Polyester Tire Cord Market Size 2024-2028

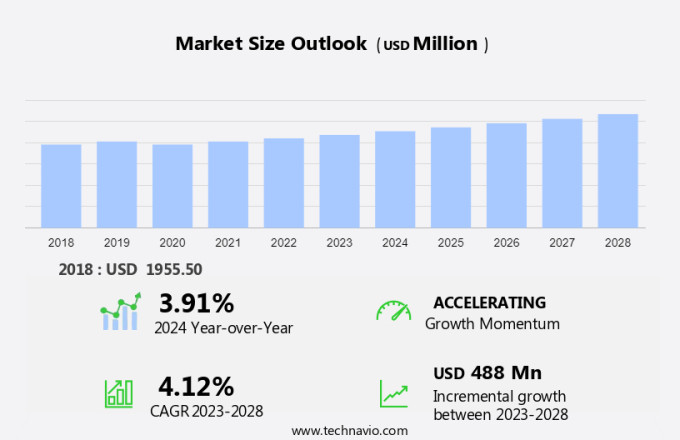

The polyester tire cord market size is forecast to increase by USD 488 million at a CAGR of 4.12% between 2023 and 2028. The market is experiencing significant growth, driven by the rising adoption of polyester tire cords in passenger cars due to their superior strength, durability, and flexibility. Another major trend influencing the automotive market is the increasing demand for and sales of electric vehicles (EVs) globally, as polyester tire cords are increasingly being used in the production of EV tires due to their lightweight properties and ability to improve fuel efficiency. However, the market also faces challenges from substitutes such as steel and nylon tire cords, which offer similar properties but at lower costs. Additionally, fluctuations in raw material prices and supply chain disruptions can impact the market's growth trajectory. Overall, the market is expected to continue its growth trajectory, driven by the increasing demand for high-performance tires and the shift toward electric vehicles.

What will be the Size of the Market During the Forecast Period?

The market represents a significant segment within the tire industry, contributing significantly to the production of reinforcing materials for tires. The market is experiencing significant growth as advancements in synthetic fibres enhance the durability and performance of aircraft tyres, providing crucial support for the aviation industry. The high tensile strength and durability of polyester tire cord fabrics make them ideal for reinforcing tires, enhancing their puncture resistance, heat resistance, and tire performance. The market for tire cord fabrics is driven by the increasing production of passenger cars and the growing demand for fuel-efficient tires.

Furthermore, the market, which includes polyester, nylon, aramid, rayon, and other synthetic fibers, plays a crucial role in the production of tires for passenger cars and vehicles. The demand for fuel-efficient tires, which offer improved mileage and reduced emissions, has led to a growing interest in high-performance tire cord fabrics. Raw material prices, particularly for polyester fibers, have a significant impact on the tire cord market. However, the increasing adoption of polyester fibers in tire production is expected to offset the cost impact to some extent. Additionally, the growing popularity of electric vehicles (EVs) is expected to create new opportunities for tire cord fabric manufacturers.

Moreover, heat resistance is a critical factor in tire performance, and polyester tire cord fabrics offer excellent heat resistance. This property makes them suitable for use in high-performance tires, where heat generation is a concern. Furthermore, the flexibility of polyester fibers enables tire manufacturers to produce tires with improved handling and ride quality. In conclusion, the market is an essential component of the tire industry, offering superior performance characteristics that contribute to the production of high-quality tires. The market is driven by factors such as increasing demand for fuel-efficient tires, growing adoption of EVs, and the unique properties of polyester fibers.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Automotive

