Securities Exchanges Market Size 2025-2029

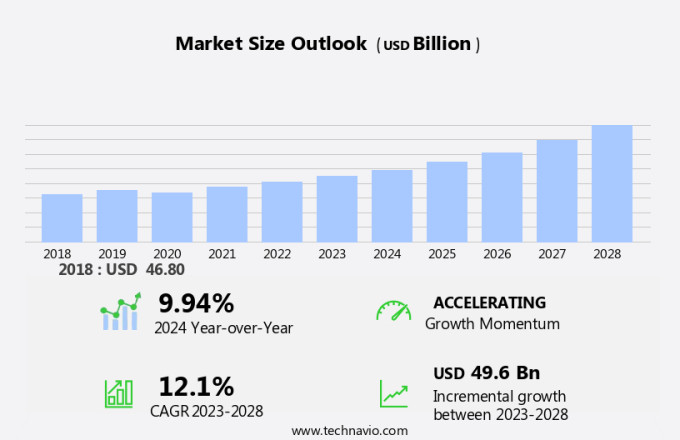

The securities exchanges market size is forecast to increase by USD 56.67 billion at a CAGR of 12.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for investment opportunities. This trend is fueled by a global economic recovery and a rising interest in various asset classes, particularly in emerging markets. Another key driver is the increasing focus on sustainable and environmental, social, and governance (ESG) investing. This shift reflects a growing awareness of the importance of long-term value creation and the role of exchanges in facilitating socially responsible investments. This trend is driven by the expanding securities business units, including stocks, bonds, mutual funds, and other securities, which cater to the needs of investment firms and individual investors. However, the market is not without challenges. Increasing market volatility poses a significant risk for exchanges and their clients.

- Furthermore, the rapid digitization of trading and the emergence of alternative trading platforms are disrupting traditional exchange business models. To navigate these challenges, exchanges must adapt by investing in technology, expanding their product offerings, and building strong regulatory frameworks. Data analytics and big data are also crucial tools for e-brokerage firms to gain insights and make informed decisions. By doing so, they can capitalize on the market's growth potential and maintain their competitive edge. Geopolitical tensions, economic instability, and regulatory changes can all contribute to market fluctuations and uncertainty.

What will be the Size of the Securities Exchanges Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the dynamic market, financial instrument classification plays a crucial role in facilitating efficient trade matching through advanced execution quality metrics and order book liquidity. Quantitative trading models leverage options clearing corporation data to optimize portfolio holdings, while trade matching engines utilize high-speed data storage solutions and portfolio optimization algorithms to minimize latency and enhance market depth indicators. Data center infrastructure and network bandwidth capacity are essential components for supporting complex algorithmic trading strategies, including latency reduction and price volatility forecasting. Market impact measurement and risk assessment methodologies are integral to managing market impact and mitigating fraud, ensuring regulatory compliance through transaction reporting standards and regulatory compliance software.

Exchange traded funds (ETFs) have gained popularity, necessitating robust quote dissemination systems and trade surveillance analytics. Server virtualization and cybersecurity threat mitigation strategies further strengthen the market's resilience, enabling seamless integration of data-driven quantitative models and sophisticated fraud detection algorithms. Additionally, users of online trading platforms can easily monitor the performance of their assets thanks to real-time stock data.

How is this Securities Exchanges Industry segmented?

The securities exchanges industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Market platforms

- Capital access platforms

- Others

- Trade Finance Instruments

- Equities

- Derivatives

- Bonds

- Exchange-traded funds

- Others

- Type

- Large-cap exchanges

- Mid-cap exchanges

- Small-cap exchanges

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Switzerland

- UK

- APAC

- China

- Hong Kong

- India

- Japan

- Rest of World (ROW)

