Production Testing Market Size 2024-2028

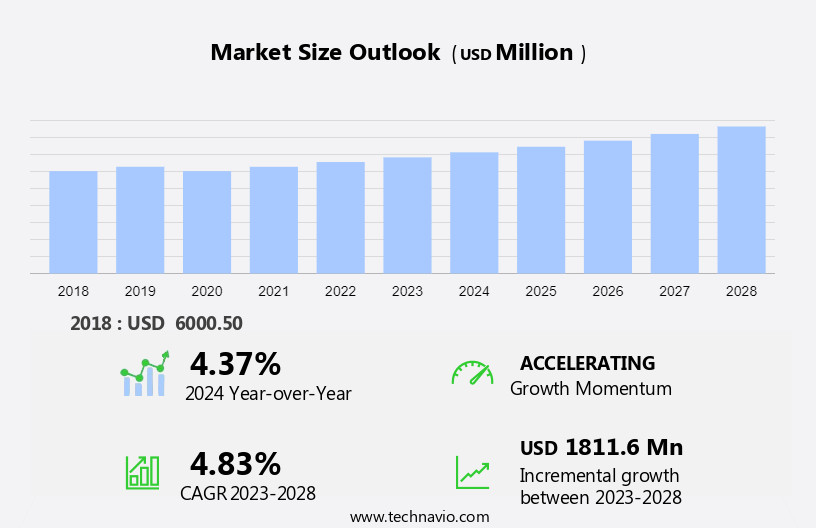

The production testing market size is forecast to increase by USD 1.81 billion at a CAGR of 4.83% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing global consumption of oil and gas is driving market expansion, as the energy sector seeks to meet rising demand. Additionally, the rise in deepwater and ultra-deepwater, exploration and production (E and P) activities is contributing to market growth, as these projects require advanced testing technologies to ensure efficiency and safety. The production testing market is experiencing rapid growth, driven by the integration of artificial intelligence and machine learning technologies to enhance testing efficiency and accuracy. Furthermore, the change in energy mix towards renewable sources is also impacting the market, as traditional energy companies invest in new technologies to adapt to the shifting landscape. These trends are shaping the future of the market and presenting both opportunities and challenges for industry players.

What will be the Size of the Production Testing Market During the Forecast Period?

- The market encompasses various techniques used to evaluate the physical and mechanical properties of materials, including oil and gas industry applications for reservoir management and land-based drilling operations. Relevant testing methods include destructive and non-destructive approaches, such as thermal analysis, material testing for structural and mechanical properties, and non-destructive testing techniques. These assessments are crucial for industries like oil and gas, construction, and medical sectors, ensuring product quality, safety, and efficiency.

- Market dynamics are influenced by factors such as the increasing demand for resource conservation and reducing wastage in the oil and gas industry, driven by fluctuating oil prices. Technological advancements in hybrid lightweight materials and the integration of non-destructive testing methods are also key trends shaping the market. The growing emphasis on enhancing operational efficiency and improving product quality across various industries further bolsters market growth.

How is this Production Testing Industry segmented and which is the largest segment?

The production testing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Onshore

- Offshore

- Geography

- North America

- Canada

- US

- APAC

- China

- Middle East and Africa

- Europe

- South America

- North America

By Application Insights

- The onshore segment is estimated to witness significant growth during the forecast period.

The market primarily focuses on assessing the performance and productivity of production wells, with onshore testing holding a significant market share. Onshore production testing is essential for reservoir management, production optimization, and capital discipline in the oil and gas industry. The demand for onshore production testing is driven by the vast onshore reserves, including shale reserves in the Permian Basin and deep-sea reserves. Onshore testing encompasses material testing, evaluating physical, structural, and mechanical properties, and employing advanced materials and techniques such as hybrid lightweight materials, thermal analysis, microscopy, destructive testing, and non-destructive testing.

The industrialization of sectors like construction and medicine necessitates the efficient use of resources, further fueling the demand for production testing. The market's growth is influenced by the increasing industrialization, the importance of oil prices, and the need for rapid testing methods.

