School Bus Market Size 2025-2029

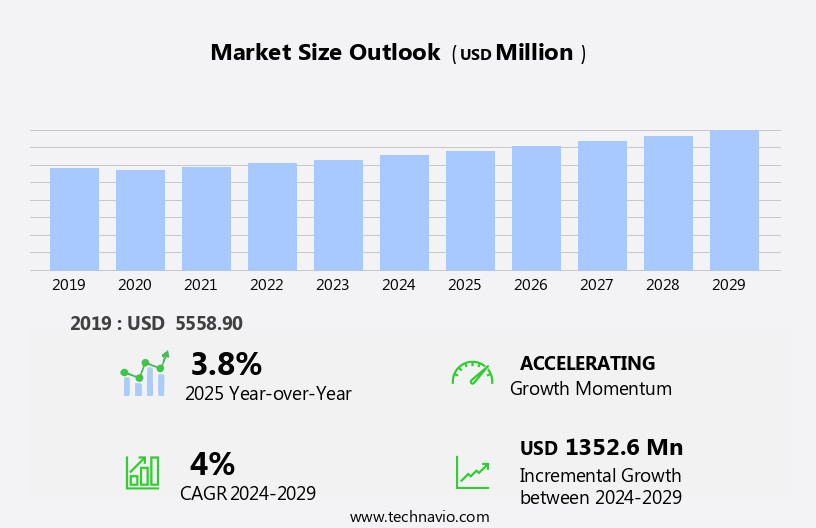

The school bus market size is forecast to increase by USD 1.35 billion at a CAGR of 4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing number of school enrollments worldwide. This trend is particularly noticeable in developing countries, where expanding access to education is a priority. Another key factor fueling market expansion is the adoption of technological innovations, such as GPS tracking systems, electronic fare collection, and real-time student information systems. These advancements not only enhance safety and efficiency but also provide valuable data for school administrators and parents. However, the market is not without challenges. Stringent emission and fuel economy standards are becoming increasingly important, necessitating the use of alternative fuels and more efficient bus designs.

- Meeting these regulations while maintaining affordability is a significant challenge for market participants. Additionally, the ongoing COVID-19 pandemic has disrupted traditional school bus operations, leading to the need for flexible and adaptable solutions. Companies seeking to capitalize on market opportunities and navigate these challenges effectively must stay informed about the latest regulatory requirements and technological advancements, and be prepared to pivot their strategies as needed.

What will be the Size of the School Bus Market during the forecast period?

- The market in the US is experiencing significant growth, driven by the increasing adoption of electric buses to mitigate harmful emissions and address student health concerns, such as allergies and asthma. This shift towards electromobility is also influenced by the integration of advanced technologies, including GPS tracking, enhanced braking systems, and IoT-enabled fleet management solutions. The market's evolution is further fueled by the rising student enrollment in educational institutions, which necessitates the expansion of transportation capacities. Parents' growing emphasis on student safety, mental and physical well-being, and reaction time improvements are also critical factors. The integration of artificial intelligence and seat belts enhances safety features, while improved driver visibility and fuel efficiency contribute to the market's expansion.

- Air pollution concerns and the need for greenhouse gas emissions reduction further bolster the market's momentum. Byd, among other players, is making strides in this sector by offering efficient and eco-friendly electric buses.

How is this School Bus Industry segmented?

The school bus industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Powertrain Type

