Paper Bag Market Size 2025-2029

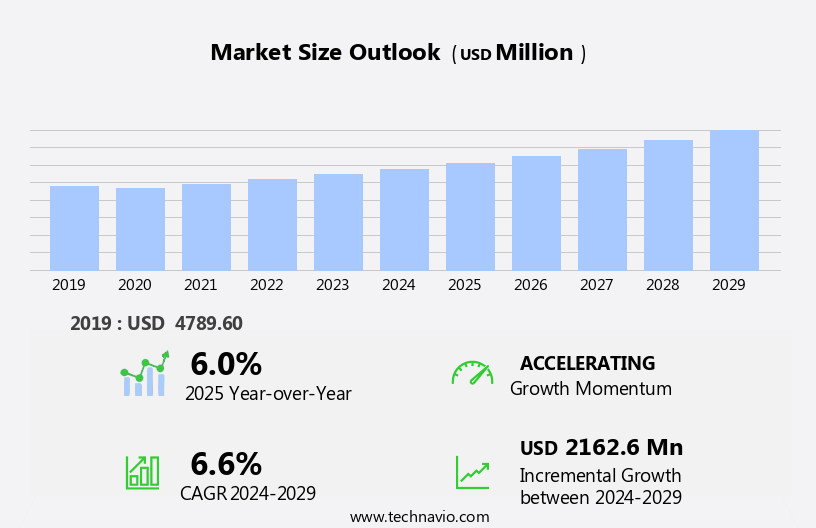

The paper bag market size is forecast to increase by USD 2.16 billion at a CAGR of 6.6% between 2024 and 2029.

- The market witnesses significant growth, driven by the increasing consumer awareness and preference for eco-friendly alternatives to plastic bags. The environmental benefits of paper bags, such as biodegradability and recyclability, resonate with consumers, leading to their widespread adoption. However, this market faces challenges, including the limited durability of paper bags compared to their plastic counterparts. This can impact the customer experience and potentially limit repeat purchases. Furthermore, regulatory hurdles, such as taxes and bans on plastic bags in certain regions, fuel the demand for paper bags. The market is witnessing significant growth due to the increasing awareness and adoption of eco-friendly packaging solutions.

- To capitalize on this market opportunity, companies must focus on enhancing the durability of paper bags through technological innovations and sustainable production methods. By addressing these challenges, market players can effectively cater to the growing demand for eco-friendly packaging solutions and solidify their market position. Moreover, the use of renewable resources like pulp from cocoa and hazelnut waste in the production of paper bags adds to their eco-friendliness.

What will be the Size of the Paper Bag Market during the forecast period?

- In the dynamic packaging market, paper bags continue to gain traction due to their affordability and environmental appeal. The cost of packaging, a significant expense for businesses, can be mitigated through the use of bio-based materials in paper bag production. Brands increasingly prioritize sustainability and environmental awareness, leading to a shift towards paper bags made from renewable resources. Advancements in printing technology enable customized branding, enhancing consumer perception and customer experience. Global trade and logistics optimization require packaging that ensures product protection during transit. Zero waste and sustainability trends drive the demand for longer shelf life paper bags. The beauty and gifting industries have also shown strong demand for biodegradable paper bags, as consumers seek to reduce their carbon footprint and minimize greenhouse gas emissions.

- Bag making equipment and material sourcing play a crucial role in packaging innovation, with companies investing in efficient production processes and circular economy principles. Supply chain disruptions necessitate flexible packaging solutions, making alternative packaging options, such as paper bags, increasingly popular. Sustainability trends extend to digital marketing and e-commerce platforms, where paper bags offer a cost-effective, eco-friendly alternative to plastic. Packaging design remains a critical factor in consumer behavior, with paper bags offering versatility and customization options. The National Green Tribunal and other regulatory bodies have imposed restrictions on single-use plastic bags, leading to a shift towards sustainable solutions. The market continues to evolve, driven by consumer preferences, technological advancements, and the circular economy.

How is this Paper Bag Industry segmented?

The paper bag industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Brown kraft

- White kraft

- End-user

- Retail

- Food and beverage

- Construction

- Pharmaceutical

- Others

- Product Type

- Flat paper bags

- Multi-wall sacks

- Twist handle bags

- Others

- Distribution Channel

- B2B

- Retail stores

- E-commerce

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Material Insights

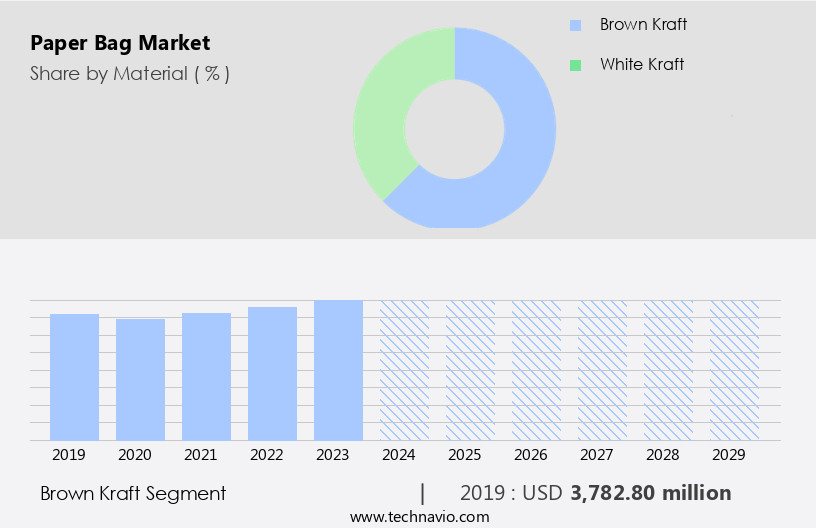

The brown kraft segment is estimated to witness significant growth during the forecast period. Brown kraft paper bags have gained popularity due to their durability and versatility in various industries. The kraft process used to manufacture this paper, which involves removing most lignin from wood, results in a stronger and more elastic product compared to other pulping methods. Kraft paper is widely used for merchandise packaging due to its high tear resistance and handle strength. In the food industry, it is employed for packaging consumer goods such as flour, sugar, and dried fruits and vegetables, ensuring food safety standards are met. Custom logo printing and branding are essential for businesses looking to distinguish their products. The beauty and gifting industry, as well as convenience stores and shopping malls, are significant contributors to the market's growth. R

Flexographic printing, a printing method using flexible plates, is commonly used for mass-producing high-quality prints on kraft paper bags. The supply chain management of these bags is crucial for retailers, ensuring stock availability and timely delivery. Sustainability certifications, such as FSC and SFI, are increasingly important for eco-conscious consumers. Recycled paper is another sustainable alternative, contributing to the growing demand for eco-friendly packaging. The market offers various print options, including digital printing, to cater to diverse consumer needs. Kraft paper bags come in various sizes and weights, suitable for different applications. Bulk packaging, shipping bags, and stand-up bags are popular choices for various industries, including convenience stores, bakeries, and restaurants.

The Brown kraft segment was valued at USD 3.78 billion in 2019 and showed a gradual increase during the forecast period. Chemical companies are also investing in bioplastics as a more sustainable alternative to petrochemical-based plastics. Water resistance and grease resistance are essential features for food packaging, making kraft paper an ideal choice for the food service industry. Inventory management and shipping logistics are critical aspects of the Kraft market. Manufacturing processes must adhere to packaging regulations to ensure product quality and consumer safety. The pricing models vary depending on factors such as bag size, paper weight, and customization options. Overall, the Kraft market is evolving to meet the demands of various industries while prioritizing sustainability and product quality.