Get a glance at the Production Testing Industry report of share of various segments Request Free Sample

The onshore segment was valued at USD 4.12 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

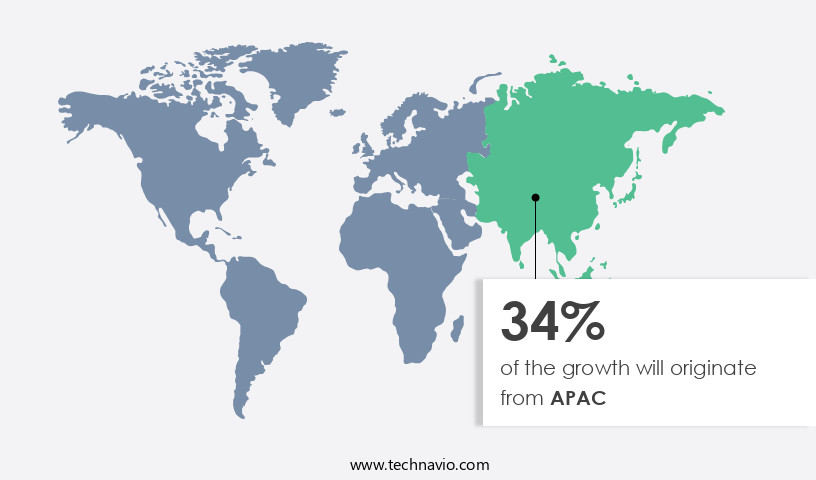

- APAC is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is primarily driven by the significant increase in oil and gas production in the US and Canada, two major oil-producing countries in the region. Unconventional exploration and production (E&P) activities, such as the drilling of shale reserves in the US and oil sands in Canada, have led to a rise in production output. This trend is attributed to the rise in E&P activities in unconventional sources like shale and oil sands, which account for a substantial portion of the overall crude oil and natural gas production in North America. The market in the region is expected to grow due to the increasing demand for ensuring the optimal performance of production wells and the need for material testing of various components used in the oil and gas industry.

Key testing parameters include the physical and structural properties of reservoirs, the mechanical properties of materials, and the use of advanced materials and testing techniques such as thermal analysis, microscopy, destructive testing, and non-destructive testing. The market is further influenced by rapid industrialization in sectors like construction and medicine, as well as the need to reduce the wastage of resources and maintain capital discipline amidst fluctuating oil prices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Production Testing Industry?

Rising global oil and gas consumption is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for liquid fuels and the need for oil companies to discover new oil wells to meet this demand. According to the Energy Information Administration (EIA), global liquid fuel consumption reached 96.90 million barrels per day (mbpd) in 2018, up from 85.44 mbpd in 2009. With most oil-producing countries lacking sufficient storage capacities for crude oil, there is a pressing need for companies to explore new and existing oil fields to maintain supply. This trend is particularly evident in regions such as the Permian Basin in the US, where shale reserves and deep-sea reserves are being exploited.

- The market is essential in ensuring the optimal performance of production wells by assessing the physical and structural properties of reservoirs, including material testing for mechanical properties, thermal analysis, and microscopy techniques. Moreover, the use of advanced materials, such as hybrid lightweight materials, is gaining popularity in various industries, including the construction sector and medical sector, further fueling the demand for production testing. Industrialization and the development of new trade routes are also contributing factors. Organizations, including research institutions and educational institutions, play a crucial role in advancing production testing technology through research and development.

What are the market trends shaping the Production Testing Industry?

The rise in deepwater and ultra-deepwater E and P activities is the upcoming market trend.

- The market encompasses various testing techniques employed by upstream oil and gas operators to optimize reservoir management and enhance production from oil and gas wells. This includes material testing of hybrid lightweight materials, thermal analysis, and microscopy techniques for assessing physical, structural, and mechanical properties. The focus on capital discipline and profitability has led oil and gas companies to explore deeper reserves, such as those in the Permian Basin and deep sea, where large shale reserves and offshore oil and gas deposits exist. The increase in oil prices and the rapid industrialization of sectors like construction and medicine have further boosted the demand for production testing.

