US Office And Commercial Coffee Equipment And Supplies Market Size 2024-2028

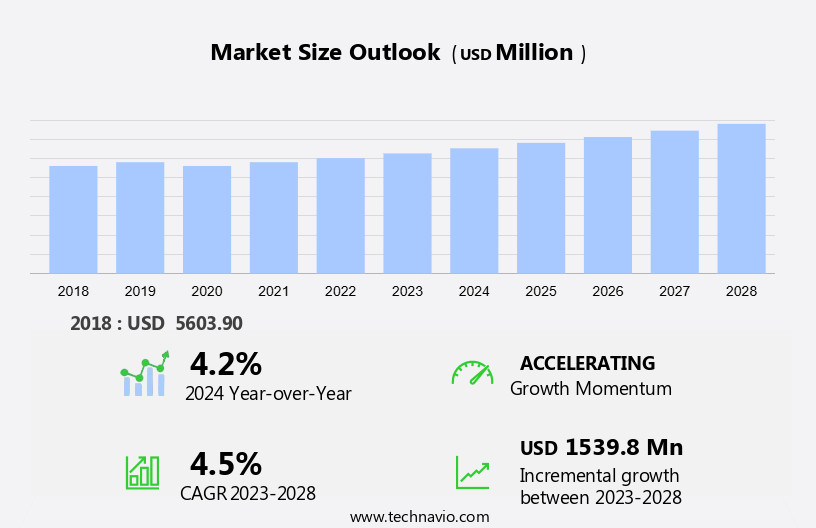

The US office and commercial coffee equipment and supplies market size is forecast to increase by USD 1.54 billion at a CAGR of 4.5% between 2023 and 2028.

- The office and commercial coffee equipment and supplies market In the US is witnessing significant growth due to several key trends. Technological and design innovations in coffee brewers continue to drive market growth, as businesses seek to offer their employees and customers the latest and most advanced coffee solutions. Eco-friendly packaging materials and recyclable paper are also in high demand. This market encompasses a wide range of products, including hot brewing equipment, espresso machines, grinders, water filtration systems, brewing accessories, coffee beans, coffee pods, filters, cleaning products, and more. Another trend is the increasing demand for sustainable coffee solutions, as consumers become more environmentally conscious and companies look to reduce their carbon footprint. Additionally, the fluctuating prices of coffee beans can impact the market, as price volatility can lead to both opportunities and challenges for suppliers and buyers alike. Overall, the market is expected to experience steady growth In the coming years, driven by these and other market dynamics.

What will be the size of the US Office And Commercial Coffee Equipment And Supplies Market during the forecast period?

- The office and commercial coffee supplies market In the US is a dynamic and evolving industry, catering to various sectors such as foodservice outlets, restaurants, convenience stores, healthcare, hospitality, and offices. Trends in this market include the growing popularity of specialty coffee, premium coffee blends, and barista-quality beverages. Sustainability is also a key consideration, with eco-friendly coffee solutions, reusable coffee pods, and energy-efficient machines gaining traction.

- Digital archives and market research reports indicate that single-serve pod systems and automated espresso machines continue to dominate the market, offering convenience and consistency. Disinflation has been observed In the market, with prices remaining relatively stable despite increasing demand. The industry is expected to continue growing, driven by the increasing number of coffee drinkers and the continued expansion of foodservice and hospitality industries.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Offices

- Foodservice outlets/restaurants and convenience stores

- Healthcare and hospitality

- Education

- Others

- Geography

- US

By Distribution Channel Insights

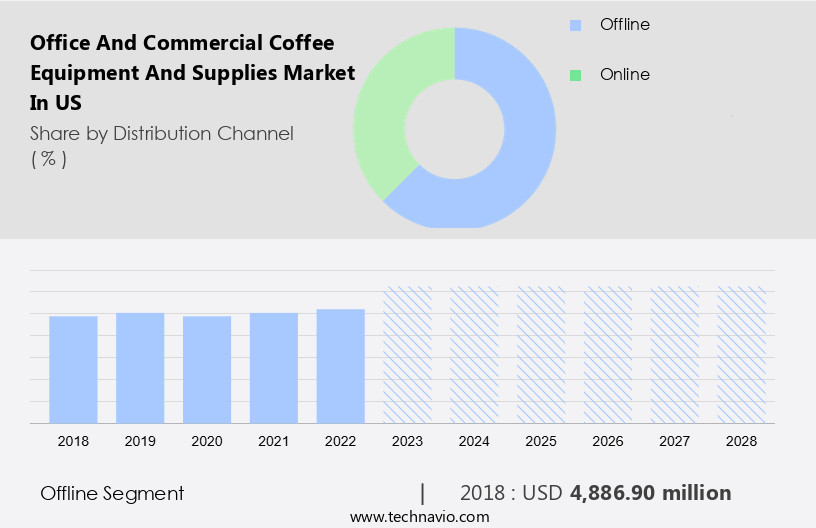

- The offline segment is estimated to witness significant growth during the forecast period.

