Printed Signage Market Size 2024-2028

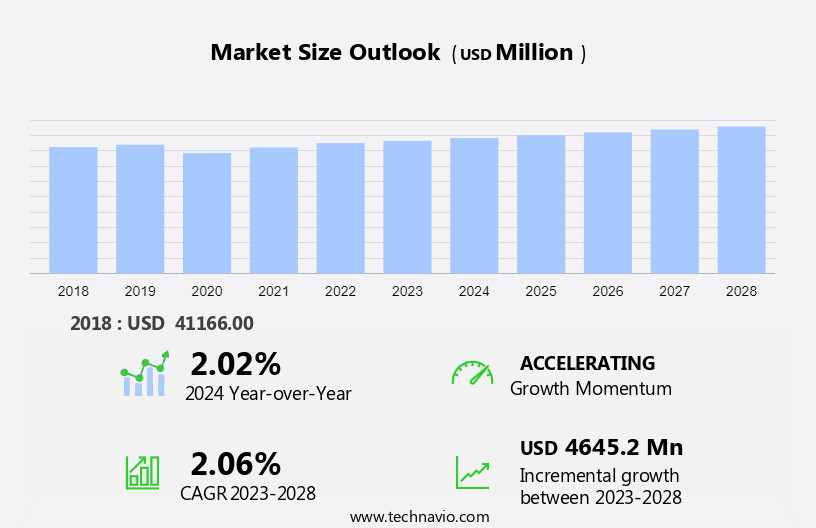

The printed signage market size is forecast to increase by USD 4.65 billion at a CAGR of 2.06% between 2023 and 2028.

- The market is experiencing significant growth, driven by various factors. One key trend is the increasing adoption of digital signage in outdoor advertising, particularly in sectors such as retail and BFSI, due to its ability to deliver dynamic and targeted content. Another trend is the use of reflective materials for enhanced visibility in construction sites and transportation applications.

- Additionally, the e-commerce sector's surge has led to a higher demand for labels and display signage. In terms of materials, plywood and aluminum continue to be popular choices, while polypropylene is gaining traction due to its durability and cost-effectiveness. Logistics challenges remain a concern, as efficient delivery and installation are crucial for businesses to maximize the impact of their signage investments.

- Overall, the market for printed signage is poised for continued growth, driven by these trends and the enduring demand for effective and visually appealing signage solutions.

What will be the Size of the Printed Signage Market During the Forecast Period?

- The market encompasses a diverse range of products, including billboards, backlit displays, posters, banners, backdrops, pop up displays, graphics, and signage for retail stores and shopping malls. This market is experiencing robust growth, driven by increasing demand for eye-catching, cost-effective marketing and advertising solutions. Large format printing technology, such as Softjet Grand and Kornit Digital, plays a significant role in producing high-quality, customized signage for various industries. Moreover, the integration of digital signage and e-commerce platforms is expanding the market's reach and potential for economies of scale. The retail sector, in particular, is a key contributor to the market's growth, with retailers seeking to enhance brand identity and attract customers through visually appealing signage.

- Strategic factories and media expos showcase the latest advancements in print equipment sales, enabling businesses to stay informed about the latest trends and technologies. Despite the increasing popularity of digital signage, traditional signage solutions, such as posters and banners, continue to hold a strong presence in the market due to their cost-effectiveness and versatility. Maintenance costs and sustainability concerns are also influencing the market, with a growing emphasis on using eco-friendly materials and energy-efficient technologies.

How is this Printed Signage Industry segmented and which is the largest segment?

The printed signage industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Outdoor

