Online Grocery Market Size 2025-2029

The online grocery market size is valued to increase by USD 1535.6 billion, at a CAGR of 18.5% from 2024 to 2029. Increased popularity and adoption of e-commerce platform will drive the online grocery market.

Major Market Trends & Insights

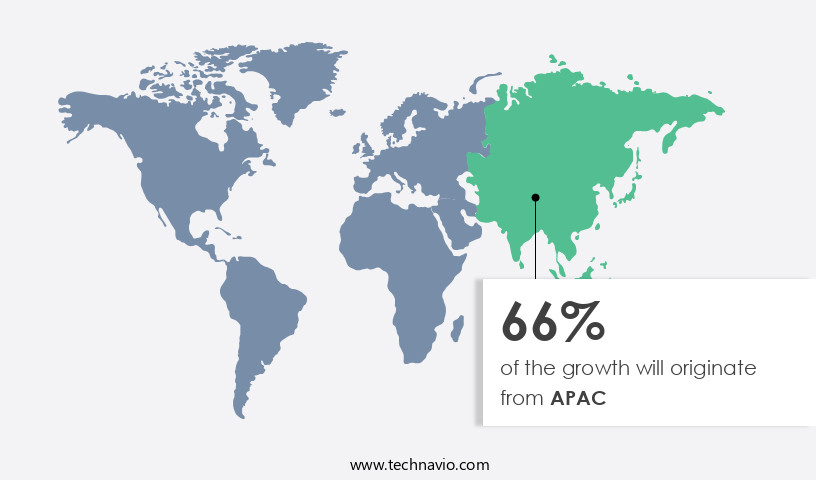

- APAC dominated the market and accounted for a 66% growth during the forecast period.

- By Product - Food products segment was valued at USD 309.70 billion in 2023

- By Type - One time customers segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 503.29 billion

- Market Future Opportunities: USD 1535.60 billion

- CAGR from 2024 to 2029 : 18.5%

Market Summary

- The market has witnessed significant expansion in recent years, fueled by the increasing convenience and accessibility it offers consumers. Global online grocery sales are projected to reach USD 250 billion by 2025, underscoring the market's immense potential. Functional food and beverages, a segment experiencing notable growth in the broader FMCG industry, have found a strong presence in the online grocery space. Consumers' evolving preferences and the convenience of having groceries delivered to their doorsteps have led to a shift in shopping behavior. End-users now demand seamless online experiences, with features such as personalized recommendations, real-time inventory tracking, and contactless delivery gaining popularity.

- However, challenges persist, including ensuring product freshness and maintaining the cold chain during transportation. The market's future direction lies in continuous innovation and the integration of advanced technologies like AI, machine learning, and IoT. These technologies can enhance the shopping experience, improve supply chain efficiency, and address concerns around product quality and delivery. As the market matures, it will be essential for players to differentiate themselves through unique offerings and exceptional customer service.

What will be the Size of the Online Grocery Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Online Grocery Market Segmented ?

The online grocery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Food products

- Non-food products

- Type

- One time customers

- Subscribers

- Delivery Mode

- Home delivery

- Click and collect

- Product Type

- Fresh produce

- Breakfast and dairy

- Snacks and beverages

- Staples and cooking essentials

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Russia

- UK

- APAC

- China

- India

- Indonesia

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The food products segment is estimated to witness significant growth during the forecast period.

In the ever-evolving retail landscape, the market continues to gain momentum, with food products accounting for a significant portion of revenue. Consumers increasingly prefer this channel for its convenience, ease of access, and personalized offerings. Key factors driving this trend include customizable options, swift delivery, integrated return policies, and a wide range of products and brands. Major players like Nestle, Danone, PepsiCo, Mars, Coca-Cola, Kraft-Heinz, Abbott, and Mondelez have capitalized on this trend, offering their products directly through their websites and third-party retailers. Advanced technologies such as pricing optimization algorithms, loyalty program integration, and user interface design enhance the shopping experience.

The Food products segment was valued at USD 309.70 billion in 2019 and showed a gradual increase during the forecast period.

Cold chain logistics ensure the safe handling of perishable goods, while sales conversion optimization and product assortment planning cater to consumer behavior. Mobile app development, last-mile delivery, and customer relationship management tools further streamline the process. Data analytics dashboards, automated order fulfillment, and real-time tracking systems facilitate efficient operations, while fraud detection systems and inventory management software maintain security and accuracy. The market's continued growth is further evidenced by the increasing popularity of personalized recommendations, customer retention strategies, and e-commerce platforms. With the integration of marketing automation tools, customer service chatbots, and online payment gateways, the future of grocery shopping promises a seamless, convenient, and personalized experience.

Online grocery sales in the US are projected to reach USD 102.1 billion by 2025, underscoring the market's potential.

Regional Analysis

APAC is estimated to contribute 66% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Online Grocery Market Demand is Rising in APAC Request Free Sample

The market in Asia-Pacific (APAC) is experiencing significant growth, driven by rising income levels, Westernization of buying habits, and increasing awareness about the convenience of online shopping. According to recent reports, the market is expected to expand at a substantial rate during the forecast period. In APAC, the demand for both food and non-food products is on the rise, particularly among young consumers, especially Millennials. This demographic prefers the convenience and wide range of products offered by online grocery platforms.

Additionally, several consumer packaged goods (CPG) manufacturers have introduced affordable product lines to cater to price-conscious consumers in the region, further fueling demand for online grocery shopping. The trend is expected to continue as more consumers embrace the convenience and time-saving benefits of shopping online for groceries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing rapid growth as consumers increasingly prefer the convenience and time-saving benefits of shopping for groceries online. To stay competitive in this dynamic market, retailers are leveraging advanced technologies to optimize their operations and enhance the customer experience. One such innovation is the use of AI to optimize grocery delivery routes, reducing fuel consumption and delivery times while improving customer satisfaction. Another trend is the integration of loyalty programs with e-commerce platforms, enabling personalized offers and rewards based on shopping history. To attract and retain customers, online grocery retailers are designing user-friendly mobile apps that offer seamless shopping experiences, allowing customers to easily manage their orders and track their delivery status. Managing perishable goods in online grocery operations is a critical challenge, and retailers are implementing real-time inventory tracking systems to ensure freshness and minimize waste. Predictive modeling is also being used for online grocery demand forecasting, enabling retailers to optimize their inventory levels and reduce out-of-stock situations. Improving customer retention strategies is essential in the market, and retailers are analyzing sales data to personalize pricing strategies and offer targeted promotions. Website usability is another key factor in the online grocery shopping experience, and retailers are investing in enhancing their websites to make them more intuitive and visually appealing. Automating order fulfillment processes in online grocery warehouses is also crucial to ensure efficient and accurate order processing and delivery. Overall, these technological innovations are transforming the market, enabling retailers to better meet the evolving needs and preferences of consumers.

What are the key market drivers leading to the rise in the adoption of Online Grocery Industry?

- The e-commerce market's growth is primarily attributed to the rising popularity and adoption of e-commerce platforms.

- The market has undergone significant evolution in the last decade, becoming a major player in the retail sector. In 2024, the U.S. Online retail market reached approximately USD 1.374 trillion, fueled by over 250 million internet users and around 200 million digital buyers. A key driver of this growth is the increasing global internet penetration, enabling millions of consumers to access online retail platforms and fostering the omnichannel shopping model.

- Emerging markets, such as China and India, present substantial opportunities due to their vast populations and rising per capita income.

What are the market trends shaping the Online Grocery Industry?

- Functional food and beverages are experiencing increasing demand, representing an emerging market trend.

- The global demand for functional food and beverages is experiencing a significant surge due to their numerous health benefits, including enhanced immunity, improved mental strength, heart rate regulation, digestive health support, hydration, and electrolyte replenishment. Consumers are increasingly prioritizing their well-being and engaging in non-traditional fitness activities, leading to a preference for functional food and beverages as a healthy source of nutrition. Given the unavailability of these products at traditional retail stores, the markets have emerged as a popular avenue for consumers to access a wide range of functional food and beverage options. This trend is further fueled by the convenience and accessibility that online shopping provides, making it an essential application sector for the functional food and beverage industry.

What challenges does the Online Grocery Industry face during its growth?

- The growth of the online grocery industry is significantly influenced by end-users' perceptions and experiences. Specifically, addressing the challenges associated with end-users' perception is crucial for industry expansion.

- The market is undergoing significant evolution, expanding at a remarkable pace. However, it faces challenges in altering the mindset of a substantial consumer base, as the market is still in its infancy. End-users, particularly those purchasing perishable goods, prioritize product quality and the tangible experience of touch and feel. A survey revealed that 70% of consumers still prefer traditional grocery shopping over online channels.

- This preference stems from concerns about product freshness and the desire for a personalized shopping experience. The online grocery sector, however, offers numerous advantages, including convenience and time savings. It's crucial for companies to address consumer concerns and innovate to create a compelling online shopping experience.

Exclusive Technavio Analysis on Customer Landscape

The online grocery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online grocery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Online Grocery Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, online grocery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albertsons Companies Inc. - This company specializes in e-commerce for household essentials, including dairy, beverages, and canned goods, providing convenience for consumers through online purchasing and delivery.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albertsons Companies Inc.

- Amazon.com Inc.

- Blink Commerce Pvt. Ltd.

- Bundl Technologies Pvt. Ltd.

- Coles Group Ltd.

- Costco Wholesale Corp.

- Flipkart Internet Pvt. Ltd.

- HOFER KG

- Innovative Retail Concepts Pvt. Ltd.

- Koninklijke Ahold Delhaize NV

- Ocado Group Plc

- Rakuten Group Inc.

- Reliance Industries Ltd.

- Seven and i Holdings Co. Ltd.

- SPAR International

- Target Corp.

- Tesco Plc

- Transform Holdco LLC

- Walmart Inc.

- Woolworths Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Grocery Market

- In January 2024, Amazon Fresh, a leading player in the market, announced the expansion of its delivery coverage area in over 100 cities across the United States (Amazon press release). This strategic move aimed to cater to a larger customer base and intensify competition with major players like Walmart and Kroger.

- In March 2024, Instacart, a prominent grocery delivery service, formed a partnership with Albertsons Companies, a large supermarket chain in the US, to expand its reach and offerings (Instacart press release). This collaboration enabled Instacart to access Albertsons' extensive inventory, enhancing its product variety and customer convenience.

- In May 2024, Ocado, a UK-based online grocery retailer, secured a USD 1.1 billion investment from Microsoft to expand its global footprint and develop new technologies (Ocado press release). This significant funding round strengthened Ocado's position in the market and provided resources for further innovation in automation and AI-driven solutions.

- In April 2025, Walmart, the world's largest company by revenue, obtained regulatory approval to acquire a 40% stake in India's leading online grocery platform, Flipkart's BigBasket (Reuters). This strategic move allowed Walmart to enter the Indian market and compete with Amazon and Reliance Retail.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Grocery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

239 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.5% |

|

Market growth 2025-2029 |

USD 1535.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.2 |

|

Key countries |

China, US, UK, India, Japan, France, Indonesia, Russia, Canada, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with innovation driving growth and shaping consumer behavior. Grocery delivery scheduling and last-mile delivery solutions streamline the shopping experience, enabling seamless integration with consumers' busy lives. Pricing optimization algorithms and dynamic pricing strategies ensure competitive offerings, while loyalty program integration fosters customer retention. Cold chain logistics and perishable goods handling are crucial for maintaining product quality and food safety regulations. User interface design and mobile app development enhance the shopping experience, with sales conversion optimization and personalized recommendations driving increased sales. Industry growth is expected to reach double-digit percentages, fueled by the integration of customer relationship management tools, marketing automation, and customer service chatbots.

- Order management systems and demand forecasting models optimize inventory management and stock replenishment strategies. A prominent online grocery retailer experienced a 30% increase in sales due to the implementation of an automated order fulfillment system and real-time tracking system. These advancements improved efficiency and customer satisfaction, ultimately contributing to the market's continuous dynamism. Supply chain logistics and warehouse automation ensure efficient operations, while data analytics dashboards and fraud detection systems provide valuable insights and safeguard against potential threats. Search engine optimization and e-commerce platform development expand reach and accessibility, further propelling the market forward.

What are the Key Data Covered in this Online Grocery Market Research and Growth Report?

-

What is the expected growth of the Online Grocery Market between 2025 and 2029?

-

USD 1535.6 billion, at a CAGR of 18.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Food products and Non-food products), Type (One time customers and Subscribers), Delivery Mode (Home delivery and Click and collect), Product Type (Fresh produce, Breakfast and dairy, Snacks and beverages, Staples and cooking essentials, and Others), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increased popularity and adoption of e-commerce platform, End-user perception of online grocery shopping

-

-

Who are the major players in the Online Grocery Market?

-

Albertsons Companies Inc., Amazon.com Inc., Blink Commerce Pvt. Ltd., Bundl Technologies Pvt. Ltd., Coles Group Ltd., Costco Wholesale Corp., Flipkart Internet Pvt. Ltd., HOFER KG, Innovative Retail Concepts Pvt. Ltd., Koninklijke Ahold Delhaize NV, Ocado Group Plc, Rakuten Group Inc., Reliance Industries Ltd., Seven and i Holdings Co. Ltd., SPAR International, Target Corp., Tesco Plc, Transform Holdco LLC, Walmart Inc., and Woolworths Group Ltd.

-

Market Research Insights

- The market is a continually evolving sector, characterized by the integration of various technologies and strategies to enhance the shopping experience for consumers. Two notable developments include the increasing popularity of scheduled delivery options and the implementation of website analytics tracking. According to recent industry reports, over 60% of online grocery sales are now made through delivery apps, representing a significant shift from traditional e-commerce platforms.

- Furthermore, the industry is projected to grow by approximately 20% annually in the coming years, reflecting the increasing demand for convenience and the expanding reach of digital marketing efforts. For instance, a major grocery retailer reported a sales increase of 35% following the implementation of a targeted email marketing campaign.

We can help! Our analysts can customize this online grocery market research report to meet your requirements.