- Organizations set industry standards for testing methods, while research institutions and educational institutions contribute to the advancement of testing technologies. The market dynamics are influenced by factors like the type of test, industrialization, and trade routes. The market is witnessing significant growth due to the increasing importance of production optimization and the need to minimize wastage of resources. Non-destructive testing and destructive testing methods are employed to ensure the integrity of production wells and prevent costly downtime. The market is expected to continue growing as oil prices remain stable and companies seek to maximize their returns on investment.

What challenges does the Production Testing Industry face during its growth?

Change in energy mix is a key challenge affecting the industry growth.

- The market encompasses various testing techniques and technologies used by oil and gas operators to ensure the optimal performance of production wells. This market caters to the assessment of material and physical properties, including structural and mechanical properties, of reservoirs in the Permian Basin, deep sea, and shale reserves. The adoption of advanced materials, such as hybrid lightweight materials, is on the rise due to the need for capital discipline and production optimization. Material testing plays a crucial role in determining the suitability of equipment and materials for oil and gas production. ASTM and ISO are renowned organizations that provide standardized testing methods and certifications.

- Research organizations and educational institutions are also contributing significantly to the advancement of production testing through research and development. Industrialization in sectors like construction and medicine is driving the demand for production testing. Destructive and non-destructive testing techniques, such as thermal analysis and microscopy, are essential for evaluating the type of test required. The increasing industrialization and trade routes are further fueling the growth of the market. Despite the benefits of production testing, the wastage of resources due to low oil prices remains a challenge. The market dynamics are influenced by various factors, including technological advancements, regulatory frameworks, and market trends.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the production testing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, production testing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baker Hughes Co.

- Expro Group Holdings NV

- Fesco LTD.

- Grant Production Testing Services Ltd

- GREENE S ENERGY GROUP

- Halliburton Co.

- Hamdon Energy Solutions Ltd.

- PROFLO Production Testing Ltd.

- Roska DBO Inc.

- Schlumberger Ltd.

- Skyline Well Testing Inc.

- TC Mobile vessels LTD

- testwells Ltd.

- TETRA Technologies Inc.

- Weatherford International Plc

- WELLMAX

- Wespro Production Testing Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of services and technologies employed to evaluate the performance and integrity of equipment and systems used in the production of various industries. This market is driven by the need to ensure optimal production efficiency, reduce downtime, and maintain safety standards. Production testing plays a crucial role in industries where equipment failure can result in significant financial losses and potential safety hazards. In the context of industrialization, the increasing demand for advanced materials and technologies in sectors such as construction and medicine is driving growth in the market. One of the primary applications of production testing is in the energy sector, specifically in the management of reservoirs and optimization of production wells.

Moreover, the testing of physical and structural properties, such as mechanical strength and thermal conductivity, is essential to ensure the efficient extraction of resources from reservoirs. The use of hybrid lightweight materials in drilling and production equipment is also driving demand for advanced production testing techniques. The importance of production testing is not limited to the energy sector. In the manufacturing industry, for instance, the market is driven by the need to ensure the quality and reliability of products. This is particularly important in industries where safety is a critical concern, such as the medical sector. The market is characterized by a diverse range of testing techniques, including destructive and non-destructive methods.

Furthermore, thermal analysis and microscopy techniques are commonly used to evaluate the physical and structural properties of materials. The choice of testing method depends on various factors, including the nature of the material being tested and the specific requirements of the industry. The market is also influenced by broader market dynamics, such as rapid industrialization and the evolution of trade routes. The increasing demand for advanced materials and technologies is driving innovation in production testing methods and equipment. Additionally, the wastage of resources due to equipment failure or inefficiency is a significant concern, further emphasizing the importance of production testing in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market Growth 2024-2028 |

USD 1.82 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Key countries |

US, China, Canada, Saudi Arabia, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Production Testing Market Research and Growth Report?

- CAGR of the Production Testing industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Middle East and Africa, Europe, and South America

- A thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the production testing market growth of industry companies

We can help! Our analysts can customize this production testing market research report to meet your requirements.