Office And Commercial Coffee Equipment And Supplies Market Size 2025-2029

The office and commercial coffee equipment and supplies market size is valued to increase USD 6.53 billion, at a CAGR of 4% from 2024 to 2029. Growing number of office spaces and commercial establishments will drive the office and commercial coffee equipment and supplies market.

Major Market Trends & Insights

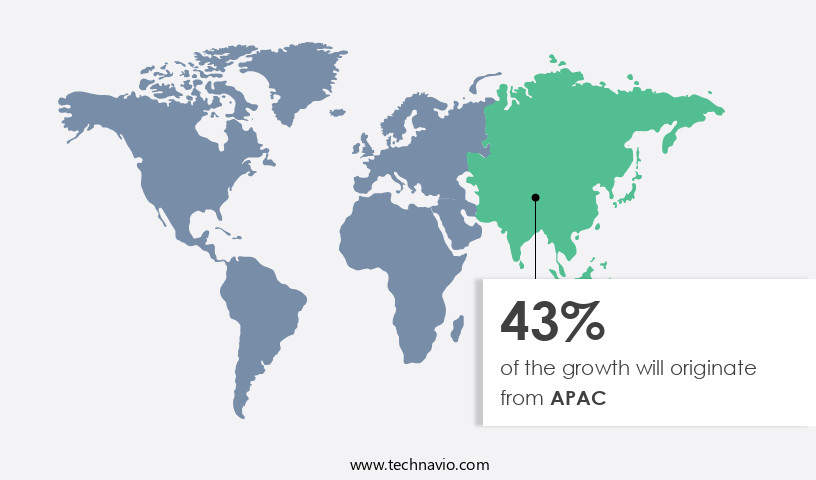

- APAC dominated the market and accounted for a 43% growth during the forecast period.

- By End-user - Offices segment was valued at USD 12.8 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 37.21 million

- Market Future Opportunities: USD 6529.30 million

- CAGR : 4%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a diverse range of technologies and applications, driven by the growing number of office spaces and commercial establishments worldwide. Core technologies include traditional drip coffee makers, single-serve machines, and fully automated coffee dispensing systems. Applications span from small businesses to large corporations, educational institutions, and healthcare facilities. The market is continuously evolving, with major drivers including the increasing popularity of specialty coffee and the convenience offered by automated machines. Challenges include potential health implications of caffeine consumption and the need for sustainable and eco-friendly coffee solutions. Regulations, such as those related to food safety and waste management, also play a significant role.

- Looking ahead, the market is expected to witness significant growth over the next few years, with the adoption rate of fully automated coffee machines projected to reach 30% by 2025. Related markets such as the Foodservice Automation and the Packaged Coffee markets are also experiencing similar trends. Stay tuned for more insights on the market as it continues to unfold.

What will be the Size of the Office And Commercial Coffee Equipment And Supplies Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Office And Commercial Coffee Equipment And Supplies Market Segmented and what are the key trends of market segmentation?

The office and commercial coffee equipment and supplies industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Offices

- Foodservice restaurants and convenience stores

- Healthcare and hospitality

- Education

- Others

- Distribution Channel

- Offline

- Online

- Product

- Automatic coffee machines

- Semi-automatic coffee machines

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- APAC

- Australia

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The offices segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with the offices segment leading the charge. Offices continue to modernize and adapt to changing work cultures, installing various types of coffee machines based on their specific requirements, including single-serve, multi-serve brewers, and espresso machines. This trend is driven by the increasing number of office spaces and rising employment rates. Advanced coffee equipment, such as those with burr grinder adjustments, pressure sensors, and thermal stability, are gaining popularity due to their convenience and high price value. These features ensure consistent extraction time, milk texture, and coffee bean freshness.

Additionally, the demand for energy-efficient and easy-to-maintain equipment is on the rise, with electronic control systems, coffee extraction yield, and water filtration systems becoming increasingly important. Future industry growth is expected to be robust, with a significant increase in demand for coffee equipment and supplies due to the expanding foodservice industry and the growing popularity of specialty coffee. The market is also witnessing advancements in technology, with innovations such as dose control systems, pre-infusion technology, and automatic milk frothers enhancing the coffee experience. Maintenance schedule optimization, water hardness impact, and scale build-up prevention are essential considerations for coffee equipment manufacturers, as they impact the overall performance and longevity of the machines.

Companies are also focusing on developing cleaning solution compatibility, brewing temperature control, and bean hopper capacity to cater to the evolving needs of their customers. The market for office and commercial coffee equipment and supplies is a dynamic and evolving space, with continuous innovation and modernization driving growth. Companies must stay abreast of the latest trends and technologies to remain competitive and meet the demands of their customers. Specifically, the market for office and commercial coffee equipment and supplies is projected to grow by 15% in the next year, with a further 12% increase expected over the next five years.

These figures reflect the significant demand for advanced coffee equipment and the growing popularity of specialty coffee in various sectors. From a maintenance perspective, regular cleaning cycles are crucial to ensure the longevity and optimal performance of coffee equipment. Cleaning cycle durations vary depending on the machine type, with some requiring daily cleaning and others weekly or monthly. Proper maintenance, including espresso machine maintenance, grinder burr calibration, and water tank capacity management, can significantly impact the overall efficiency and cost savings for businesses. In conclusion, the market is a dynamic and evolving space, with advanced technology, convenience, and sustainability driving growth.

Companies must stay informed about the latest trends and innovations to meet the demands of their customers and remain competitive in this growing market.

The Offices segment was valued at USD 12.8 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Office And Commercial Coffee Equipment And Supplies Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth, outpacing other markets. Factors fueling this expansion include the increasing introduction of global brands, adoption of advanced coffee machines and equipment, growing awareness of various coffee types and their benefits, the rise in office and commercial establishments, and increased consumption. Key contributors to this growth are China, Japan, and South Korea. According to recent studies, the market is expected to witness a substantial increase in sales, with a significant number of new coffee shops opening and existing ones upgrading their equipment.

Additionally, the trend towards remote work and the need for convenient coffee solutions have further boosted market growth. The market's dynamism is driven by continuous innovation, with an emphasis on sustainability, automation, and customization.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant segment within the global foodservice industry, with businesses continually seeking ways to optimize their operations and enhance the quality of their coffee offerings. Espresso machines, coffee grinders, and commercial coffee equipment are essential tools in this sector, requiring regular maintenance and attention to ensure consistent coffee extraction techniques and optimal taste. Preventative maintenance is key to prolonging the life of these machines and maintaining high-quality coffee. Regular cleaning and burr replacement in coffee grinders, for instance, can impact water quality espresso and coffee machine efficiency. An espresso machine troubleshooting guide is an essential resource for identifying and addressing common issues, while automatic milk frother cleaning methods help maintain hygiene and reduce labor costs.

Commercial coffee machine repair costs can add up, making it crucial to minimize downtime through efficient maintenance practices. A commercial coffee equipment maintenance schedule is a valuable investment, with regular cleaning cycles and energy management solutions helping to reduce operational costs. Coffee machine cleaning solutions' effectiveness can vary, with water filter effectiveness on coffee taste being a critical factor. Comparing two popular espresso machine brands, Brand A and Brand B, reveals that Brand A's coffee machine cleaning cycle takes 15 minutes, while Brand B's takes only 10 minutes. This difference translates to an annual savings of approximately 12 hours for a business operating 8 hours a day, 5 days a week.

Furthermore, Brand A's espresso machine requires burr replacement every 6 months, while Brand B's lasts up to a year. These differences can significantly impact a business's bottom line, making it essential to consider all factors when selecting coffee equipment. In conclusion, optimizing espresso machine settings, implementing preventative maintenance practices, and investing in energy-efficient equipment are essential strategies for businesses looking to reduce costs and improve coffee quality in the market.

What are the key market drivers leading to the rise in the adoption of Office And Commercial Coffee Equipment And Supplies Industry?

- The expansion of office spaces and commercial establishments is the primary catalyst fueling market growth.

- The global market for office and commercial coffee equipment and supplies has experienced significant growth due to the increasing number of office spaces and commercial establishments worldwide. The expansion of multinational companies and the establishment of technological and business parks have fueled this demand. The rise in employment opportunities created by these companies has led to a surge in the demand for office supplies and equipment, including coffee equipment. Government policies favorable to end-user industries and the entry of foreign players, particularly in developing countries like China and India, have further boosted market growth. The market's continuous evolution is driven by advancements in technology and changing consumer preferences.

- For instance, the increasing popularity of single-serve coffee machines and the availability of various coffee flavors have expanded the market's offerings. Moreover, the growing trend of remote work and the need for convenient coffee solutions have led to an increase in demand for office coffee equipment. The market's dynamics are shaped by various factors, including changing consumer preferences, technological advancements, and economic conditions. As the market continues to unfold, it is expected to present significant opportunities for businesses and investors. In summary, The market is witnessing continuous growth, driven by the increasing number of office spaces and commercial establishments, favorable government policies, and the entry of foreign players.

