Rapid Thermal Processing Equipment Market Size 2025-2029

The rapid thermal processing equipment market size is forecast to increase by USD 307.1 million at a CAGR of 6.7% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing adoption of the Internet of Things (IoT) and connected devices. The integration of IoT and rapid thermal processing equipment enables real-time monitoring and control, enhancing efficiency and productivity. The RTP market is also essential for the production of advanced materials for consumer electronics and energy harvesting applications. Furthermore, technological advancements continue to shape the market, with innovations in materials, processes, and automation improving the capabilities and performance of rapid thermal processing equipment. However, the high costs associated with these advanced systems pose a challenge for market growth.

- Companies must balance the potential benefits against the costs to determine the optimal time for investment and ensure a strong return on investment. To capitalize on market opportunities and navigate challenges effectively, organizations should focus on optimizing their existing processes, exploring cost-effective solutions, and collaborating with technology partners to leverage the latest advancements in rapid thermal processing equipment. The capital-intensive nature of rapid thermal processing equipment makes it a significant investment for organizations, necessitating careful consideration and strategic planning. One of the primary drivers is the increasing adoption of the Internet of Things (IoT) and connected devices, which require advanced thermal processing technologies for manufacturing.

What will be the Size of the Rapid Thermal Processing Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The Rapid Thermal Processing (RTP) equipment market is experiencing significant growth due to the increasing demand for advanced materials and technologies in various industries. Integrated circuits, carbon nanotubes, and quantum dots are among the advanced materials driving market expansion. Uniform heating and 3D integration are crucial process requirements for manufacturing high-performance computing components and flexible electronics. Automation software and process control systems are essential for optimizing manufacturing processes, reducing material waste, and improving yield. Advanced manufacturing trends include the integration of automation in manufacturing, predictive modeling, and smart manufacturing. RTP equipment plays a vital role in the production of microelectronic devices, such as LEDs, and in the development of future technologies like the Internet of Things, artificial intelligence, and renewable energy.

- Gas flow control and process qualification are critical aspects of RTP, ensuring gas purity and temperature gradient for chemical vapor deposition and printed electronics. Process optimization and control systems are essential for the production of advanced packaging, data center cooling, and biomedical devices. Lamp technology continues to evolve, providing improved process capabilities and energy efficiency. Equipment calibration and temperature gradient control are crucial for ensuring the production of high-quality wearable electronics.

How is this Rapid Thermal Processing Equipment Industry segmented?

The rapid thermal processing equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Lamp-based

- Laser-based

- Application

- Industrial

- Research and development

- Technology

- Fully automated

- Semi-automated

- Manual

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Taiwan

- Rest of World (ROW)

- North America

By Type Insights

The lamp-based segment is estimated to witness significant growth during the forecast period. Lamp-based rapid thermal processing equipment, a critical component in semiconductor manufacturing, leverages high-intensity lamps to deliver swift heating and cooling cycles. The equipment's primary advantage lies in its capacity to ensure precise and uniform heating. High-intensity lamps generate intense heat, enabling rapid and efficient substrate or wafer heating. This temperature control leads to uniformity across the material, enhancing performance and yield in manufacturing processes. Additionally, lamp-based rapid thermal processing equipment is versatile, accommodating various materials such as silicon wafers, compound semiconductors, and glass substrates. These systems can handle a broad range of material types and sizes, making them indispensable in the industry.

Advanced materials, like advanced semiconductors and display technologies, are processed using this equipment in research institutes and university laboratories. The integration of technology innovation, such as artificial intelligence and machine learning, facilitates process modeling, data analysis, and real-time monitoring, further enhancing the equipment's efficiency and effectiveness. Inline processing, process automation, and remote monitoring enable industrial automation, reducing operating expenses and optimizing yield. The equipment's energy efficiency, thermal processes, and heating technologies adhere to environmental regulations, ensuring a cleanroom environment and safety standards. The cost of ownership, including capital expenditures and service life, is a significant consideration for process engineers when selecting rapid thermal processing equipment.

