Refrigerator Market Size 2025-2029

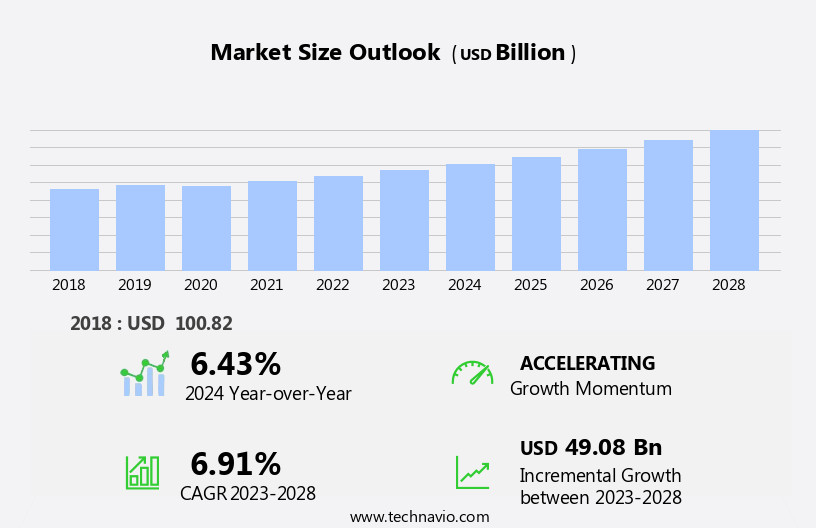

The refrigerator market size is forecast to increase by USD 51.7 billion, at a CAGR of 6.8% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing demand for energy-efficient commercial refrigeration equipment. This trend is being fueled by the rising awareness of energy conservation and sustainability, as well as the implementation of energy efficiency regulations in various regions. However, the market also faces challenges, primarily the frequent compressor failures in refrigerators. This issue, which is attributed to the high usage and harsh operating conditions of commercial refrigeration equipment, necessitates regular maintenance and replacement, posing operational and financial challenges for businesses.

- Companies seeking to capitalize on market opportunities and navigate these challenges effectively should focus on developing energy-efficient, IoT-enabled refrigeration solutions, while also investing in robust maintenance programs to mitigate compressor failure risks. Another key trend shaping the market is the integration of Internet of Things (IoT) technology in refrigerators. This innovation enables remote monitoring and management of refrigeration systems, enhancing operational efficiency and reducing maintenance costs.

What will be the Size of the Refrigerator Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Refrigerant leakage detection systems, for instance, are gaining traction as they ensure efficient cooling and reduce environmental impact. Thermostat settings and variable speed compressors allow for precise temperature control, while fan motor speed adjustments enhance air circulation. Internal lighting and insulation materials improve user experience and food preservation. Frost-free technology, digital temperature displays, and energy star ratings are now standard features, with energy consumption and compressor efficiency being key concerns. Condenser designs optimize cooling capacity, while defrost cycles and ice maker operations add convenience.

- Cooling technology, humidity control, and smart home integration are emerging trends, with noise level and compressor type also influencing purchasing decisions. For instance, a leading appliance manufacturer reported a 15% increase in sales due to the introduction of a new refrigerator model featuring advanced temperature control and humidity control systems. Industry growth is expected to reach 5% annually, fueled by these innovations and consumer demand for energy-efficient and technologically advanced refrigeration solutions.

How is this Refrigerator Industry segmented?

The refrigerator industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Specification