- ICE-powered

- Electric

- Type

- Type C

- Type B

- Type A

- Type D

- Geography

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- South America

- North America

By Powertrain Type Insights

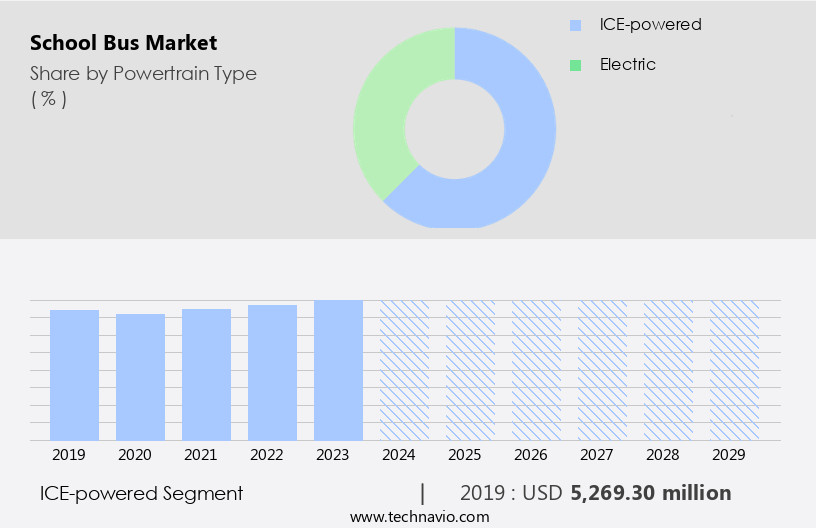

The ice-powered segment is estimated to witness significant growth during the forecast period.

School buses, a vital component of the transport sector, are transitioning towards cleaner and more efficient alternatives to address the air pollution issue. ICE vehicles, including diesel buses, continue to dominate the market but face challenges due to their harmful emissions. Particulate matter and volatile organic compounds (VOCs) are major pollutants emitted by ICE-powered school buses, which can penetrate deep into the lungs and cause severe health issues such as asthma, allergies, and respiratory health concerns. To mitigate these challenges, alternative fuel options like compressed natural gas (CNG) and propane have gained traction. These fuels use the same powertrain as ICE vehicles but offer reduced emissions.

Additionally, electric buses are gaining popularity due to their zero-emission capabilities. Manufacturers like Thomas Built Buses and BYD are introducing electric school buses with advanced features such as thermal management systems, Artificial Intelligence, and Fleet Management Solutions to enhance student safety, cognitive development, and driver visibility. These buses also offer longer life, better fuel efficiency, and lower maintenance costs. Electromobility and clean mobility initiatives are driving the market, with incentives and incentives for zero-emission models. The integration of IoT, GPS tracking, and mobile power units further enhances the student experience, providing a peaceful ride and addressing mental well-being concerns.

Despite these advancements, challenges remain, such as battery weight, charging infrastructure, and grid failures. However, economies of scale and continuous technological advancements are expected to overcome these hurdles. Rising student enrollment and essential services necessitate the need for reliable and efficient school transportation solutions. The market's evolving patterns reflect a shift towards cleaner, more sustainable, and cost-effective alternatives, ensuring a healthier environment for students and the community.

Get a glance at the market report of share of various segments Request Free Sample

The ICE-powered segment was valued at USD 5.27 billion in 2019 and showed a gradual increase during the forecast period.

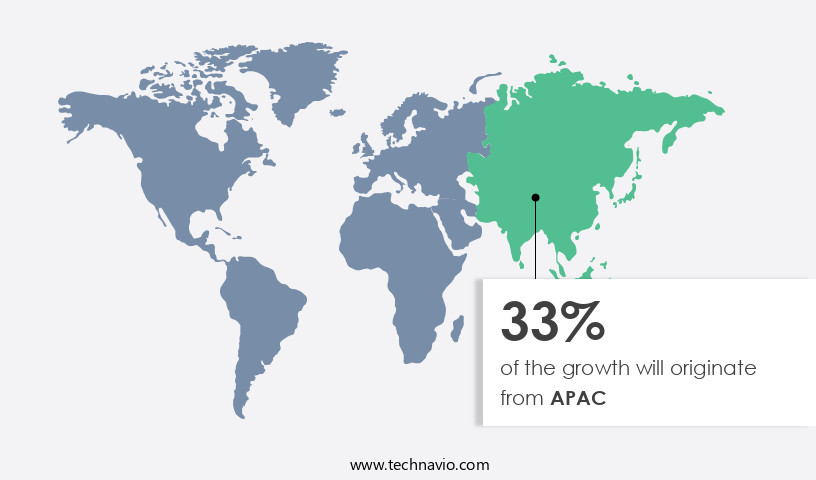

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is marked by the presence of prominent players, including Blue Bird Corporation, IC Bus, and Thomas Built Buses Inc., who also serve international markets. These companies are continually innovating to expand their market share. For instance, Thomas Built Buses introduced the Saf-T-Liner C2 Jouley, an all-electric school bus, while IC Bus offers a thermal management system to enhance fuel efficiency and longer bus life. Air pollution is a pressing issue in the transport sector, and school buses contribute to it through harmful emissions. To address this, companies are introducing low-emission models, such as those powered by propane or electric motors.

Electric School Buses from BYD, for instance, come with a lithium-ion battery pack and DC Fast Chargers, while Zeelo's e-buses offer power banking for extended runs during electricity outages. Driver visibility, cognitive development, and student safety are essential considerations in the market. Companies are integrating Artificial Intelligence, IoT, and GPS tracking to improve reaction time and ensure a peaceful ride for students. Fleet Management Solutions, such as those from First Student, help maintain buses, manage servicing, and optimize running costs. As the demand for cleaner mobility grows, electromobility and zero-emission models are gaining popularity. Incentives from Educational Institutions and governments are further driving the adoption of these buses.

However, challenges such as battery weight, charging infrastructure, and grid failures persist. Companies are addressing these issues through innovations like rooftop solar panels, EV Tariff categories, and mobile power units. Maneuverability and parking spaces are essential factors in the market, especially in urban areas. Companies are focusing on enhancing maneuverability through advanced braking systems, seat belts, and AC/DC inverters. Additionally, bus chassis converters are being used to retrofit existing diesel buses with electric motors. The rising student enrollment necessitates the need for more buses, leading to economies of scale. However, the market also faces challenges like natural calamities and noise pollution.

To mitigate these issues, companies are focusing on enhancing bus durability and reducing noise levels through features like AC Chargers and AC/DC inverters. Parents are increasingly concerned about their children's mental and physical well-being. Companies are addressing these concerns by offering features like improved ventilation systems, better thermal management, and enhanced driver visibility. Moreover, companies are focusing on reducing allergens, such as those from diesel exhaust, to ensure a healthier environment for students.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of School Bus Industry?

- Increase in number of school enrollments is the key driver of the market.

- The market has experienced significant growth due to the increasing enrollment numbers in primary and secondary education sectors. According to the World Bank Group, the global primary and secondary education sectors witnessed a Compound Annual Growth Rate (CAGR) of 0.05% and 0.55%, respectively, between 2017 and 2020. This trend is expected to continue driving the growth of the market.

- With approximately 10,000 international schools in operation as of 2020, the demand for reliable and efficient transportation solutions for students is on the rise. The growing number of schools and the need for adequate infrastructure, including transportation, are key factors contributing to the expansion of the market.

What are the market trends shaping the School Bus Industry?

- Technological innovations is the upcoming market trend.

- The market is experiencing technological advancements, particularly in the realm of information technology. One such innovation is In-Depth Diagnostics, which utilizes advanced sensors to alert drivers to engine faults, damaged indicator lights, and issues with oil tanks, transmission, or exhaust systems. This enables more precise and timely repairs, preventing breakdowns and reducing long-term maintenance expenses. Another development is Advanced Telematics, which incorporates sensor-based detection systems for seat belt use, door opening and shutting, stop sign and stop arm functionality, speed control, and engine idle time.

- These features assist in conducting pre-trip tests, thereby enhancing school bus safety.

What challenges does the School Bus Industry face during its growth?

- Stringent emission and fuel economy standards is a key challenge affecting the industry growth.

- The growing concern over environmental sustainability and the depletion of conventional fuel sources have led governments worldwide to impose stringent fuel emissions and economy standards. Vehicle emissions contribute significantly to air pollution, resulting in approximately 53,000 early deaths annually in the US, as reported in a study conducted at the Massachusetts Institute of Technology. The US Environmental Protection Agency (EPA) states that vehicles account for 56% of carbon monoxide emissions, emphasizing the need for stricter regulations. In response, Original Equipment Manufacturers (OEMs) are under obligation to meet these requirements, driving the demand for alternative fuel buses and advanced emission control technologies.

- The market for school buses is expected to witness substantial growth as players in the industry focus on developing eco-friendly and cost-effective solutions to meet the evolving regulatory landscape.

Exclusive Customer Landscape

The school bus market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the school bus market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, school bus market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ashok Leyland Ltd. - The company specializes in providing school buses, including the Sunshine Diesel model, with a focus on fuel efficiency and reliability, enhancing student transportation while minimizing environmental impact. Our offerings cater to diverse school district requirements, ensuring safety and comfort for students. With a commitment to innovation, we deliver buses that adhere to stringent industry standards and incorporate advanced technologies, making every school commute a productive and enjoyable experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashok Leyland Ltd.

- Blue Bird Corp.

- Collins Bus Corp.

- Eicher Motors Ltd.

- Ford Motor Co.

- Forest River Inc.

- GreenPower Motor Co. Inc.

- Higer Bus USA

- IC Bus Navistar

- JCBLGroup

- Mahindra and Mahindra Ltd.

- Mercedes Benz Group AG

- Scania AB

- SML Isuzu Ltd.

- Tata Motors Ltd.

- The Lion Electric Co.

- Thomas Built Buses

- Trans Tech Bus

- Van Con Inc.

- Zhengzhou Yutong Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The transport sector continues to evolve, with the market experiencing significant changes driven by various factors. One of the key trends shaping this market is the focus on physical and mental well-being of students. As a result, there is a growing demand for ice vehicles, which offer enhanced thermal management systems and improved air quality. These buses are designed to ensure a peaceful ride for students, reducing exposure to harmful emissions and noise pollution. Fuel efficiency is another critical factor influencing the market. Traditional diesel buses are being replaced by low-emission models, such as those powered by propane or electric motors.

The adoption of these alternatives is driven by the need to reduce greenhouse gas emissions and improve overall environmental impact. The integration of artificial intelligence (AI) and fleet management solutions is also transforming the market. These technologies enable real-time monitoring of bus locations, student attendance, and maintenance schedules. They also improve driver visibility, reaction time, and student safety through features like GPS tracking, seat belts, and enhanced braking systems. The air pollution issue is a major concern for educational institutions, particularly in densely populated areas. To address this, some schools are turning to electric buses, which offer zero tailpipe emissions and can be charged using renewable energy sources like rooftop solar.

Others are exploring the use of mobile power units and battery storage to provide backup power during grid failures. Economies of scale are also driving the adoption of electromobility and clean mobility solutions in the market. By pooling resources and collaborating with manufacturers and suppliers, educational institutions can reduce the cost of purchasing and maintaining electric buses and charging infrastructure. Despite these advancements, challenges remain. Battery weight and charging infrastructure are two significant hurdles to the widespread adoption of electric buses. Additionally, natural calamities and essential services disruptions can impact bus operations, highlighting the importance of contingency plans and backup power sources.

In , the market is undergoing significant changes, driven by factors like physical and mental well-being, fuel efficiency, and environmental concerns. The integration of AI, fleet management solutions, and renewable energy sources is transforming the industry, while challenges like battery weight and charging infrastructure persist. As the market continues to evolve, it will be essential for stakeholders to stay informed and adapt to the changing landscape. Entities seamlessly integrated into complete sentences: * The transport sector continues to evolve, with the market experiencing significant changes driven by various factors. * One of the key trends shaping this market is the focus on physical and mental well-being of students.

* There is a growing demand for ice vehicles, which offer enhanced thermal management systems and improved air quality. * Fuel efficiency is another critical factor influencing the market. * The adoption of these alternatives is driven by the need to reduce greenhouse gas emissions and improve overall environmental impact. * The integration of artificial intelligence (AI) and fleet management solutions is also transforming the market. * These technologies enable real-time monitoring of bus locations, student attendance, and maintenance schedules. * They also improve driver visibility, reaction time, and student safety through features like GPS tracking, seat belts, and enhanced braking systems.

* The air pollution issue is a major concern for educational institutions, particularly in densely populated areas. * To address this, some schools are turning to electric buses, which offer zero tailpipe emissions and can be charged using renewable energy sources like rooftop solar. * Others are exploring the use of mobile power units and battery storage to provide backup power during grid failures. * Economies of scale are also driving the adoption of electromobility and clean mobility solutions in the market. * By pooling resources and collaborating with manufacturers and suppliers, educational institutions can reduce the cost of purchasing and maintaining electric buses and charging infrastructure.

* Despite these advancements, challenges remain. * Battery weight and charging infrastructure are two significant hurdles to the widespread adoption of electric buses. * Additionally, natural calamities and essential services disruptions can impact bus operations, highlighting the importance of contingency plans and backup power sources.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2025-2029 |

USD 1352.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.8 |

|

Key countries |

US, Canada, China, Japan, UK, Germany, France, India, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this School Bus Market Research and Growth Report?

- CAGR of the School Bus industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the school bus market growth of industry companies

We can help! Our analysts can customize this school bus market research report to meet your requirements.