Organic Wine Market Size 2025-2029

The organic wine market size is forecast to increase by USD 7.35 billion at a CAGR of 10.4% between 2024 and 2029.

- The market exhibits significant growth potential, driven by the increasing trend of organic wine tourism and the expanding distribution of organic wines through duty-free retail stores. Consumers' growing preference for healthier and sustainable food and beverage options fuels the demand for organic wines. However, regulatory hurdles impact adoption, as organic wine production and certification require adherence to strict regulations. Volatile fuel prices pose challenges to the supply chain, increasing production costs and affecting the competitiveness of organic wines in the market. To capitalize on the market opportunities, companies should focus on innovation, such as developing new organic wine varieties and exploring alternative distribution channels.

- Effective supply chain management and strategic partnerships with retailers and distributors can help mitigate the impact of fuel price volatility and regulatory complexities. By addressing these challenges and leveraging the market trends, companies can establish a strong presence in the market and meet the growing demand for organic and sustainable beverage options.

What will be the Size of the Organic Wine Market during the forecast period?

- The market in the US is experiencing significant growth due to increasing consumer interest in healthier and more natural beverage options. Unlike conventional wines, which may contain pesticides, herbicides, and chemical fertilizers, organic wines are produced using organic vineyards and natural processes. This includes the use of fungicides derived from natural sources, such as sulfur, and natural yeasts for fermentation. Red and white organic wines, including those vinified from grapes, are gaining popularity among consumers. E-commerce platforms and aluminum cans have made organic wine more accessible to a wider audience, contributing to the market's expansion. The wine business is responding by introducing new flavors and expanding their organic offerings to bakery goods, restaurants, and other food service industries.

- However, organic certification remains a crucial factor for consumers, ensuring that the wine they purchase meets specific standards. While glass bottles have traditionally been the container of choice for organic wine, the shift towards aluminum cans offers advantages in terms of sustainability and convenience. Overall, the market is poised for continued growth as consumers prioritize health and naturalness in their food and beverage choices.

How is this Organic Wine Industry segmented?

The organic wine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Organic still wine

- Organic sparkling wine

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

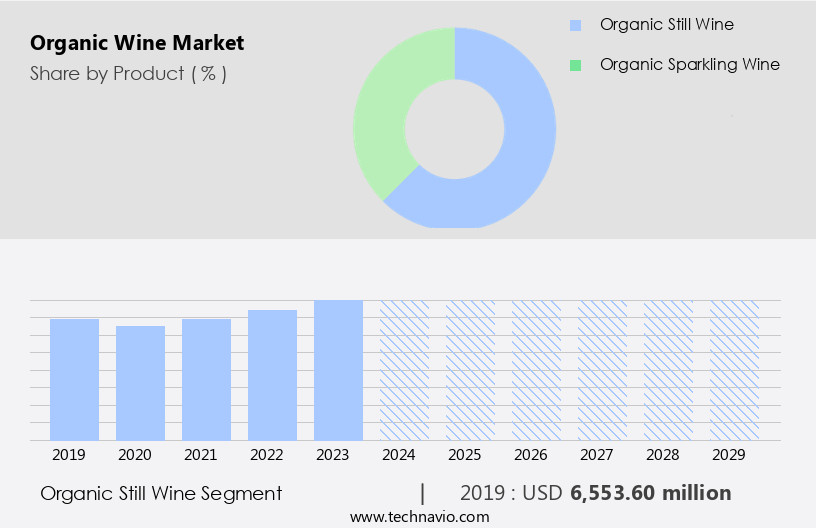

The organic still wine segment is estimated to witness significant growth during the forecast period.

Organic still wine, a popular and widely consumed alcoholic beverage type, is produced by fermenting grape juice without the addition of bubbles. Red wine and rose wine are among the most preferred still wine varieties. The color of still wine depends on the amount of color extracted from grape skins during processing. Major rose wine producers include France, Spain, the US, and Italy. The organic still wine market is experiencing growth due to the availability of diverse flavors infused through spices and fruit aromas. For example, Emiliana Organic Vineyards offers Vigno Carignan, a purplish-red wine with aromas of black fruits like blueberries and plums.

E-commerce platforms have made it easier for consumers to purchase organic still wines, expanding market reach. Organic vineyards, committed to naturalness, avoid using pesticides, herbicides, and chemical fertilizers, ensuring healthier grapes. Glass bottles and aluminum cans are popular packaging options for organic still wines, preserving the wine's taste and freshness. Restaurants and hotels are increasingly incorporating organic still wines into their menus, catering to the growing consumer interest. Ingredients like sulfur and fungicides are used minimally in organic wine production, while wild and natural yeasts are employed for fermentation. Organic certification ensures the authenticity and quality of organic still wines.

Organic food establishments, bars, and clubs promote organic still wines as specialized goods, further boosting demand. Nutraceuticals, derived from organic still wines, offer additional health benefits. Consumers are drawn to the healthiness and naturalness of organic still wines, making it a dynamic and evolving market.

The Organic still wine segment was valued at USD 6.55 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market is experiencing significant growth, with a focus on health benefits and naturalness driving consumer interest. Organic vineyards, free from pesticides, herbicides, and chemical fertilizers, are increasingly popular. New flavors and production methods, such as the use of wild and natural yeasts, are attracting a diverse customer base. E-commerce platforms and aluminum cans have made organic wine more accessible, expanding its reach to bakeries, restaurants, hotels, and bars. The organic certification process ensures the use of organic ingredients, including grapes, in the production of organic wine. The wine business is responding with new product launches and marketing strategies to capitalize on this trend.

The forecast period is expected to see continued growth, with European countries like Norway, Sweden, Finland, Denmark, Germany, the UK, Switzerland, and Austria being major importers of organic wine. The focus on healthiness and naturalness is not limited to wine, as the organic food market also experiences a surge in demand. The use of sulfur and fungicides is minimized in organic vineyards, while specialized goods like red and white organic wines, and vinified grapes, are gaining popularity. The production cost of organic wine may be higher due to the absence of agrochemicals, but the potential for a greater return on investment is significant.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Organic Wine market drivers leading to the rise in the adoption of Industry?

- The increasing popularity of organic wine tourism is the primary growth factor for the market. Organic wine tourism refers to the practice of visiting vineyards and wineries that produce organic wines, adhering to sustainable and eco-friendly farming practices. This trend caters to consumers' growing preference for healthier and environmentally-friendly options, thereby driving market expansion.

- The market has gained significant traction due to the increasing demand for organic foods and beverages. Consumers are increasingly conscious of the health risks associated with conventional wines produced using agrochemicals, including pesticides and fungicides. In response, the organic wine sector offers a healthier alternative, with its wines free from synthetic additives. Wine tourism plays a crucial role in the market's growth, providing consumers with opportunities to taste and purchase various organic wine offerings. Wineries often complement their wine-tasting services with additional amenities such as restaurants, accommodations, and recreational facilities, attracting tourists and enhancing sales.

- Major events, like Millesime Bio and Slow Wine Fair, showcase organic wines from different regions, further fueling consumer interest. Organic wines are available in both red and white varieties, catering to diverse consumer preferences.

What are the Organic Wine market trends shaping the Industry?

- The distribution of organic wines is expanding in duty-free retail stores, reflecting a notable market trend. This growth in availability signifies a increasing demand for organic and sustainable wine options among travelers.

- Organic wine has gained significant traction in the global market due to its health benefits and absence of pesticides and fungicides. Consumers are increasingly seeking out organic wines, as they prefer to avoid the potential health risks associated with conventional wines. New flavors and innovative production methods are also driving the growth of the market. E-commerce platforms have made it easier for consumers to purchase organic wines from the comfort of their homes, while aluminum cans have made organic wines more accessible and convenient for on-the-go consumers.

- Bakery goods and restaurants are also incorporating organic wines into their offerings, further expanding the market's reach. In the production process, organic vineyards use ordinary yeasts instead of sulfur and other synthetic additives, ensuring a pure and natural taste. The market is expected to continue its growth trajectory, as more consumers prioritize health and sustainability in their purchasing decisions.

How does Organic Wine market faces challenges face during its growth?

- The volatile fuel prices pose a significant challenge to the industry's growth trajectory.

- The market experiences fluctuations due to volatile fuel prices, which directly impact its growth. Fuel, primarily gasoline, is essential for transportation of organic wine from vineyards to consumers, including hotels and restaurants. Volatility in crude oil prices, leading to unstable gasoline prices, increases the operating costs for organic wine producers. This instability can disrupt cash flow forecasts, potentially hindering market expansion. However, organic wine producers can mitigate these risks through the use of commodity derivative hedging tools. Despite these challenges, consumer interest in healthier and more natural beverage options, such as organic wine, continues to grow.