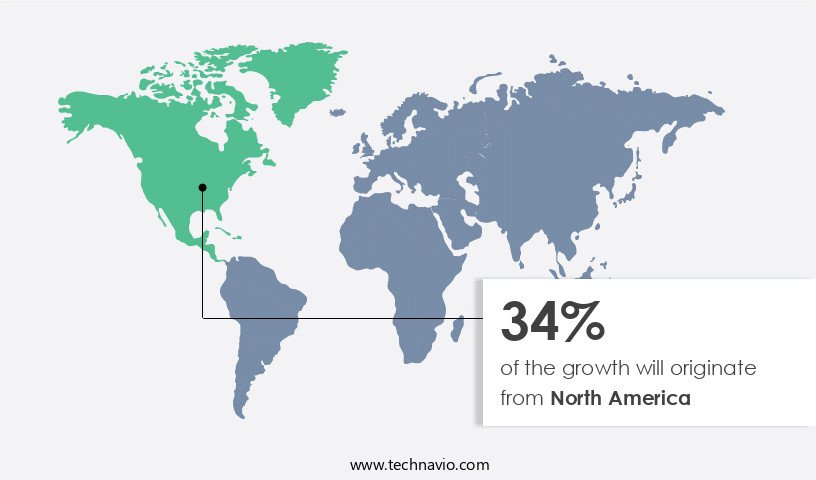

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to shifting consumer preferences and stringent regulations. With the rise of fast food and convenience food culture, the demand for paper bags as packaging solutions has increased. Moreover, regulations mandating the reduction of packaging waste have further boosted market demand. Paper bags with enhanced barrier properties are increasingly sought after to meet this need. Sustainability is a key trend, with recycled paper packaging gaining popularity due to environmental concerns. Chemical companies, such as Braskem, are entering the bioplastic packaging segment to cater to the growing demand from various industries.

Supply chain management and inventory management are crucial aspects of the paper bag industry. Flexible lead times and stock availability are essential for retailers and manufacturers to maintain a smooth operation. Product branding and custom printing are also important factors, with companies utilizing various print options, including flexographic and digital printing, to enhance their brand image. In the food industry, food safety standards and grease resistance are essential considerations for paper bags. The bakery industry, in particular, requires paper bags with specific properties, such as tear resistance and handle strength. The market also caters to various industries, including convenience stores, restaurants, and online retail, with offerings like window bags, shipping bags, and gift bags.

Sustainability certifications, such as FSC and SFI, are becoming increasingly important for paper bag manufacturers. Eco-friendly packaging and the use of recycled paper are becoming industry standards. Bag sizes, paper weights, and bag quality are also crucial factors that influence consumer choice. Manufacturing processes, such as kraft paper production and gusset design, play a significant role in the market. The market also offers various handle styles and bag designs, including stand-up bags and water-resistant bags, to cater to diverse consumer needs. Pricing models vary depending on the specifications and the volume of orders. Overall, the market is dynamic and evolving, with a focus on sustainability, functionality, and consumer convenience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Paper Bag market drivers leading to the rise in the adoption of Industry?

- The environmental advantages linked to the use of paper bags serve as the primary market driver, making them a preferred choice over plastic bags for many consumers and businesses. Paper bags have gained popularity in the online retail industry due to their eco-friendly attributes. These bags are more sustainable than plastic alternatives, aligning with consumer preferences for environmentally responsible packaging. Paper bags offer several benefits, including being recyclable, reusable, and energy-saving. Recyclable paper bags are made from materials that can be broken down by microorganisms, making them biodegradable and reducing the time it takes for them to decompose. Reusable paper bags can be used multiple times, thereby reducing the need for constant production and disposal. Moreover, paper bags are often manufactured using locally sourced materials, minimizing transportation costs and energy consumption.

- Inventory management for paper bags is streamlined with various print options, such as window bags, gusset designs, stand-up bags, and water resistance. Sustainability certifications, like FSC (Forest Stewardship Council) and SFI (Sustainable Forestry Initiative), ensure the ethical sourcing of raw materials. Shipping bags also come in paper material to maintain the eco-friendly theme. Packaging regulations mandate that businesses comply with specific guidelines for paper bags, including minimum size and strength requirements. Overall, paper bags offer a sustainable and cost-effective solution for businesses looking to reduce their carbon footprint while meeting regulatory standards.

What are the Paper Bag market trends shaping the Industry?

- Eco-friendly material adoption is becoming a significant market trend. It is essential for businesses to prioritize the use of sustainable materials in their operations to remain competitive and align with consumer preferences. The market is experiencing growth due to increasing demand from industries such as food service and convenience stores. However, there is a growing emphasis on sustainable production processes and the use of eco-friendly materials to meet consumer health and environmental concerns. As a result, manufacturers are exploring alternative sources for paper production, such as edamame beans, waste hazelnuts, and cocoa beans. These materials not only offer grease resistance but also contribute to sustainable paper sourcing. For instance, edamame bean remains can be recycled to create soy packaging for edamame snacks, while hazelnut shells and cocoa bean skins can be utilized in paper manufacturing.

- Both food service and retail sectors benefit from the convenience and sustainability of these paper bags. SFI and FSC certifications ensure the use of responsibly sourced materials and ethical manufacturing processes. Pricing models vary based on the specifications and volume requirements of each customer. The bakery industry, in particular, has shown a significant interest in these eco-friendly paper bags due to their ability to maintain freshness and appeal.

How does Paper Bag market faces challenges face during its growth?

- The limited durability of paper bags poses a significant challenge to the expansion and growth of the industry. The shift towards eco-friendly packaging solutions has led to a significant increase in demand for paper bags in various industries. However, the use of paper bags for bulk packaging, particularly in the food and beverage sector, presents certain challenges. Paper bags, made from brown or kraft paper, may not be suitable for carrying heavy food items due to their light weight and thin material thickness. This can result in damage during transportation or handling, leading to food loss. To address these concerns, businesses opting for paper bags must consider investing in higher quality options, such as reinforced or multi-layered bags.

- These enhanced paper bags offer improved durability and strength, making them more suitable for handling food items. Moreover, digital printing technology enables customization of paper bags, adding value for businesses in the mail order and restaurant industries. While paper bags are an eco-friendly alternative to plastic, their use in food packaging requires careful consideration to ensure the bags can withstand the weight and moisture of the items being transported. By investing in high-quality paper bags, businesses can mitigate potential issues and maintain the integrity of their products during transit.

Exclusive Customer Landscape

The paper bag market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the paper bag market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, paper bag market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bulldog Bag Ltd. - This company specializes in the production and distribution of high-quality paper bags, catering to various industries such as clothing, garment, grocery, hardware, and pharmacy.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bulldog Bag Ltd.

- Burgass Carrier Bags

- C.E.E. R. SCHISLER

- Gilchrist Bag Manufacturing LLC

- Inteplast Group

- International Paper Co.

- Jinan Xinshunyuan Packing Co. Ltd.

- Mondi Plc

- Novolex

- NOVPLASTA CZ s.r.o.

- Packaging Pro

- Paperera de Girona SA

- Papier-Mettler KG

- ProAmpac Holdings Inc.

- Ronpak Inc.

- Smurfit Kappa Group

- Sonoco Products Co.

- Thai Showa Paxxs Co Ltd

- United Bags Inc.

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Paper Bag Market

- In January 2024, international packaging giant Smurfit Kappa announced the launch of its new eco-friendly paper bag range, BioNova, made from 100% recycled paper and certified compostable (Smurfit Kappa press release, 2024). This development marks a significant shift towards sustainable packaging solutions in the market.

- In March 2025, Amcor and Danone entered into a strategic partnership to develop and commercialize renewable and recycled packaging for Danone's water brand, Evian. The collaboration includes the production of paper-based bottles and paper bags, further emphasizing the growing importance of eco-friendly alternatives in the market (Amcor press release, 2025).

- In July 2024, Sealed Air completed the acquisition of Hemas Packaging, a leading packaging solutions provider in South Asia, expanding its geographic reach and market presence in the region (Sealed Air press release, 2024). This strategic move enables Sealed Air to cater to the growing demand for paper bags in emerging markets like India and Sri Lanka.

- In October 2025, the European Union passed a regulation banning single-use plastic bags starting from 2026. This regulatory initiative is expected to significantly boost the demand for paper bags as a viable alternative (European Parliament press release, 2025). According to a study by the European Commission, the ban on plastic bags could lead to a 70% increase in paper bag consumption in the EU (European Commission report, 2023).

Research Analyst Overview

The market continues to evolve, driven by shifting consumer preferences and industry trends. Grease resistance and convenience remain key factors, with applications spanning various sectors. FSC certified and retail bags are increasingly popular in the sustainable packaging movement, while SFI certified paper sourcing ensures responsible forest management. Food safety standards are paramount in food service and consumer goods, leading to advancements in manufacturing processes. Direct sales and the bakery industry rely on custom printing and logo printing for branding, with options including flexographic printing and offset printing. Pricing models vary, influenced by factors such as bag size, paper weight, and material thickness.

Online retail and mail order require shipping bags, while window bags and stand-up bags offer merchandise display advantages. Water resistance and print options are essential for various applications, with eco-friendly packaging gaining traction. Inventory management and supply chain optimization are ongoing concerns, as are packaging regulations and weight limits. The market's continuous dynamism reflects the industry's commitment to meeting diverse customer needs and staying at the forefront of innovation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Paper Bag Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 2.16 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, Canada, China, Germany, UK, Japan, France, The Netherlands, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Paper Bag Market Research and Growth Report?

- CAGR of the Paper Bag industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the paper bag market growth of industry companies

We can help! Our analysts can customize this paper bag market research report to meet your requirements.