Recreational Vehicle (RV) Rental Market Size 2025-2029

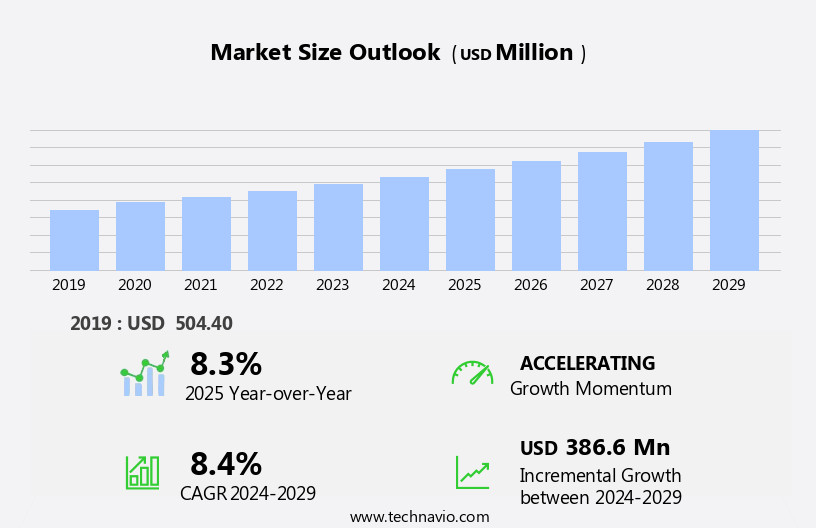

The recreational vehicle (RV) rental market size is forecast to increase by USD 386.6 million, at a CAGR of 8.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rising popularity of road trips and outdoor adventures. This trend is fueled by the increasing number of consumers seeking unique travel experiences and a desire to escape the confines of traditional accommodations. Additionally, the increasing demand for electric RVs is reshaping the market, as more environmentally-conscious consumers opt for eco-friendly travel options. However, this market is not without challenges. Operators face a higher risk of accidents or damages related to the operation and maintenance of recreational vehicles. Ensuring the safety and reliability of rental RVs is crucial to mitigate potential risks and maintain customer satisfaction.

- Companies must invest in robust maintenance programs and implement stringent safety protocols to address these challenges and capitalize on the market's potential. The strategic landscape of the RV rental market is dynamic, with both opportunities and obstacles shaping its future trajectory. Companies seeking to succeed in this market must stay agile, adapt to evolving consumer preferences, and prioritize safety and reliability to meet the growing demand for recreational vehicle rentals. Additionally, investments in technology, such as telematics and predictive analytics, can help rental companies optimize fleet management, reduce operational costs, and enhance the customer experience.

What will be the Size of the Recreational Vehicle (RV) Rental Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its various sectors. Mobile apps have become integral to the industry, streamlining processes and enhancing customer experiences. In this ever-changing landscape, vehicle inspection and cleaning services are crucial for maintaining fleet quality. Seasonal pricing strategies cater to peak demand, while delivery services expand accessibility. Customer service, referral programs, and liability insurance are essential components of a robust rental business. Fleet management, pre-rental checklists, and waste disposal are critical aspects of operational efficiency. Engine type, insurance claims, satellite TV, and loyalty programs add value to the customer experience.

Heating systems, safety features, and emergency services ensure comfort and security. Marketing campaigns, rental agreements, roadside assistance, maintenance agreements, and water tanks are essential elements of the business model. Online booking, passenger and sleeping capacity, fuel efficiency, and revenue management optimize operations. Class A, B, and C RVs, truck campers, and pop-up campers cater to diverse customer preferences. Solar panels, onboard technology, and GPS navigation offer modern conveniences. RV parks and pickup locations provide essential infrastructure. Storage space, booking platforms, and rental insurance offer flexibility and peace of mind. Return policies, pricing strategies, and collision damage waivers protect both renters and rental companies.

