Online Smartphone And Tablet Games Market Size 2024-2028

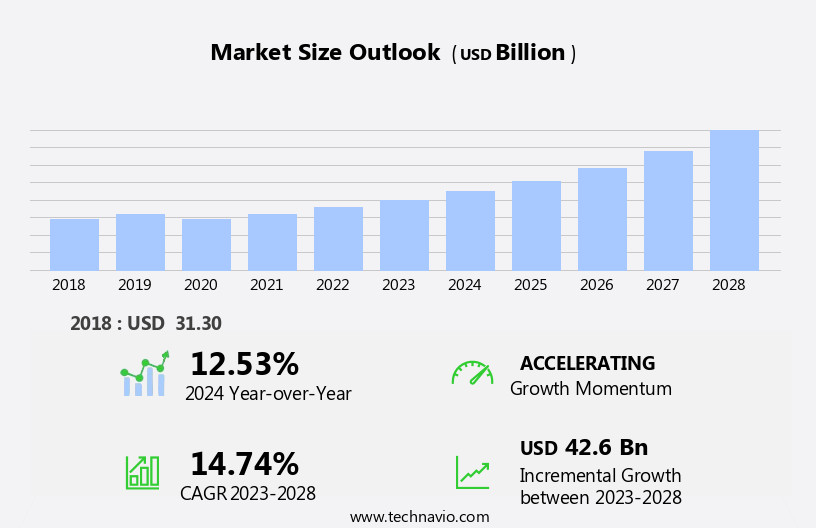

The online smartphone and tablet games market size is forecast to increase by USD 42.6 billion at a CAGR of 14.74% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. The increasing adoption of mobile gaming among the youth demographic is driving market growth. Moreover, the surge in popularity of cloud-based gaming applications allows users to access high-quality games without the need for expensive computer hardware. However, concerns around data security remain a challenge for the market. The implementation of blockchain technology and artificial intelligence can help mitigate these concerns.

- Additionally, the integration of augmented reality and virtual reality in games is expected to further boost market growth. As machine learning algorithms improve, games are becoming more immersive and interactive, providing a more engaging experience for users.

- Despite these growth factors, the lack of social interaction in online games is a potential challenge that needs to be addressed to retain user engagement. Overall, the market is poised for continued growth, with innovative technologies and consumer demand driving the industry forward.

What will be the Size of the Online Smartphone And Tablet Games Market During the Forecast Period?

- The market represents a significant segment of the global interactive entertainment systems industry. With the proliferation of mobile devices such as smartphones and tablets, the market has experienced exponential growth in recent years. Smartphone game providers continue to innovate, offering user-friendly interfaces and advanced mobile development platforms that cater to diverse gaming genres, including augmented reality, multiplayer games, location-based games, simulation games, action, and virtual reality. These digital games are accessible via app stores and online platforms, enabling seamless integration with console-based gaming experiences.

- Encryption-based security measures ensure the protection of user data and financial transactions. The market's size and direction reflect the increasing popularity of mobile gaming, which is poised to surpass traditional console gaming in terms of user engagement and revenue generation.

How is this Online Smartphone And Tablet Games Industry segmented and which is the largest segment?

The online smartphone and tablet games industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Device

- Smartphone

- Tablet

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Device Insights

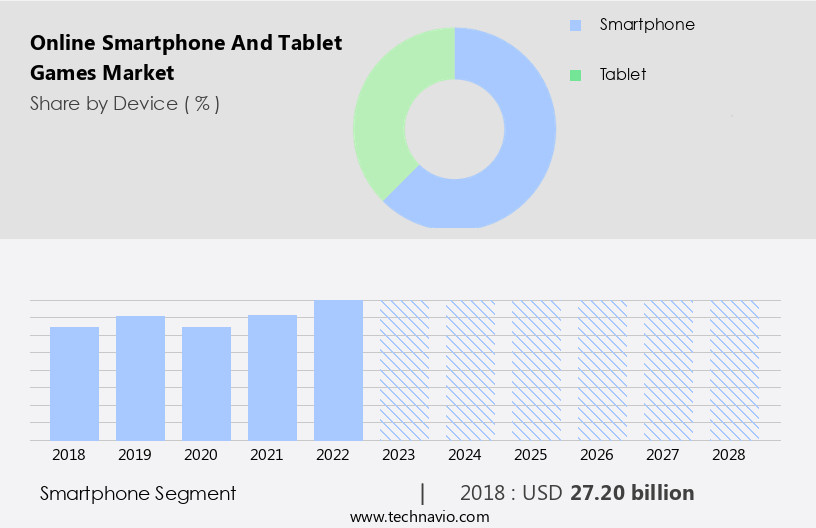

- The smartphone segment is estimated to witness significant growth during the forecast period.

The global market for online smartphone and tablet games is experiencing significant growth, driven by the increasing prevalence of mobile devices as primary Internet access points. With each new smartphone release, devices become more advanced and powerful, enabling users to easily access and play a wide range of interactive entertainment systems, including casual, social, first-person shooter, role-playing, and multiplayer games. Cloud gaming and 5G networks enable seamless gameplay, while encryption-based security and user-friendly interfaces prioritize data privacy and security concerns. Mobile development platforms, such as Android, support the creation and distribution of games through app stores and online platforms. The iGaming industry, including mobile slots and in-app purchases, is a major contributor to market revenue.

As data privacy and storage become increasingly important, machine learning and artificial intelligence technologies are being integrated into gaming apps to enhance user experiences. However, concerns around crypto crime and digital games' impact on youth remain areas of focus for regulators and industry experts.

Get a glance at the Online Smartphone And Tablet Games Industry report of share of various segments Request Free Sample

The Smartphone segment was valued at USD 27.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

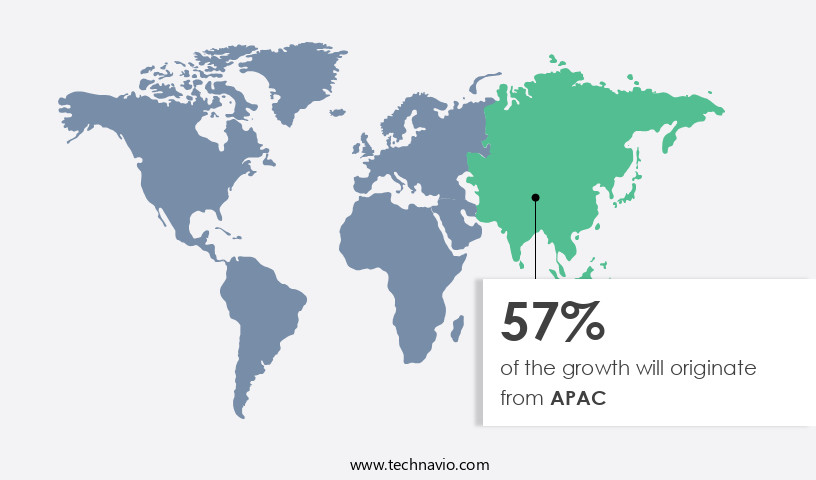

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is projected to experience significant growth in 2023, driven by the expansion of 5G networks and increasing penetration of key companies. China, South Korea, and Japan are the major revenue contributors to the market in this region. For instance, major network operators in China, such as China Mobile, China Unicorn, and China Telecom, activated their 5G networks in October 2019. Similarly, Japanese telecommunications carrier SoftBank Group Corp. Completed the initial phase of its 5G network in 2023. This technological advancement is expected to boost the growth of the market, enabling faster download and upload speeds, reduced latency, and enhanced user experience.

Furthermore, the increasing popularity of interactive entertainment systems, such as smartphone game providers, is fueling the demand for user-friendly interface games, including casual, social, cloud gaming, first-person shooter, role-playing, and simulation games. The market is also witnessing the integration of encryption-based security, machine learning, and artificial intelligence to enhance the gaming experience and ensure data privacy. In-app purchases, blockchain, and virtual reality are other emerging trends In the market. Despite these advancements, data privacy concerns and crypto crime remain challenges for market growth. Mobile development platforms, app stores, and online platforms are key areas of focus for market players to expand their offerings and cater to the diverse needs of consumers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Online Smartphone And Tablet Games Industry?

Rise in adoption of games among youth is the key driver of the market.

- The interactive entertainment landscape has been transformed by the emergence of advanced technology, with young people leading the charge. Smartphone game providers have capitalized on this trend, delivering a diverse range of digital games for mobile devices. Encryption-based security ensures user data privacy, while user-friendly interfaces facilitate seamless gameplay. The mobile development platform has given rise to various genres, such as casual, social, and first-person shooter games. Cloud gaming and 5G networks have further enhanced the user experience, enabling real-time multiplayer gameplay and location-based games. In-app purchases and blockchain technology have emerged as significant monetization strategies. As the iGaming industry evolves, so too do the challenges.

- Data privacy concerns and data storage requirements necessitate innovative solutions, such as machine learning and artificial intelligence. Crypto crime and digital games' impact on education are also subjects of ongoing debate. Multiplayer games, including role-playing, simulation, action-adventure, strategy, sports, and educational games, continue to dominate the digital gaming landscape. Virtual reality and massively multiplayer online games offer immersive experiences, while esports tournaments attract millions of viewers. Service providers cater to diverse gaming preferences, with offerings ranging from mobile slots to console and PC games. In-app spending remains a significant revenue stream, with app stores and online platforms driving growth.

- The future of gaming lies In the intersection of technology, entertainment, and social connection.

What are the market trends shaping the Online Smartphone And Tablet Games Industry?

Surge in adoption of cloud-based gaming applications is the upcoming market trend.

- The market is experiencing significant growth as consumers, particularly those In the youth demographic, increasingly turn to cloud-based interactive entertainment systems. With the widespread availability of strong 4G networks and the impending rollout of 5G, cloud gaming is becoming an attractive alternative to traditional on-premise gaming. In this model, gamers can access a vast library of games online without the need to purchase physical or digital copies. Key market drivers include the convenience and accessibility of cloud gaming, as well as the ongoing research and development in this area. Consumers can look forward to a user-friendly interface, advanced security features such as encryption, and the integration of technologies like machine learning and artificial intelligence.

- Additionally, in-app purchases, blockchain, and multiplayer games are gaining popularity, as is the integration of augmented and virtual reality. The market for digital games, including casual, social, first-person shooter, role-playing, simulation, action, adventure, strategy, sports, educational, esports, and more, is expected to continue growing on both mobile devices and online platforms. However, concerns around data privacy and security, as well as the potential for crypto crime, remain challenges for service providers in this industry.

What challenges does the Online Smartphone And Tablet Games Industry face during its growth?

Lack of social interaction is a key challenge affecting the industry growth.

- The interactive entertainment systems market, driven by smartphone game providers, has witnessed substantial growth among the youth. Encryption based security ensures safe gaming experiences, while user-friendly interfaces enhance user engagement. Mobile development platforms, such as Android, cater to both casual and social games, including first-person shooter, role-playing, and multiplayer games. Cloud gaming, 5G networks, and in-app purchases are transforming the digital games industry. Blockchain technology adds a layer of security and enables in-app spending. Data privacy concerns are addressed through advanced data storage solutions, machine learning, and artificial intelligence. The market encompasses various genres, including simulation games, action, adventure, strategy games, sports games, role-playing, educational games, esports, and more.

- Virtual and augmented reality games further elevate the user experience. Service providers offer games on mobile devices, online platforms, and even on consoles and personal computers. In-app purchases and mobile slots are popular revenue streams. Despite data storage and privacy concerns, the iGaming industry continues to grow, offering a wide array of gaming apps for users to enjoy.

Exclusive Customer Landscape

The online smartphone and tablet games market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online smartphone and tablet games market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online smartphone and tablet games market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Com2uS Holdings Corp.

- CyberAgent Inc.

- Electronic Arts Inc.

- King.com Ltd.

- Machine Zone Inc.

- Melior Games Ukraine

- NCSoft Corp.

- Netmarble Corp.

- NEXON Co. Ltd.

- Nintendo Co. Ltd.

- PLR Worldwide Sales Ltd.

- Rovio Entertainment Corp.

- Sony Group Corp.

- Square Enix Holdings Co. Ltd.

- Supercell Oy

- Take Two Interactive Software Inc.

- Tencent Holdings Ltd.

- The Walt Disney Co.

- Vivendi SE

- Warner Bros Discovery Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The interactive entertainment industry has witnessed a significant shift towards smartphone and tablet games in recent years. This trend is driven by several factors, including the widespread adoption of user-friendly interface mobile development platforms and the increasing availability of encryption-based security measures. These advancements have made mobile gaming more accessible and secure for consumers. The smartphone game market is segmented into various categories, with casual games and social games leading the charge. The popularity of these types of games can be attributed to their ease of use and ability to be played in short bursts. Another emerging trend in mobile gaming is cloud gaming, which allows users to access high-performance games over a 5G network without the need for extensive hardware.

In-app purchases and in-app spending have become a significant revenue stream for smartphone game providers. The integration of blockchain technology into mobile gaming has also gained traction, offering players the ability to buy, sell, and trade virtual assets. However, the use of blockchain technology also raises concerns around data privacy and security. First-person shooter and role-playing games are popular genres In the digital games market. These types of games offer immersive experiences, with some featuring multiplayer gameplay and augmented reality elements. Location-based games have also gained popularity, utilizing the mobile device's GPS to create interactive experiences. The mobile development platform landscape is competitive, with various service providers vying for market share.

Console and PC gaming industries have also started to explore mobile gaming opportunities, further expanding the market. In-app purchases and spending remain a significant contributor to revenue, with data storage and machine learning technologies enabling personalized gaming experiences. Data privacy concerns have emerged as a major issue In the mobile gaming industry. Companies must ensure they comply with data protection regulations and implement robust data storage solutions to protect user information. Artificial intelligence and machine learning are being used to enhance gaming experiences, but there are also concerns around their potential use in crypto crime. The igaming industry, which includes mobile slots and other digital games, has seen significant growth.

Virtual reality and massively multiplayer online games are also gaining popularity, offering players immersive experiences. Simulation games, action, adventure, strategy games, sports games, role-playing games, educational games, esports, and video game consoles and personal computers all contribute to the diverse landscape of digital gaming. In conclusion, the smartphone and tablet games market is a dynamic and evolving industry, driven by advancements in mobile development platforms, encryption-based security, and emerging technologies such as cloud gaming and blockchain. The market is segmented into various genres, with casual and social games leading the charge. Data privacy concerns and the potential use of artificial intelligence and machine learning in crypto crime are emerging issues that must be addressed. The industry continues to expand, with console and PC gaming industries exploring mobile opportunities and revenue streams such as in-app purchases and in-app spending remaining significant contributors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.74% |

|

Market growth 2024-2028 |

USD 42.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.53 |

|

Key countries |

China, US, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Smartphone And Tablet Games Market Research and Growth Report?

- CAGR of the Online Smartphone And Tablet Games industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online smartphone and tablet games market growth of industry companies

We can help! Our analysts can customize this online smartphone and tablet games market research report to meet your requirements.