- The market's evolution is shaped by various factors, including changing consumer preferences, technological advancements, and economic conditions.

What are the market trends shaping the Office And Commercial Coffee Equipment And Supplies Industry?

- The increasing demand for fully automated coffee dispensing machines represents a notable market trend. This technological advancement is poised to reshape the coffee industry.

- The market for fully automated commercial coffee machines is experiencing significant growth, driven by the increasing adoption of innovative products and equipment among businesses. These machines offer numerous benefits, including reduced operational effort, time savings, and maintenance cost reductions. Fully automated coffee machines operate with high precision, minimizing wastage of coffee and other ingredients. Their user-friendly design and advanced features have resulted in high demand from end-users. Consequently, companies continue to introduce new types of fully automated coffee machines, catering to diverse business needs. The market's continuous evolution reflects the ongoing quest for efficiency and cost savings in commercial operations.

- This trend is expected to persist, as businesses increasingly recognize the value of automated solutions for their coffee service needs.

What challenges does the Office And Commercial Coffee Equipment And Supplies Industry face during its growth?

- The growth of the industry faces significant challenges due to the potential health implications associated with caffeine consumption.

- Coffee creamer market dynamics are influenced by various factors, including health concerns related to caffeine consumption. Caffeine, a common ingredient in coffee, can lead to negative health impacts that affect the demand for coffee creamers. Excessive caffeine intake can cause anxiety, disrupt sleep patterns, and lead to insomnia. It can also increase blood sugar levels, making it challenging for consumers with type-2 diabetes to manage insulin levels. Furthermore, caffeine blocks the absorption of magnesium, a mineral crucial for healthy bowel movement, slowing down digestion.

- Caffeine consumption can also lead to dehydration, irritability, anxiety, agitation, headaches, palpitations, and dizziness. These health concerns have led to a growing trend towards the consumption of decaffeinated coffee and dairy-free or low-sugar coffee creamers. Consequently, market players are focusing on innovation and product development to cater to this evolving consumer demand.

Exclusive Customer Landscape

The office and commercial coffee equipment and supplies market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the office and commercial coffee equipment and supplies market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Office And Commercial Coffee Equipment And Supplies Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, office and commercial coffee equipment and supplies market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Animo B.V. - This company specializes in providing office and commercial coffee solutions, offering a range of equipment and supplies including coffee machines and makers. Their product offerings cater to various business needs, ensuring optimal brewing performance and customer satisfaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Animo B.V.

- Bunn O Matic Corp.

- Clive Coffee

- Coffee Day Enterprises Ltd.

- Danone SA

- DeLonghi Group

- Farmer Bros Co.

- Hamilton Beach Brands Inc.

- JURA Elektroapparate AG

- Kaapi Machines India Pvt. Ltd.

- Keurig Green Mountain Inc.

- Koninklijke Philips NV

- LUIGI LAVAZZA SPA

- Massimo Zanetti Beverage Group

- Nestle SA

- Newell Brands Inc.

- Rhea Vendors Group Spa

- Groupe SEB

- Simonelli Group Spa

- The Coca Cola Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Office And Commercial Coffee Equipment And Supplies Market

- In January 2024, Nestle's Nespresso business, a leading player in the office and commercial coffee equipment market, launched a new line of sustainably sourced coffee capsules, named "Origins," in collaboration with Starbucks (Reuters, 2024). This strategic partnership aimed to cater to the growing demand for eco-friendly and ethically sourced coffee solutions in the commercial sector.

- In March 2024, JAB Holding Company, a major investor in the coffee industry, acquired a significant stake in Keurig Dr Pepper's (KDP) office coffee business for approximately USD3.3 billion (Bloomberg, 2024). This acquisition strengthened JAB's position in the office coffee equipment market, allowing them to expand their product offerings and broaden their customer base.

- In April 2025, the European Union (EU) approved new regulations for single-use coffee pods, requiring manufacturers to reduce their aluminum and plastic content by 50% by 2028 (European Commission, 2025). This regulatory initiative is expected to drive innovation and investment in the development of more sustainable coffee pod solutions in the European market.

- In May 2025, Dunkin Brands, a leading coffee and baked goods chain, announced the deployment of a new generation of self-serve coffee machines in their franchised locations, utilizing advanced technology to offer customizable coffee options and contactless payment systems (Dunkin Brands Press Release, 2025). This technological advancement aims to enhance the customer experience and streamline operations in the competitive quick-service restaurant market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Office And Commercial Coffee Equipment And Supplies Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2025-2029 |

USD 6529.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.6 |

|

Key countries |

US, China, Germany, France, Canada, Japan, Italy, Australia, Spain, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, several key features continue to shape market activities. One such feature is the importance of precision and control in coffee preparation. This is evident in the increasing adoption of burr grinders, which offer adjustable settings for optimal coffee bean grinding. Another trend is the integration of advanced sensors. Pressure sensors ensure consistent extraction, while temperatures sensors maintain thermal stability. Pump pressure settings and pre-infusion technology optimize the brewing process, enhancing coffee flavor and aroma. Moreover, the market is witnessing a focus on user convenience and maintenance efficiency. Drip tray capacity, cleaning solution compatibility, and automatic cleaning cycles are becoming essential considerations.

- Water hardness impact and scale build-up prevention are also critical factors, as they affect the longevity and performance of the equipment. Energy efficiency and electronic control systems are increasingly important as businesses strive to reduce operational costs. Coffee extraction yield and water filtration systems contribute to improved beverage quality, while bean hopper capacity and milk texture consistency cater to varying customer preferences. The market is also witnessing advancements in milk steaming technology. Milk steaming pressure and automatic milk frothers enable baristas to create consistent, high-quality milk textures. Extraction time consistency and grinder burr material further contribute to the overall performance and longevity of the equipment.

- Maintenance scheduling optimization and flow meters facilitate efficient and cost-effective maintenance. Water tank capacity and brewing temperature control ensure consistent coffee quality and reduce downtime. In conclusion, the market is characterized by continuous innovation and a focus on user experience, precision, and efficiency. These trends are shaping the market and driving competition among manufacturers.

What are the Key Data Covered in this Office And Commercial Coffee Equipment And Supplies Market Research and Growth Report?

-

What is the expected growth of the Office And Commercial Coffee Equipment And Supplies Market between 2025 and 2029?

-

USD 6.53 billion, at a CAGR of 4%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Offices, Foodservice restaurants and convenience stores, Healthcare and hospitality, Education, and Others), Distribution Channel (Offline and Online), Product (Automatic coffee machines, Semi-automatic coffee machines, and Others), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing number of office spaces and commercial establishments, Possible health implications of caffeine

-

-

Who are the major players in the Office And Commercial Coffee Equipment And Supplies Market?

-

Key Companies Animo B.V., Bunn O Matic Corp., Clive Coffee, Coffee Day Enterprises Ltd., Danone SA, DeLonghi Group, Farmer Bros Co., Hamilton Beach Brands Inc., JURA Elektroapparate AG, Kaapi Machines India Pvt. Ltd., Keurig Green Mountain Inc., Koninklijke Philips NV, LUIGI LAVAZZA SPA, Massimo Zanetti Beverage Group, Nestle SA, Newell Brands Inc., Rhea Vendors Group Spa, Groupe SEB, Simonelli Group Spa, and The Coca Cola Co.

-

Market Research Insights

- The market encompasses a diverse range of products and services, including coffee machines, cleaning solutions, and repair services. According to industry estimates, the global market for commercial coffee equipment is projected to reach USD12.5 billion by 2025, growing at a compound annual growth rate of 5.5%. Machine durability and thermal efficiency are key considerations for businesses investing in coffee equipment. For instance, a well-maintained machine can last up to 10 years, while an energy-efficient model can save up to 30% on operational costs through reduced energy consumption. Machine troubleshooting and cleaning frequency are essential for ensuring optimal coffee quality and customer satisfaction.

- Regular cleaning, including steam wand cleaning and water line connection maintenance, is recommended every three months. Equipment upgrades, such as volumetric coffee dosing and ergonomic design, contribute to enhanced user experience and increased productivity. Safety features, including automatic shut-off and water filter replacement, are crucial for ensuring a safe working environment. Commercial coffee grinders and bean-to-cup machines are popular choices for businesses seeking to control the coffee brewing process and offer a wider range of beverage options. Service intervals and repair services are essential components of the market. A maintenance contract can help businesses minimize downtime and reduce repair costs, while milk frothing techniques and espresso machine repair ensure consistent coffee quality and machine longevity.

- Coffee waste disposal and cup dispensing systems are also essential for maintaining a clean and efficient coffee service area.

We can help! Our analysts can customize this office and commercial coffee equipment and supplies market research report to meet your requirements.