Plumbing systems, electrical systems, and propane tanks ensure functionality and safety. Damage repair and cooling systems address operational challenges. Reservation systems and customer reviews facilitate seamless transactions and continuous improvement. The RV rental market's continuous dynamism underscores the importance of adaptability and innovation.

How is this Recreational Vehicle (RV) Rental Industry segmented?

The recreational vehicle (RV) rental industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Online

- Offline

- Product

- Caravans

- Motorhomes

- Rental Category

- Short-term rentals

- Long-term rentals

- Ownership

- Company-owned RV rentals

- Peer-to-peer (P2P) RV rentals

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The online segment is estimated to witness significant growth during the forecast period.

The market in the US is experiencing significant growth, driven by the convenience and efficiency of online platforms. RV4U, for instance, has emerged as a popular choice for renters and owners. This online marketplace offers a diverse selection of RVs for rent, including motorhomes, campervans, travel trailers, and more. Customers can effortlessly search and book their preferred RV through the user-friendly interface, allowing them to compare prices, inspect vehicle details, and read customer reviews. To ensure a satisfactory rental experience, RV4U prioritizes vehicle inspection and cleaning services. Seasonal pricing and delivery services cater to the varying demands of the market.

Liability insurance is a crucial aspect of fleet management, and customers can opt for maintenance agreements and roadside assistance. Travel trailers come equipped with essential amenities such as water tanks, plumbing systems, and electrical systems. RV4U's loyalty programs and referral schemes incentivize repeat business and word-of-mouth recommendations. Class A, B, and C RVs cater to different customer preferences, with varying passenger and sleeping capacities, fuel efficiency, and engine types. Safety features, heating systems, and onboard technology are essential considerations for customers. Marketing campaigns and peak season pricing strategies attract a large customer base. RV parks and pickup locations offer convenient storage solutions for RV owners.

Online booking, GPS navigation, and rental insurance policies provide added convenience. Post-rental inspections ensure that RVs are in top condition for the next customer. In case of damages, RV4U offers collision damage waivers and damage repair services. Cooling systems, propane tanks, and waste disposal are essential features that RV4U ensures are functioning optimally. Satellite TV and solar panels are popular add-ons for long-term renters. Rental agreements and return policies are transparent and flexible, ensuring a hassle-free rental experience.

The Online segment was valued at USD 305.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the market, North America stands out as a significant player due to its expansive landscapes, abundant tourist attractions, and well-established infrastructure. The region's natural wonders, including the Rocky Mountains in the US and Niagara Falls in Canada, provide an ideal setting for travelers seeking adventure and exploration. RV rentals offer travelers the flexibility to explore national parks, coastal regions, and scenic drives at their own pace, making them a popular choice. Moreover, North America is home to numerous RV manufacturers, such as Winnebago Industries and Thor Industries, producing a diverse range of models to cater to various preferences and budgets.

To ensure customer satisfaction, RV rental companies prioritize vehicle inspection, cleaning services, and pre-rental checklists. Seasonal pricing and delivery services cater to travelers' needs, while customer service, referral programs, and loyalty programs enhance the overall rental experience. Liability insurance, fleet management, and maintenance agreements provide peace of mind for renters. RV parks and pickup locations offer convenient access to waste disposal, water tanks, and fuel stations. Online booking platforms, passenger and sleeping capacity, fuel efficiency, and peak season pricing strategies facilitate easy and efficient rentals. Heating systems, cooling systems, and electrical and plumbing systems ensure comfort during travel.

