Oil And Gas Upstream Equipment Market Size 2025-2029

The oil and gas upstream equipment market size is forecast to increase by USD 11.81 billion, at a CAGR of 3.3% between 2024 and 2029.

- The market is driven by the increasing preference for pipeline transportation and the rising adoption of digitalization and automation in upstream operations. Pipeline transportation is favored due to its cost-effectiveness and environmental sustainability, making it an attractive alternative to traditional methods of transporting oil and gas. Furthermore, the integration of digital technologies and automation in upstream processes enhances operational efficiency, reduces costs, and improves safety. However, the market faces challenges from the uncertainties associated with low crude oil prices. The volatility in oil prices can significantly impact the profitability of upstream projects, making it essential for companies to adopt risk management strategies and explore alternative revenue streams.

- Additionally, the implementation of digitalization and automation requires substantial investment, which may be a barrier for smaller players in the market. Companies seeking to capitalize on opportunities in the market must focus on optimizing their pipeline networks and investing in digital technologies to enhance operational efficiency while managing risks associated with price volatility.

What will be the Size of the Oil And Gas Upstream Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, driven by the ever-changing requirements of various sectors. Entities such as flow assurance, reservoir stimulation, downstream operations, market volatility, drilling services, renewable energy, sustainable energy, hydrocarbon recovery, drilling efficiency, safety equipment, upstream operations, well logging, remote operations, enhanced oil recovery, reservoir characterization, workforce development, energy security, resource estimation, training and certification, seismic surveys, environmental regulations, geopolitical risks, and more, play integral roles in this complex ecosystem. Flow assurance solutions ensure uninterrupted production by addressing challenges related to solid and liquid formation in pipelines, while reservoir stimulation techniques enhance hydrocarbon recovery through the injection of chemicals or gases.

Downstream operations encompass the processing and refining of crude oil into marketable products, while renewable energy and sustainable energy solutions are increasingly being integrated into the industry to reduce emissions and promote sustainability. Market volatility, driven by factors such as supply chain disruptions, geopolitical risks, and ESG factors, necessitates the adoption of flexible and efficient drilling services. Drilling efficiency is a critical focus area, with horizontal drilling, directional drilling, and pressure testing playing essential roles in optimizing drilling operations. Safety equipment and upstream operations are paramount to maintaining operational excellence and ensuring the wellbeing of personnel.

Well logging and remote operations enable real-time data analysis and intervention, enhancing production optimization and efficiency. Enhanced oil recovery techniques, such as hydraulic fracturing, are employed to extract residual hydrocarbons from mature reservoirs. Cloud computing and big data analytics facilitate the digital oilfield, enabling data-driven decision-making and improving overall industry performance. The ongoing energy transition and the integration of renewable energy and sustainable energy solutions into the oil and gas industry present new opportunities and challenges. Pipeline infrastructure and gas processing remain crucial components of the value chain, while industry standards continue to evolve to address emerging trends and technologies.

The market is a dynamic and intricate system, requiring a deep understanding of its various components and their interconnectedness to effectively navigate its complexities.

How is this Oil And Gas Upstream Equipment Industry segmented?

The oil and gas upstream equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Exploration and drilling

- Completion and procedure

- Others

- Deployment

- Onshore

- Offshore

- Type

- Drilling equipment

- Production equipment

- Well intervention equipment

- Pressure control equipment

- Others

- Component

- Surface Equipment

- Subsurface Equipment

- Drilling Tools

- Pumps and Valves

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

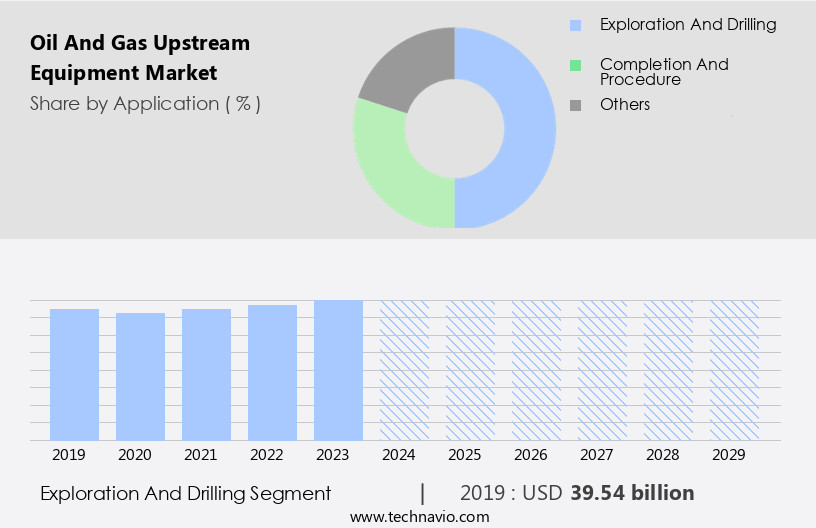

The exploration and drilling segment is estimated to witness significant growth during the forecast period.

In the upstream sector of the oil and gas industry, the exploration process begins with advanced geological mapping using seismic surveys. Technologically advanced methods, including reflective, passive, gravity, and magnetic surveys, are employed to identify potentially hydrocarbon-bearing rocks, or prospects. Subsequently, exploratory wells are drilled to recover crude oil or natural gas. Seismic surveys utilize sophisticated technologies such as streamers, vessels, hydrophones, geophones, and receivers to capture vast amounts of high-frequency data throughout the entire seismic survey value chain. Geologists analyze this data in real-time to pinpoint the optimal location for production. Drilling fluids play a crucial role in the drilling process, ensuring efficient and safe drilling operations.

Well performance analysis and well intervention are essential to optimize production and maintain well integrity. Horizontal drilling and directional drilling techniques enhance reservoir access and recovery. Reservoir engineering and characterization are integral to understanding the reservoir's properties and maximizing hydrocarbon recovery. Corrosion prevention and emissions reduction are essential aspects of upstream operations, ensuring safety, efficiency, and environmental compliance. Well completion and production platforms facilitate the production process, while petroleum geology and reservoir stimulation techniques, such as hydraulic fracturing, enhance oil and gas recovery. Cloud computing and big data analytics enable real-time data processing and analysis, optimizing production efficiency and flow assurance.

Industry standards and regulations govern safety, environmental, and operational aspects of upstream operations. The energy transition and the integration of renewable and sustainable energy sources impact the oil and gas industry, necessitating adaptations and innovations. Midstream operations, downstream operations, and the digital oilfield facilitate the integration of various aspects of the energy value chain. Market volatility, geopolitical risks, and supply chain disruptions pose challenges to the upstream sector. Safety equipment, remote operations, and enhanced oil recovery techniques mitigate these risks and improve production efficiency. Workforce development, training, and certification are essential for maintaining a skilled workforce and ensuring energy security.

Subsea equipment and offshore platforms expand the reach of upstream operations, enabling exploration and production in deeper waters and challenging environments. Data management and ESG factors are increasingly important considerations in upstream operations, ensuring transparency, sustainability, and social responsibility.

The Exploration and drilling segment was valued at USD 39.54 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American region dominates the market due to its high rig count and the resumption of deep and ultra-deep oil and gas projects in the Gulf of Mexico. Crude oil price stabilization has fueled this trend, increasing the potential for market growth. Unconventional energy sources, such as shale and oil sands, are also driving demand for upstream equipment as drilling and production continue in this sector. Advancements in technologies like artificial intelligence (AI), big data analytics, cloud computing, and digital oilfield are transforming upstream operations. These technologies enable real-time well performance analysis, production optimization, and remote operations, enhancing efficiency and safety.

Horizontal drilling and hydraulic fracturing have become essential techniques for accessing unconventional resources, leading to increased demand for drilling services, well completion equipment, and production services. Corrosion prevention and emissions reduction technologies are also gaining traction due to environmental regulations and the energy transition towards renewable and sustainable energy sources. Midstream operations, including pipeline infrastructure and gas processing, require upstream equipment for transportation and processing of raw hydrocarbons. Industry standards and regulations, such as those related to safety, flow assurance, and reservoir characterization, are crucial for ensuring the safe and efficient operation of upstream equipment. Directional drilling and reservoir engineering play a significant role in maximizing hydrocarbon recovery, while reservoir stimulation techniques like enhanced oil recovery are essential for extracting hard-to-reach reserves.

Upstream equipment is also critical for downstream operations, including refining and petrochemical processing. Market volatility, geopolitical risks, and supply chain disruptions are some challenges facing the market. However, opportunities exist for innovation and growth, particularly in the areas of ESG factors, subsea equipment, and offshore platforms. In conclusion, the market is dynamic and evolving, driven by factors such as technological advancements, market trends, and regulatory requirements. The market's future potential lies in its ability to adapt to these changes and meet the demands of the energy industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Oil And Gas Upstream Equipment Industry?

- The growing demand for pipeline transportation is the primary factor fueling market growth. (Maintaining a professional tone, ensuring grammatical correctness, and adhering to the 100-word limit.)

- The market encompasses the production phase of the energy value chain, focusing on wellhead equipment, hydraulic fracturing, directional drilling, and gas processing. This market is characterized by the adoption of advanced technologies such as cloud computing, big data analytics, and the digital oilfield to enhance production services and optimize production efficiency. Hydraulic fracturing, a critical process in extracting shale gas and oil, has significantly impacted global energy markets by increasing production volumes. The oil and gas industry is undergoing a transformation, with the energy transition towards renewable energy sources gaining momentum. However, the oil and gas sector continues to invest in technology to improve production and reduce operational costs.

- Production optimization and efficiency are key priorities, with industry standards and regulations driving the adoption of new technologies. Gas processing is another crucial aspect of the upstream equipment market, ensuring the purity and quality of natural gas before it is transported to end-users. The transportation of oil and gas is primarily through pipelines due to their energy efficiency and low carbon footprint, making them the preferred choice for long-distance transport. The market is a long-term investment, with projects having an average life cycle of 20-30 years.

What are the market trends shaping the Oil And Gas Upstream Equipment Industry?

- The increasing prevalence of digitalization and automation represents a significant market trend. This shift towards technology-driven solutions is mandatory for businesses seeking to remain competitive and efficient.

- In the market, digitalization plays a significant role in enhancing operations' efficiency and safety. The integration of sensors and IoT devices enables real-time data collection from equipment and assets, allowing operators to monitor performance and condition remotely. Advanced analytics and machine learning algorithms are employed to predict equipment failures, optimize production processes, and schedule maintenance proactively. Automation facilitates remote monitoring and control of drilling rigs, production facilities, and pipelines, reducing the need for on-site personnel and operational costs. Furthermore, digitalization supports enhanced oil recovery techniques such as flow assurance, reservoir stimulation, and well logging. Market volatility, driven by factors like crude oil prices, geopolitical risks, and regulatory changes, necessitates the adoption of digital solutions to improve hydrocarbon recovery and drilling efficiency.

- Safety equipment and remote operations are essential in upstream operations, especially in hazardous environments. The transition towards sustainable energy and renewable sources may impact the market's growth, but digitalization offers opportunities for cost savings and operational improvements.

What challenges does the Oil And Gas Upstream Equipment Industry face during its growth?

- The uncertainties surrounding the impact of low crude oil prices on industry growth represent a significant challenge for the sector.

- The market experiences significant influence from various factors. Commodity price fluctuations, a key market driver, can significantly impact the financial health of upstream sector companies. The recent trend of low crude oil prices has put immense pressure on these firms, compelling many to halt exploration and drilling projects. Pureplay upstream companies have been particularly affected, as they lack the diversification offered by integrated oil companies. However, the market dynamics are not entirely bleak. Workforce development and reservoir characterization remain crucial for enhancing resource estimation and improving operational efficiency. Training and certification programs, geopolitical risks, and environmental regulations are other critical factors shaping the market.

- Seismic surveys and data management are essential for effective reservoir characterization. Environmental regulations and ESG factors are becoming increasingly important, as companies strive to minimize their carbon footprint and adhere to sustainability standards. Moreover, supply chain disruptions and geopolitical risks pose significant challenges. The ongoing tensions in various regions can lead to uncertainties and potential disruptions in the supply of raw materials and equipment. Drilling rigs, subsea equipment, and offshore platforms are integral components of the upstream sector, requiring continuous innovation and technological advancements to maintain competitiveness. In conclusion, the market faces numerous challenges, including price volatility, regulatory pressures, and geopolitical risks.

- However, companies that invest in workforce development, technology, and operational efficiency are well-positioned to navigate these challenges and thrive in the evolving energy landscape.

Exclusive Customer Landscape

The oil and gas upstream equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oil and gas upstream equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oil and gas upstream equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aker Solutions ASA - The company specializes in supplying advanced Oil & Gas upstream solutions, encompassing equipment such as wellheads, subsea trees, and tie-in systems. These offerings optimize operational efficiency and enhance overall performance in the energy sector. Our expertise lies in delivering cutting-edge technology and exceptional engineering, ensuring clients' projects are executed with precision and reliability. Our commitment to innovation and quality sets us apart in the market, ultimately contributing to our clients' success.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aker Solutions ASA

- Archer Ltd.

- ATB Holding Spa

- Atlas Copco AB

- AXON Pressure Products Inc.

- Dril Quip Inc.

- Evolution Oil Tools Inc.

- Flowserve Corp.

- Forum Energy Technologies Inc.

- General Electric Co.

- Geometrics Inc.

- Halliburton Co.

- Helmerich and Payne Inc.

- NOV Inc.

- Schlumberger Ltd.

- Seadrill Ltd.

- Siemens AG

- SPX FLOW Inc.

- Sumitomo Corp.

- Weatherford International Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Oil And Gas Upstream Equipment Market

- In March 2023, Baker Hughes, a GE company, announced the launch of its new ShaleReef completions system, which utilizes advanced reservoir modeling and digital technologies to optimize oil and gas production in unconventional reservoirs (Baker Hughes press release, 2023). This innovation is expected to enhance efficiency and reduce costs for upstream oil and gas operators.

- In August 2024, Shell and TotalEnergies formed a strategic collaboration to develop and commercialize hydrogen and carbon capture technologies. The partnership aims to reduce carbon emissions in the oil and gas industry by focusing on the production, transport, and utilization of hydrogen (Shell press release, 2024). This collaboration signifies a significant shift towards sustainable energy solutions in the upstream sector.

- In January 2025, Equinor and ExxonMobil announced a merger of their upstream businesses in the US Gulf of Mexico. The combined entity, named Gulf of Mexico Upstream Partnership, will create the largest oil and gas producer in the region, with an estimated 1.6 million barrels of oil equivalent per day in production (ExxonMobil press release, 2025). This merger represents a major consolidation within the upstream market.

- In May 2025, Saudi Aramco and Siemens Energy signed a memorandum of understanding to collaborate on the development and deployment of carbon capture, utilization, and storage (CCUS) technologies. The agreement is part of Saudi Aramco's efforts to reduce its carbon footprint and align with global climate goals (Saudi Aramco press release, 2025). This strategic partnership highlights the growing importance of CCUS technologies in the oil and gas industry.

Research Analyst Overview

- The market encompasses a range of technologies and solutions essential to the exploration and production of oil and natural gas. Key components include fracking fluids for enhanced extraction, underwater robotics for subsea inspections, and gas compression systems for processing and transportation. Formation evaluation tools facilitate reservoir characterization, while energy efficiency and energy storage solutions reduce carbon footprint and enhance operational sustainability. Flow metering and pipeline design optimize production and transportation, with offshore installation expertise critical for accessing deepwater reserves. Offshore wind and renewable energy sources increasingly intersect with the market, necessitating collaboration between traditional and green technology sectors.

- Environmental impact assessments and completion fluids address regulatory requirements and operational challenges, while gas dehydration and wellbore stability technologies ensure efficient and safe production. Downhole tools and reservoir simulation software enable improved production forecasting, and hydrogen energy and battery technology offer promising alternatives for future energy needs. Solar energy and marine construction solutions contribute to the overall sustainability and expansion of the market. Production forecasting and subsea tree technologies facilitate optimized resource management and extended field life. The industry continues to evolve, with a focus on reducing environmental impact and enhancing energy efficiency.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Oil And Gas Upstream Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 11.81 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, Germany, Canada, China, UK, Brazil, Japan, France, UAE, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oil And Gas Upstream Equipment Market Research and Growth Report?

- CAGR of the Oil And Gas Upstream Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oil and gas upstream equipment market growth of industry companies

We can help! Our analysts can customize this oil and gas upstream equipment market research report to meet your requirements.