Root Beer Market Size 2024-2028

The root beer market size is forecast to increase by USD 143.6 million at a CAGR of 4.28% between 2023 and 2028. The market is experiencing significant growth, driven by the expanding global non-alcoholic beverage industry and the increasing popularity of root beer floats in restaurants and hotels. However, the market faces challenges such as low consumer awareness and the lack of a standardized definition of quality. Key ingredients, including sassafras root bark, wintergreen leaf, honey, vanilla extract, water, black cherry bark, sweet birch, cinnamon, acacia, and nutmeg, contribute to the unique flavor profile of root beer. Producers must ensure the authenticity and consistency of these ingredients to meet consumer expectations and differentiate their products. The root beer remains a beloved classic beverage, with its distinct taste and nostalgic appeal continuing to attract consumers.

Root beer, a unique and beloved American beverage, has been a staple in the country's non-alcoholic beverage industry for decades. This classic carbonated soft drink, traditionally flavored with the sassafras tree, wintergreen leaf, honey, and sugar, continues to capture the taste buds of consumers. The market in the US is characterized by its diversity, with both carbonated and non-carbonated options available. Modern root beers often incorporate synthetic sassafras tastes to mimic the traditional flavor while adhering to regulations that limit the use of natural sassafras due to health concerns.

Furthermore, the demand for root beer is widespread, with its popularity extending beyond the home market. The foodservice sector, including bars, restaurants, and hotels, is a significant consumer of root beer. This trend is particularly noticeable among millennials, who are increasingly seeking out unique and nostalgic beverage options. The distribution network for root beer is extensive, with sales taking place in various retail channels. Supermarkets, hypermarkets, specialty stores, liquor shops, and online sales platforms are all key outlets for root beer. The beverage is also available in departmental stores, further expanding its reach. The production of root beer involves the use of various ingredients, such as sassafras root bark and wintergreen leaf.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Decaffeinated

- Caffeinated

- Distribution Channel

- Off-trade

- On-trade

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- South America

- Middle East and Africa

- North America

By Product Insights

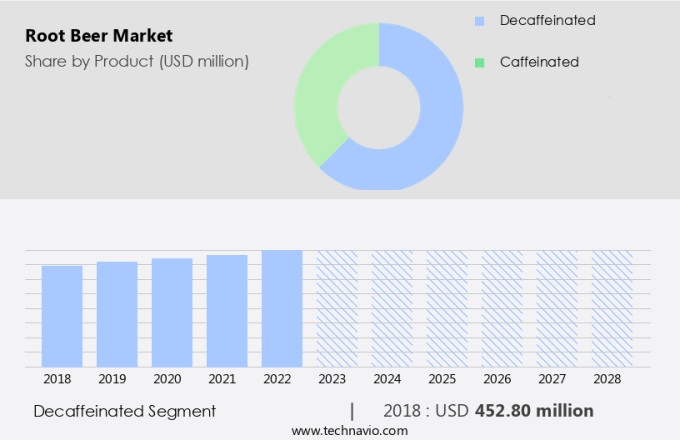

The decaffeinated segment is estimated to witness significant growth during the forecast period. Root beer, a popular non-alcoholic beverage in the United States, has seen significant growth in the decaffeinated segment due to increasing health consciousness among consumers. The demand for caffeine-free root beer is on the rise, with many manufacturers introducing new decaffeinated products to cater to this trend. Traditional root beer recipes once included caffeine derived from kola nuts, but modern variations use filtered water, sugar, and extracts from licorice root and sassafras, which are gluten-free and caffeine-free.

Furthermore, this shift towards decaffeinated and natural ingredients is expected to continue during the forecast period. As a result, the market is likely to witness steady growth, with consumers, particularly teenagers, continuing to enjoy this classic American beverage without the added stimulation of caffeine.

Get a glance at the market share of various segments Request Free Sample

The decaffeinated segment was valued at USD 452.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

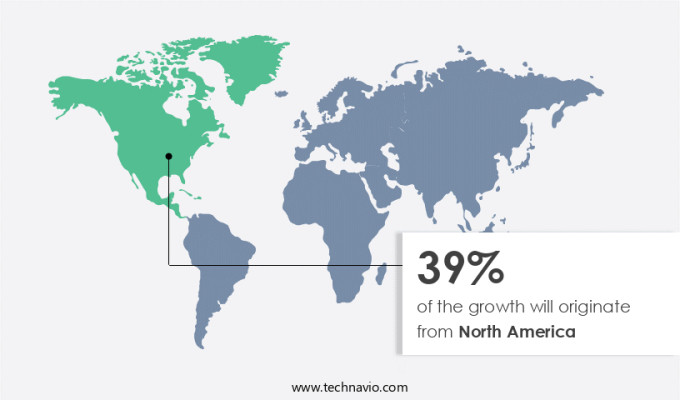

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is experiencing significant expansion due to several key factors. The increasing popularity of this unique beverage, driven by its natural ingredients such as roots, herbs, berries, and barks, is a primary growth driver. Key companies are based in the US and Canada and contribute significantly to the market's growth. Furthermore, the increasing number of local and craft breweries in the region is fueling market expansion. Consumers' rising disposable income also plays a role in the growing demand for root beer, as they seek out more flavorful and authentic alternatives to traditional carbonated soft drinks.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growing global beer market is the key driver of the market. This growth can be attributed to the growing availability of diverse beer options worldwide. To cater to the evolving preferences of consumers, market players have introduced an array of new flavors and products. For example, MillerCoors introduced Two Hats, a light beer with fruit flavors, targeting new beer drinkers. Sweeteners such as high fructose corn syrup and cane sugar continue to be popular in root beer production.

Furthermore, traditional root beer flavors, including anise, sarsaparilla, and vanilla, remain consumer favorites. Additionally, some root beer brands have incorporated plant sterol supplements to offer health benefits. The craft root beer segment has gained traction, with artisan beers offering unique twists on traditional recipes. Root spice blends and wintergreen flavors are among the innovations in this segment. Root beer's versatility extends beyond beverages, with vanilla ice cream being a popular pairing. Root beer floats, a classic dessert, continue to be a crowd-pleaser. Root beer's appeal also extends to the alcoholic beverage market, with artisan breweries producing root beer-flavored ales and stouts. The market's growth is expected to continue, driven by consumer demand for unique and authentic flavors.

Market Trends

The increasing prominence of root beer floats is the upcoming trend in the market. Root beer, a beloved non-alcoholic beverage, continues to gain popularity in various sectors, particularly in the foodservice industry of the United States. Its unique taste, derived from natural ingredients such as sassafras root bark, wintergreen leaf, honey, vanilla extract, water, black cherry bark, sweet birch, cinnamon, acacia, and nutmeg, has made it a favorite among consumers. One of the primary reasons for its increasing demand is the creation of root beer floats, a popular dessert item. This beverage is often served with scoops of ice cream, resulting in a delightful and refreshing treat. Some establishments, including restaurants and hotels, have incorporated root beer floats into their menus, attracting a wider customer base.

Moreover, the versatility of root beer extends beyond floats. Bartenders in the US and other countries have discovered innovative ways to use root beer in cocktails, adding a unique twist to traditional drinks. Root beer's sweet and slightly spicy flavor complements various mixers and spirits, making it an intriguing ingredient for mixologists. Additionally, non-alcoholic root beer is a popular choice among children in the US, making it a staple item in family-friendly establishments. Its appeal lies in its delicious taste and the nostalgic experience of enjoying a root beer float. Overall, the market for root beer is expected to grow steadily during the forecast period, driven by these trends and the enduring appeal of this classic beverage.

Market Challenge

Low awareness of root beer and lack of a standardized definition of quality is a key challenge affecting the market growth. Root beer, derived from the Smilax medica plant and traditionally flavored with safrole, faces challenges in gaining widespread recognition. Establishing brand loyalty and introducing new brands to consumers can take up to 2-3 years. To accelerate market penetration, smaller root beer manufacturers must invest significantly in marketing initiatives. However, the road to popularity is long, as root beer remains a niche beverage among the general public. A major hurdle for market regulators is the absence of a standardized definition of quality for root beer. While some prefer alcohol-free varieties, others opt for low alcoholic beverages. The foodservice market, including bars, is a significant consumer base.

Furthermore, millennials, in particular, are driving demand for root beer due to its nostalgic appeal. Industrial distributors and supermarkets play a crucial role in making root beer accessible to consumers. The beverage's unique flavor profile, derived from ingredients like molasses and safrole, sets it apart from other beverages. However, concerns regarding safrole's carcinogenic properties and the use of artificial sweeteners and caffeine have raised regulatory scrutiny.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AleSmith Brewing Co. - The company focuses on handcrafted ales prepared in a variety of styles. The key offerings of the company include root beer such as San Diego State Ale.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anheuser Busch InBev SA NV

- Beerwulf BV

- BrewDog Plc

- Cloudwater Brew Co.

- Diageo Plc

- East 9th Brewing Co.

- Forbidden Root Restaurant and Brewery

- Iconic Brewing Co.

- Keurig Dr Pepper Inc.

- Kirin Holdings Co. Ltd.

- Mikkeller APS

- Mission Brewery

- Molson Coors Beverage Co.

- Saranac Brewery

- Sprecher

- Stone Brewing Co. LLC

- Swinkels Family Brewers

- The Boston Beer Co. Inc.

- Wild Beer Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Root beer, a unique and beloved beverage in the world of non-alcoholic carbonated soft drinks, has a rich history rooted in the use of natural ingredients like roots, herbs, berries, and barks. Traditionally made from the volatile oils of the sassafras tree, modern root beers often incorporate synthetic sassafras tastes due to health concerns surrounding the carcinogenic component, safrole. Root beer's distinctive flavor profile includes notes of anise, sarsaparilla, vanilla, wintergreen, and various plant sterols. These beverages are popular among consumers of all ages, with millennials and teenagers particularly drawn to the sweet, foamy, and often sweetener-free or low-sugar varieties.

Furthermore, root beer's versatility extends beyond the supermarket and industrial distributors, with applications in foodservice markets such as bars, restaurants, hotels, and even coffee shops. In recent years, there has been a rise in the popularity of craft root beer, artisan beers, and non-alcoholic product segments, catering to diverse consumer preferences. Root beer's health benefits, including its caffeine-free and gluten-free nature, have made it a staple in various retail outlets, from specialty stores and liquor shops to e-commerce platforms and departmental stores. With the rise of vegan foods and anti-alcohol campaigns, alcohol-free and low-alcoholic root beer varieties have gained significant traction.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.28% |

|

Market Growth 2024-2028 |

USD 143.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.91 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 39% |

|

Key countries |

US, Canada, UK, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AleSmith Brewing Co., Anheuser Busch InBev SA NV, Beerwulf BV, BrewDog Plc, Cloudwater Brew Co., Diageo Plc, East 9th Brewing Co., Forbidden Root Restaurant and Brewery, Iconic Brewing Co., Keurig Dr Pepper Inc., Kirin Holdings Co. Ltd., Mikkeller APS, Mission Brewery, Molson Coors Beverage Co., Saranac Brewery, Sprecher, Stone Brewing Co. LLC, Swinkels Family Brewers, The Boston Beer Co. Inc., and Wild Beer Co. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch