Peer To Peer Lending Market Size 2024-2028

The peer to peer lending market size is forecast to increase by USD 754 billion at a CAGR of 39% between 2023 and 2028.

- P2P lending has emerged as a disruptive financing alternative in financial services, offering several advantages over traditional banking methods. The market is driven by factors such as reduced operational costs for P2P lending companies and the increasing adoption of digital loans.

- However, the market also faces challenges, including security and fraud risks. The operational cost savings result from the elimination of intermediaries and automation of processes, leading to faster loan approvals and lower interest rates. The rise in digital adoption is fueled by the convenience and accessibility of P2P platforms, particularly among the millennial population. However, these benefits come with risks, such as the potential for fraudulent activities and data breaches, which require data security to mitigate.

What will be the Size of the Peer To Peer Lending Market During the Forecast Period?

- The peer-to-peer (P2P) lending market represents a non-traditional financing avenue that enables direct transactions between investors and borrowers, bypassing traditional financial intermediaries. This market's growth is driven by increasing internet penetration, investor appetite for alternative investment opportunities, and consumer demand for quicker and more accessible loan origination. P2P platforms offer consumer loans with flexible repayment terms and competitive interest rates, catering to various needs such as debt consolidation, medical expenses, and education.

How is this Peer To Peer Lending Industry segmented and which is the largest segment?

The P2P lending industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Business Segment

- Traditional lending

- Marketplace lending

- End-user

- Individual consumer

- Small businesses

- Large businesses

- Real estate

- Loan Type

- Secured

- Unsecured

- Purpose Type

- Repaying Bank Debt

- Credit Card Recycling

- Education

- Home Renovation

- Buying Car

- Family Celebration

- Others

- Geography

- APAC

- China

- North America

- Canada

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By Business Segment Insights

The traditional lending segment is estimated to witness significant growth during the forecast period. The global Peer-to-Peer (P2P) lending market experienced significant growth in 2023, with traditional P2P lending holding a substantial market share. This form of money lending, where platforms facilitate transactions between borrowers and investors, offers advantages such as high transparency, simple investment structures, and efficient debt collection. Increasing consumer and business demand for alternative lending options, driven by the need for funds, propels market expansion. Key sectors In the P2P lending landscape include consumer loans, business loans, inventory purchase, and loan structuring. P2P platforms enable loan transactions for various purposes, including debt consolidation, medical expenses, small businesses, microenterprises, student loans, green lending, and home improvement.

Market growth is influenced by factors like Internet penetration, investor appetite, and regulatory compliance. However, challenges persist, including regulatory uncertainties, platform fraud, and cybersecurity threats. To mitigate risks, platforms employ advanced technologies like machine learning for credit assessment, blockchain for transaction security, and mobile technologies for accessibility and platform efficiency. Innovative fintech solutions, such as artificial intelligence and structured environments, aim to streamline borrowing and provide quicker, more competitive loans. Borrower and lender trust are crucial in this market, with education initiatives and fraud prevention measures playing essential roles. The P2P lending market is poised for exponential growth, contributing to economic development.

Get a glance at the market report of various segments. Request Free Sample

The Traditional lending segment was valued at USD 39.50 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

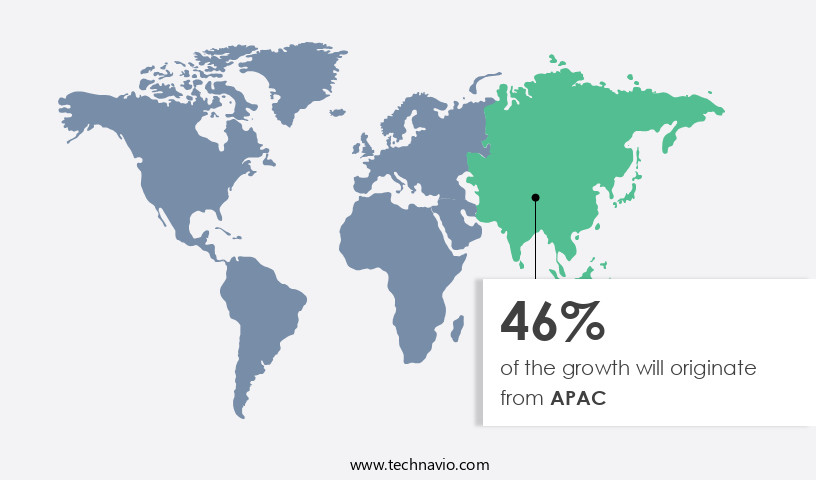

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Peer-to-Peer (P2P) lending market In the APAC region held a significant market share in 2023, driven by the increasing adoption of cloud-based platforms and heavy investments in research and development by fintech. The region's growth is fueled by the rise of online marketplace lending and the awareness of alternative financing methods among investors and borrowers. The increasing penetration of internet access In the region, with over 50% of the population online, has facilitated the growth of P2P lending. Consumer loans, including debt consolidation, medical expenses, and education, as well as business loans for small businesses and microenterprises, are popular loan types In the market.

Platform efficiency, accessibility, and security are crucial elements in P2P lending. Loan transactions, listings, and borrower and lender trust are ensured through machine learning-based credit assessment, blockchain technology, and transaction security. Regulatory compliance and fraud prevention are also prioritized. P2P lending offers competitive interest rates, quicker loan approvals, and flexible repayment terms. However, regulatory uncertainties, platform fraud, and cybersecurity threats pose challenges to the market's growth. The P2P lending market's business model encompasses loan structuring, economic development, and home improvement loans. Artificial intelligence and innovation are essential to borrower and lender protection, loan type diversification, and streamlined borrowing processes. The market's exponential growth is expected to continue, driven by consumer behavior, loan type expansion, and fintech solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.Risk management is a critical component of P2P lending, with platforms employing rigorous loan approval processes and sophisticated algorithms to assess borrower creditworthiness. Despite this, concerns around platform fraud and regulatory compliance persist, necessitating ongoing efforts to build borrower and lender trust. The market's exponential growth is fueled by established players and emerging startups, offering a diverse range of loan types and catering to various regions, including emerging markets. As the market matures, education initiatives and secure transactions are becoming increasingly important to maintain investor and consumer confidence. Overall, the P2P lending market continues to disrupt traditional financial services, offering a more accessible, efficient, and transparent lending experience.

What are the key market drivers leading to the rise In the adoption of Peer To Peer (P2P) Lending Industry?

- Reduced operational costs of P2P lending vendors is the key driver of the market.Peer-to-peer (P2P) lending markets operate through the Internet, enabling investor appetite for consumer and business loans without the need for substantial physical infrastructure. P2P lending companies generate profits by charging borrowers and deducting fees from loan repayments to investors. The market's growth is driven by the accessibility and efficiency of these online platforms. Consumer loans, including debt consolidation, medical expenses, and student loans, are popular loan types on P2P platforms. Small businesses and microenterprises also benefit from these services for inventory purchases and loan structuring. P2P lending offers quicker loan approvals and competitive interest rates compared to traditional financial institutions.

- However, regulatory uncertainties, platform fraud, and cybersecurity threats pose challenges to the market's growth. Risk management and regulatory compliance are crucial aspects of P2P lending, ensuring borrower and lender trust. Machine learning, credit assessment, blockchain, transaction security, and mobile technologies are employed to streamline borrowing processes and prevent fraud and defaults. The fintech ecosystem continues to innovate, with artificial intelligence and non-traditional loan types, such as green lending, gaining traction. P2P lending platforms prioritize secure transactions, consumer behavior analysis, and education initiatives to foster a structured environment for borrowers and lenders. The market's exponential growth is a testament to its potential in economic development, home improvement, and business expansion.

What are the market trends shaping the Peer To Peer (P2P) Lending market?

- Rise in adoption of digital loans is the upcoming market trend.Peer-to-peer (P2P) lending markets have experienced significant growth due to the increasing internet penetration and investor appetite for consumer loans. Loan origination in this digital ecosystem is streamlined, allowing for quicker loan approvals and competitive interest rates. P2P platforms offer various loan types, including debt consolidation, medical expenses, small business, and microenterprise loans. However, regulatory uncertainties, platform fraud, and cybersecurity threats pose challenges. To mitigate risks, platforms employ advanced technologies such as machine learning for credit assessment, blockchain for transaction security, and mobile technologies for accessibility. P2P lending caters to diverse borrower needs, including student loans, green lending, and loan structuring for inventory purchase and home improvement.

- The business model's efficiency and accessibility have led to exponential growth, with established players focusing on regulatory compliance, borrower trust, and lender trust. Artificial intelligence and innovation are essential components of the fintech ecosystem, enabling fraud prevention, default prevention, and loan type diversification. Consumer behavior is shifting towards streamlined borrowing, with borrowers preferring secure transactions and a structured environment. P2P lending platforms provide a competitive alternative to traditional financial institutions, offering quicker loan processing and personalized services. Overall, the P2P lending market's growth is driven by its ability to cater to diverse borrowing needs while maintaining a focus on borrower and lender protection.

What challenges does the Peer To Peer (P2P) Lending Industry face during its growth?

- Security and fraud risks is a key challenge affecting the industry growth.Peer-to-peer (P2P) lending markets have experienced exponential growth due to increased Internet penetration and investor appetite for consumer loans. Loan origination in this space includes various loan types such as debt consolidation, medical expenses, small business, and microenterprise loans. Platforms facilitate loan transactions by listing loan opportunities and connecting borrowers with potential lenders. Risk management is crucial in P2P lending, with loan approvals based on credit assessment using machine learning and artificial intelligence. Interest rates and repayment terms vary, with competitive rates attracting investors. However, regulatory uncertainties, platform fraud, and cybersecurity threats pose challenges. P2P platforms must ensure regulatory compliance, borrower trust, and lender trust through fraud prevention and default prevention measures.

- Interest in P2P lending extends to various loan types, including student loans, green lending, inventory purchase, and loan structuring. The fintech ecosystem supports this market, with innovations in blockchain, transaction security, and mobile technologies enhancing platform efficiency, accessibility, and borrower protection. P2P platforms must prioritize secure transactions, addressing consumer behavior and streamlining borrowing for quicker loan approvals and competitive interest rates.

Exclusive Customer Landscape

The peer to peer lending market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the P2P lending market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, peer to peer (p2p) lending market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AS Mintos Marketplace

- Avant LLC

- Bondora Capital OU

- Bridge Fintech Solutions Pvt. Ltd.

- Enova International Inc.

- Fairassets Technologies India Pvt. Ltd.

- Funding Circle Holdings plc

- Innofin Solutions Pvt. Ltd.

- Kiva Microfunds

- Lendbox

- LendingClub Corp.

- Lendingkart Finance Ltd.

- LendingTree LLC

- Metro Bank Plc

- Prosper Funding LLC

- Zopa Bank Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Peer-to-peer (P2P) lending, also known as crowdlending or social lending, represents a significant disruption In the traditional financial services industry. This marketplace-based financing model enables consumers and businesses to borrow directly from a pool of investors, bypassing the need for intermediaries such as banks. The P2P lending market has experienced exponential growth in recent years, fueled by increasing internet penetration and investor appetite. Consumers and businesses seek alternative financing options due to competitive interest rates, repayment terms, and quicker loan approvals. The market caters to various loan types, including consumer loans for debt consolidation, medical expenses, and education, as well as business loans for small businesses, microenterprises, inventory purchase, and loan structuring.

Risk management plays a crucial role In the P2P lending ecosystem. Platforms employ machine learning and credit assessment algorithms to evaluate borrower applications and assess creditworthiness. Additionally, they implement fraud prevention measures and ensure regulatory compliance to maintain borrower and lender trust. Platform efficiency and accessibility are essential factors driving the popularity of P2P lending. Mobile technologies enable users to access loan listings and manage transactions on the go. Furthermore, blockchain technology enhances transaction security, ensuring secure transactions and transparency. However, P2P lending faces regulatory uncertainties and cybersecurity threats. Regulatory bodies worldwide are working to establish guidelines for this emerging market.

Platforms must navigate these complex regulatory landscapes to maintain compliance and build trust with their user base. Additionally, they must invest in robust cybersecurity measures to protect sensitive user data and prevent potential fraud. The P2P lending market operates withIn the fintech ecosystem, fostering innovation and competition. Established players continue to dominate the market, but nontraditional competitors are entering the space, offering unique value propositions and challenging the status quo. In conclusion, the P2P lending market represents a significant shift In the financial services industry, offering consumers and businesses alternative financing options with competitive interest rates, quicker approvals, and increased accessibility. Platforms must navigate regulatory uncertainties, cybersecurity threats, and competition to maintain trust and grow within this dynamic market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 39% |

|

Market growth 2024-2028 |

USD 754 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

30.72 |

|

Key countries |

China, US, Australia, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Peer To Peer Lending Market Research and Growth Report?

- CAGR of the P2P Lending industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the peer to peer lending market growth of industry companies

We can help! Our analysts can customize this P2P lending market research report to meet your requirements.