization have led to an increase in demand for efficient and reliable container liner solutions. Moreover, the pharmaceutical industry's reliance on temperature-controlled transportation to maintain the integrity of their products is driving the market's growth. However, the market faces challenges as well. The steep increase in raw material prices poses a significant threat to the profitability of container liner manufacturers. These rising costs could lead to higher prices for customers, potentially reducing demand or forcing companies to seek alternative materials or manufacturing methods.

- To capitalize on market opportunities and navigate these challenges effectively, container liner companies must focus on innovation, cost management, and strategic partnerships. The use of protective packaging materials like polyethylene, PVC, and polypropylene in shipping containers is on the rise to ensure the safe transportation of temperature-sensitive goods, particularly in the agriculture sector, where products like rice, wheat, flour, and animal feed are transported. By investing in research and development, optimizing production processes, and collaborating with industry partners, companies can differentiate themselves and remain competitive in this dynamic market.

What will be the Size of the Shipping Container Liners Market during the forecast period?

- The market is a critical segment of the global maritime logistics industry, encompassing various aspects such as ventilation, cost, innovation, technology, recycling, certification, cleaning, material, repair, manufacturing, standardization, safety, durability, regulations, thickness, weight, insulation, and replacement. Container liner ventilation systems ensure optimal cargo conditioning, while innovation and technology drive cost savings and efficiency. Recycling initiatives reduce environmental impact, and certification and cleaning maintain hygiene standards.

- Container liner material selection influences durability and safety, while regulations govern thickness, weight, and insulation requirements. Manufacturers invest in standardization and repair technologies to enhance interoperability and reduce replacement frequency. Container liner safety and durability are paramount to mitigate risks and maintain cargo integrity throughout the supply chain.

How is this Shipping Container Liners Industry segmented?

The shipping container liners industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Food

- Chemicals

- Minerals

- Others

- Type

- Woven polypropylene

- Woven polyethylene

- PE/PET film

- Others

- Product

- Dry containers

- Reefer containers

- Flat rack containers

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

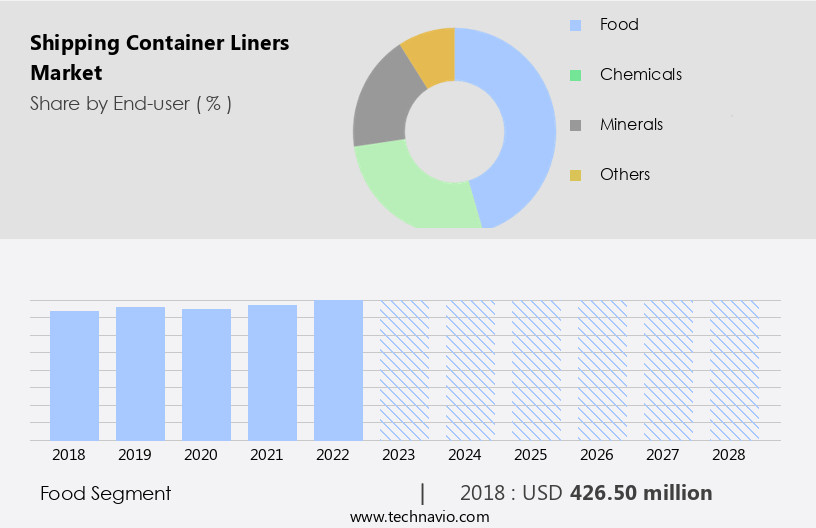

By End-user Insights

The food segment is estimated to witness significant growth during the forecast period. Container liners play a crucial role in the global food industry, ensuring the safe and hygienic transportation and storage of various food products. These liners fit inside shipping containers, offering an extra protective layer against moisture, contamination, and damage for grains, flour, sugar, spices, fruits, seeds, barley, malt, and animal feed. The demand for container liners is driven by the increasing focus on food safety and hygiene. Cargo handling companies provide container maintenance services, ensuring liners are in optimal condition for use. Container insurance and cleaning services further safeguard against potential risks. Container yard management systems facilitate efficient organization and tracking of liners.

Container standards, such as ISO standards, ensure uniformity and compatibility across the industry. Container security measures, including tracking devices and theft prevention systems, protect against theft and loss. Container capacity, utilization, and stacking are essential considerations for container terminal operators managing large volumes of food products. Intermodal rail and freight shipping services enable seamless transportation between different modes of transport. Container repair and certification services ensure compliance with regulations and maintain the longevity of the liners. Container leasing and finance options provide flexibility for businesses. Crane operations and container management systems streamline the loading and unloading process. Container recycling and disposal services address the environmental impact of used liners. Container telematics provide real-time information on container location and condition. Container damage, load factor, and cargo weight are critical factors in maintaining the integrity of the food supply chain. Maritime logistics, container barge, and dry container services cater to specific transportation needs. Port infrastructure and flat rack or reefer container options accommodate various food types. In summary, container liners are a vital component in the food industry, providing a cost-effective and protective solution for transporting and storing food products while ensuring food safety and hygiene.

The Food segment was valued at USD 437.50 million in 2019 and showed a gradual increase during the forecast period.

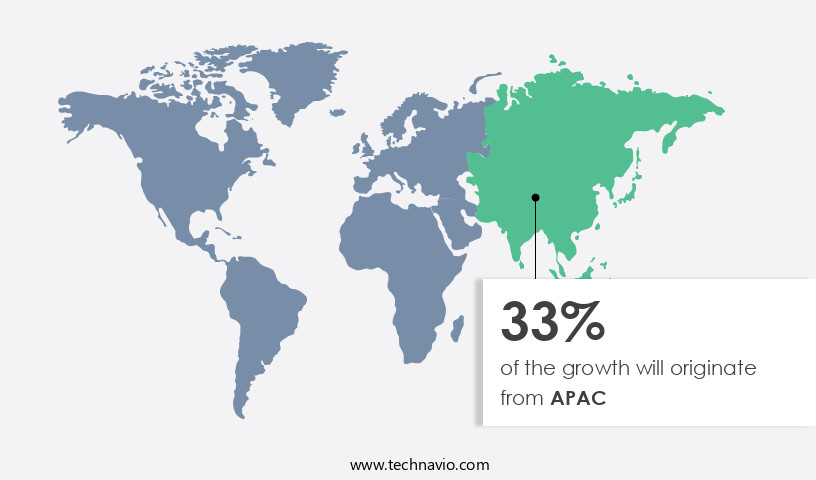

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The agriculture sector in Asia Pacific (APAC) plays a significant role in global food production, with countries like China, India, and Japan being among the top producers. APAC's agricultural exports to neighboring regions and Europe, and the Americas have been increasing, fueling the demand for efficient and reliable container solutions. Container liners, specifically tank containers, play a crucial role in the transportation of perishable goods, ensuring their safety and preserving their quality. Container maintenance, insurance, cleaning, and certification are essential aspects of container management, ensuring the longevity and safe usage of these assets. Cargo handling, a critical component of container logistics, is streamlined through container management systems and intermodal rail and transport.

Crane operations and cargo weight management are also vital in the efficient loading and unloading of containers at ports and terminals. Container yard management, safety, and inspection are essential for maintaining optimal container utilization and preventing damage. Container standards, regulations, and tracking devices ensure the secure transportation of goods and help prevent theft. Container recycling and disposal are essential for minimizing environmental impact and maintaining a sustainable supply chain. Container leasing, telematics, and real-time tracking systems enable efficient container fleet management and optimize container usage. Intermodal transport, including container ships and barges, provide cost-effective and efficient solutions for moving goods across long distances.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Shipping Container Liners market drivers leading to the rise in the adoption of Industry?

- Seaborne trade's expansion is the primary catalyst fueling market growth. The global container liner market is driven by the increasing volume of seaborne trade, fueled by the expanding global economy and rising demand for goods and materials from various regions. For instance, the exports of French wine, a significant export commodity, reached USD 18.42 billion in 2023, highlighting the importance of seaborne transportation in international trade. Container liners play a crucial role in intermodal transport, ensuring the safe and efficient movement of goods from container ships to trucks and vice versa. Container repair and maintenance, container regulations, and container safety inspections are essential aspects of the container liner market, ensuring adherence to ISO standards for container quality and safety.

- Container logistics software and technology solutions further enhance the efficiency and accuracy of container management and transportation operations. The cost-effectiveness of seaborne transportation compared to other methods also contributes to the market's growth. The container liner market is poised for continued growth, driven by the increasing demand for international trade and the need for efficient and cost-effective transportation solutions.

What are the Shipping Container Liners market trends shaping the Industry?

- The pharmaceutical sector's growing requirement for cold chain logistics represents a significant market trend. Cold chain logistics, which ensures the proper storage and transportation of temperature-sensitive goods, is increasingly in demand within the pharmaceutical industry due to the increasing production and distribution of temperature-sensitive medications. The container liner market is driven by the increasing demand for maritime logistics in various industries, particularly in the pharmaceutical sector. Despite pharmaceutical companies primarily relying on air freight and trucking for their transportation needs, the high cost of airfreight and the need to reduce logistics expenses have led to an increase in the use of containerized shipping for cold chain logistics. This trend is expected to continue during the forecast period. Container terminals play a crucial role in the efficient handling and utilization of cargo. Container stacking and load factor are essential factors influencing container terminal operations.

- Dry containers, including flat racks and standard containers, are commonly used for various types of cargo, while reefer containers are specifically designed for transporting temperature-sensitive goods. Container damage is a significant concern in the container liner market, leading to increased focus on improving container utilization and reducing the risk of damage during transportation. Container barge services offer an alternative to traditional container shipping, providing a more cost-effective and eco-friendly solution for transporting cargo over long distances. Port infrastructure development and advancements in container technology are expected to further boost the container liner market's growth. Pharmaceutical companies, under pressure to reduce costs and compete with generic medicines, are increasingly turning to containerized shipping for their cold chain logistics requirements. This shift towards sea freight is expected to continue, offering significant opportunities for market growth.

How does Shipping Container Liners market face challenges during its growth?

- The escalating costs of raw materials pose a significant challenge to the industry's growth trajectory. Container liners, a crucial component of shipping containers, are primarily manufactured using polypropylene (PP), a petrochemical derived from crude oil. The prices of PP have been influenced by the volatility in crude oil markets. In recent years, the production of crude oil by countries such as Russia, Canada, and the US, through conventional means and advanced technologies like fracking, led to a surplus in the market, resulting in a decrease in crude oil prices. However, the surplus is expected to diminish as demand outpaces supply, causing an anticipated increase in crude oil prices.

- This price trend will subsequently impact the cost of PP and container liners. Container maintenance, cleaning, insurance, certification, cargo handling, container yard management, security, and capacity are essential aspects of the container market. Ensuring container standards and addressing challenges such as container theft are critical to maintaining efficiency and profitability in the industry.

Exclusive Customer Landscape

The shipping container liners market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the shipping container liners market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, shipping container liners market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc - The company specializes in providing shipping solutions through the utilization of advanced container liners, such as Amcor FlexiBag.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- AP Moller Maersk AS

- Berry Global Inc.

- Bulk Flow

- Bulk Handling Australia Group Pty Ltd.

- CDF Corp.

- Eceplast Srl

- Emmbi Industries Ltd.

- Greif Inc.

- Intertape Polymer Group Inc.

- LC Packaging International BV

- Ozerden Plastik Sanayi ve Ticaret AS

- Palmetto Industries International Inc.

- Praxas B.V.

- Protek Cargo

- Rishi FIBC Solutions Pvt. Ltd.

- Thermal Packaging Solutions Ltd.

- THRACE PLASTICS CO S.A.

- United Bags Inc.

- Ven Pack

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Shipping Container Liners Market

- In February 2023, Maersk, a leading shipping container liner company, introduced its new product, the Maersk E-Commerce Box. This innovative solution is designed specifically for e-commerce businesses, featuring enhanced security and tracking capabilities to ensure safe and efficient transportation of goods (Maersk press release).

- In June 2024, CMA CGM, the third-largest container shipping company, formed a strategic partnership with IBM to implement AI and IoT technologies across their operations. This collaboration aims to optimize fleet performance, reduce fuel consumption, and enhance supply chain visibility (IBM press release).

- In October 2024, Hapag-Lloyd and MSC, two major container liner companies, announced their merger plans. The combined entity is expected to create the world's largest container shipping company, with an estimated market share of 21% (Reuters news article).

Research Analyst Overview

The shipping container liner market continues to evolve, driven by the dynamic interplay of various factors. Cargo weight and container terminal operations are key considerations, with ongoing advancements in container utilization and maritime logistics shaping industry trends. Container stacking and port infrastructure development are crucial elements, as they impact the efficiency and capacity of container handling. Container liners come in various forms, including dry containers, flat racks, and reefers, each catering to specific cargo requirements. Maritime logistics and container barge operations play a vital role in the seamless transportation of goods. Container yard management systems, container maintenance, and container chassis are essential components of the supply chain, ensuring the smooth flow of cargo.

The Shipping Container Liners Market is expanding as industries focus on enhancing container liner durability and efficiency. Innovations in container liner manufacturing have led to improvements in container liner thickness and container liner weight, optimizing transportation safety. Advanced container liner insulation ensures temperature control, vital for sensitive goods. Regular container liner cleaning and timely container liner repair help maintain functionality, reducing the need for container liner replacement. The container liner cost is influenced by factors like materials and technology, with sustainable practices such as container liner recycling gaining traction. Emerging container liner innovation and container liner technology are revolutionizing logistics, driving demand for high-performance liners.

Container capacity, container load factor, and container yard management are interconnected, with the optimization of container stacking and cargo handling crucial for maximizing efficiency. Container damage, container theft, and container security are ongoing concerns, with advancements in container certification, container inspection, and container tracking devices helping to mitigate risks. Container leasing, container finance, and container telematics are increasingly important aspects of the market, enabling real-time monitoring and management of container fleets. Intermodal rail and intermodal transport, crane operations, and container repair are integral to the broader logistics ecosystem. ISO standards and container regulations continue to shape the industry, with a focus on safety, efficiency, and sustainability. Container recycling and container disposal are essential for minimizing waste and reducing the environmental impact of container shipping. Overall, the shipping container liner market remains a dynamic and evolving landscape, with ongoing innovation and adaptation to meet the changing needs of global trade.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Shipping Container Liners Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.8% |

|

Market growth 2025-2029 |

USD 257.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.5 |

|

Key countries |

US, China, Germany, Japan, UK, India, South Korea, Canada, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Shipping Container Liners Market Research and Growth Report?

- CAGR of the Shipping Container Liners industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the shipping container liners market growth of industry companies

We can help! Our analysts can customize this shipping container liners market research report to meet your requirements.