- Indoor

- End-user

- Retail

- BFSI

- Transportation and logistics

- Healthcare

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Application Insights

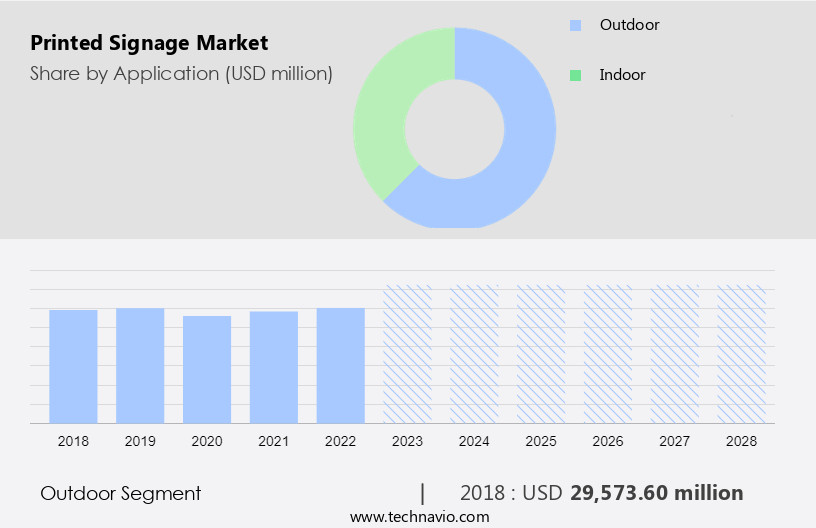

The outdoor segment is estimated to witness significant growth during the forecast period. Outdoor printed signage plays a significant role in marketing and advertising, encompassing applications such as billboards, retail displays, wayfinding signs, and traffic signs. Advanced printing technologies and durable materials, including PVC, wood, polypropylene, and plywood, are utilized to create visually striking, weather-resistant displays. These signs serve multiple purposes: providing essential company information, making a good first impression, and promoting sales and specials to increase foot traffic. Outdoor signage is an extension of a company's brand identity and can effectively capture and maintain audience attention in various industries, including retail, transportation and logistics, healthcare, and more. Companies offer print equipment and solutions for creating high-quality outdoor signage. Economies of scale and cost-effectiveness make printed signage a popular choice for businesses looking to maximize their marketing efforts.

Get a glance at the market report of various segments. Request Free Sample

The Outdoor segment was valued at USD 29.57 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

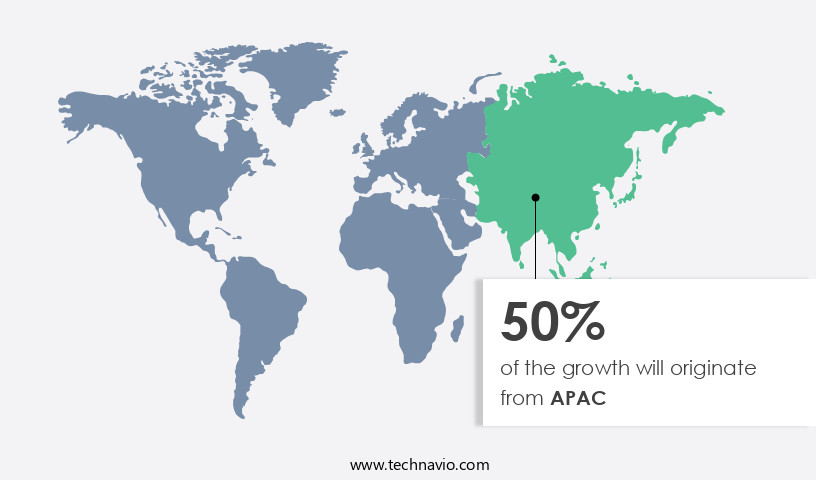

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to the increasing demand for marketing and branding applications. Retailers in countries such as China, South Korea, Thailand, Singapore, and India are focusing on enhancing customer experiences, driving the need for high-quality printed signage. The region's expansion of commercial retail space is a key factor fueling market growth. In India, the Printed Signage Industry has undergone substantial transformation over the past decade. Adapting to changing times and demands, the industry has evolved in all aspects, from sourcing to manufacturing and end-product development. Key trends include the use of advanced technologies such as Large Format Printing, Digital Signage, and Indoor/Outdoor Signage. Economies of scale and cost-effectiveness are critical factors influencing market growth. Materials used include PVC, wood, polypropylene, and marine plywood. Industry players are focusing on acquisitions and mergers to expand their offerings and gain a competitive edge.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Printed Signage Industry?

- Several benefits of using printed signage is the key driver of the market.The market is experiencing notable growth due to its numerous benefits for various industries. One of the primary reasons for its popularity is its affordability. Compared to other advertising methods, printed signage offers an economical solution for businesses to disseminate their messages on a large scale. This cost-effective marketing strategy allows companies to allocate their resources towards other essential business needs. Moreover, printed signage is an effective tool for attracting consumers. It is versatile and can be used in various applications, including billboards, backlit displays, retail signage, and digital signage. The use of high-quality graphics, PVC (Polyvinyl Chloride), wood, Polypropylene, and other materials ensures that the signs are visually appealing and grab the attention of potential customers.

Printed signage is also used extensively In the retail sector, shopping malls, and retail stores. It is an essential component of corporate graphics, exhibitions, and trade shows. In addition, printed signage is used in transportation and logistics, healthcare, and industrial settings. Maintenance costs for printed signage are relatively low compared to other advertising methods. Signs made from durable materials like PVC, wood, Polypropylene, and Marine plywood can last for years with minimal maintenance. Furthermore, printed signage is available in various types, including banners, backdrops, pop-up displays, and posters. Printed signage is also used for informative signs, promotional signage, and brand identity.

It is an essential tool for businesses looking to create a strong brand image and reach a wider audience. Companies can also choose from a range of printed signage applications, including indoor and outdoor signage, and various industries, including healthcare, transportation, and logistics. Industrial tapes and reflective materials are used to enhance the durability and visibility of printed signage. AR displays and screen printing technologies are also used to create interactive and engaging signage. Print equipment sales are increasing due to the cost-effectiveness and versatility of printed signage. In conclusion, the market is growing due to its numerous benefits, including affordability, versatility, and effectiveness in attracting consumers.

It is a cost-effective marketing strategy that is widely used in various industries and applications. The use of high-quality materials, advanced printing technologies, and innovative design solutions ensures that printed signage remains a popular choice for businesses looking to create a strong brand image and reach a wider audience.

What are the market trends shaping the Printed Signage market?

- Growing demand for printed signage in BFSI sector is the upcoming market trend.The market encompasses various applications withIn the retail and BFSI sectors. In retail, signage types include billboards, backlit displays, large format printing, digital signage, and pop-up displays. For the BFSI sector, signage is utilized at ATMs (posters, banners, backdrops), interiors (wall graphics, wall projections), and exteriors. The increasing investment in marketing and advertising is driving the demand for cost-effective printed signage solutions, which offer a longer lifespan compared to digital alternatives. Key elements of the market include PVC (Polyvinyl Chloride), wood, polypropylene, marine plywood, oak, and birch plywood. Industrial tapes, reflective materials, and traffic signs are also essential components.

Economies of scale and advancements in print equipment sales, such as Screen Inkjet, Sheetfed, and Indoor/Outdoor technology, contribute to the market's growth. Additionally, printed signage finds applications in transportation and logistics, healthcare, and exhibitions and trade shows. Companies like Astra Signs, Durst, Vanguard, and Kornit Digital are leading players In the market, offering a range of printed signage solutions.

What challenges does the Printed Signage Industry face during its growth?

- Growing use of digital signage is a key challenge affecting the industry growth.The market encompasses various types and verticals, including Billboards, Backlit displays, Large format printing, Digital signage, Retail signage, and more. Global governments and businesses increasingly utilize printed signage for marketing and advertising purposes, with applications ranging from retail sectors to transportation and logistics, healthcare, and exhibitions and trade shows. Strategic acquisitions and mergers among industry players, such as Astra Signs, Durst, Vanguard, and Kornit Digital, have driven economies of scale and cost effectiveness. Digital outdoor advertising, a segment of the market, offers enterprises the flexibility to target specific customer groups based on time and weather conditions. For instance, an ice cream parlor can display ads when temperatures rise, or a stationery shop can advertise during school hours.

Moreover, digital displays can be connected to customers' mobile devices, directing them to enterprises' social media accounts or websites. Additionally, printed signage comes in various materials, such as PVC (Polyvinyl Chloride), Wood, Polypropylene, Marine plywood, Oak, and Birch plywood, catering to diverse industries and applications. Indoor signage, such as Pop-up displays, Graphics, and Posters, and outdoor signage, including Backdrops, Banners, and Traffic signs, are essential for brand identity and informative purposes. Industrial tapes and reflective materials ensure the durability and safety of these signs, while AR displays and Screen printing technologies offer innovative solutions for the market.

Exclusive Customer Landscape

The printed signage market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the printed signage market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, printed signage market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avery Dennison Corp.

- Canva Pty Ltd.

- Chandler Signs LLC

- Cimpress Plc

- EhKo Sign Industries Kft.

- IGEPA group GmbH and Co. KG

- James Publishing

- Kelly Signs

- L and H Companies

- LINTEC Corp.

- Mativ Holdings Inc.

- ORAFOL Europe GmbH

- Paddock Printing

- Schweiter Technologies AG

- Sign Solutions USA

- Signage US

- Signs Express

- SmartSign

- Spandex Ltd.

- Techprint Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of visual communication solutions, including billboards, backlit displays, and strategic factory signage. This sector caters to various industries, such as retail, transportation and logistics, healthcare, and exhibitions and trade shows. Large format printing plays a pivotal role in producing high-impact signage, with technologies like digital signage, screen printing, and inkjet printing leading the charge. The market for printed signage is driven by several factors. Firstly, the growing importance of marketing and advertising in today's competitive business landscape necessitates eye-catching visuals to attract and retain customer attention. Secondly, the need for cost-effective brand identity solutions has led businesses to explore various printed signage types, such as posters, banners, backdrops, pop-up displays, and graphics.

Moreover, the advent of e-commerce has expanded the scope of printed signage applications beyond traditional retail settings. For instance, in logistics and transportation, companies use printed signage to ensure vehicle conspicuity and personal safety. In the healthcare sector, informative signs are essential for wayfinding and patient safety. The market is characterized by continuous innovation, with companies investing in research and development to create new products and improve existing ones. For example, the use of PVC (polyvinyl chloride), wood, polypropylene, marine plywood, and oak in signage production has led to increased durability and versatility. Additionally, the integration of reflective materials and industrial tapes enhances the functionality and safety of printed signage.

The market for printed signage is also influenced by industry trends, such as the increasing popularity of digital signage and the adoption of AR (augmented reality) displays. Mergers and acquisitions, such as those involving Astra Signs, Durst, and Vanguard, have led to consolidation and economies of scale withIn the industry. In conclusion, the market is a dynamic and evolving industry that caters to various sectors and applications. The demand for cost-effective, durable, and innovative visual communication solutions continues to drive growth and innovation within this sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.06% |

|

Market growth 2024-2028 |

USD 4.65 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.02 |

|

Key countries |

US, China, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Printed Signage Market Research and Growth Report?

- CAGR of the Printed Signage industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the printed signage market growth of industry companies

We can help! Our analysts can customize this printed signage market research report to meet your requirements.