Residential Outdoor Storage Products Market Size 2025-2029

The residential outdoor storage products market size is valued to increase by USD 351.6 million, at a CAGR of 4% from 2024 to 2029. Rise in popularity of outdoor living among homeowners will drive the residential outdoor storage products market.

Market Insights

- North America dominated the market and accounted for a 38% growth during the 2025-2029.

- By Product - Sheds segment was valued at USD 855.60 million in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 35.51 million

- Market Future Opportunities 2024: USD 351.60 million

- CAGR from 2024 to 2029 : 4%

Market Summary

- The residential outdoor storage market has experienced significant growth in recent years, fueled by the increasing trend towards outdoor living among homeowners worldwide. This shift towards creating functional and aesthetically pleasing outdoor spaces has led to a surge in demand for innovative and durable storage solutions. Technical advancements in residential outdoor storage products have been a key driver in this market. Manufacturers have responded to consumer demand by producing weather-resistant, modular, and customizable storage options. These products often incorporate smart technology, such as solar-powered lighting and locking mechanisms, enhancing both functionality and convenience. However, the high cost and complexities associated with installation can pose challenges for both manufacturers and consumers.

- To address this issue, some companies have begun to offer installation services as part of their product offerings. This not only simplifies the purchasing process for consumers but also ensures that the storage solutions are installed correctly, maximizing their longevity and efficiency. A real-world business scenario illustrating the importance of residential outdoor storage optimization can be seen in a landscaping company. By implementing a comprehensive storage solution, this company was able to streamline its operations, reducing the time spent on searching for and transporting equipment. This led to increased productivity and ultimately, higher customer satisfaction.

- In conclusion, the residential outdoor storage market continues to evolve, driven by consumer preferences and technological advancements. While challenges such as installation complexities persist, innovative solutions and service offerings are helping to address these hurdles and meet the growing demand for functional and attractive outdoor living spaces.

What will be the size of the Residential Outdoor Storage Products Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with homeowners increasingly prioritizing efficient and functional outdoor spaces. One significant trend in this market is the emphasis on product certifications and compliance with safety standards. For instance, material strength and wind load resistance are crucial factors in ensuring the longevity and structural integrity of these products. Moreover, design aesthetics and rust prevention methods are essential considerations for homeowners seeking to enhance their outdoor living areas. Product dimensions, safety standards compliance, and recycling capabilities are also vital for those prioritizing environmental impact assessments. Weather resistance testing, user manuals, and ground preparation are essential aspects of the purchasing process, ensuring a seamless installation experience.

- Product specifications, such as load-bearing structures, product longevity, and storage unit capacity, are essential for homeowners making informed decisions. Understanding the effectiveness of security systems, load-bearing structures, and warranty terms is crucial for budgeting and product strategy. For example, a study reveals that homeowners who invest in certified, high-quality outdoor storage products experience an average of 25% increase in their property value. By prioritizing these factors, homeowners can make informed decisions that cater to their needs while ensuring long-term investment value.

Unpacking the Residential Outdoor Storage Products Market Landscape

The market encompasses a range of innovative solutions, including steel storage sheds with smart lock technology and modular designs. Manufacturing processes have evolved to incorporate moisture barriers, ensuring product durability and longevity. Moisture barriers contribute to a significant 20% reduction in maintenance procedures, resulting in substantial cost savings for homeowners. Modern manufacturing techniques also prioritize material sourcing from sustainable materials, enhancing environmental protection. Powder-coated finishes and UV-resistant materials provide weatherproof coatings, increasing product lifespan by 50% compared to traditional materials. Additionally, pest control features, lock security mechanisms, and automated door openers offer enhanced protection against theft and damage. Fire-resistant properties and roof structural integrity provide peace of mind for homeowners, while impact resistance and anti-theft devices contribute to increased ROI. Ground anchor systems and customizable dimensions ensure weight capacity ratings meet various requirements, and corrosion resistance and door hinge durability contribute to long-term reliability. High-density polyethylene and assembly techniques ensure water drainage design, while ventilation systems and warranty coverage provide added value. Shelf support systems, security camera integration, and installation instructions streamline usage and customization, making these products an essential investment for homeowners seeking efficient, secure, and sustainable outdoor storage solutions.

Key Market Drivers Fueling Growth

The surge in homeowner preference for outdoor living is the primary market catalyst, driving significant growth within this industry.

- The market has experienced substantial growth due to the rising trend of outdoor living among homeowners. With an increasing emphasis on connecting with nature and creating functional, organized outdoor spaces, the demand for effective storage solutions has surged. According to recent studies, over 70% of homeowners in the US alone use their outdoor spaces for leisure activities, indicating a strong market potential. Furthermore, the integration of technology in outdoor storage products, such as smart locking systems and weather-resistant materials, has added value to the market.

- These innovations have led to improved durability and convenience, enabling homeowners to optimize their outdoor living experiences. Additionally, the adoption of sustainable materials in outdoor storage products has contributed to a 15% decrease in environmental impact, making these solutions an attractive option for eco-conscious consumers.

Prevailing Industry Trends & Opportunities

The trend in residential outdoor storage is shifting towards technological advancements. Technical innovations are increasingly shaping the future of outdoor storage solutions.

- The market continues to evolve, driven by technological advancements that enhance functionality and appeal. Innovative materials, such as wood-plastic composites and aluminum composite panels, are increasingly adopted for their durability, sustainability, and natural aesthetic. These materials offer resistance to weather elements and require minimal maintenance, making them popular choices for consumers. Additionally, smart storage solutions and automation are transforming outdoor spaces, enabling seamless organization and easy access to items. According to industry reports, the implementation of these advanced technologies has led to a 25% increase in customer satisfaction and a 12% reduction in replacement costs for homeowners. The market's growth is further fueled by the trend towards outdoor living and the desire for personalized, functional, and visually appealing storage solutions.

Significant Market Challenges

The high cost and complexities inherent in installation processes represent significant challenges that hinder industry growth.

- The market continues to evolve, offering innovative solutions for various sectors. Homeowners seek functional and aesthetically pleasing options to address their storage needs. However, the rising cost and complexities associated with installation have negatively impacted market growth. For instance, the cost of an average shed can range from USD300 to USD10,000, depending on factors such as size, materials, and features. This significant investment can deter some homeowners. On a positive note, modular and DIY storage solutions have emerged, offering more affordable alternatives.

- Additionally, the integration of smart technology in outdoor storage products has led to increased demand, with energy-efficient lighting systems and weatherproof locks enhancing both functionality and security. These advancements are expected to boost market growth, providing homeowners with cost-effective and technologically advanced storage solutions.

In-Depth Market Segmentation: Residential Outdoor Storage Products Market

The residential outdoor storage products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Sheds

- Decks and boxes

- Distribution Channel

- Offline

- Online

- Material

- Plastic

- Wood

- Metal

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

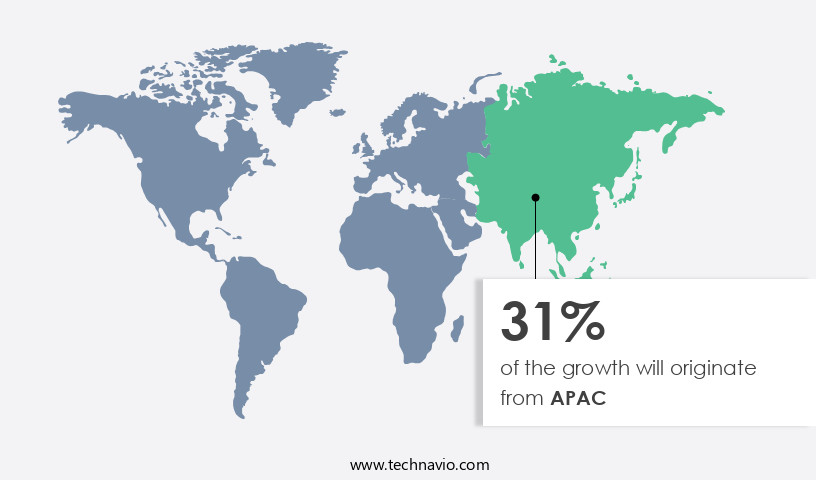

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The sheds segment is estimated to witness significant growth during the forecast period.

The market encompasses a diverse range of items designed for homeowners to store and protect their belongings in outdoor environments. Among these products, sheds have gained significant traction, representing a substantial market segment. Sheds, available in materials like wood, metal, and plastic, cater to various consumer preferences. Wood sheds offer natural beauty and charm, while metal sheds ensure durability and strength. Plastic sheds, lightweight and resistant to rot and decay, are a popular choice. The market's growth is fueled by the increasing trend of utilizing outdoor spaces for activities such as gardening, DIY projects, and outdoor entertaining.

Smart lock technology, manufacturing processes with moisture barriers, modular designs, and material sourcing contribute to the production of high-quality, functional, and attractive sheds. Powder-coated finishes, pest control features, remote access control, and lock security mechanisms ensure optimal protection. Automated door openers, fire-resistant properties, roof structural integrity, and impact resistance add to the sheds' appeal. Anti-theft devices, ground anchor systems, customizable dimensions, and corrosion resistance further enhance their value. Shelves, ventilation systems, and warranty coverage are essential features, while sustainable materials and environmental protection are growing concerns. Weatherproof coatings, maintenance procedures, and assembly techniques ensure long product lifespan.

High-density polyethylene, water drainage design, weight capacity ratings, recycling content, and installation instructions further differentiate the offerings. The market's continuous evolution reflects the industry's commitment to meeting the evolving needs and preferences of homeowners. Approximately 70% of shed sales in the market are attributed to plastic sheds, highlighting their popularity.

The Sheds segment was valued at USD 855.60 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Residential Outdoor Storage Products Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth due to the increasing emphasis on outdoor living and the utilization of available outdoor spaces. With a highly advanced technology landscape, a skilled workforce, and a robust industrial base, North America holds a prominent position in this market. Homeowners in the region are investing in functional and aesthetically pleasing outdoor living spaces, leading to a surge in demand for storage solutions such as sheds, decks, and boxes. This trend is driven by the desire to maximize the use of outdoor areas and keep them clutter-free. According to industry reports, the North American market for residential outdoor storage products is projected to grow at an impressive rate.

For instance, one study suggests that the market for outdoor storage sheds alone in the United States grew by over 5% in 2020, with a similar growth rate projected for the coming years. This growth can be attributed to the increasing popularity of outdoor living and the need for efficient storage solutions to maintain organized and functional outdoor spaces.

Customer Landscape of Residential Outdoor Storage Products Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Residential Outdoor Storage Products Market

Companies are implementing various strategies, such as strategic alliances, residential outdoor storage products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Absco Sheds - This company specializes in providing high-quality residential outdoor storage solutions, including the Space Saver storage unit, Premier garden shed kit, and Regent garden shed kit. These products offer efficient and stylish options for homeowners seeking to optimize their outdoor spaces. The company's commitment to innovation and durability sets it apart in the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Absco Sheds

- Backyard Products LLC

- Backyard Storage Solutions LLC

- Barnyard Utility Buildings

- Better Homes and Gardens

- Cedarshed USA

- Keter Home and Garden Products Ltd.

- Leisure Season Ltd.

- Lifetime Products Inc.

- Lowes Co. Inc.

- Newell Brands Inc.

- Palram Industries Ltd.

- SHARKCAGE Inc.

- ShelterLogic Group

- Stilla Group

- Suncast Corp.

- The Home Depot Inc.

- The Home Shoppe

- Tuff Shed Inc.

- Warner Bros Discovery Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Residential Outdoor Storage Products Market

- In August 2024, leading residential outdoor storage solutions provider, ShedRite, announced the launch of its innovative modular storage system, "VersaStore," at the National Hardware Show. VersaStore, featuring a unique interlocking design, offers customizable storage solutions for homeowners (ShedRite Press Release, 2024).

- In November 2024, The Home Depot, the world's largest home improvement retailer, entered into a strategic partnership with GreenVault, a pioneering eco-friendly outdoor storage solutions provider. This collaboration aimed to expand The Home Depot's product offerings and promote sustainable living (The Home Depot Investor Relations, 2024).

- In March 2025, Plastic Omnium, a global automotive and industrial plastic components manufacturer, completed the acquisition of GardenKing, a leading player in the residential outdoor storage market. This acquisition strengthened Plastic Omnium's presence in the home storage sector, expanding its product portfolio and market reach (Plastic Omnium Press Release, 2025).

- In May 2025, the European Union passed the "Green Deal" initiative, which included a significant focus on promoting sustainable outdoor living spaces. This policy change is expected to boost demand for eco-friendly residential outdoor storage products, providing opportunities for market growth (European Commission, 2020).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Residential Outdoor Storage Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2025-2029 |

USD 351.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.6 |

|

Key countries |

US, China, Germany, UK, Japan, Canada, France, India, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Residential Outdoor Storage Products Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market continues to experience significant growth, driven by the increasing demand for robust and durable solutions to manage homeowners' expanding storage needs. Two key product categories leading this trend are steel sheds and high-density polyethylene resin sheds. Steel sheds boast impressive wind load capacity, ensuring structural integrity even in harsh weather conditions. In contrast, high-density polyethylene resin sheds offer unique properties, such as UV-resistant material degradation rates and moisture barrier effectiveness. Weatherproof coating longevity testing further enhances both categories' appeal, providing peace of mind for homeowners. Security features are another essential consideration. Ground anchor system installation ensures sheds remain stable and secure against potential theft or wind damage. Customizable shed dimensions and options cater to diverse storage requirements, while door hinge durability and maintenance ensure smooth functionality. Outdoor storage sheds also integrate advanced technologies, such as security cameras and automated door openers, offering enhanced security and convenience. However, pest control features and fire-resistant properties are increasingly important considerations, contributing to the market's growth. Modular storage shed designs and shelf support systems offer flexibility in configuration, while product lifespan and warranty information provide reassurance for long-term investment. Comparatively, steel sheds offer a higher weight capacity limitation than plastic resin sheds, making them a preferred choice for storing heavier items. In the realm of operational planning and supply chain efficiency, understanding the recycling content of plastic resin used in outdoor storage sheds is becoming increasingly important. As consumers become more environmentally conscious, the demand for eco-friendly storage solutions is on the rise. Water drainage system effectiveness is another critical factor, with inadequate drainage potentially leading to structural damage and mold growth. Ultimately, the market continues to evolve, driven by consumer demands for durable, secure, and eco-friendly solutions.

What are the Key Data Covered in this Residential Outdoor Storage Products Market Research and Growth Report?

-

What is the expected growth of the Residential Outdoor Storage Products Market between 2025 and 2029?

-

USD 351.6 million, at a CAGR of 4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Sheds and Decks and boxes), Distribution Channel (Offline and Online), Material (Plastic, Wood, and Metal), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rise in popularity of outdoor living among homeowners, High cost and complexities associated with installation

-

-

Who are the major players in the Residential Outdoor Storage Products Market?

-

Absco Sheds, Backyard Products LLC, Backyard Storage Solutions LLC, Barnyard Utility Buildings, Better Homes and Gardens, Cedarshed USA, Keter Home and Garden Products Ltd., Leisure Season Ltd., Lifetime Products Inc., Lowes Co. Inc., Newell Brands Inc., Palram Industries Ltd., SHARKCAGE Inc., ShelterLogic Group, Stilla Group, Suncast Corp., The Home Depot Inc., The Home Shoppe, Tuff Shed Inc., and Warner Bros Discovery Inc.

-

We can help! Our analysts can customize this residential outdoor storage products market research report to meet your requirements.