The market for this technology continues to evolve, with equipment suppliers introducing new advancements, such as laser-based systems, plasma processing, and high-temperature processing, to cater to the industry's evolving needs. The growth of the market depends on several factors, such as the rising adoption of IoT and connected devices, the growing demand for energy-efficient solutions, and the rise in the adoption of renewable energy sources.

The Lamp-based segment was valued at USD 474.30 million in 2019 and showed a gradual increase during the forecast period.

The Rapid Thermal Processing (RTP) Equipment Market is gaining traction amid growing demand from LED production, photovoltaic cells, and electric vehicles. RTP systems utilize RF power and controlled thermal treatment to achieve rapid heating with high thermal uniformity, vital for advanced node technologies. Manufacturers are prioritizing yield improvement through precise process integration, supported by rigorous process validation and equipment qualification protocols. Innovations in digital twins are enhancing real-time monitoring and predictive maintenance. Additionally, ensuring thermal stability and mechanical strength during fabrication processes is key to sustaining performance and reliability. As industries shift toward high-efficiency, miniaturized, and sustainable electronics, RTP equipment remains a cornerstone of next-generation semiconductor manufacturing. Moreover, manufacturers are able to collect and analyze data related to equipment performance, energy consumption, and maintenance needs with the implementation of sensors and connectivity modules.

Regional Analysis

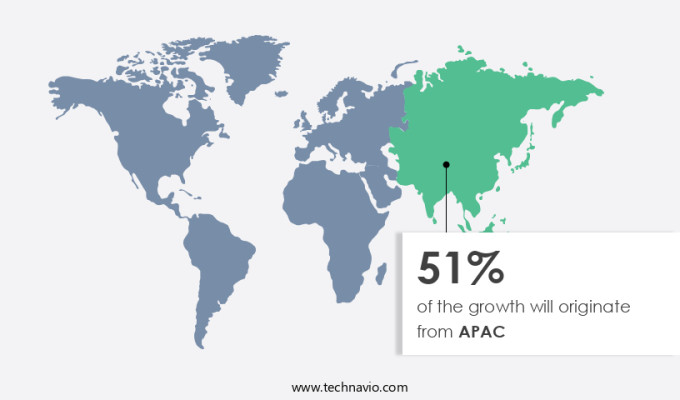

APAC is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic and innovative realm of materials science, rapid thermal processing equipment is gaining significant traction, particularly in the Asia Pacific (APAC) region. The market's expansion is driven by the presence of numerous consumer electronics, automotive, telecommunication, and other Original Equipment Manufacturers (OEMs) in APAC, including Acer Inc., ASUSTeK Computer Inc., Seiko Epson Corp., and Panasonic Corp. APAC's manufacturing costs are lower compared to other regions, enabling these companies to produce goods at more affordable prices. This cost advantage results in a rise in the availability of affordable consumer electronics in the region. Advancements in technology innovation, such as artificial intelligence, inline processing, and plasma processing, are revolutionizing the industry.

Dielectric etching and thin film deposition techniques are crucial in the production of solar cells and display technologies. Rapid thermal processing equipment plays a pivotal role in these processes, ensuring high dielectric constant, film uniformity, and yield optimization. Carbon footprint and particle contamination are critical concerns for process engineers, necessitating the implementation of energy-efficient heating technologies and real-time monitoring systems. Cloud computing and industrial automation are essential for data analysis and process control. Flash Lamp Systems and Laser Heating are popular choices for high-temperature processing. Capital expenditures, operating expenses, and safety standards are essential considerations for equipment suppliers. Advanced materials and process modeling are essential for maintaining high-quality wafer processing.

