Pharmaceutical Contract Packaging Market Size 2025-2029

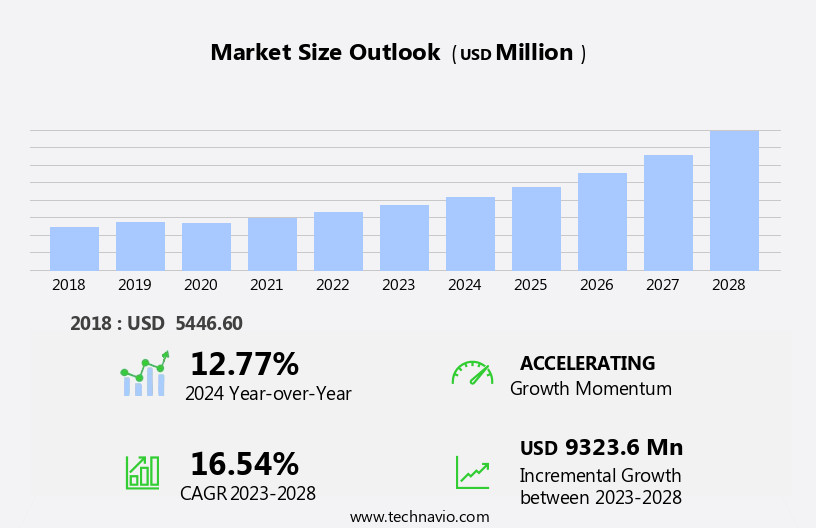

The pharmaceutical contract packaging market size is forecast to increase by USD 10.44 billion, at a CAGR of 16.5% between 2024 and 2029. The market is experiencing significant growth due to the increasing research and development spending in the pharmaceutical industry. This investment in R&D leads to an influx of new drugs entering the market, creating a demand for contract packaging services.

Major Market Trends & Insights

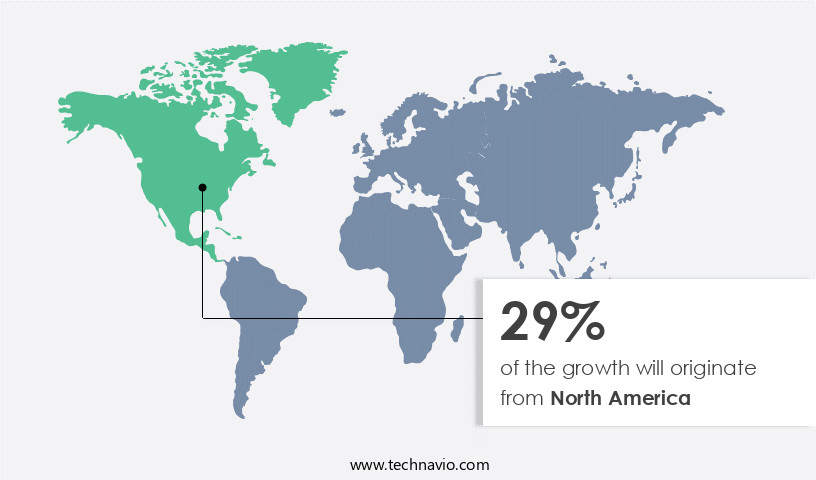

- North America dominated the market and accounted for a 29% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

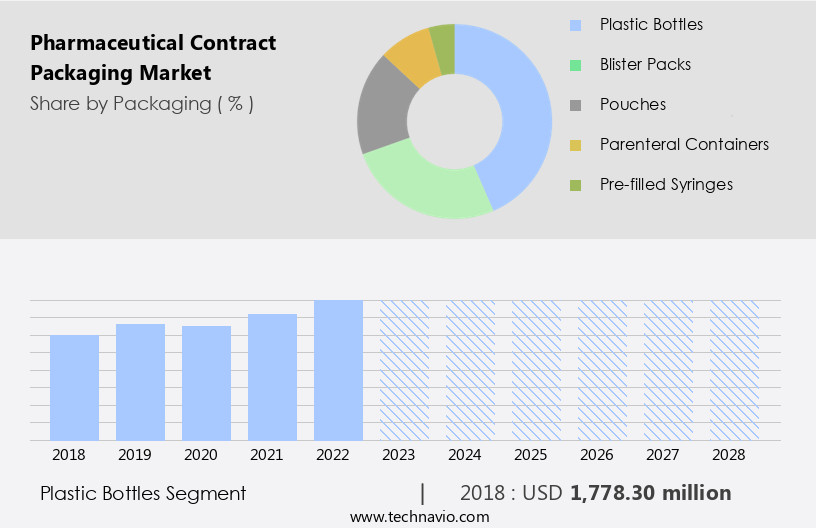

- Based on the Packaging, the plastic bottles segment led the market and was valued at USD 2.62 billion of the global revenue in 2023.