- North America

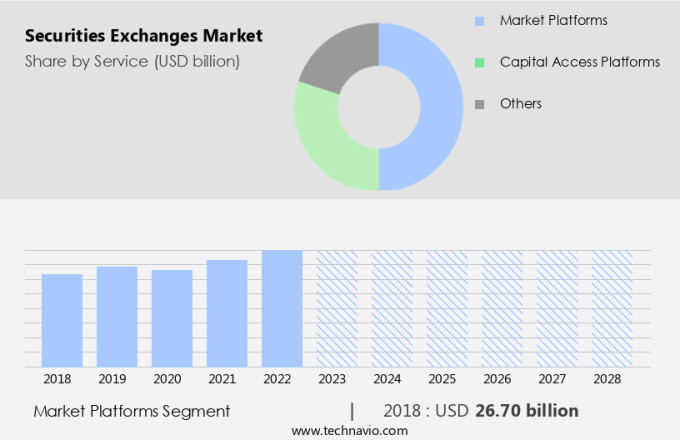

By Service Insights

The Market platforms segment is estimated to witness significant growth during the forecast period. The market is characterized by advanced technologies and systems that enable efficient price discovery, manage settlement risk, and ensure regulatory compliance. Market platforms, which include trading platforms, order-matching systems, and market data dissemination, hold the largest share of the market. These platforms facilitate the buying and selling of securities, providing market liquidity and transparency. Real-time market surveillance and high-frequency trading infrastructure are crucial components, ensuring fair and orderly markets and enabling efficient trade execution. Financial modeling techniques and algorithmic trading platforms optimize trading strategies, while electronic communication networks and central counterparty clearing minimize risk. Regulatory reporting systems and compliance monitoring tools ensure adherence to regulations, including short selling regulations and data security protocols.

Blockchain technology applications and distributed ledger technology enhance security and transparency, streamlining processes and reducing operational costs. Risk management systems and order management systems manage trade lifecycles, from pre-trade to post-trade. Market data feeds provide real-time information, enabling informed decision-making. Trading algorithm optimization and network latency measurement further enhance trading efficiency. Derivatives trading platforms and portfolio management systems cater to the complex needs of institutional investors. Market microstructure modeling and transaction cost analysis help market participants understand market dynamics and minimize costs. Trade execution systems facilitate the execution of trades, ensuring efficient and effective market interaction.

Overall, the market is dynamic and evolving, driven by technological advancements and regulatory requirements. In addition, banks, securities firms, and online trading platforms facilitate securities transactions through brokerage services, charging brokerage fees for their expertise and access to market data analytics.

The Market platforms segment was valued at USD 29.2 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

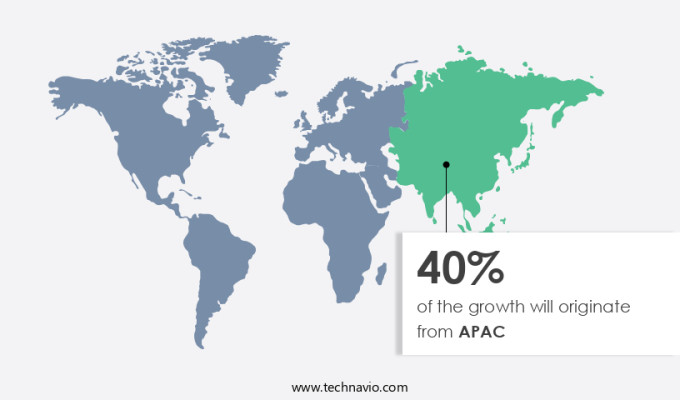

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is a dynamic and intricate ecosystem, underpinned by advanced financial systems and economies. With major players like China, Japan, India, South Korea, and Australia, APAC hosts some of the world's most significant and rapidly expanding economies. These exchanges serve as vital catalysts for capital formation, investment, and trading activities. APAC's securities exchanges are renowned for their liquidity and attractiveness to both domestic and international investors. Notable exchanges, such as the Shanghai Stock Exchange and the Hong Kong Stock Exchange, play pivotal roles in the region. Companies in APAC leverage these exchanges to raise capital through Initial Public Offerings (IPOs) and subsequent secondary market trading. ESG investing integration and algorithmic trading strategies are emerging trends.

Price discovery processes are integral to these exchanges, ensuring fair and transparent valuation of securities. Settlement risk management is meticulously handled to ensure secure and efficient transactions. Advanced technologies like blockchain and distributed ledger technology are increasingly applied to enhance security and streamline processes. Real-time market surveillance is employed to monitor and mitigate potential risks, while financial modeling techniques aid in informed decision-making. Electronic communication networks facilitate seamless communication between market participants. Central counterparty clearing and regulatory reporting systems ensure regulatory compliance. Index tracking methodologies provide valuable benchmarks for investment strategies, while compliance monitoring tools ensure adherence to regulations.

Algorithmic trading platforms and high-frequency trading infrastructure enable sophisticated trading strategies. Risk management systems and order management systems help manage and optimize trading activities. Market data feeds provide real-time information for informed decision-making, while trading algorithm optimization and transaction cost analysis enhance trading efficiency. Advanced charting tools, artificial intelligence, machine learning, and big data analytics are increasingly integrated into these platforms to enhance the trading experience. Order routing protocols facilitate efficient order execution, and derivatives trading platforms offer additional investment opportunities. Portfolio management systems enable effective asset allocation and trade lifecycle management ensures seamless execution from initiation to settlement. Market microstructure modeling provides insights into market dynamics, and high-frequency trading infrastructure supports advanced trading strategies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Securities Exchanges market drivers leading to the rise in the adoption of Industry?

- The market is driven forward by the increasing demand for investment opportunities, underscoring the significance of this trend for professionals seeking to grow their portfolios. Securities exchanges serve as essential platforms for investment opportunities, attracting individuals and institutions seeking to expand their financial portfolios. The increasing economic landscape shift, characterized by low-interest rates, necessitates investors to explore alternative investment avenues beyond conventional options such as bonds and certificates of deposit (CDs). One popular investment choice is stocks, representing ownership shares in publicly-traded companies. For instance, investors who bought Amazon or Tesla stocks a few years ago have experienced significant returns due to these companies' impressive performance.

- Compliance monitoring tools ensure adherence to regulations, and algorithmic trading platforms facilitate efficient and automated transactions. Network latency measurement and co-location services optimize trading speed, providing a competitive edge. Options pricing models enable investors to manage risk and capitalize on market volatility. In summary, securities exchanges offer a dynamic and sophisticated investment ecosystem, where regulatory reporting systems, index tracking methodologies, compliance monitoring tools, algorithmic trading platforms, network latency measurement, co-location services, and options pricing models contribute to an engaging and seamless trading experience. Regulatory reporting systems ensure transparency and compliance in securities trading, while index tracking methodologies provide benchmarks for investment strategies.

What are the Securities Exchanges market trends shaping the Industry?

- Sustainable and environmental, social, and governance (ESG) investing is gaining significant attention in the financial market. The trend toward ESG investing mandates a focus on companies that prioritize sustainable business practices, strong social responsibility, and effective governance. The market is witnessing a notable shift towards Environmental, Social, and Governance (ESG) investing. This trend is driven by the increasing awareness among investors of the significance of integrating sustainability factors into their investment decisions. In response, securities exchanges are introducing ESG-focused products, promoting transparency, and enhancing sustainability reporting.

- They are also ensuring data security protocols to protect sensitive market data feeds. Additionally, trading algorithm optimization is being used to identify ESG investment opportunities and manage risks effectively. Short selling regulations are also being strictly enforced to maintain market stability. Overall, the market is evolving to meet the changing needs of investors and promote sustainable investing practices. The growing concern among investors regarding environmental and social challenges, such as climate change, natural resource depletion, pollution, and social inequality, is a primary driver of this trend. These issues can materially impact the financial performance and long-term sustainability of companies.

How does Securities Exchanges market faces challenges during its growth?

- The market volatility, which has been on the rise, poses a significant challenge to the industry's growth trajectory. The market faces a substantial challenge from market volatility. During volatile market conditions, investors may react impulsively by selling their assets, leading to significant drops in stock prices and decreased trading volumes. This can negatively impact the revenue of brokerage firms and stock exchanges. Moreover, market volatility can create an unstable and uncertain environment that erodes investor confidence, potentially resulting in the withdrawal of investments and further revenue loss for brokerage firms and exchanges.

- High-frequency trading infrastructure and market microstructure modeling enable market participants to analyze transaction costs and optimize trading strategies. These technologies can help mitigate the impact of market volatility by providing valuable insights and enabling efficient trade execution. Investing in advanced technology and implementing effective risk management strategies are crucial for brokerage firms and stock exchanges to navigate the challenges posed by market volatility and maintain profitability. Order routing protocols, derivatives trading platforms, portfolio management systems, and trade lifecycle management tools are essential for managing market risk and maintaining market stability.

Exclusive Customer Landscape

The securities exchanges market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the securities exchanges market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, securities exchanges market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ASX Ltd. - The company specializes in securities exchange services, including the SSE Composite, SSE 50, and STAR 50 indices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASX Ltd.

- BSE Ltd.

- Deutsche Borse AG

- DUBAI FINANCIAL MARKET PJSC

- Euronext N.V.

- Gielda Papierow Wartosciowych w Warszawie S.A

- Hong Kong Exchanges and Clearing Ltd.

- Intercontinental Exchange Inc.

- Japan Exchange Group Inc.

- JSE Ltd.

- London Stock Exchange Group plc

- Moscow Exchange

- Nasdaq Inc.

- National Stock Exchange of India Ltd.

- Shanghai Stock Exchange

- SIX Group Ltd.

- Tadawul Group

- Taiwan Stock Exchange Corp.

- The Korea Exchange

- TMX Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Securities Exchanges Market

- In January 2024, NYSE (New York Stock Exchange) announced the launch of its new platform, NYSE Arca Innovation, designed for trading innovative technologies and emerging growth companies, marking a significant push into the burgeoning tech sector (NYSE press release).

- In March 2024, Nasdaq entered into a strategic partnership with Google Cloud to modernize its market technology infrastructure, enhancing its data analytics and cloud capabilities (Nasdaq press release).

- In May 2024, the Singapore Exchange (SGX) completed the acquisition of the Jakarta and Surabaya stock exchanges in Indonesia, expanding its footprint in the Southeast Asian market (SGX press release).

- In February 2025, the European Securities and Markets Authority (ESMA) approved the European Multilateral Trading Facility (MTF) for the trading of crypto-assets, paving the way for the institutionalization of digital assets in Europe (ESMA press release).

Research Analyst Overview

The market continues to evolve, with dynamic price discovery processes shaping trading activities across various sectors. Real-time market surveillance and regulatory reporting systems ensure compliance and mitigate settlement risk management. Blockchain technology applications and distributed ledger technology are revolutionizing transaction processing and record-keeping. Electronic communication networks facilitate seamless communication between market participants, enabling efficient order routing protocols and algorithmic trading platforms. Central counterparty clearing and portfolio management systems streamline trade lifecycle management, while high-frequency trading infrastructure optimizes trading algorithm execution.

Network latency measurement and co-location services are essential for minimizing trade execution delays. Options pricing models and market data feeds provide valuable insights for risk management systems and index tracking methodologies. Compliance monitoring tools ensure adherence to short selling regulations and other market rules. Trade execution systems and order management systems enable efficient transaction processing, while market microstructure modeling and transaction cost analysis optimize trading strategies. Data security protocols safeguard sensitive information, and market dynamics continue to unfold, shaping the ongoing evolution of the market.

Additionally, continuous analysis of market trends and investor behavior can help market participants anticipate market movements and adapt to changing market conditions. To facilitate ESG investing, securities exchanges are leveraging advanced technologies like distributed ledger technology and implementing robust risk management and order management systems. Cryptocurrency wallets and tokenized assets enable gamers to monetize their virtual assets and participate in decentralized applications (dApps) built on Ethereum blockchains. However, the market's growth potential is tempered by several challenges. The insurance industry is one sector exploring the potential of DeFi technology providers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Securities Exchanges Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.5% |

|

Market growth 2025-2029 |

USD 56.67 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.6 |

|

Key countries |

US, China, UK, Japan, Germany, India, Hong Kong, Canada, France, and Switzerland |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Securities Exchanges Market Research and Growth Report?

- CAGR of the Securities Exchanges industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the securities exchanges market growth of industry companies

We can help! Our analysts can customize this securities exchanges market research report to meet your requirements.