Universities and research institutes contribute significantly to the development of new technologies and process simulation. Semiconductor manufacturing, thermal cycling, and heat transfer are integral aspects of the market. Environmental regulations and thermal stress management are crucial for process control. Wafer handling, defect density, and service life are essential factors in the cost of ownership. Laser-based systems and heating elements are essential components of the equipment. Energy efficiency and big data analytics are crucial for optimizing processes and reducing costs. The Internet of Things and vacuum chamber technologies are transforming the industry. Machine learning and process monitoring are essential for improving efficiency and productivity.

The market is witnessing significant growth in the APAC region due to the presence of numerous OEMs and lower manufacturing costs. Technological advancements, energy efficiency, and cost optimization are driving the market's evolution. Process control, safety standards, and environmental regulations are essential considerations for market participants. The versatility in handling various types of materials, such as silicon wafers, compound semiconductors, or glass substrates, and the ability to accommodate a wide range of materials and sizes is another significant advantage of this segment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Rapid Thermal Processing Equipment market drivers leading to the rise in the adoption of Industry?

- The rise in IoT adoption and the proliferation of connected devices serve as the primary catalyst for market growth. The increasing acceptance and implementation of the Internet of Things (IoT) technology and the widespread use of connected devices are the primary factors fueling market expansion. The market is witnessing significant growth due to the integration of process automation technologies, such as High-intensity lamps, Laser Heating, and thermal cycling. Capital expenditures on advanced equipment, including Laser-based systems and silicon wafer processing, are increasing as industries seek to improve Heat and cooling efficiency and extend service life.

- IoT and connected devices are transforming the market, allowing for advanced materials and process modeling through cloud computing. These innovations enhance equipment performance, reduce downtime, and improve overall efficiency. The market's future is promising, with continuous advancements in technology and the increasing demand for high-performance, cost-effective solutions. Control systems with real-time monitoring capabilities are becoming essential for industrial automation, enabling manufacturers to optimize processes and reduce energy consumption. There is an increasing adoption of this segment across various industries due to its flexibility including semiconductor fabrication, optoelectronics, and photovoltaics (PVs).

What are the Rapid Thermal Processing Equipment market trends shaping the Industry?

- The trend in the market involves significant advancements in rapid thermal processing equipment technology. This sector is poised for growth, making it an essential focus for professionals and businesses. Rapid thermal processing equipment has experienced substantial growth due to technological advancements, transforming the industry. Heating technologies have been a significant focus, with traditional methods using halogen lamps encountering challenges in temperature control and uniformity.

- Environmental regulations and safety standards necessitate stringent process control, thermal stress management, wafer handling, defect density reduction, and film uniformity. Innovations such as metal heating elements and rapid thermal annealing (RTA) lamps have addressed these issues, providing enhanced temperature control and uniform heating. This improvement leads to precise and dependable thermal processing, boosting device performance and yield optimization. Key applications include plasma processing for solar cells and display technologies in university laboratories, semiconductor manufacturing, and process simulation.

How does Rapid Thermal Processing Equipment market face challenges during its growth?

- The escalating costs linked to rapid thermal processing equipment pose a significant challenge and hinder the growth of the industry. The market faces a notable challenge with the high cost of equipment. This market comprises essential tools for industries such as semiconductors, solar energy, and research and development. Rapid Thermal Processing Equipment, including Rapid Thermal Annealing (RTA) and systems, necessitate sophisticated heating elements and temperature control mechanisms to deliver precise thermal profiles.

- Heating technologies, such as infrared and induction, are integral to rapid thermal processing. Temperature control and batch processing are essential aspects of these systems, with precise heat transfer and uniformity being essential for optimal results. Despite the challenges, the potential benefits of rapid thermal processing, including improved material properties and enhanced production efficiency, make it an attractive investment for various industries. Advanced data acquisition systems and process monitoring technologies are integral to these processes. Energy efficiency is a critical consideration, with the Internet of Things (IoT) and machine learning playing significant roles in optimizing energy usage. Cost of ownership is a crucial factor for material scientists and manufacturers, necessitating a focus on energy efficiency and big data analytics.

Exclusive Customer Landscape

The rapid thermal processing equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rapid thermal processing equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rapid thermal processing equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allwin21 Corp. - The company specializes in advanced thermal processing technology, providing innovative solutions through its AccuThermo AW Series Atmospheric Rapid Thermal Processors and Vacuum Rapid Thermal Processors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allwin21 Corp.

- AMETEK Inc.

- ANNEALSYS SAS

- Applied Materials Inc.

- centrotherm international AG

- CoorsTek Inc.

- CVD Equipment Corp.

- ECM Techologies

- Heraeus Holding GmbH

- KOKUSAI ELECTRIC CORP

- Levitech B.V.

- Mattson Technology Inc.

- PLASMA THERM

- Screen Holdings Co. Ltd.

- SemiTEq JSC

- SSi Inc.

- UniTemp GmbH

- Veeco Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rapid Thermal Processing Equipment Market

- In January 2024, Applied Materials, a leading supplier of semiconductor equipment, announced the launch of its new RTP system, the Centura RT800, which offers increased throughput and improved uniformity for advanced semiconductor manufacturing processes (Applied Materials Press Release, 2024).

- In March 2024, Tokyo Electron Limited and Lam Research Corporation, two major players in the market, entered into a strategic collaboration to develop next-generation RTP technologies, aiming to enhance their product offerings and strengthen their market positions (Tokyo Electron Press Release, 2024).

- In May 2024, KLA Corporation, a leading provider of process control and yield management solutions for the semiconductor industry, completed the acquisition of Orbotech Ltd., a leading supplier of yield enhancement solutions, including rapid thermal processing equipment, for the electronics industry. The acquisition is expected to expand KLA's portfolio and enhance its position in the global semiconductor market (KLA Corporation Press Release, 2024).

- In February 2025, Intel Corporation, the world's largest semiconductor chipmaker, announced the successful deployment of its new 7nm process technology using rapid thermal processing equipment from a leading supplier, achieving significant improvements in transistor performance and power efficiency (Intel Corporation Press Release, 2025).

Research Analyst Overview

In the dynamic and ever-evolving world of materials science, rapid thermal processing (RTP) equipment continues to play a pivotal role in various sectors, from semiconductor manufacturing to solar cells and display technologies. This continuous unfolding of market activities is driven by the ongoing pursuit of innovation and the need for advanced materials and processes. RTP equipment, which includes flash lamp systems, high-intensity lamps, and laser-based systems, enables thermal processes that optimize yield and improve film uniformity. Process simulation and modeling are crucial in this context, allowing process engineers to fine-tune parameters and minimize thermal stress, particle contamination, and defect density.

University laboratories and research institutes are key contributors to the RTP market, pushing the boundaries of technology and discovering new applications for RTP in areas such as thin film deposition and dielectric etching. Environmental regulations and safety standards are increasingly influencing the market, with a growing emphasis on energy efficiency, heat transfer, and temperature control. Capital expenditures and operating expenses are significant considerations for RTP equipment, with the cost of ownership a critical factor in the decision-making process. Process automation, remote monitoring, and real-time data acquisition are essential to reducing operating expenses and improving process control.

The integration of advanced technologies such as artificial intelligence, machine learning, cloud computing, and the Internet of Things is transforming the RTP market, enabling predictive maintenance, process optimization, and improved energy efficiency. The future of RTP is bright, with ongoing research and development in areas such as compound semiconductors, heat and cooling technologies, and big data analytics. The industrial segment plays a significant role across several manufacturing industries, including electronics, semiconductors, automotive, and aerospace, which utilize such equipment for various processes and applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rapid Thermal Processing Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.7% |

|

Market growth 2025-2029 |

USD 307.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, China, Taiwan, South Korea, Japan, Canada, Germany, India, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rapid Thermal Processing Equipment Market Research and Growth Report?

- CAGR of the Rapid Thermal Processing Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rapid thermal processing equipment market growth of industry companies

We can help! Our analysts can customize this rapid thermal processing equipment market research report to meet your requirements.