- Based on the Type, the primary segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 24.77 Million

- Future Opportunities: USD 10.44 Billion

- CAGR (2024-2029): 16.5%

- North America: Largest market in 2023

The expiration of patents for several blockbuster drugs presents opportunities for contract packaging providers to offer their services for these generic medications. However, the high cost of implementing anti-counterfeit packaging technology poses a challenge for market participants. This technology is crucial to ensure product authenticity and patient safety, but the significant investment required may deter some companies from adopting it.

To capitalize on market opportunities and navigate challenges effectively, companies must stay abreast of technological advancements and regulatory requirements in the pharmaceutical industry. Additionally, strategic partnerships and collaborations can help offset the high costs associated with anti-counterfeit packaging technology. Overall, the market presents both opportunities and challenges for market participants, requiring a strategic approach to remain competitive and meet the evolving needs of the pharmaceutical industry.

What will be the Size of the Pharmaceutical Contract Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-changing needs of various sectors in the healthcare industry. This dynamic market encompasses a range of services, from vial filling and liquid filling to unit dose packaging and label printing. Quality control is paramount, with cleanroom facilities ensuring the highest standards are met. Supply chain management plays a crucial role, with contract manufacturing and primary packaging solutions streamlining production processes. Flexible packaging, such as pouch packing and foil pouches, offers advantages in terms of cost and sustainability. Regulatory compliance and packaging validation are integral parts of the process, with tamper-evident seals and serialization solutions ensuring product safety and traceability.

Bottle capping, labeling, and warranty seals are essential components of secondary packaging, which protects the primary packaging during transportation and storage. Packaging automation, including cartoning systems and weight checking, enhances efficiency and accuracy. Injection molding and packaging materials are key elements in the production of various types of pharmaceutical packaging, such as blister packaging and child-resistant packaging. Industry growth is expected to remain robust, with estimates suggesting a steady increase of around 5% annually. For instance, a leading pharmaceutical company reported a 10% increase in sales due to the implementation of advanced packaging solutions. This continuous unfolding of market activities underscores the importance of staying informed and adaptable in the ever-evolving pharmaceutical packaging landscape.

How is this Pharmaceutical Contract Packaging Industry segmented?

The pharmaceutical contract packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Packaging

- Plastic bottles

- Blister packs

- Pouches

- Parenteral containers

- Pre-filled syringes

- Type

- Primary

- Secondary

- Tertiary

- Industry Application

- Small molecule pharmaceuticals

- Biopharmaceuticals

- Vaccines

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Packaging Insights

The plastic bottles segment is estimated to witness significant growth during the forecast period.

Pharmaceutical contract packaging involves various processes such as vial filling, quality control, unit dose packaging, supply chain management, cleanroom facilities, liquid filling, label printing, warranty seals, flexible packaging, bottle capping, bottle labeling, contract manufacturing, primary packaging, blister packaging, tamper-evident seals, packaging design, regulatory compliance, packaging validation, secondary packaging, pouch packing, weight checking, cartoning systems, injection molding, packaging materials, packaging automation, child-resistant packaging, foil pouches, fill and finish, serialization solutions, e-commerce packaging, pharmaceutical packaging, sterile packaging, and tablet counting. Companies provide services ranging from fabricating plastic bottles for primary packaging to purchasing them from suppliers and offering packaging services. Plastic bottles, made from materials like low-density polyethylene (LDPE), high-density polyethylene (HDPE), and polypropylene, are increasingly popular in the pharmaceutical industry due to their elimination of tertiary packaging and enhanced product safety throughout the supply chain.

According to a report by Smithers Pira, the global pharmaceutical packaging market is expected to grow by 4% annually between 2021 and 2026. For instance, a pharmaceutical company increased its sales by 15% by switching to plastic bottles for its liquid medication.

The Plastic bottles segment was valued at USD 1.96 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, with the US being a major contributor. Established pharmaceutical companies in the US, such as Johnson and Johnson, Pfizer, Abbot Laboratories, and Bristol Myers Squibb, are driving market expansion. The increasing value of US pharmaceutical exports, rising healthcare spending, and an aging population are key growth factors. The US healthcare market is further expanding due to recent government initiatives, like the Inflation Reduction Act, which enhances Medicare benefits starting in 2024, including a USD2,000 annual cap on out-of-pocket prescription drug costs and a USD35 monthly insulin price. According to industry reports, the market is expected to grow by approximately 5% annually in the coming years, driven by increasing demand for outsourced packaging services, regulatory compliance requirements, and technological advancements.

For instance, the adoption of automation and digital technologies in packaging processes is streamlining operations, reducing costs, and improving efficiency. Additionally, the rising trend of personalized medicines and the growing popularity of e-commerce platforms are further fueling market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global lidding films market is experiencing significant growth due to the increasing demand for advanced packaging solutions in the pharmaceutical industry. Pharmaceutical contract packaging capabilities are in high demand, particularly for complex projects involving high-speed tablet packaging lines and sterile vial filling and stoppering. Contract manufacturing for drug products requires custom pharmaceutical packaging solutions that ensure compliance with FDA packaging regulations and provide efficient cold chain packaging logistics. Automated blister packaging systems are a popular choice for pharmaceutical companies due to their ability to increase production speed and reduce errors. Integrated serialization and aggregation are essential features for ensuring traceability and compliance with regulatory requirements. Sustainable packaging materials are also gaining popularity in the industry, with innovative solutions offering advanced aseptic liquid filling technologies and state-of-the-art packaging inspection systems.

Child-resistant packaging solutions for drugs are crucial for patient safety, and quality control in pharmaceutical packaging is a top priority for companies. Flexible packaging for pharmaceutical products offers numerous benefits, including cost savings, reduced waste, and improved product protection. The use of flexible packaging materials is expected to increase in the coming years, particularly for applications such as pouch packaging and sachets. Lidding films play a critical role in the success of these packaging solutions, providing a reliable and effective seal that ensures product integrity and maintains the required barrier properties. With the increasing focus on sustainable and eco-friendly packaging, the use of biodegradable and recyclable lidding films is also gaining traction in the market. Overall, the global lidding films market is expected to continue growing, driven by the demand for advanced packaging solutions that meet the unique needs of the pharmaceutical industry.

What are the key market drivers leading to the rise in the adoption of Pharmaceutical Contract Packaging Industry?

- The pharmaceutical industry's significant investment in research and development is the primary catalyst driving market growth.

- The pharmaceutical industry's escalating research and development expenditures fuel the expansion of the market. With an increasing focus on innovative drug formulations, biologics, and personalized medicine, packaging complexity has escalated. Contract packaging firms provide pharmaceutical companies with scalable, cost-effective solutions, allowing them to concentrate on core research and development activities while adhering to stringent regulatory standards. The burgeoning pipeline of clinical trials and new drug approvals amplifies the demand for adaptable packaging solutions catering to diverse dosage forms, stability requirements, and patient-centric designs.

- For instance, the adoption of advanced technologies such as nanocoatings for improved drug stability and patient-friendly packaging designs has resulted in a 15% increase in sales for some contract packaging firms. The market is projected to grow by over 5% annually, underscoring its significance in the evolving healthcare landscape.

What are the market trends shaping the Pharmaceutical Contract Packaging Industry?

- The patent expiration of certain drugs is leading to significant market trends, with new opportunities arising for generic versions and potential price reductions. This shift is expected to have a substantial impact on the pharmaceutical industry.

- The market is experiencing significant dynamics due to the increasing number of patent expirations. By 2026, a notable wave of blockbuster drugs, including Ticagrelor (Brilinta) and Entresto (sacubitril/valsartan, each with annual sales exceeding USD 3 billion), are projected to lose exclusivity. This trend is driving the entry of affordable generic and biosimilar alternatives, leading to heightened competition and potential profit margin reductions for original brand-name producers. Despite these challenges, investing in research and development for innovative and customized packaging remains difficult for pharmaceutical manufacturers.

- In 2025, over 40 major drugs are expected to face patent expiration, posing a substantial risk to the industry's revenue structure. This shift in the market landscape underscores the importance of adaptability and strategic planning for pharmaceutical companies.

What challenges does the Pharmaceutical Contract Packaging Industry face during its growth?

- The high cost of implementing anti-counterfeit packaging technology poses a significant challenge to the industry's growth, as companies must invest heavily to protect their brand authenticity and consumer trust.

- The market faces a substantial challenge due to the high cost of implementing advanced anti-counterfeit packaging technologies. With the proliferation of counterfeit drugs posing serious health risks and damaging brand reputation, pharmaceutical companies are under increasing pressure to adopt solutions like RFID tags, holograms, tamper-evident seals, and blockchain-based tracking systems. However, these technologies necessitate significant investment in specialized equipment, software integration, and skilled labor, which can be prohibitively expensive for many contract packaging organizations, particularly small and mid-sized firms. Furthermore, the need to comply with diverse regulatory standards across international markets adds to the complexity and cost of implementation and scalability.

- For instance, integrating RFID technology into packaging processes can cost upwards of USD 1 million, making it a considerable investment for many firms. According to a report, the pharmaceutical packaging market is projected to grow by over 6% annually in the coming years, driven by the increasing demand for advanced packaging solutions.

Exclusive Customer Landscape

The pharmaceutical contract packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pharmaceutical contract packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pharmaceutical contract packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc - The company specializes in pharmaceutical contract packaging solutions, providing High Shield Pharma Laminates, Inert Shield Pharma Laminates, SureForm Forming Films, and Pouches to ensure product integrity and compliance in the pharmaceutical industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- AptarGroup Inc.

- Becton Dickinson and Co.

- Berlin Packaging LLC

- Bilcare Ltd.

- Catalent Inc.

- CCL Industries Inc.

- Cencora Inc.

- Constantia Flexibles Group GmbH

- Datwyler Holding Inc.

- FedEx Corp.

- Gerresheimer AG

- Jabil Inc.

- James Alexander Corp.

- KP Holding GmbH and Co. KG

- Oliver Healthcare Packaging Co.

- Pharma Packaging Solutions

- Precision Concepts International

- SCHOTT AG

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pharmaceutical Contract Packaging Market

- In January 2024, Pfizer Inc. announced a strategic partnership with Patheon N.V., a leading contract development and manufacturing organization (CDMO), to expand its global supply chain capabilities for small molecule active pharmaceutical ingredients (APIs) and finished dosage forms. This collaboration aimed to enhance Pfizer's agility and responsiveness in meeting market demands (Pfizer Press Release, 2024).

- In March 2024, Catalent, a global leader in pharmaceutical and biopharmaceutical services, acquired Cook Pharmica, a CDMO specializing in the manufacturing of sterile injectables, for approximately USD 1.2 billion. This acquisition expanded Catalent's capabilities in injectable drug development and manufacturing (Catalent Press Release, 2024).

- In May 2024, Thermo Fisher Scientific, a biotech product development and manufacturing solutions provider, received FDA approval for its new facility in Massachusetts, which increased its capacity for clinical and commercial manufacturing of biologics and advanced therapies. This expansion was part of Thermo Fisher's ongoing commitment to support the growing biopharmaceutical industry (Thermo Fisher Scientific Press Release, 2024).

- In February 2025, DSM Biomedical, a leading provider of contract manufacturing services for injectable drugs, announced the launch of its new facility in Singapore, which focused on the production of complex injectables. This expansion strengthened DSM Biomedical's presence in the Asia Pacific market and enabled it to better serve customers in the region (DSM Biomedical Press Release, 2025).

Research Analyst Overview

- The market continues to evolve, driven by the increasing demand for efficient and compliant solutions across various sectors. Quality assurance and safety testing are paramount, with in-line inspection systems and validation protocols ensuring product handling adheres to stringent standards. Tablet packaging, capsule filling, and powder filling require sterilization techniques such as tray sealing and aseptic processing to maintain packaging integrity. Contract packagers utilize packaging lines, inspection systems, and design verification to optimize processes and reduce risk. Large scale packaging projects necessitate supply chain optimization and regulatory affairs management. Sustainability is a growing concern, with an industry expectation of 10% annual growth in eco-friendly packaging solutions.

- For instance, a leading contract packager recently reported a 15% increase in sales from its digital printing capabilities for clinical trials packaging. Process optimization and material sourcing are crucial, with cold chain logistics ensuring temperature-sensitive drugs remain effective. Risk management strategies, including risk assessment and mitigation, are essential to maintain product quality and consumer safety. Regulatory compliance, high-speed packaging, and blister cards are also key areas of focus.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pharmaceutical Contract Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.5% |

|

Market growth 2025-2029 |

USD 10437 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.8 |

|

Key countries |

US, China, Canada, UK, Germany, Japan, India, France, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pharmaceutical Contract Packaging Market Research and Growth Report?

- CAGR of the Pharmaceutical Contract Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pharmaceutical contract packaging market growth of industry companies

We can help! Our analysts can customize this pharmaceutical contract packaging market research report to meet your requirements.