The office and commercial coffee equipment and supplies market In the US is a substantial sector driven by various customer segments, including foodservice outlets, restaurants, convenience stores, healthcare, hospitality, and offices. The market encompasses a range of products, such as coffee machines, single-serve pod systems, espresso machines, grinders, water filtration systems, brewing accessories, coffee beans, coffee pods, filters, cleaning products, specialty coffee, premium coffee blends, and eco-friendly coffee solutions. Key players in this industry leverage an efficient sales force to cater to these segments through direct channels and dealers/distributors.

Retailers, including specialty stores, hypermarkets, supermarkets, convenience stores, and department stores, are significant contributors to the offline sales of coffee equipment and supplies. The market continues to evolve with advancements in technology, such as automation, energy efficiency, remote connectivity, IoT, and coffee consumption monitoring, providing customizable brewing options, touchscreens, and mobile apps for workplace wellness and high-quality coffee offerings.

Get a glance at the market share of various segments Request Free Sample

The offline segment was valued at USD 4.89 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Office And Commercial Coffee Equipment And Supplies Market?

Technological and design innovations in coffee brewers is the key driver of the market.

- The Office and Commercial Coffee Equipment and Supplies market In the US is witnessing significant growth due to technological advancements and the increasing preference for high-quality coffee offerings. Modern coffee equipment now features touchless operation, app integration, and IoT-enabled smart systems, allowing users to customize brewing preferences and monitor machine performance remotely. These innovations cater to businesses aiming to enhance the coffee experience for employees and customers. Brewing technology advancements are also driving market growth, with machines offering precision temperature control, automatic grind adjustments, and multi-beverage capabilities, including espresso, lattes, and cold brews. Premium coffee blends, such as specialty and artisanal brews, are gaining popularity, leading to the emergence of eco-friendly coffee solutions, including reusable coffee pods and energy-efficient machines.

- Moreover, the shift towards remote work and hybrid work models has increased the demand for office coffee equipment and supplies, as businesses aim to provide a comfortable and productive work environment. The market also caters to various industries, including foodservice outlets, restaurants, convenience stores, healthcare, hospitality, and more. Innovations in coffee machines, such as automated espresso machines, grinders, water filtration systems, brewing accessories, and cleaning products, are contributing to the market's growth. Additionally, mobile apps, touchscreens, remote connectivity, IoT, and coffee consumption monitoring are becoming essential features, enabling predictive ordering and customizable brewing options. Thus, the Office and Commercial Coffee Equipment and Supplies market In the US is experiencing growth due to technological advancements, the increasing preference for high-quality coffee offerings, and the shift towards remote work and hybrid work models. These factors are driving the demand for advanced coffee equipment and supplies, including espresso machines, coffee mixes, hot brewing equipment, and brewing accessories.

What are the market trends shaping the US Office And Commercial Coffee Equipment And Supplies Market?

Increase in demand for sustainable coffee solutions is the upcoming trend In the market.

- The Office and Commercial Coffee Equipment and Supplies market In the US is witnessing significant growth due to the increasing preference for high-quality coffee offerings in various industries, including foodservice outlets, restaurants, convenience stores, healthcare, hospitality, and office environments. Sustainability is a key trend in this market, with a focus on eco-friendly coffee solutions. The use of biodegradable and unbleached paper coffee pods, as well as reusable coffee pods, is gaining popularity. Automation, energy efficiency, and remote connectivity are other significant trends in the market.

- Coffee machines, single-serve pod systems, automated espresso machines, grinders, water filtration systems, brewing accessories, coffee beans, coffee pods, filters, cleaning products, specialty coffee, premium coffee blends, and barista-quality beverages are among the essential supplies. Grinder technology, precision brewing, mobile apps, and workplace wellness are also driving market growth. The market is expected to continue growing due to the increasing adoption of automation, IoT, coffee consumption monitoring, predictive ordering, and customizable brewing options.

What challenges does US Office And Commercial Coffee Equipment And Supplies Market face during the growth?

Rising and fluctuating prices of coffee beans is a key challenge affecting the market growth.

- The office and commercial coffee equipment and supplies market In the US has faced challenges due to rising coffee bean prices. Fluctuations In the market, limited production, unfavorable weather conditions, natural disasters, and increasing labor costs have contributed to the inconsistency In the demand-supply balance, leading to high prices for coffee beans. This negatively impacts companies' profit margins, as the cost of production for coffee beans increases. Despite these challenges, the market continues to evolve with advancements in technology. Hot brewing equipment, such as Coffee Machines, Single-serve pod systems, and Automated espresso machines, are in high demand. Brewing accessories, including Grinders, Water filtration systems, and Cleaning products, are essential for maintaining the quality of the coffee.

- Moreover, there is a growing trend towards Eco-friendly coffee solutions, such as Reusable coffee pods and Energy-efficient machines. Automation, including Touchscreens, Remote connectivity, IoT, and Coffee consumption monitoring, is also becoming increasingly popular. Predictive ordering and Grinder technology are also gaining traction, providing Customizable brewing options for Foodservice outlets, Restaurants, Convenience stores, Healthcare, Hospitality, and Office environments. The market for Commercial coffee supplies, including Coffee Mixes and Premium coffee blends, continues to grow, with a focus on Barista-quality beverages and High-quality coffee offerings. Specialty coffee culture and Artisanal brewing methods are also on the rise, with a growing emphasis on Workplace wellness and providing employees with the best possible coffee experience.

- Thus, the office and commercial coffee equipment and supplies market In the US remains dynamic, with ongoing advancements in technology and a growing focus on sustainability and quality. Despite the challenges presented by rising coffee bean prices, the market continues to evolve and adapt, providing innovative solutions for businesses and consumers alike.

Exclusive US Office And Commercial Coffee Equipment And Supplies Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Vending Services

- Bunn O Matic Corp.

- Clive Coffee

- Danone SA

- Farmer Bros Co.

- Hamilton Beach Brands Holding Co.

- Koffee King Beverage and Food Service Co.

- LUIGI LAVAZZA SpA

- Nestle SA

- Newell Brands Inc.

- Panera Brands

- Royal Cup Inc.

- Starbucks Corp.

- The Coca Cola Co.

- The Kraft Heinz Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The office and commercial coffee equipment and supplies market In the United States is a dynamic and evolving industry, driven by the growing demand for high-quality coffee offerings in various sectors. This market caters to the needs of food service outlets, restaurants, convenience stores, healthcare facilities, hospitality establishments, and offices. Coffee is an essential beverage in many workplaces and businesses, fueling productivity and providing a comfortable environment for employees and customers. The market for coffee equipment and supplies encompasses a wide range of products, including hot brewing equipment, espresso machines, grinders, water filtration systems, brewing accessories, coffee beans, coffee pods, filters, cleaning products, and more.

The market for office and commercial coffee equipment and supplies is influenced by several factors. The trend towards remote work and hybrid work models has led to an increased demand for energy-efficient and automated coffee machines that can provide barista-quality beverages with minimal human intervention. The growing popularity of specialty coffee and premium coffee blends has also driven the market for high-quality coffee offerings. Moreover, the market is witnessing the integration of technology into coffee equipment and supplies. IoT (Internet of Things) enabled machines allow for coffee consumption monitoring, predictive ordering, and remote connectivity. Grinder technology has advanced to provide precision brewing, and mobile apps offer customizable brewing options.

Another trend In the market is the focus on eco-friendly coffee solutions. Reusable coffee pods and biodegradable coffee filters are gaining popularity as businesses strive to reduce their environmental footprint. The market is also seeing an increase in demand for single-serve pod systems that use compostable or recyclable pods. The office and commercial coffee equipment and supplies market is expected to continue growing as businesses prioritize workplace wellness and strive to offer their employees and customers high-quality coffee experiences. The market is also expected to be influenced by advancements in technology and the increasing popularity of specialty coffee and artisanal brewing methods.

Thus, the office and commercial coffee equipment and supplies market In the United States is a dynamic and growing industry driven by the demand for high-quality coffee offerings and the integration of technology. The market caters to various sectors, including food service outlets, restaurants, convenience stores, healthcare facilities, and offices. The trend towards remote work and hybrid work models, the focus on eco-friendly solutions, and the growing popularity of specialty coffee are expected to influence the market's growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 1.54 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch