Residential HVAC Market Size 2025-2029

The residential HVAC market size is forecast to increase by USD 48.82 billion, at a CAGR of 8.8% between 2024 and 2029. The market is experiencing significant growth, driven primarily by the increasing demand for energy-efficient heating and cooling systems in the construction industry.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 49% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

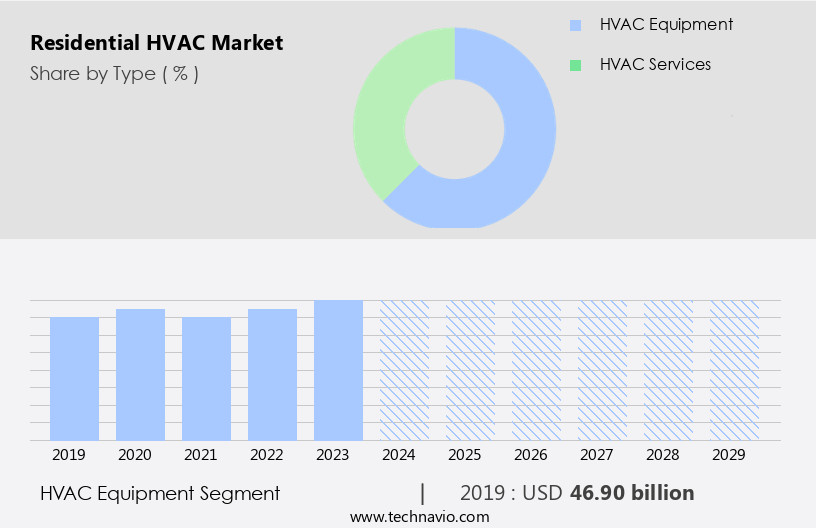

- Based on the Type, the HVAC euipment segment led the market and was valued at USD 58.79 billion of the global revenue in 2023.

- Based on the Product, the air conditioning system segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 92.84 Billion

- Future Opportunities: USD 48.82 Billion

- CAGR (2024-2029): 8.8%

- APAC: Largest market in 2023

The market is experiencing significant advancements, driven by the integration of smart grids and HVAC automation. Data analytics plays a crucial role in optimizing HVAC systems, enabling energy savings and improved customer satisfaction. HVAC innovation continues to evolve, with sustainable design and LEED certification gaining prominence in the industry. HVAC troubleshooting and repair techniques are being enhanced through remote monitoring and predictive maintenance. Building codes and regulations mandate higher energy efficiency standards, driving the demand for HVAC optimization software and commissioning services.

What will be the Size of the Residential HVAC Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. System commissioning, a critical process ensuring HVAC systems operate at peak efficiency, is increasingly prioritized. Refrigerant leak detection, for instance, has gained significance due to the environmental implications of refrigerant loss. Indoor air quality (IAQ) is another major focus, with EER and SEER ratings becoming essential considerations. Heat exchanger design and evaporator coil cleaning are key elements in maintaining optimal IAQ and energy efficiency. Air quality monitoring and duct sealing techniques further enhance system performance and user comfort. Energy Star certification, ventilation system design, and smart home integration are trends shaping the market.

Air balancing services, variable refrigerant flow, and HVAC system maintenance are essential components of modern systems. Humidifier installation, dehumidifier operation, and evaporative cooling systems cater to diverse climate requirements. Airflow measurement, cooling load calculation, and air handler selection are crucial aspects of system design. Variable speed drives, HVAC system zoning, pressure drop calculation, and energy efficiency ratings are essential for optimizing performance and reducing energy consumption. Blower motor efficiency, condenser coil cleaning, thermostat programming, heat pump efficiency, and HVAC system zoning are some areas where improvements can lead to substantial energy savings. Air filtration systems, dehumidifier operation, and evaporative cooling systems contribute to enhanced comfort and improved health.

According to industry reports, the market is expected to grow by over 5% annually, driven by increasing demand for energy-efficient systems and advanced technologies. For instance, a leading HVAC manufacturer reported a 15% increase in sales of smart thermostats in the last quarter.

How is this Residential HVAC Industry segmented?

The residential hvac industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- HVAC equipment

- HVAC services

- Product

- Air conditioning system

- Heating system

- Ventilating system

- Installation Type

- New Construction

- Retrofit/Replacement

- Distribution Channel

- Online

- Offline

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The HVAC equipment segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 58.79 billion in 2023. It continued to the largest segment at a CAGR of 7.02%.

HVAC market trends reflect a growing emphasis on energy efficiency and indoor air quality in both residential and commercial sectors. System commissioning ensures optimal performance of HVAC systems, reducing energy waste and improving comfort. Refrigerant leak detection is crucial for maintaining system efficiency and preventing environmental harm. Indoor air quality is a significant concern, driving demand for air filtration systems and air quality monitoring. EER and SEER ratings are essential metrics for measuring cooling efficiency, while heating load calculation and variable refrigerant flow optimize heating performance. Heat exchanger design and evaporator coil cleaning enhance system durability and efficiency.

Energy Star certification is a key market driver, as consumers seek energy-efficient solutions. Ventilation system design and air balancing services ensure proper air distribution and pressure balance within buildings. Smart home integration allows for remote control and automation of HVAC systems. Variable speed drives and HVAC system zoning offer energy savings and customized comfort. Airflow measurement and cooling load calculation are crucial for system optimization. Humidifier installation and dehumidifier operation maintain ideal indoor humidity levels. Evaporative cooling systems provide energy-efficient cooling alternatives in dry climates. The HVAC industry anticipates steady growth, with estimates suggesting a 5% increase in annual revenue over the next five years.

HVAC system maintenance remains essential for prolonging system life and ensuring peak performance. Blower motor efficiency and condenser coil cleaning contribute to overall system efficiency. Thermostat programming and heat pump efficiency enable customized comfort and energy savings. Air conditioning refrigerant and HSPF ratings are important considerations for environmentally-conscious consumers.

The HVAC equipment segment was valued at USD 44.66 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth, driven by the increasing construction of new residential buildings and the rising demand for energy-efficient solutions. Population growth and urbanization in countries like India and China are major factors fueling this trend. In response, enterprises are investing in the construction of LEED-certified residential buildings, prioritizing energy efficiency and sustainable infrastructure. Energy Star certification, variable refrigerant flow, and smart home integration are key features that resonate with consumers in this region. System commissioning, refrigerant leak detection, and air quality monitoring are essential services ensuring optimal system performance and indoor comfort. Heat exchanger design, evaporator coil cleaning, and air filtration systems contribute to energy efficiency and improved indoor air quality.

The market also anticipates growth due to the increasing adoption of advanced technologies such as air balancing services, variable speed drives, and HVAC system zoning. These technologies enable customized temperature control, improved energy efficiency, and enhanced user experience. Additionally, the market is witnessing a surge in demand for airflow measurement, cooling load calculation, and air handler selection to ensure accurate system design and installation. According to recent industry reports, the market in APAC is expected to grow by 10% annually over the next five years. This growth can be attributed to the increasing focus on energy efficiency, indoor air quality, and the adoption of advanced technologies in the region.

For instance, a leading HVAC manufacturer reported a 15% increase in sales of energy-efficient air conditioners in India last year.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for energy-efficient solutions and advanced technologies. One key trend in this market is the optimization of residential HVAC systems for improved energy efficiency. This includes the use of high-efficiency air filtration media, variable speed air handler installation, and ductless mini split system maintenance. Advanced HVAC control strategies, such as refrigerant charge calculation procedures and airflow optimization in residential applications, are also gaining popularity. Moreover, smart thermostat energy usage monitoring and efficient refrigerant management practices are becoming essential for optimizing residential HVAC system performance.

Improving HVAC energy efficiency metrics is a top priority for homeowners and building developers alike. Effective residential heating system design and efficient cooling system operation strategies are crucial for reducing energy consumption and lowering utility bills. Preventative maintenance scheduling guidelines are essential for ensuring the longevity and efficiency of residential HVAC systems. Designing effective HVAC ventilation systems and improving indoor air quality in residential buildings are also critical for maintaining a healthy living environment. Residential HVAC system installation best practices and efficient refrigerant management are key considerations for contractors and installers. Overall, the market is focused on delivering innovative solutions that enhance comfort, reduce energy consumption, and ensure compliance with evolving efficiency standards.

What are the key market drivers leading to the rise in the adoption of Residential HVAC Industry?

- The surge in demand for HVAC systems in the construction industry serves as the primary market driver.

- The market is experiencing robust growth, fueled by the expansion of the construction industry. This sector's demand for HVAC systems and services is surging, with the global market poised for significant growth. The construction industry's expansion is a key driver, with numerous factors contributing to its growth, particularly in the APAC region. This area is the leading market for construction and is projected to grow at an impressive rate during the forecast period, primarily due to infrastructure and real estate developments.

- The trend toward green buildings is also gaining momentum, leading to increased environmental concerns and heightened demand for energy-efficient HVAC systems. For instance, the adoption of green building practices in the US has led to a 39% increase in energy-efficient commercial buildings between 2015 and 2018. The market's growth is expected to continue, with industry analysts projecting a 5% increase in market size by 2025.

What are the market trends shaping the Residential HVAC Industry?

- In the realm of HVAC systems, the adoption of power evaluation software is becoming increasingly prevalent, signifying a notable market trend.

- The market is experiencing significant growth due to the increasing adoption of advanced power evaluation software programs. Traditionally, HVAC technicians and homeowners had to manually review power bills and consumption data to determine if a new HVAC unit was necessary. However, the introduction of these software tools has streamlined this process, saving both time and resources. These analytical software solutions enable contractors to easily access and analyze power records, leading to improved system performance and potential cost savings. By calculating the lifetime power usage and associated statistics of an HVAC device, these tools provide valuable insights for decision-making.

- As a result, the market for residential HVAC power evaluation software is poised for continued growth, with expectations of a substantial increase in demand.

What challenges does the Residential HVAC Industry face during its growth?

- The growth of the HVAC industry is significantly impacted by challenges pertaining to equipment-related issues.

- The market encompasses intricate heating and cooling systems, comprised of an array of software-based, electrical, and mechanical components. With the proliferation of advanced technology, HVAC units have become more complex, increasing the likelihood of component failure. For instance, neglected or worn-out filters can significantly impact system performance, necessitating additional energy consumption and potentially shortening the unit's lifespan. According to industry reports, the global HVAC market is projected to expand at a robust pace, with a significant increase in demand driven by factors such as growing awareness of energy efficiency and the rising adoption of smart home technology.

- This growth is expected to reach approximately 15% in the next five years. By addressing component maintenance promptly, homeowners can optimize their HVAC systems' efficiency and longevity, ultimately reducing energy costs and ensuring a comfortable living environment.

Exclusive Customer Landscape

The residential hvac market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the residential hvac market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, residential hvac market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Carrier Global Corp. - This company specializes in providing a range of residential HVAC solutions, including Daikin POLARA and 19 Series wall mount single zone air conditioners, as well as Daikin ATMOSPHERA wall mount heat pumps and FDMQ heating and cooling multi zone systems. These energy-efficient products cater to various climate control needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Carrier Global Corp.

- Daikin Industries Ltd.

- Danfoss AS

- Electrolux Group

- Fujitsu Ltd.

- Gree Electric Appliances Inc. of Zhuhai

- Haier Smart Home Co. Ltd.

- Honeywell International Inc.

- Johnson Controls International Plc

- Lennox International Inc.

- LG Electronics Inc.

- MIDEA Group Co. Ltd.

- National HVAC Service

- Paloma Co. Ltd.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Systemair AB

- Toshiba Corp.

- Trane Technologies Plc

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Residential HVAC Market

- In January 2024, Carrier Global Corporation, a leading HVAC manufacturer, announced the launch of its new line of energy-efficient residential air conditioners, the Infinity® Touch CP Series. These models feature a user-friendly touchscreen interface and Greenspeed™ intelligence for precise temperature control and energy savings (Carrier Press Release).

- In March 2024, Johnson Controls, another major player in the HVAC industry, entered into a strategic partnership with Google to integrate its GLAS smart thermostat with Google Nest. This collaboration enables users to control their HVAC systems using Google Assistant and other Nest devices (Johnson Controls Press Release).

- In April 2025, Lennox International, Inc. Completed the acquisition of SunSource Homes, a leading provider of solar energy systems for residential HVAC applications. This acquisition expands Lennox's offerings to include renewable energy solutions and strengthens its position in the growing solar HVAC market (Lennox International Press Release).

- In May 2025, the U.S. Department of Energy announced the approval of a USD50 million grant for the development of advanced HVAC technologies. The funding will support research and innovation in areas such as energy efficiency, smart grid integration, and carbon capture and utilization (U.S. Department of Energy Press Release).

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in technology and changing consumer preferences shaping its dynamics. For instance, the adoption of electronic expansion valves in fan coil units and air handlers has led to improved system efficiency and energy savings. According to a recent study, the global market for fan coil units is expected to grow by over 5% annually. Additionally, the demand for radiant heating systems and improved ventilation is on the rise, as homeowners prioritize energy-saving strategies and humidity control. Air filter selection and filtration technology have gained significant attention, with air purification technology becoming increasingly popular.

- System troubleshooting and compressor efficiency are also key areas of focus, with the integration of building codes HVAC and smart thermostat features driving innovation. The HVAC industry anticipates continued growth, with energy audits, demand-controlled ventilation, and building automation systems playing crucial roles in optimizing thermal comfort and reducing energy consumption. The market for packaged units, split systems, and geothermal heat pumps is also expected to expand, with ductwork design and refrigerant recovery gaining importance in the refrigeration cycle.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Residential HVAC Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

0 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2025-2029 |

USD 48824.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.4 |

|

Key countries |

China, US, Germany, Japan, UK, India, South Korea, France, Canada, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Residential HVAC Market Research and Growth Report?

- CAGR of the Residential HVAC industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the residential hvac market growth of industry companies

We can help! Our analysts can customize this residential hvac market research report to meet your requirements.