Rolling Stock Market Size 2025-2029

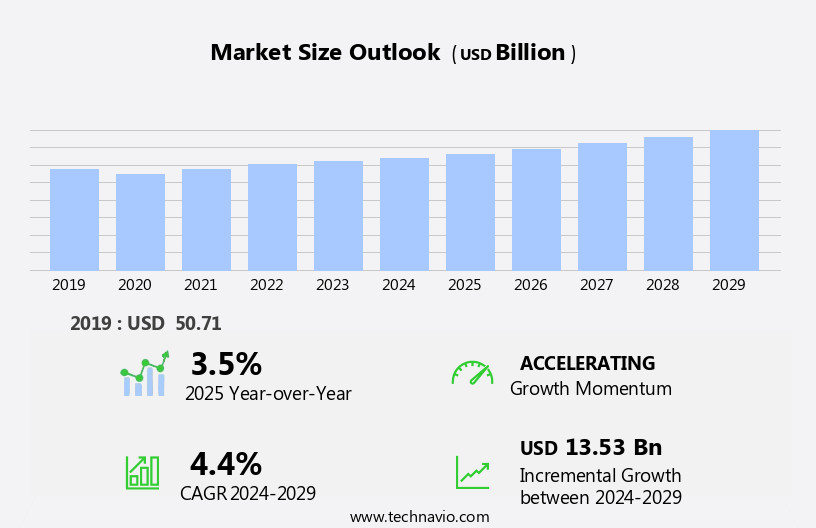

The rolling stock market size is forecast to increase by USD 13.53 billion, at a CAGR of 4.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rise in e-commerce and the increasing adoption of electrification and hybrid solutions in transportation. The e-commerce sector's expansion has led to a rise in demand for efficient and reliable logistics solutions, which rolling stock provides. Moreover, the shift towards sustainable and environmentally friendly transportation is fueling the market's growth, with electrification and hybrid solutions gaining popularity. However, the market faces challenges, including high capital costs in manufacturing. The integration of advanced technologies, such as automation and IoT, into rolling stock production, increases the initial investment required. Companies must navigate these challenges to capitalize on market opportunities and maintain competitiveness. To succeed, they must focus on cost reduction through operational efficiencies, strategic partnerships, and technology innovation. By addressing these challenges, manufacturers can tap into the market's potential and meet the evolving demands of customers.

What will be the size of the Rolling Stock Market during the forecast period?

- The market encompasses the design, manufacturing, maintenance, and operation of vehicles used for transporting passengers and freight on railway networks. This market is driven by various factors, including the demand for efficient and sustainable transportation solutions in the energy sector. With the increasing focus on electricity and reducing carbon emissions, the electrification of railway systems is gaining momentum. Mechanical brakes are being gradually replaced by more energy-efficient and environmentally friendly electric brakes. Additionally, the adoption of hydrogen fuel as a cleaner alternative to traditional diesel engines is a significant trend in the market.

- The market is expected to grow steadily due to the increasing demand for greener transportation options and the expansion of railway networks and rail service facilities. Railway telematics, which enable real-time monitoring and optimization of rail travel, are also gaining popularity due to their potential to improve efficiency and reduce costs. Overall, the market is poised for growth as it plays a crucial role in the transition towards more sustainable and efficient energy systems.

How is this Rolling Stock Industry segmented?

The report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Rail freight

- Rail passenger

- Type

- Diesel

- Electric

- Electro-diesel

- Product

- Locomotive

- Rapid transit vehicle

- Wagon

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

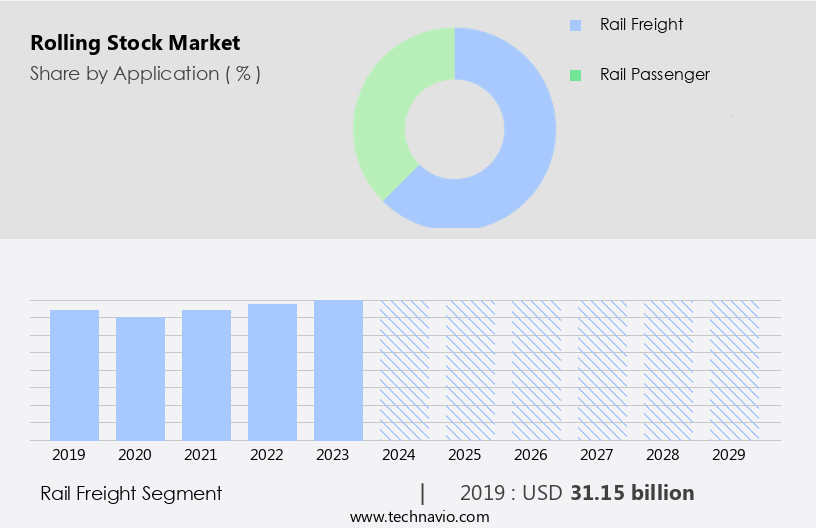

The rail freight segment is estimated to witness significant growth during the forecast period. The rail transportation sector experiences significant demand due to the close correlation with economic activity and the need for efficient freight transport. Industries such as agriculture, mining, energy, and manufacturing rely heavily on rail freight for transporting raw materials and finished products. The expansion and modernization of rail networks, including the construction of new lines and upgrading of existing tracks, necessitate additional rolling stock, including locomotives, freight cars, and maintenance equipment. The types and quantities of commodities transported influence the demand. Furthermore, the shift towards greener transportation and decarbonization initiatives has led to an increased focus on energy-efficient rolling stock, such as electric-based and battery-operated rail vehicles.

Energy conservation technologies, including mechanical brakes, hydrogen fuel, and EV charging infrastructure, are also gaining traction. Urban planners and city infrastructure developers are investing in rapid transit systems, tramways, and high-speed trains to provide affordable and eco-friendly transportation options for commuters. The OEMs and rail operators are responding to these trends by offering energy-efficient rolling stock, onboard Wi-Fi, predictive maintenance, data analytics, sensors and train systems control centers. The metro segment is expected to witness significant growth due to the increasing urbanization and population growth in cities. The rail services facilities market is also expected to grow due to the increasing demand for rail transportation and the need for maintenance and repair services.

Get a glance at the market report of share of various segments Request Free Sample

The rail freight segment was valued at USD 31.15 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

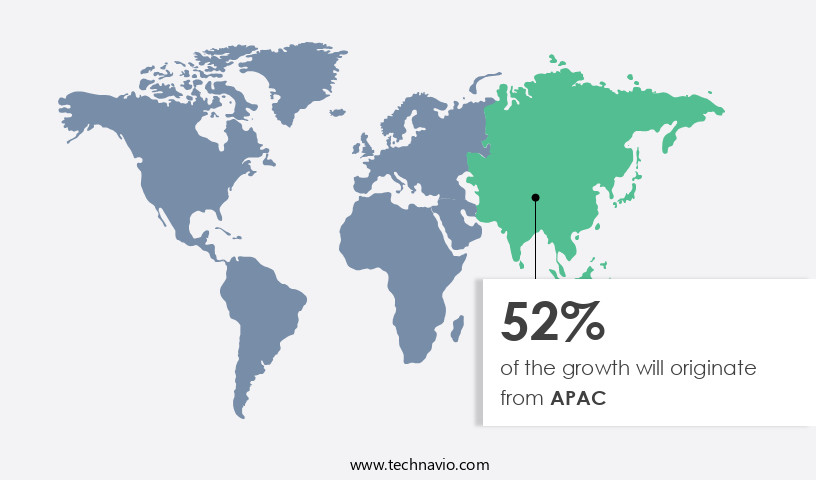

APAC is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia-Pacific (APAC) region's diverse economies and urbanization patterns fuel the growth of the market. Urbanization in APAC countries, such as China, Japan, and South Korea, drives demand for efficient urban transit systems, including subways, light rail, and commuter trains. High-speed rail networks, a necessity for many APAC countries due to extensive trade and logistics networks, necessitate the production of specialized rolling stock. Incorporating energy-efficient technologies, such as electric-based and hydrogen fuel cells, contributes to decarbonization efforts and eco-friendly transportation.

Original Equipment Manufacturers (OEMs) and rail operators collaborate to provide energy-efficient, technologically advanced solutions, including onboard Wi-Fi, predictive maintenance, and sensors for data analytics. Rapid transit systems, including low-floor trains and trams, cater to the affordability and accessibility needs of commuters. The integration of computer vision, railway telematics, and control centers enhances rail services facilities, improving the overall rail travel experience. The APAC market encompasses passenger rails, freight trains, and railway infrastructure, including rapid transit vehicles, railway freight transport, and railway services facilities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Rolling Stock Industry?

- Growing e-commerce boosting rolling stock market is the key driver of the market. The market experiences growth due to the increasing demand for efficient transportation solutions, particularly in freight transportation. The rise of e-commerce is a significant factor driving this demand, as more consumers shop online and expect faster delivery times.

- In response, e-commerce companies are building distribution centers and warehouses closer to urban areas to streamline their logistics operations. Rail transportation plays a vital role in moving goods between these hubs, offering a cost-effective and eco-friendly alternative to trucking and air freight. As e-commerce continues to expand, the need for reliable and efficient rolling stock solutions will only increase.

What are the market trends shaping the Rolling Stock Industry?

- Electrification and hybrid solutions is the upcoming market trend. The market is witnessing a significant shift towards electrification and hybrid solutions to address environmental concerns and enhance energy efficiency. Electrified railways, including high-speed and urban transit systems, are gaining popularity due to their lower greenhouse gas emissions compared to diesel-powered counterparts. High-speed rail networks, which are typically electrified for efficiency and speed, are expanding in regions such as Europe and Asia, fueling the demand for advanced electric rolling stock.

- Hybrid locomotives, which combine diesel and electric power, are also becoming increasingly common. This trend aligns with global efforts to reduce carbon footprints and combat climate change, making electric rolling stock a preferred choice for sustainable transportation solutions. The demand is expected to increase as environmental concerns intensify.

What challenges does the Rolling Stock Industry face during its growth?

- High capital costs in rolling stock manufacturing are a key challenge affecting the industry growth. The market encompasses the manufacturing and procurement of specialized vehicles for passenger and freight services. The industry involves significant capital investments, posing a financial barrier for new entrants and challenging rail operators. The production necessitates advanced technology, precision engineering, and skilled labor, contributing to high costs. Safety is a paramount concern in this sector, necessitating compliance with stringent regulations and standards.

- Meeting these requirements often involves the use of costly specialized materials and components. The engineering and design complexity necessitates a high level of expertise, further increasing production costs. The market demands substantial investments and advanced technology, making it a challenging industry. The importance of safety and regulatory compliance adds to the costs, highlighting the need for efficient manufacturing processes and cost management strategies.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALSTOM SA - The company offers rolling stock products for rail industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Caterpillar Inc.

- Central Japan Railway Co.

- CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES S.A.

- CRRC Corp. Ltd.

- Hitachi Ltd.

- Hyundai Motor Co.

- IHI Corp.

- Kawasaki Heavy Industries Ltd.

- MAPNA Group Co.

- PATENTES TALGO S.L.U.

- Pesa Group

- PPF Group

- Siemens AG

- Stadler Rail Ag

- Tatravagonka a.s. Poprad

- The Greenbrier Companies Inc.

- The Kinki Sharyo Co. Ltd.

- Trinity Industries Inc.

- Westinghouse Air Brake Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the design, manufacturing, and maintenance of rail vehicles, including passenger trains and freight trains. This sector plays a crucial role in the transportation industry, providing an alternative to traditional road and air transportation. The demand is driven by several factors, including the need for greener transportation, urban infrastructure development, and decarbonization efforts. Energy conservation is a significant trend in the market. Electricity, hydrogen fuel, and battery-operated are gaining popularity due to their lower carbon emissions and energy efficiency. Mechanical brakes are being replaced with more advanced systems, such as regenerative braking, to reduce energy consumption and improve overall performance.

Further, the transportation sector, including rolling stock, is undergoing a transformation to meet the demands of urban planners and commuters for affordable and efficient transportation. Rapid transit systems, tramways, and high-speed trains are becoming increasingly common in cities around the world. Refurbishing existing rolling stock fleets is also a popular solution for rail operators looking to extend the life of their assets while maintaining affordability. Decarbonization is a major focus in the rail industry, with a shift towards electric-based rolling stock and the electrification of railway infrastructure. Diesel-based rolling stock is being phased out due to its high carbon emissions.

In addition, passenger rails and freight trains are essential components of the transportation network, with daily commuting and railway freight transport relying heavily on these modes of transport. Rail services facilities, such as control centers and train systems, are becoming more advanced, with the integration of computer vision, railway telematics, and predictive maintenance. Sensors and data analytics are used to optimize train performance, reduce downtime, and improve safety. The metro segment is a growing area of focus in the market, with eco-friendly transport solutions, such as electric trains and high-speed rail networks, gaining popularity. The global warming crisis has highlighted the importance of reducing carbon emissions, and the rail industry is responding by investing in energy-efficient rolling stock and infrastructure.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market Growth 2025-2029 |

USD 13.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.5 |

|

Key countries |

US, China, Japan, India, UK, South Korea, Germany, France, Italy, The Netherlands, |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rolling Stock Market Research and Growth Report?

- CAGR of the Rolling Stock industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, Middle East and Africa,

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rolling stock market growth of industry companies

We can help! Our analysts can customize this rolling stock market research report to meet your requirements.