- Construction

- Two wheelers

- Agriculture

- Aerospace

- Geography

- APAC

- China

- Japan

- Thailand

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

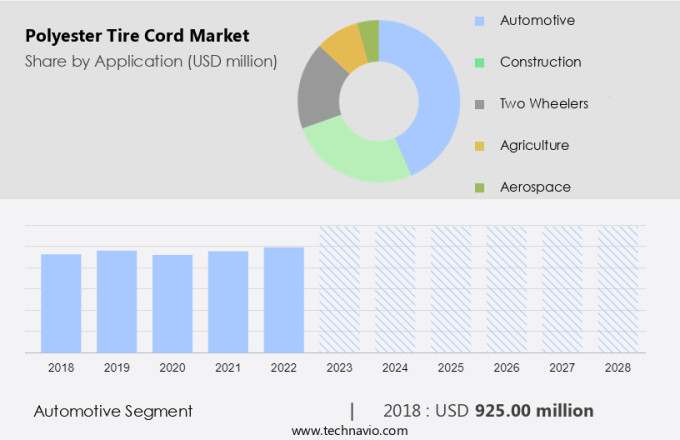

The automotive segment is estimated to witness significant growth during the forecast period. The market holds significant importance in the global automotive industry due to the material's benefits in tire manufacturing. These benefits include dimensional stability, heat resistance, and low elongation, which contribute to tire integrity and safety. As a key component in high-performance tires, polyester tire cords ensure the tires maintain their shape, support vehicle weight, and endure road demands. The automotive sector has experienced remarkable growth in 2023, with a notable increase in global vehicle sales by 14%. This expansion has led to a higher demand for tires, consequently driving the market forward. Additionally, the shift towards electric vehicles (EVs) is expected to further boost the market, as polyester tire cords are suitable for producing tires for these vehicles.

Moreover, two primary types of polyester tire cords are recycled polyester and bioderived polyester. Recycled polyester is sourced from post-consumer waste, making it an eco-friendly alternative. Meanwhile, bioderived polyester is derived from renewable resources, offering sustainability benefits. Both types contribute to the market's growth as they cater to the increasing demand for environmentally conscious products in the automotive industry. In conclusion, the market plays a crucial role in the automotive industry by providing essential tire reinforcement, ensuring tire integrity and safety. With the industry's continued growth and the increasing popularity of electric vehicles, the market is poised for continued expansion. The use of recycled and bioderived polyester tire cords further strengthens the market's position by addressing environmental concerns.

Get a glance at the market share of various segments Request Free Sample

The Automotive segment accounted for USD 925.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 66% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. Fuel-efficient tires are gaining popularity, leading to an increased demand for tire reinforcing materials with superior heat resistance and tire performance. Tire cord fabrics made from synthetic fibers, such as polyester, are well-positioned to meet this demand. Raw material prices for polyester have been relatively stable, making it an attractive option for tire manufacturers. The replacement tire industry is also a major contributor to market growth, as consumers seek to maintain their vehicles with high-performing tires. In the APAC region, developing economies like India and China, along with established automotive markets such as Japan and South Korea, are driving market expansion.

Furthermore, the region's rapid economic development has increased consumer purchasing power, leading to higher automobile sales and a subsequent rise in tire demand. In conclusion, the market is poised for continued growth, fueled by the increasing popularity of fuel-efficient tires and the expanding automotive industries in the APAC region. Tire manufacturers are turning to polyester tire cord fabrics for their heat resistance and tire performance benefits, making them a preferred choice for tire production. The stable raw material prices and the growing replacement tire market further bolster the market's growth prospects.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising adoption of polyester tire cords for passenger cars is the key driver of the market. Polyester tire cords are a preferred choice in the manufacturing of radial tires for passenger vehicles in the United States. These cords exhibit desirable properties, including heat resistance, dimensional stability, and mechanical compatibility under extreme weight conditions.

Moreover, the automotive industry values polyester tire cords for their high tensile strength and durability, which contribute to the tires' ability to withstand high abrasion. As a result, the demand for polyester tire cords is anticipated to grow significantly in the passenger car segment during the forecast period.

Market Trends

Increasing demand for sales of electric vehicles globally is the upcoming trend in the market. The global automotive industry has witnessed a notable shift towards electric vehicles (EVs) in recent years. In 2023, the sales of EVs registered a notable increase, with over 14 million new units sold worldwide, bringing the total number of EVs on the roads to approximately 40 million. This growth is in line with the forecast from the Global EV Outlook (GEVO-2023).

Furthermore, compared to the previous year, EV sales in 2023 increased by 35%, totaling 3.5 million units, including plug-in hybrid vehicles. This growth can be attributed to the high tensile strength, tread wear resistance, and puncture resistance offered by polyester tire cord fabrics, making them an ideal choice for manufacturing tires for electric vehicles.

Market Challenge

Presence of substitutes is a key challenge affecting the market growth. In the automotive industry, various materials, including steel, nylon, rayon, and aramid fibers, are utilized for manufacturing vehicles. Among these, nylon tire cords have gained significant popularity due to their high wear resistance, making them an ideal choice for commercial applications such as aircraft tires, agricultural tires, and truck tires.

Moreover, the superior qualities of nylon tire cords, including superior fatigue resistance, high tenacity, and improved adhesion, contribute to their increased demand. Furthermore, aramid fibers are increasingly being used to produce lightweight and wear-resistant tires for electric vehicles (EVs). Although aramid fibers are predominantly used in high-performance tires, their applications extend to passenger car tires due to their desirable properties such as low shrinkage, high strength, and cost-effectiveness.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Asahi Kasei Corp. - The company offer Leona nylon 66 filament featuring exceptional strength, heat resistance, and durability which is used for making tire cord to give better handling of vehicle tires during the running condition.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BIKAWA Enterprise Sdn Bhd

- Century Enka Ltd.

- COLMANT COATED FABRICS

- Far Eastern Group

- Firestone Fibers and Textiles Company LLC

- Formosa Taffeta Co. Ltd.

- HANOI INDUSTRIAL TEXTILE JSC

- Hyosung Corp.

- Indorama Ventures Public Co. Ltd.

- Kolon Industries Inc.

- KORDARNA Plus AS

- Kordsa Teknik Tekstil AS

- Madura Industrial Textiles Ltd.

- Qingdao HL Group Ltd.

- Shenma Industrial Co. Ltd.

- SRF Ltd.

- Star Polymers Inc.

- Teijin Ltd.

- Toray Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for high-performance tyres in various applications. Textile materials, such as polyester fibers, play a crucial role in reinforcing tires, providing them with high tensile strength, puncture resistance, and tire integrity. These synthetic polymers are preferred over natural fibers due to their superior properties, including high heat resistance, temperature resistance, and flexibility. Polyester fibers are widely used in tire cord fabrics due to their high modulus and ability to withstand extreme temperatures. They offer excellent tensile strength, durability, and resistance to abrasion, making them ideal for use in radial tires, high-performance tires, and fuel-efficient tires.

Moreover, the vehicle manufacturing industry is a significant consumer of tire cord fabrics, with passenger cars and performance cars being the primary segments. Other reinforcement materials, such as Nylon, Aramid fibers, and Rayon, are also used in the tire industry, with each offering unique properties like durability, flexibility, and high abrasion resistance. The market is also witnessing growth in the replacement tire industry, driven by the increasing demand for fuel-efficient tires and the rising popularity of electric vehicles (EVs). Recycled polyester and bioderived polyester are emerging as sustainable alternatives to virgin polyester, offering cost savings and reduced environmental impact. Intelligent tyres, equipped with sensors and other advanced technologies, are also gaining popularity, offering improved tire performance, fuel efficiency, and vehicle safety. The tire cord fabrics market is expected to grow further due to the increasing demand for high-performance tire reinforcing materials and the ongoing research and development in tire technologies. However, raw material prices and availability remain key challenges for market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.12% |

|

Market growth 2024-2028 |

USD 488 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.91 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 66% |

|

Key countries |

China, US, Thailand, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Asahi Kasei Corp., BIKAWA Enterprise Sdn Bhd, Century Enka Ltd., COLMANT COATED FABRICS, Far Eastern Group, Firestone Fibers and Textiles Company LLC, Formosa Taffeta Co. Ltd., HANOI INDUSTRIAL TEXTILE JSC, Hyosung Corp., Indorama Ventures Public Co. Ltd., Kolon Industries Inc., KORDARNA Plus AS, Kordsa Teknik Tekstil AS, Madura Industrial Textiles Ltd., Qingdao HL Group Ltd., Shenma Industrial Co. Ltd., SRF Ltd., Star Polymers Inc., Teijin Ltd., and Toray Industries Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch