Parachute Fabric Market Size 2024-2028

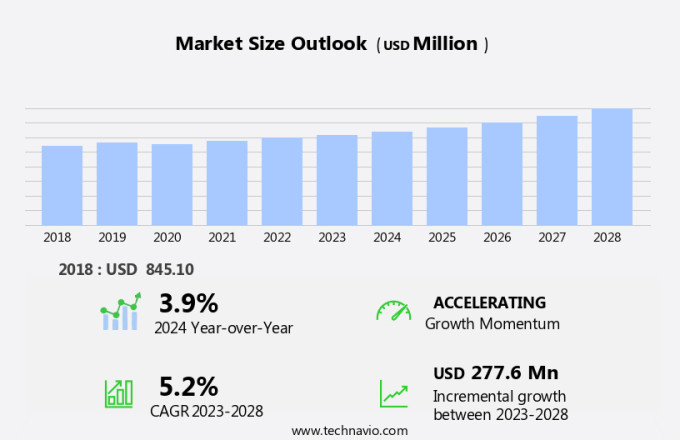

The parachute fabric market size is forecast to increase by USD 277.6 million at a CAGR of 5.2% between 2023 and 2028.

- The market is experiencing significant advancements, driven by the increasing popularity of extreme sports and military exercises. Fabric technology continues to evolve, with a focus on blend innovation and advanced coatings for enhanced durability and weather resistance. Biodegradable materials are also gaining traction due to growing environmental concerns. Certification programs, such as those for fabric water resistance, ensure product quality and consumer safety. Furthermore, the use of parachute fabric in weather balloons and other scientific applications expands the market's scope. Despite raw material costs and volatility, the market is expected to grow steadily due to these trends and the continuous development of new fabric technologies.

What will the size of the market be during the forecast period?

- The parachute fabric market is a significant sector within the textile industry, catering to various applications in aerospace technology and recreational uses. This market is driven by the need for high-performance, durable, and safe fabrics that meet the stringent requirements of these industries. Fabric performance is a crucial factor in the parachute fabric market. Producers invest in research and development to create fabrics with enhanced properties such as water resistance, colorfastness, and UV resistance. These features ensure the longevity and effectiveness of parachutes, especially in extreme conditions. Fabric durability is another essential aspect of the parachute fabric market. The materials used must be able to withstand high forces and stresses during deployment. Fabric testing plays a vital role in ensuring durability, with rigorous procedures evaluating factors such as shrinkage, abrasion, pilling, and fire resistance. Safety protocols are paramount in the parachute fabric market. Producers focus on creating fabrics that meet the highest safety standards. This includes not only physical properties but also certification programs that guarantee compliance with regulatory bodies. Aerospace technology is a significant market for parachute fabrics, where the demand for high-performance and lightweight materials is high. Recreational uses, including adventure tourism and commercial applications, also contribute to the market's growth.

- Fabric innovation continues to shape the parachute fabric market, with a focus on sustainable materials and improved fabric weight. This not only benefits the environment but also enhances the overall performance and durability of the fabrics. Training courses for fabric production and maintenance are essential in the parachute fabric market. These courses ensure that professionals have the necessary skills and knowledge to produce and maintain high-quality parachute fabrics. Breathability is an increasingly important fabric property in the parachute fabric market. Producers are developing fabrics that allow for better airflow, improving user comfort and overall performance. In conclusion, the parachute fabric market is a dynamic and evolving sector, driven by the need for high-performance, durable, and safe materials. Producers are continually investing in research and development to create innovative fabrics that meet the demands of the aerospace and recreational industries. The focus on sustainability and safety protocols further strengthens the market's growth potential.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Nylon

- Kevlar

- Others

- Type

- Military Parachutes

- Civil Parachutes

- Geography

- North America

- Canada

- US

- Europe

- UK

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Material Insights

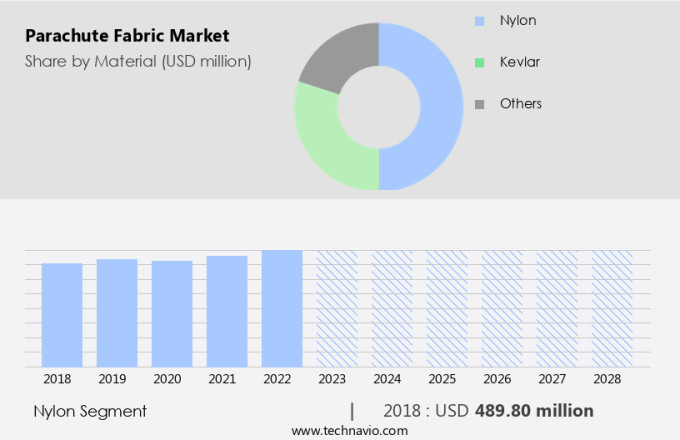

- The nylon segment is estimated to witness significant growth during the forecast period.

The market is driven by the nylon segment due to its superior performance characteristics and cost-effectiveness. Nylon's high tensile strength, durability, and resistance to abrasion and adverse weather conditions make it an ideal choice for both military and civilian parachute applications. Its ability to maintain structural integrity under extreme stress is crucial for parachute performance. Leading manufacturers prefer nylon 6,6 and nylon 6 variants for their consistent performance across various atmospheric conditions and affordability at scale. Fabric testing and colorfastness are essential considerations in the production process to ensure safety and reliability.

Further, industry trends include a focus on fabric innovation, such as the development of lightweight and high-performance materials. Training courses and certifications are also crucial for ensuring the highest standards in fabric production and performance. Fabric shrinkage and fire resistance are important performance factors, with natural fire resistance becoming increasingly desirable. Overall, the market is driven by the need for reliable, safe, and high-performing materials in demanding applications.

Get a glance at the market report of share of various segments Request Free Sample

The nylon segment was valued at USD 489.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

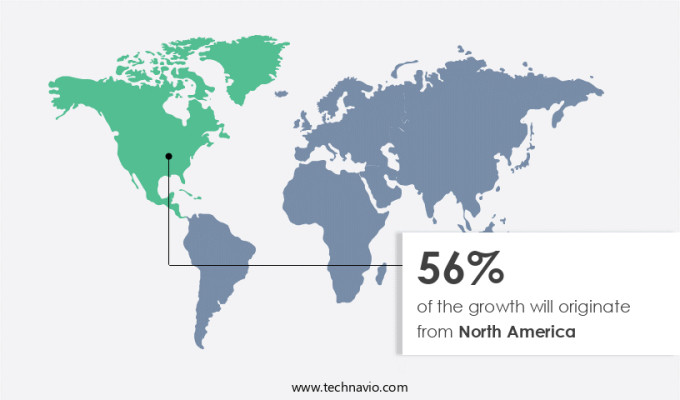

- North America is estimated to contribute 56% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market dominates the global parachute fabric industry, fueled by substantial military spending, a thriving recreational skydiving sector, and advanced aerospace applications. The United States leads this demand, driven by extensive military programs requiring high-performance parachute systems for special forces and airborne divisions. Additionally, the region's aerospace sector significantly contributes to market growth, with organizations like NASA and commercial space companies utilizing specialized parachute fabrics for recovery systems and landing mechanisms. This market trend underscores the importance of parachute fabrics in ensuring safety and success in various sectors, including adventure sports and cargo deployment for paragliding and recreational activities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Parachute Fabric Market?

Growth in adventure sports is the key driver of the market.

- The market is experiencing significant growth due to the increasing popularity of adventure sports and recreational activities, such as skydiving and paragliding, in the US and globally. These high-energy pursuits require specialized equipment, including high-quality parachutes, to ensure safety and optimal performance. The demand for advanced fabric technology is on the rise, with a focus on innovation in materials, such as composites, hybrid fabrics, and advanced coatings. Fabric properties, including tensile strength, water resistance, colorfastness, and fire resistance, are crucial considerations for manufacturers. Additionally, sustainability is a key trend in the industry, with a growing emphasis on using biodegradable materials and reducing the environmental impact of production.

- Training programs and research collaborations are essential for improving fabric performance and safety protocols. The market is also driven by the increasing use of parachutes in civil applications, such as airborne operations, cargo drops, personnel drops, and aerial delivery systems, as well as research operations. Market analysis and industry trends indicate continued growth in the market, with a focus on fabric durability, breathability, and abrasion resistance. Fabric pilling and shrinkage are ongoing challenges, and risk management remains a top priority for manufacturers and end-users alike. Overall, the market is poised for continued innovation and growth, driven by the demand for specialized equipment in adventure sports and recreational activities.

What are the market trends shaping the Parachute Fabric Market?

Developing new fabrics is the upcoming trend in the market.

- The market is experiencing notable growth and innovation, with a focus on creating high-quality materials for use in adventure sports and recreational activities. Safety is a top priority, with research and development efforts centered on enhancing fabric properties such as tensile strength, fire resistance, and UV resistance. Fabric manufacturers are collaborating with organizations in the adventure sports industry, including those specializing in paragliding, skydiving, and aerial delivery systems, to create advanced fabrics for these applications. New fabric technologies are being explored, including composites, hybrid fabrics, and advanced coatings. Biodegradable materials are also gaining popularity due to their environmental benefits.

- Certification programs ensure the fabric meets rigorous safety standards for various uses, such as cargo drops, personnel drops, and rescue missions. Social media platforms are used to showcase new fabric designs and training programs, keeping the industry informed of the latest trends and innovations. Market analysis reports highlight the importance of fabric performance, including breathability, stretch, and colorfastness, in the market. Industry trends include the use of sustainable materials and a focus on reducing fabric shrinkage and pilling. Fabric testing is crucial to ensure fabric properties meet the demands of various applications, from recreational uses to military exercises and civil applications.

What challenges does Parachute Fabric Market face during the growth?

Raw material costs and volatility is a key challenge affecting market growth.

- The market encompasses a wide range of applications in adventure sports and civil applications, including paragliding, skydiving, and airborne operations for cargo and personnel drops. Manufacturers prioritize safety, innovation, and high-quality fabric design in their offerings, focusing on advanced coatings, tensile strength, and weather resistance. The market faces challenges due to the volatility and high costs of raw materials, primarily synthetic fibers like nylon and polyester. This dependency on petroleum markets leaves prices susceptible to fluctuations and availability issues. To address these challenges, collaborations and research initiatives are underway to explore alternative materials, such as composites, hybrid fabrics, and biodegradable materials.

- Certification programs ensure fabric water resistance, colorfastness, and performance meet industry standards. Training courses and safety protocols are essential for risk management in recreational activities and aerial delivery systems. Fabric innovation continues to drive market trends, with a focus on sustainability, durability, and fabric properties like breathability, fire resistance, UV resistance, and shrinkage. Market analysis and environmental impact studies are crucial for the industry's future growth.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Airborne Systems - The company offers parachute fabric for use in the Gemini tandem, PS-2 multi-mission parachute, personnel parachute, and other applications.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Belton Industries Inc.

- Butler Parachute Systems Inc.

- ChutingStar Enterprises Inc.

- DELCOTEX

- FXC Corp.

- Heathcoat Fabrics Ltd.

- Hiltex Indusrtial Fabrics Pvt. Ltd.

- HLC Industries Inc.

- Kusumgar Corporates Pvt ltd

- Milliken and Co.

- Mills Manufacturing Corp.

- Performance Textiles

- Porcher Industries

- Sachsische Spezialkonfektion GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Parachute fabric is a critical component in various adventure sports and civil applications, including paragliding, skydiving, and aerial delivery systems. The design and manufacturing of these fabrics require extensive research and collaborations between fabric manufacturers and industry experts. The use of advanced composites, hybrid fabrics, and high-quality materials ensures the tensile strength, weather resistance, and colorfastness necessary for these applications. Social media platforms have significantly influenced the popularity of adventure sports and recreational activities, leading to an increase in demand for parachute fabrics. Training programs and certification programs are essential to ensure safety protocols and risk management in airborne operations, cargo drops, and personnel drops. Fabric innovation continues to be a key trend in the industry, with research focusing on developing sustainable materials, improving fabric performance, and enhancing fabric properties such as breathability, fire resistance, and UV resistance.

Additionally, advanced coatings and biodegradable materials are also gaining popularity due to their environmental impact. Additionally, the civil application of weather balloon involves testing fabric properties such as fabric colorfastness, fabric fire resistance, fabric UV resistance, fabric abrasio durability, and fabric breathability to ensure optimal performance in varying environmental conditions. Fabric testing and certification are crucial to ensure safety and quality in the parachute fabric market. Fabric manufacturers invest in research operations to develop new fabric technologies, such as stretching and shrinkage-resistant fabrics, to meet the evolving needs of the market. The market analysis indicates that the demand for parachute fabrics will continue to grow, driven by the increasing popularity of adventure tourism and civil applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2024-2028 |

USD 277.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Key countries |

US, China, UK, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch