Robo Taxi Market Size 2024-2028

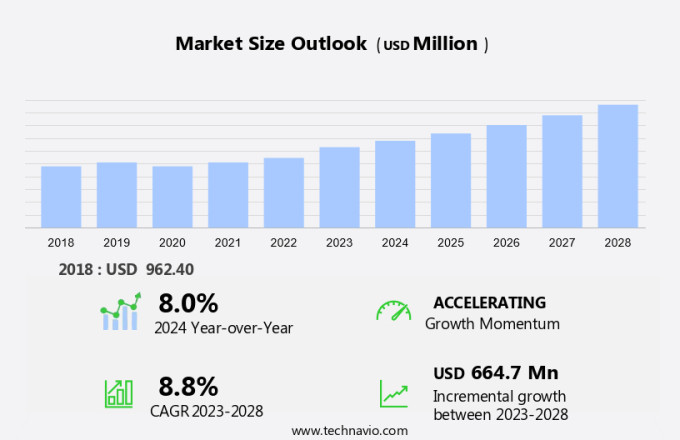

The robo taxi market size is forecast to increase by USD 664.7 million at a CAGR of 8.8% between 2023 and 2028.

- The market is witnessing significant growth due to the increased focus of Original Equipment Manufacturers (OEMs) on developing autonomous taxis. This trend is driven by the integration of Internet of Things (IoT) technology and Artificial Intelligence (AI) in automobiles. The use of these advanced technologies enables vehicles to learn from their surroundings, improve system reliability, and provide a more personalized and efficient ride experience for passengers. However, challenges such as regulatory frameworks and public acceptance of autonomous vehicles continue to pose obstacles to market growth. Despite these challenges, the potential benefits of robo taxis, including reduced traffic congestion, improved safety, and increased mobility for the elderly and disabled, make it an attractive and rapidly evolving market.

What will be the Size of the Robo Taxi Market During the Forecast Period?

- The market, also known as the autonomous taxi or self-driving ride-sharing services sector, is experiencing significant growth as shared autonomous mobility gains traction worldwide. Robotaxis, or driverless vehicles for ride-hailing, integrate advanced technologies such as LiDAR, radar, high-density sensors, and software algorithms to navigate the v2x environment and ensure safe and efficient operation. These vehicles rely on internet connections and semiconductor chips to process sensor data and run deep neural networks (DNNs) for real-time decision-making. However, the market faces challenges, including the semiconductor chip shortage and public trust concerns. Autonomous vehicles require strong charging infrastructure, which is a significant investment for automotive manufacturers.

- Additionally, robotaxis also offer potential applications beyond passenger transportation, including goods delivery and robotic assistance. The market's success hinges on the ability to navigate complex urban environments, ensure passenger safety, and provide a convenient and cost-effective alternative to traditional taxi services. The integration of AI and advanced sensors, including cameras and navigating systems, enables robotaxis to learn from their environment and improve performance over time. Driver intervention remains an essential backup measure, ensuring a smooth and reliable ride-sharing experience.

How is this Robo Taxi Industry segmented and which is the largest segment?

The robo taxi industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Goods transportation

- Passenger transportation

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- Spain

- Norway

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

By Application Insights

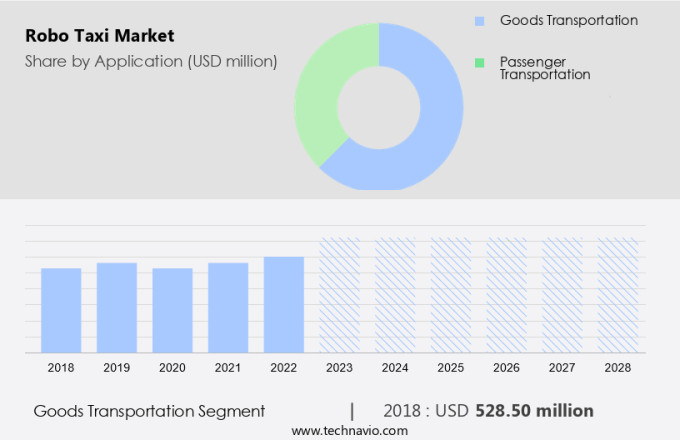

- The goods transportation segment is estimated to witness significant growth during the forecast period.

The market encompasses the use of autonomous vehicles for passenger and goods transportation. Autonomous taxis, also known as robotaxis, utilize self-driving technology, including LiDAR, RADAR, and high-density sensors, to navigate roads safely. Ride-sharing services, such as Uber and Lyft, are integrating shared autonomous mobility into their offerings. Autonomous driving technologies, including software algorithms, AI, and machine learning, enable collision avoidance and traffic reduction. The market faces challenges, including the semiconductor chip shortage, public trust, and accidents.

However, the shift towards electric, hybrid electric, and fuel cell vehicles aligns with emission norms and concerns for fuel efficiency. Autonomous driving technology continues to advance, with deep neural networks (DNNs) and artificial intelligence (AI) playing a significant role. The market includes passenger taxis, ride-sharing services, and goods transportation. Companies are investing in charging infrastructure, autonomous vehicle development, and robo taxis for public transport and e-commerce logistics. Despite challenges, the market's potential for reducing traffic congestion and improving transportation efficiency remains significant.

Get a glance at the Robo Taxi Industry report of share of various segments Request Free Sample

The goods transportation segment was valued at USD 528.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

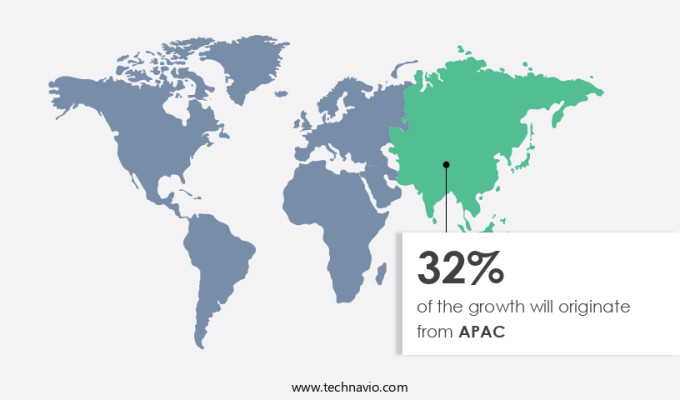

- APAC is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

North American automakers are leading the charge in robo taxi development, with significant investments in autonomous technologies. Since 2015, major manufacturers like Ford, Tesla, and General Motors have initiated research and development In the US. These companies are collaborating with technology firms and fleet operators, such as Uber and Lyft, to integrate advanced AI systems into robo taxis. The focus is on creating self-driving vehicles through acquisitions of tech startups and strategic partnerships. Autonomous driving technologies, including LiDAR, RADAR, high-density sensors, software algorithms, and V2X environments, are essential for robo taxis.

Additionally, electric, hybrid electric, and fuel cell vehicles are prioritized due to emission norms and concerns over fuel efficiency. The development of autonomous driving technologies also involves deep neural networks (DNNs) and artificial intelligence (AI) for collision avoidance and traffic control. The implementation of these technologies in passenger taxis and goods transportation is expected to reduce traffic congestion and improve public trust in autonomous vehicles. The integration of sensors, cameras, navigating systems, and AI is crucial for the success of robo taxis, which are poised to revolutionize ride-sharing services and transportation as a whole.

Market Dynamics

Our robo taxi market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Robo Taxi Industry?

Increased focus of OEMs toward the development of robo taxis is the key driver of the market.

- The autonomous taxi market, also known as Robotaxis, is an emerging segment In the ride-sharing services industry. Self-driving vehicles, powered by advanced technologies such as LiDAR, RADAR, and high-density sensors, are poised to revolutionize mobility development. Autonomous driving technologies, including software algorithms, AI, and machine learning, enable collision avoidance and traffic reduction in a V2X environment. Internet connections and semiconductor chips are essential components, but the ongoing chip shortage poses a challenge. Autonomous vehicles, including electric, hybrid electric, and fuel cell vehicles, are subject to emission norms and autonomous driving technology advancements. DNNs, or Deep Neural Networks, process sensor data to enhance passenger safety and improve fuel efficiency. Robotic assistance and goods delivery are additional applications for this technology. Public trust is crucial In the adoption of autonomous vehicles.

- Additionally, accidents and road safety are primary concerns, necessitating stringent traffic control measures. Automotive manufacturers invest heavily in charging infrastructure and autonomous driving technology research and development. The shift from traditional passenger taxis to shared autonomous mobility services is driven by factors such as traffic congestion, emission concerns, and the desire for cost-effective transportation. The future of the automotive industry lies In the integration of autonomous vehicles into various transportation sectors, including passenger and goods transport. Electric propulsion, AI navigating systems, and autonomous driving technology are shaping the future of transportation. The market dynamics are influenced by factors such as the development of autonomous driving technologies, public trust, and the availability of charging infrastructure. The autonomous taxi market is expected to grow significantly, offering opportunities for innovation and growth In the automotive industry.

What are the market trends shaping the Robo Taxi Industry?

Internet of Things integration powered by AI technology for automobiles is the upcoming market trend.

- The autonomous taxi market, also known as Robotaxi, is a segment of the ride-sharing services industry that utilizes self-driving vehicles for passenger and goods transportation. These vehicles are equipped with high-density sensors, LiDAR, RADAR, and other advanced technologies such as software algorithms, AI, and machine learning, to navigate the V2X environment and ensure road safety. Autonomous driving technologies, including collision avoidance systems, ADAS, and DNNs, are essential for the successful implementation of autonomous vehicles. The integration of IoT, including Internet connections and sensor data, is crucial for the proper functioning of autonomous vehicles. Electric propulsion, hybrid electric vehicles, and fuel cell vehicles are gaining popularity due to emission norms and concerns for fuel efficiency. Autonomous driving technology is revolutionizing transportation, reducing traffic and congestion, and offering potential cost savings through the elimination of driver salaries.

- However, the autonomous vehicle market faces challenges, including the semiconductor chip shortage, charging infrastructure, and public trust concerns following accidents. Autonomous vehicles come in various types, including passenger taxis, ride-sharing services, and goods delivery vehicles. The development of autonomous vehicles is a significant step towards shared autonomous mobility and the future of transportation. In summary, the autonomous vehicle market is a rapidly evolving industry that offers numerous benefits, including improved traffic control, reduced emissions, and increased safety. The integration of advanced technologies, including IoT, AI, and machine learning, is essential for the successful implementation of autonomous vehicles. Despite challenges, the future of transportation lies In the development of autonomous vehicles, which will revolutionize passenger and goods transportation.

What challenges does the Robo Taxi Industry face during its growth?

Less system reliability is a key challenge affecting the industry's growth.

- The Robotaxi market, also known as the autonomous taxi industry, is experiencing significant growth as self-driving technology advances. Ride-sharing services, such as shared autonomous mobility, are increasingly integrating robotaxis into their fleets. Autonomous vehicles rely on LiDAR, RADAR, high-density sensors, software algorithms, and V2X environments to navigate roads safely. Internet connections and semiconductor chips are essential for real-time data processing and communication. However, the semi-autonomous vehicle market faces challenges related to system reliability and public trust. First-time users of autonomous driving technologies require reassurance regarding safety and reliability. Although level 3 autonomous vehicles use advanced driver assistance systems (ADAS) for collision avoidance, occasional system faults can lead to user mistrust and abandonment. Electric vehicles, hybrid electric vehicles, and fuel cell vehicles are popular propulsion options In the robotaxi market, with emission norms driving the adoption of cleaner technologies.

- Additionally, autonomous driving technologies, such as deep neural networks (DNNs), AI, and machine learning, are crucial for navigating systems and traffic reduction. The robotaxi market encompasses both passenger transport and goods delivery services. Robotic assistance and collision avoidance systems are essential for ensuring road safety and traffic control. The charging infrastructure, developed by automotive manufacturers, plays a critical role In the widespread adoption of electric propulsion. Despite the advantages of autonomous vehicles, concerns regarding fuel efficiency, emission concerns, and the semiconductor chip shortage persist. The robotaxi market is expected to continue evolving, with the integration of sensors, cameras, navigating systems, and AI playing a significant role in mobility development.

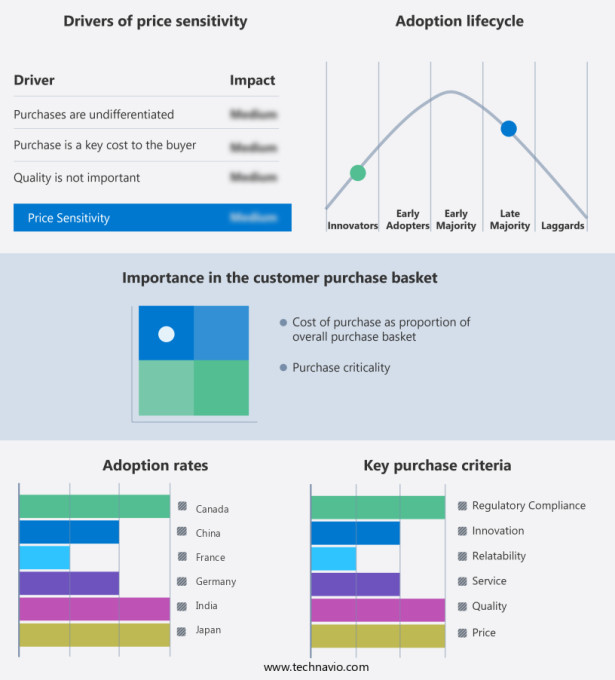

Exclusive Customer Landscape

The robo taxi market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the robo taxi market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, robo taxi market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aptiv Plc

- Argo AI LLC

- AutoX Inc.

- Baidu Inc.

- Cruise LLC

- DiDi Global Inc.

- Easymile SAS

- LeddarTech Inc.

- Lyft Inc.

- May Mobility

- Mobileye Technologies Ltd.

- Navya SA

- Nissan Motor Co. Ltd.

- Nuro Inc.

- NVIDIA Corp.

- Tesla Inc.

- Waymo LLC

- WeRide

- ZF Friedrichshafen AG

- Zoox

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The robo taxi market encompasses a burgeoning sector of autonomous ride-sharing services, characterized by self-driving vehicles devoid of human drivers. This emerging industry is fueled by advancements in autonomous driving technologies, including lidar, radar, high-density sensors, and software algorithms. These technologies enable vehicles to navigate complex environments, process real-time data from their surroundings, and make informed decisions based on their v2x (vehicle-to-everything) environment and internet connections. The robotaxi market is underpinned by a semiconductor chip shortage, which has necessitated innovative solutions to optimize the use of available resources. Autonomous vehicles, including robotaxis, rely on an intricate network of sensors, cameras, and navigating systems, all of which require advanced semiconductor chips. Autonomous driving technologies have been developed to ensure road safety and traffic control, as well as to address emission norms and fuel efficiency concerns. Electric propulsion and hybrid electric vehicles have gained traction In the robotaxi market due to their reduced environmental impact and improved fuel efficiency. Fuel cell vehicles have also emerged as a viable alternative, offering zero-emission transportation with longer driving ranges. The robotaxi market is marked by the integration of artificial intelligence (AI) and machine learning, which facilitate data storage and analysis.

Additionally, deep neural networks (DNNs) are particularly noteworthy, as they enable vehicles to learn from their experiences and improve their performance over time. The robotaxi market is poised to disrupt traditional passenger taxis and goods transportation industries, offering numerous benefits such as reduced driver salaries, increased safety, and improved traffic reduction and congestion management. The integration of robotaxis into public transport systems is expected to revolutionize the way people and goods are moved, leading to more efficient and accessible transportation solutions. However, the widespread adoption of robotaxis faces challenges, including public trust and safety concerns. Accidents and incidents, although rare, can have significant consequences and may hinder the growth of the market. Furthermore, the variety of vehicle types, from passenger taxis to goods delivery vehicles, necessitates a strong charging infrastructure to ensure seamless operation.

Thus, autonomous vehicle manufacturers are at the forefront of robotaxi development, investing heavily in research and development to create safe, efficient, and cost-effective solutions. Collaborations between automotive manufacturers and technology companies are common, as each party brings unique expertise to the table. The robo taxi market is a dynamic and evolving landscape, characterized by rapid technological advancements and shifting market trends. As the industry continues to mature, it is expected to transform the transportation sector, offering innovative solutions to address the challenges of urban mobility and logistics.

|

Robo Taxi Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2024-2028 |

USD 664.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.0 |

|

Key countries |

US, Germany, China, France, Japan, Canada, Norway, India, South Korea, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Robo Taxi Market Research and Growth Report?

- CAGR of the Robo Taxi industry during the forecast period

- Detailed information on factors that will drive the Robo Taxi growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the robo taxi market growth of industry companies

We can help! Our analysts can customize this robo taxi market research report to meet your requirements.