Safety features, emergency services, and roadside assistance are essential considerations for renters. Onboard technology, such as GPS navigation, satellite TV, and mobile apps, enhance the RV rental experience. Rental agreements, collision damage waivers, and insurance policies provide protection for both renters and rental companies. Travel trailers, fifth wheels, class A, B, and C RVs, truck campers, and pop-up campers cater to various travel preferences and budgets. Post-rental inspections ensure the RV is in good condition for the next renter. Overall, the North American RV rental market offers a wide range of options for travelers seeking adventure and exploration while prioritizing convenience, comfort, and safety.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to the growing demand for flexible and adventurous travel experiences. RVs offer self-contained accommodations, enabling travelers to explore various destinations at their own pace. RV rental companies provide a diverse fleet of vehicles, from compact class C motorhomes to spacious class A motorhomes and travel trailers. RV rentals include essentials like bedding, cooking equipment, and safety features, ensuring a comfortable and convenient journey. Popular RV rental destinations include national parks, beaches, and scenic drives. Searching for RV rentals online is simple with various rental platforms, offering filters for vehicle type, price, and availability. RV rental insurance is also available to provide peace of mind during the adventure. Join the RV community and embark on unforgettable journeys, discovering new places and creating lasting memories.

What are the key market drivers leading to the rise in the adoption of Recreational Vehicle (RV) Rental Industry?

- The surge in the preference for road trips and outdoor adventures is the primary factor fueling market growth in this sector.

- The market is experiencing significant growth due to the increasing preference for road trips and outdoor adventures. This trend is driven by the desire for more personalized and flexible travel experiences. RV rentals offer travelers the freedom to customize their itinerary and travel at their own pace. Heating systems are essential features in RVs, ensuring comfort during colder weather. Safety is a top priority for RV renters, and modern RVs come equipped with advanced safety features. Emergency services and onboard technology provide added peace of mind. RV parks offer pickup locations, making it convenient for customers to begin their journey.

- RVs also provide ample storage space for travelers' belongings. Booking platforms have made RV rentals more accessible than ever before. GPS navigation systems and towing capacity are essential onboard technologies for safe and efficient travel. Revenue management is crucial for RV rental companies to optimize their inventory and pricing strategies. Customer reviews play a significant role in the decision-making process for potential renters. Overall, the RV rental market continues to grow, offering travelers unique and memorable experiences on the road.

What are the market trends shaping the Recreational Vehicle (RV) Rental Industry?

- The electric recreational vehicle market is experiencing a significant upward trend due to increasing demand. This emerging market trend underscores the growing preference for eco-friendly and sustainable transportation solutions.

- The market has experienced significant growth due to various factors. One key driver is the increasing environmental consciousness, leading more individuals to opt for electric RVs. These vehicles produce zero tailpipe emissions, making them an eco-friendly alternative to traditional gasoline-powered RVs. This trend aligns with the growing interest in outdoor recreational activities and the desire to reduce carbon footprints. Another factor influencing the market is the availability of advanced RV models with improved plumbing, electrical, cooling, and propane systems. These enhancements offer greater comfort and convenience for renters. Rental companies provide collision damage waivers and rental insurance to mitigate potential risks, ensuring a worry-free rental experience.

- Return policies offer flexibility, allowing customers to modify or cancel reservations with minimal penalties. Pricing strategies vary, with Class A and Class C RVs catering to different market segments. Class A RVs offer luxury features, while Class C RVs are more affordable and suitable for smaller families. Pop-up campers are another popular option for budget-conscious renters. Post-rental inspections ensure that RVs are in good condition before being rented out again, maintaining the quality and reliability of the fleet. Overall, the RV rental market continues to grow, providing an immersive and harmonious experience for those seeking outdoor adventures while prioritizing environmental preservation.

What challenges does the Recreational Vehicle (RV) Rental Industry face during its growth?

- The recreational vehicle industry faces significant challenges due to the heightened risk of accidents and damages associated with their operation and maintenance, which can hinder industry growth.

- Recreational vehicles (RVs) offer unique travel experiences, but their operation and maintenance present certain challenges. The size and weight of RVs are significant factors contributing to the increased risk of accidents or damage. These vehicles are typically larger and heavier than standard cars, making them more difficult to maneuver and control. Inexperienced drivers may find it challenging to navigate tight turns or park in crowded areas, leading to collisions with other vehicles or objects. Furthermore, RVs have complex systems that require regular maintenance to ensure safe and efficient operation.

- The environments in which RVs are used, such as remote campsites or narrow roads, can also pose additional risks. To mitigate these challenges, companies are developing mobile apps to help RV renters locate campsites, plan routes, and receive maintenance alerts. These tools can enhance the RV rental experience while reducing the risks associated with operating and maintaining these vehicles.

Exclusive Customer Landscape

The recreational vehicle (RV) rental market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the recreational vehicle (RV) rental market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, recreational vehicle (RV) rental market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allstar Coaches LLC - The company specializes in providing top-tier recreational vehicle rental services, featuring the Thor Motorcoach Aria and Fleetwood Pace Arrow LXE models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allstar Coaches LLC

- Camp Monk LLP

- Camper Travel International

- Cruise America Inc.

- Fraserway RV GP Ltd.

- Hightened Path RV Rentals

- Ideamerge LLC

- Indie Campers Central Services Unipessoal Lda

- Japan RV Rental

- Motorhome Adventures

- Onroadz Car Rental Pvt. Ltd.

- Outdoorsy Inc.

- Rental Alliance GmbH

- Roadsurfer GmbH

- RVnGO

- Rvshare LLC

- Spaceships Rentals

- TC Rent Ltd.

- Tourism Holdings Ltd.

- Yescapa SAS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Recreational Vehicle (RV) Rental Market

- In January 2024, Cruise America, a leading RV rental company, announced the launch of its new electric RV rental fleet in collaboration with Lightning Systems (Reuters, 2024). This initiative marked a significant step towards sustainable solutions in the RV rental industry.

- In March 2024, Outdoorsy, a peer-to-peer RV rental marketplace, secured a USD50 million Series C funding round led by TCV and GV (Bloomberg, 2024). This investment will be used to expand their platform and enhance the user experience for both renters and RV owners.

- In April 2025, Thor Industries, the world's largest RV manufacturer, acquired Camper World, a major RV dealer and service center network, for approximately USD1.2 billion (Wall Street Journal, 2025). This acquisition will strengthen Thor Industries' position in the RV market by expanding their service and sales network.

- In May 2025, the European Union announced the approval of the European RV Rental Platform, which aims to create a single market for RV rentals across Europe (European Commission, 2025). This initiative will simplify cross-border rental processes and increase market access for RV rental companies.

Research Analyst Overview

- The market experiences continuous evolution, driven by shifting consumer preferences and technological advancements. Safety standards and accessibility features are paramount, shaping the industry's direction. Marketing automation tools streamline vacation planning and customer support, enhancing the rental experience. Adventure travel and outdoor recreation fuel market growth, with a focus on eco-friendly RVs and sustainable tourism. Employee training programs ensure regulatory compliance and risk management, while supply chain optimization and parts supply maintain operational efficiency. Energy efficiency, waste management, and water conservation are essential considerations for RV manufacturers and renters alike. Industry associations advocate for technology integration, alternative fuels, and repair services to cater to diverse customer needs.

- Hybrid RVs and adventure travel trailers are gaining popularity, reflecting the market's commitment to reducing the RV industry's carbon footprint. Training programs for employees and franchise models foster a strong distribution network, enabling businesses to adapt and thrive in this dynamic market. Data analytics and regulatory compliance are crucial components of effective risk management strategies, ensuring a seamless rental experience for all.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Recreational Vehicle (RV) Rental Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 386.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.3 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, France, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Recreational Vehicle (RV) Rental Market Research and Growth Report?

- CAGR of the Recreational Vehicle (RV) Rental industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the recreational vehicle (rv) rental market growth of industry companies

We can help! Our analysts can customize this recreational vehicle (rv) rental market research report to meet your requirements.