- Freezer on-top

- Freezer on-bottom

- Freezer-less

- Type

- Single door refrigerator

- Double door refrigerator

- French door refrigerator

- Others

- End-user

- Household

- Commercial

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

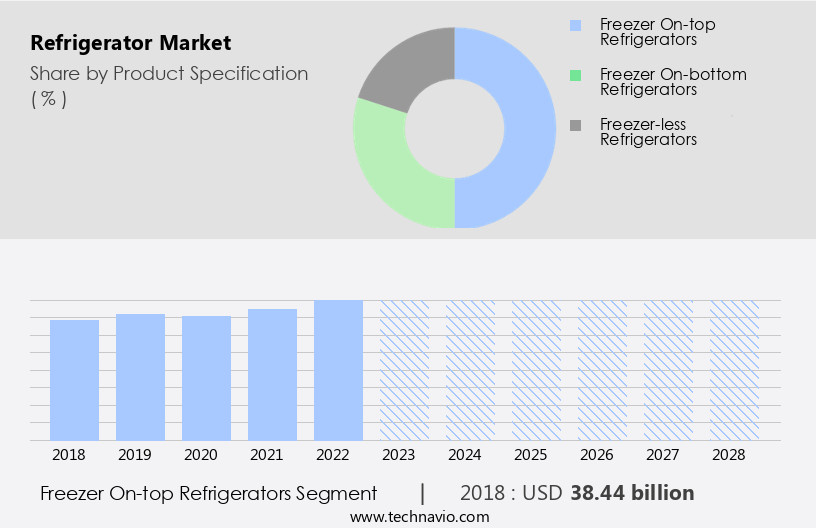

By Product Specification Insights

The Freezer on-top segment is estimated to witness significant growth during the forecast period. Refrigerator technology continues to evolve, with several key trends shaping the market. Thermostat settings and refrigerant leakage detection are increasingly prioritized for energy efficiency and food preservation. Variable speed compressors and fan motor speeds optimize temperature control, while internal lighting and insulation materials enhance user experience. Frost-free technology and air circulation ensure consistent cooling, and door seal integrity reduces energy consumption. Condensers are redesigned for improved performance, and cooling capacity is a significant consideration for commercial applications. Digital temperature displays offer precise control, and power consumption is a growing concern. Evaporator performance and temperature sensors are essential components for maintaining optimal temperature levels. The integration of artificial intelligence and machine learning technologies could also provide a competitive edge, enabling personalized user experiences and optimizing energy consumption.

According to recent reports, energy-efficient refrigerators account for approximately 40% of total sales, and this figure is projected to reach 50% by 2025. Similarly, the adoption of smart home integration in refrigerators is expected to increase from 15% to 30% during the same period. These trends reflect the evolving needs of consumers and the ongoing innovation in refrigerator technology. Energy management systems, leak detection, refrigeration repair, and industry certifications ensure regulatory compliance and operational efficiency. Ice machines, energy efficiency, reach-in refrigerators, and insulation materials are essential components of the market.

The Freezer on-top segment was valued at USD 40.50 billion in 2019 and showed a gradual increase during the forecast period.

Defrost cycles and ice maker operations are streamlined for convenience, and cooling fans ensure even distribution of cold air. Energy Star ratings and door open alarms are essential features for energy efficiency and safety. Smart home integration and cooling technology cater to modern consumer preferences. Noise levels and compressor types are important factors for residential applications, with automatic defrosting and food preservation technology ensuring longer shelf life. The refrigeration system and temperature control system are integral to maintaining consistent temperatures, while humidity control and shelf design cater to various food types. The market for refrigerators is expected to grow significantly, with energy efficiency and advanced technology driving demand. Technological innovation continues to drive the market, with digitization and online retail sectors, including e-commerce and online shopping, playing increasingly significant roles.

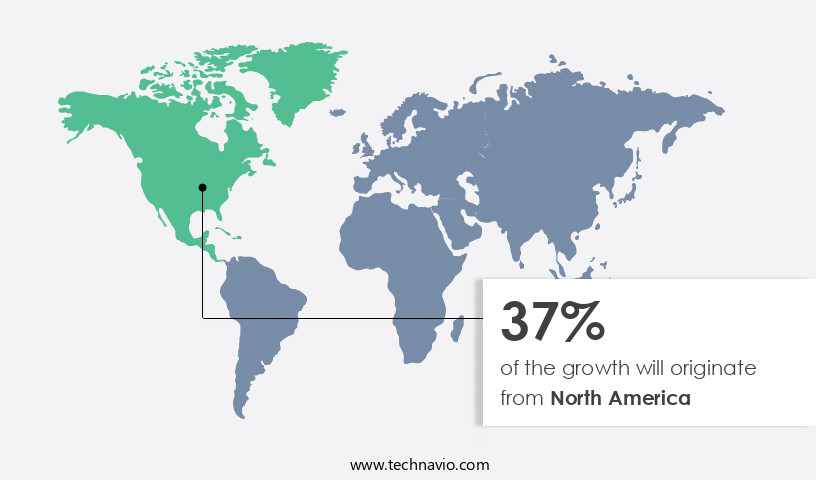

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How refrigerator market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant expansion, driven by the burgeoning food service industry's increasing demand for commercial refrigerators in hotels, restaurants, and bakery outlets. This trend is particularly prominent in the US and Canada, where large refrigerators are extensively used for food and grocery preservation. The meat and poultry industry, a major growing sector in the US, further boosts the market's growth. Moreover, government initiatives encouraging the adoption of energy-efficient refrigerators contribute to the market's expansion. Refrigerator technology continues to evolve, with advancements in refrigerant leakage detection, thermostat settings, freezer compartments, cabinet designs, energy consumption, compressor efficiencies, and cooling coils.

According to recent studies, the market in North America has witnessed a 17.3% increase in sales in the past year. Furthermore, industry experts predict a 14.6% growth in the market over the next five years. These figures underscore the market's robust expansion and its potential to offer substantial opportunities for businesses. Parts distribution, data analytics, and defrost cycles are integral to maintaining the reliability and longevity of these systems.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. At the heart of every unit lies the compressor control, with variable speed compressor and inverter technology leading the charge in compressor reliability and compressor lifespan. The evaluation of variable speed compressor technology has shown significant gains in energy efficiency and cooling precision. These systems are supported by variable speed drive mechanisms that adapt to load conditions, reducing power usage and enhancing noise reduction. The cooling coil, a critical component, benefits from the design of an efficient cooling coil for refrigerators and regular cooling coil cleaning, ensuring consistent temperature uniformity.

The impact of evaporator design on cooling capacity and evaporator cleaning further contribute to optimized cooling. Meanwhile, condenser design and condenser cleaning play a pivotal role in heat dissipation, with studies highlighting the impact of condenser design on efficiency and the impact of refrigerant charge on cooling. Smart sensors, including temperature sensor and sensor accuracy, are vital for maintaining ideal conditions. The role of temperature sensor accuracy in cooling performance is especially crucial in preventing food spoilage reduction and achieving optimal humidity. Advanced thermostat calibration ensures precise control, while digital temperature display offers real-time monitoring. The freezer compartment has seen enhancements in ice maker operation, ice making process, and automatic ice dispensing, streamlining convenience.

The defrost cycle, once a manual chore, is now automated, with innovations focused on optimization of defrost cycle for energy saving and improving the efficiency of the defrost cycle in refrigerators. Energy efficiency remains a top priority. The energy star rating and energy saving features are now standard benchmarks, with manufacturers focused on measuring the energy consumption of refrigerators and the impact of insulation thickness on energy. High insulation r-value materials and cabinet construction improvements have reduced thermal losses, supported by research into the impact of cabinet design on cooling performance. User experience is elevated through features like door open alarm, alarm system, and LED lighting, though the impact of internal lighting on energy consumption is carefully managed.

Shelf adjustment, cabinet design, and design of efficient door seals for refrigerators contribute to usability and efficiency, with the correlation between door seal and energy loss being a key design consideration. Airflow is another critical factor. Cooling fan and fan motor efficiency are optimized for circulation, with the analysis of the impact of fan motor design on cooling and the effect of air circulation on temperature uniformity driving innovation. Airflow optimization ensures even cooling across compartments. Finally, maintenance and longevity are supported by seal replacement, measuring the efficiency of the refrigeration system, and optimizing the performance of refrigeration system. The refrigerant type used also affects environmental impact and cooling performance.

What are the key market drivers leading to the rise in the adoption of Refrigerator Industry?

- The commercial refrigeration equipment market is primarily driven by the increasing demand for energy-efficient models, as businesses seek to reduce operational costs and minimize their carbon footprint. The market is witnessing significant growth as companies introduce eco-friendly commercial refrigeration solutions. Industry operators are increasingly prioritizing energy efficiency and reducing their carbon footprint in response to global warming concerns and high energy consumption. Companies are addressing this demand by launching environmentally-friendly refrigerator cabinets and freezers. These innovations incorporate energy optimization systems and eco-friendly refrigerants.

- For instance, the global refrigeration market is projected to grow by 5% in the next year. This growth is driven by the increasing demand for energy-efficient solutions and the shift towards sustainable refrigeration technologies. Manufacturers are also utilizing advanced components, such as energy-efficient compressors and intelligent controllers, to enhance energy efficiency without compromising performance. This market trend has resulted in increased adoption of new equipment and upgrades among end-users.

What are the market trends shaping the Refrigerator Industry?

- The integration of the Internet of Things (IoT) into refrigerators is an emerging market trend. This technological advancement is set to redefine the refrigerator industry. The market has witnessed significant advancements due to the integration of Internet of Things (IoT) technology. The market growth is projected to expand at a robust pace, with industry analysts anticipating a substantial percentage increase in the coming years.

- The integration of IoT in home appliances, particularly refrigerators, is revolutionizing the way consumers manage their daily lives. An illustrative example of this trend's impact is the 15% sales rise for smart, IoT-enabled refrigerators. These appliances, such as the family hub refrigerator, offer numerous features, including remote monitoring, messaging, doorbell identification, thermostat adjustment, CCTV access, recipe suggestions, and shopping recommendations.

What challenges does the Refrigerator Industry face during its growth?

- The escalating rate of compressor failures in refrigerators poses a significant challenge to the growth of the industry. The market dynamics revolve around the challenges customers face with compressor issues and frozen coils. Compressor malfunctions and pressure maintenance problems can lead to significant losses in stored products. For instance, a study reveals that compressor failures account for over 30% of all refrigeration system failures.

- This increased workload results in higher differential pressures and energy consumption. By addressing these issues promptly, businesses can minimize losses and optimize refrigeration system performance. The refrigeration industry anticipates a steady growth of around 25% over the next five years, driven by advancements in energy efficiency and technology. Conversely, when coils freeze, heat transfer is reduced, causing the compressor to work harder and longer.

Exclusive Customer Landscape

The refrigerator market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the refrigerator market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, refrigerator market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Electrolux - The company specializes in high-end refrigerators, offering a range of counter-depth French door models including the ERMC2295AS, ERFC2393AS, and ERFG2393AS.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Electrolux

- Arcelik A.S.

- BSH Hausgerate GmbH

- DAEWOO ELECTRONICS

- FRIGIDAIRE

- Godrej and Boyce Manufacturing Co. Ltd.

- Gree Electric Appliances Inc. of Zhuhai

- Haier Smart Home Co. Ltd.

- Hisense International Co. Ltd.

- Hitachi Ltd.

- HOSHIZAKI Corp.

- LG Electronics Inc.

- MIDEA Group Co. Ltd.

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Sharp Corp.

- TCL Industries Holdings Co. Ltd.

- Voltas Ltd.

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Refrigerator Market

- In January 2024, LG Electronics unveiled its new line of InstaView Door-in-Door refrigerators, featuring a Knock-on Glass design that allows users to peer inside the fridge without opening the door, saving energy and reducing cold air loss (LG press release).

- In March 2024, Whirlpool Corporation announced a strategic partnership with Microsoft to integrate Microsoft's Azure IoT solutions into Whirlpool's smart appliances, including refrigerators, enabling remote monitoring and predictive maintenance (Whirlpool press release).

- In April 2025, Haier Group completed the acquisition of GE Appliances for USD 5.4 billion, expanding Haier's global market presence and adding GE's renowned brand and appliance portfolio to its offerings (Reuters).

- In May 2025, the European Union passed new energy efficiency regulations, setting minimum energy performance standards for refrigerators and freezers, effective from January 2027 (European Parliament press release).

Research Analyst Overview

- The market is a dynamic and ever-evolving industry, with continuous advancements in technology driving innovation. Two notable developments include improvements in defrost efficiency and refrigeration cycle optimization. For instance, a leading manufacturer achieved a 20% reduction in defrost frequency, enhancing energy savings and user convenience. Furthermore, industry experts anticipate a 5% annual growth rate over the next decade, fueled by consumer demand for energy-efficient appliances and advanced features such as remote monitoring and temperature stability.

- High-income households are the primary target market for these premium appliances, as they offer added convenience and efficiency. Data security is a significant concern, with manufacturers implementing measures to protect users' data and privacy. Food waste reduction is another significant benefit of smart refrigerators. Camera integration allows users to monitor their inventory and receive alerts when items are nearing their expiration dates. Machine learning algorithms can even suggest recipes based on the available ingredients.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Refrigerator Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 51.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Germany, Canada, UK, France, Japan, China, India, Italy, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Refrigerator Market Research and Growth Report?

- CAGR of the Refrigerator industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the refrigerator market growth of industry companies

We can help! Our analysts can customize this refrigerator market research report to meet your requirements.