Power Management Integrated Circuit (PMIC) Market Size 2025-2029

The power management integrated circuit (pmic) market size is forecast to increase by USD 10.73 billion at a CAGR of 5.2% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing adoption of PMICs in various sectors, including smart buildings, construction, industrial automation, and consumer electronics. In the construction industry, PMICs are being integrated into smart buildings for efficient energy management and lighting control. In the industrial sector, PMICs are used in semiconductor materials, microprocessors, and battery chargers for industrial automation. The PMIC market is also driven by the growing demand for PMICs in consumer electronics, such as smartphones, laptops, and smart home devices, which require efficient power management. Furthermore, the increasing popularity of electric vehicles (EVs) and renewable energy sources is leading to the adoption of PMICs in power grid applications.

- Advanced technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and machine learning are also driving the growth of the PMIC market. For instance, PMICs are used in advanced driver-assistance systems (ADAS) in vehicles to manage power consumption and improve safety. In the lighting industry, PMICs are used in LED lighting systems for efficient power management.

What will be the Size of the Power Management Integrated Circuit (PMIC) Market During the Forecast Period?

- The market encompasses a diverse range of energy-efficient electronic components, including battery chargers, voltage regulators, bipolar ICs, automotive ICs, lighting ICs, motion ICs, microprocessor supervisory ICs, sensor ICs, and more. This market is driven by the increasing demand for battery-powered devices, particularly in sectors such as automotive, IoT, AI, and electric vehicles (EVs). Power density, battery life, electromagnetic interference (EMI), circuit design technologies, thermal performance, and compatibility with advanced technologies like Adas, EVs, and data centers are key considerations. The PMIC market is expected to grow significantly due to the increasing use of PMICs in various applications, including mobile devices, IT devices, telecommunications, and electronic industry power management solutions.The focus on energy efficiency, miniaturization, and high performance continues to fuel innovation and expansion in this dynamic market.

How is this Power Management Integrated Circuit (PMIC) Industry segmented and which is the largest segment?

The power management integrated circuit (pmic) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Voltage regulators

- Motor control integrated circuit

- Integrated ASSP power management integrated circuit

- Battery management integrated circuit

- Others

- End-user

- Automotive and transportation

- Consumer electronics

- Industrial

- Telecom and networking

- Others

- Usage

- 5V-15V

- Below 5V

- Above 15V

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By Product Insights

The voltage regulators segment is estimated to witness significant growth during the forecast period. Voltage regulators, specifically Power Management Integrated Circuits (PMICs), are essential components in maintaining a consistent power supply for electronic devices. PMICs integrate various functions such as battery chargers, voltage regulators, and battery management ICs into a single chip. They are utilized in a diverse range of applications, including portable devices, home appliances, communication systems, consumer electronics, automotive ICs, and lighting ICs. PMICs ensure efficient power management by minimizing power consumption, extending battery life, and reducing electromagnetic interference (EMI). Advanced PMICs, such as configurable and DC/DC regulators, offer high power density and thermal performance. With the increasing demand for energy-efficient, battery-powered devices, PMICs have gained significant importance in various sectors, including electric vehicles (EVs), data centers, and telecommunications.

PMICs are manufactured using advanced semiconductor materials like Gallium Nitride (GaN) and Silicon Carbide (SiC), enabling high power handling and quick charging capabilities. The global market for PMICs is expected to grow significantly due to the increasing adoption of smart devices, IoT, 5G networks, and the decarbonization of road transport.

Get a glance at the market report of various segments Request Free Sample

The Voltage regulators segment was valued at USD 10.54 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

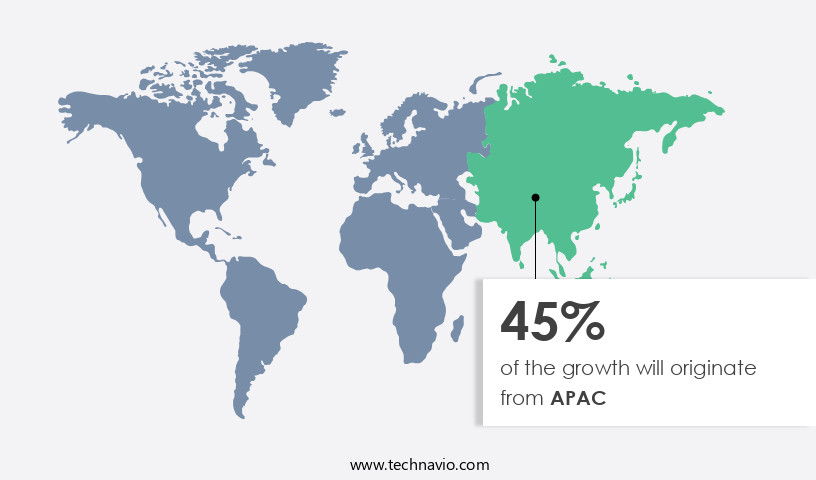

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market In the Asia Pacific (APAC) region is witnessing notable growth, driven by the region's thriving electronics industry. With countries like China, Japan, South Korea, and Taiwan being major players in electronics manufacturing, the demand for power management ICs is increasing. The electronics industry's expansion, fueled by consumer electronics, automotive electronics, industrial automation, and IoT applications, is a significant factor. APAC is the largest market for smartphones worldwide, with China, India, and Indonesia being major contributors. PMICs are essential components for powering and managing the energy consumption of various electronic devices, including battery-powered gadgets, battery chargers, voltage regulators, bipolar ICs, automotive ICs, lighting ICs, motion ICs, microprocessor supervisory ICs, sensor ICs, battery management ICs, portable devices, LED driver ICs, MX processors, configurable PMICs, DC/DC regulators, home appliances, communication, Internet, consumer electronics, telecom, networking, military electronics, medical electronics, smartphones, fitness trackers, building control, Li-ion batteries, coin cell batteries, and electronic components.

The PMIC market's growth is influenced by factors such as power density, battery life, electromagnetic interference (EMI), circuit design technologies, thermal performance, electric vehicles (EVs), and decarbonize road transport's global energy-related emissions. Semiconductor manufacturers are focusing on advanced materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) to improve power management solutions' efficiency. The market's growth is further fueled by the increasing demand for power management ICs in data centers, telecommunications, energy usage, quick charging, power distribution, OLED screens, and various industries, including the automotive sector, battery charging, and low voltage regulators.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. Moreover, the PMIC market is subject to regulatory compliance, which is driving the adoption of advanced semiconductor materials such as silicon carbide and system-on-chip (SoC) solutions for high power applications. The market is also witnessing the emergence of new applications in areas such as lithium-ion batteries for electric vehicles and computer systems.Overall, the PMIC market is expected to grow significantly due to these trends and the increasing demand for efficient power management solutions.

What are the key market drivers leading to the rise In the adoption of Power Management Integrated Circuit (PMIC) Industry?

- Growing construction of smart buildings is the key driver of the market.Power Management Integrated Circuits (PMICs) play a crucial role in managing energy consumption and efficiency in various sectors, including portable devices, home appliances, automotive, and electric vehicles (EVs). PMICs encompass a range of components, such as battery chargers, voltage regulators, bipolar ICs, automotive ICs, lighting ICs, motion ICs, microprocessor supervisory ICs, sensor ICs, battery management ICs, and LED driver ICs. These circuits are essential for managing power distribution, quick charging, and optimizing power density and battery life in electronic devices. In the consumer electronics industry, PMICs are used in smartphones, fitness trackers, and other mobile devices, as well as in IT devices, data centers, and telecommunications networks.

- The telecom sector, particularly the 5G network, relies on PMICs for power management solutions to support the increasing energy usage of smart devices and the Internet of Things (IoT), including AI and artificial intelligence applications. The automotive sector also benefits from PMICs, with applications in battery charging, low voltage regulators, and power distribution systems for electric vehicles (EVs) and hybrid vehicles. In the industrial sector, PMICs are used in building control systems, Li-ion batteries, and coin cell batteries, as well as in military and medical electronics. PMICs are also essential for managing power in EVs, which are increasingly being adopted to decarbonize road transport and reduce global energy-related emissions.

What are the market trends shaping the Power Management Integrated Circuit (PMIC) market?

- Recent developments in PMIC industry is the upcoming market trend.The market is witnessing significant advancements, with key players introducing innovative solutions to address the growing demand for energy-efficient power management in various industries. For instance, in April 2023, STMicroelectronics launched the VIPerGaN100 and VIPerGaN65, high-voltage power converters that utilize high electron mobility transistors (HEMT) and advanced pulse width modulator (PWM) controllers to enhance power density, efficiency, and reduce PCB size and cost. Furthermore, Nordic Semiconductor expanded its offerings with the introduction of the nPM1300, a single-chip solution that simplifies Bluetooth Low Energy (BLE) designs by integrating functions like hard reset, battery fuel indicator, system-level watchdog, power loss alert, and recovery from unsuccessful boot.

- These developments underscore the market's focus on energy efficiency, miniaturization, and cost reduction for battery-powered devices, home appliances, automotive ICs, and various electronic components. Additionally, the adoption of semiconductor materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) is gaining traction due to their superior thermal performance and electromagnetic interference (EMI) reduction capabilities. The PMIC market is poised to grow further as the demand for energy-efficient power management solutions increases in sectors such as consumer electronics, telecom, networking, military electronics, medical electronics, electric vehicles (EVs), data centers, and telecommunications. With the ongoing development of System-on-chips (SoCs), 5G networks, and the Internet of Things (IoT), the need for power management solutions in mobile devices, IT devices, and EVs is expected to surge.

What challenges does the Power Management Integrated Circuit (PMIC) Industry face during its growth?

- High regulatory compliance associated with PMIC is a key challenge affecting the industry growth.The market is driven by the increasing demand for energy-efficient solutions in battery-powered devices, such as portable devices, smartphones, fitness trackers, and electric vehicles (EVs). PMICs are essential components In these devices, providing functions like battery charger, voltage regulators, and DC/DC regulators. They also include various types of ICs, such as bipolar ICs, automotive ICs, lighting ICs, motion ICs, microprocessor supervisory ICs, sensor ICs, battery management ICs, and LED driver ICs. Regulatory compliance is a significant challenge In the PMIC market. Power management ICs must adhere to various safety and electromagnetic compatibility (EMC) standards to ensure product safety, electromagnetic compatibility, and environmental considerations.

- Compliance with safety regulations includes electrical insulation, protection against overvoltage and overcurrent, temperature limits, and fault detection. EMC compliance involves minimizing electromagnetic interference (EMI) and radio frequency interference (RFI) to prevent interference with other electronic devices. Manufacturers invest in rigorous testing and validation processes to ensure their PMICs meet these regulatory requirements. The PMIC market also caters to various industries, including home appliances, communication, internet, consumer electronics, telecom, networking, military electronics, medical electronics, and automotive sectors. The market is further fueled by the adoption of advanced semiconductor materials, such as Gallium Nitride (GaN) and Silicon Carbide (SiC), and system-on-chips (SoCs) based on MX processors and configurable PMICs.

Exclusive Customer Landscape

The power management integrated circuit (pmic) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the power management integrated circuit (pmic) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, power management integrated circuit (pmic) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Allegro MicroSystems Inc. - The market encompasses the production and sale of advanced semiconductor solutions that regulate, convert, and manage power in electronic systems. These circuits, such as the A4408 power management IC, are integral to optimizing power consumption and ensuring efficient energy utilization in various applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allegro MicroSystems Inc.

- Analog Devices Inc.

- Infineon Technologies AG

- MagnaChip Semiconductor Corp.

- Microchip Technology Inc.

- MinebeaMitsumi Inc.

- Mitsubishi Electric Corp.

- Nordic Semiconductor ASA

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Qorvo Inc.

- Qualcomm Inc.

- Renesas Electronics Corp.

- ROHM Co. Ltd.

- STMicroelectronics NV

- Texas Instruments Inc.

- Vishay Intertechnology Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of semiconductor components that enable efficient power conversion and management in various electronic systems. These circuits play a crucial role in ensuring optimal energy utilization and enhancing the performance of battery-powered devices. Battery-powered devices, including portable electronics and electric vehicles (EVs), are driving the growth of the PMIC market. PMICs are essential for managing the power supply In these devices, ensuring consistent voltage levels and efficient energy utilization. Voltage regulators, DC/DC converters, and battery management systems are among the key PMIC types used in battery-powered devices. PMICs are also extensively used in various sectors such as automotive, lighting, motion detection, and communication.

In the automotive sector, PMICs are used for battery charging, voltage regulation, and power distribution in hybrid and electric vehicles. In the lighting sector, PMICs are used to manage the power supply to LED drivers, ensuring efficient and consistent power delivery. PMICs are also critical in various communication systems, including telecom networks, data centers, and consumer electronics. In telecom networks, PMICs help manage power in base stations and other communication equipment, ensuring reliable and efficient power delivery. In consumer electronics, PMICs are used to manage power in smartphones, fitness trackers, and other portable devices. The PMIC market is also witnessing significant growth In the areas of energy efficiency, power density, and thermal performance.

Energy efficiency is a critical consideration In the design of PMICs, as it directly impacts the overall power consumption and battery life of the devices they power. Power density and thermal performance are also essential factors, as they impact the size and weight of the devices and their ability to operate in various temperature environments. The PMIC market is also witnessing significant advancements in circuit design technologies, including the use of gallium nitride (GaN) and silicon carbide (SiC) semiconductor materials. These materials offer improved power handling capabilities, higher efficiency, and lower electromagnetic interference (EMI), making them ideal for use in PMICs for various applications.

The PMIC market is also being driven by the increasing demand for quick charging and the need for efficient power distribution in various sectors. In the automotive sector, the decarbonization of road transport is a significant driver, with EVs becoming increasingly popular. In the consumer electronics sector, the proliferation of smart devices, IoT, and AI is driving the need for more efficient power management solutions. In conclusion, the PMIC market is a dynamic and growing sector that plays a crucial role in enabling efficient power management and utilization in various electronic systems. The market is driven by the increasing demand for battery-powered devices, energy efficiency, power density, and thermal performance, and is witnessing significant advancements in circuit design technologies.

The market is also being influenced by various trends, including the growth of the automotive, communication, and consumer electronics sectors, and the increasing demand for quick charging and efficient power distribution.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 10.73 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, UK, Germany, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Power Management Integrated Circuit (PMIC) Market Research and Growth Report?

- CAGR of the Power Management Integrated Circuit (PMIC) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the power management integrated circuit (pmic) market growth of industry companies

We can help! Our analysts can customize this power management integrated circuit (pmic) market research report to meet your requirements.