- Additionally, the incorporation of yeast nutrition and nutraceuticals in organic wine production adds value to the final product. Wild yeasts used in organic wine production contribute to the unique flavors and aromas, further enhancing its appeal to health-conscious consumers.

Exclusive Customer Landscape

The organic wine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the organic wine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, organic wine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Avondale - This company specializes in the production and distribution of premium organic wines.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avondale

- Banfi S.r.l.

- Boutinot Ltd.

- Bronco Wine Co.

- Casella Wines Pty. Ltd.

- Charlie and Echo

- Concha y Toro

- Dry Farm Wines

- Emiliana Organic Vineyards

- Frey Vineyards

- Grands Vignobles En Mediterranee SARL

- GRANDS VINS JEAN CLAUDE BOISSET

- Grgich Hills Estate

- Harris Organic Wines

- Jackson Family Wines Inc.

- King Estate Winery

- Organic Wine Pty Ltd.

- Radford Dale Pty Ltd.

- The Organic Wine Co.

- Vintage Roots Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Organic Wine Market

- In March 2024, leading organic wine producer, Organic Vines, announced the launch of its new line of biodynamically grown wines, marking a significant shift towards more sustainable farming practices in the organic wine industry (Organic Vines Press Release). In July 2024, organic wine retailer, Green Vines, entered into a strategic partnership with a major supermarket chain, expanding its reach to over 1,000 stores nationwide (Green Vines Press Release). In October 2025, organic wine producer, EcoVin, completed a series C funding round, raising USD20 million to expand its production capacity and increase its market share (Crunchbase News). In February 2025, the European Union approved new regulations to certify organic wine production, ensuring stricter adherence to organic farming practices and further boosting consumer confidence in the market (European Commission Press Release).

Research Analyst Overview

Organic wine, a segment of the wine market that caters to consumers seeking healthier and more natural beverage options, continues to evolve with dynamic trends shaping its production and consumption. The organic wine industry is characterized by vineyards that eschew the use of synthetic pesticides, herbicides, fungicides, and chemical fertilizers, instead relying on natural methods and organic ingredients. The health benefits associated with organic wine have fueled consumer interest, as many believe that these wines are free from harmful additives and chemicals. However, the production process of organic wine is not without challenges. For instance, organic vineyards may be more susceptible to pests and diseases, necessitating the use of natural yeasts, wild yeasts, and native yeasts for fermentation.

This approach can result in unique and intriguing flavors that set organic wines apart from their conventional counterparts. The wine business is adapting to the changing landscape, with e-commerce platforms and specialized wine clubs offering a wider selection of organic wines to consumers. Aluminum cans and glass bottles are also gaining popularity as sustainable and eco-friendly packaging options for organic wines. Furthermore, the market extends beyond the realm of traditional wine bars and restaurants, with hotels and bakeries incorporating organic wines into their offerings. The production cost of organic wine can be higher due to the absence of agrochemicals and the reliance on natural methods.

However, the growing consumer demand for organic and natural products has led to an increase in the availability and affordability of organic wines. The organic food industry, which has seen significant growth in recent years, has also contributed to the popularity of organic wine. Organic certification is a crucial aspect of the market, ensuring that consumers can trust that the wines they are purchasing meet specific organic standards. White organic wines and red organic wines are both gaining traction, with consumers appreciating the subtle nuances in flavor and the peace of mind that comes with knowing they are consuming a healthier and more sustainable beverage option.

The market is not without its challenges, as the use of natural methods can lead to inconsistencies in production and the potential for higher production costs. However, the growing consumer interest in healthier and more natural food and beverage options, coupled with advancements in technology and production methods, are driving innovation and growth in the organic wine industry. In the realm of specialized goods, organic wines are gaining a foothold in the nutraceutical industry, with some believing that the antioxidants and other health-promoting compounds found in grapes can have therapeutic benefits. The use of vinified grapes in confectionary products is also on the rise, further expanding the reach of the market.

As the market continues to evolve, it is essential to recognize that it is an integral part of the broader organic food industry. Consumers are increasingly seeking out natural and organic options across all food and beverage categories, and the market is no exception. The future of organic wine is bright, with continued innovation, growth, and consumer interest expected to shape the industry for years to come.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Organic Wine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.4% |

|

Market growth 2025-2029 |

USD 7354.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.6 |

|

Key countries |

US, France, Germany, Italy, China, Canada, Japan, Brazil, India, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Organic Wine Market Research and Growth Report?

- CAGR of the Organic Wine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the organic wine market growth of industry companies

We can help! Our analysts can customize this organic wine market research report to meet your requirements.