Non-Alcoholic Beverages Market Size 2025-2029

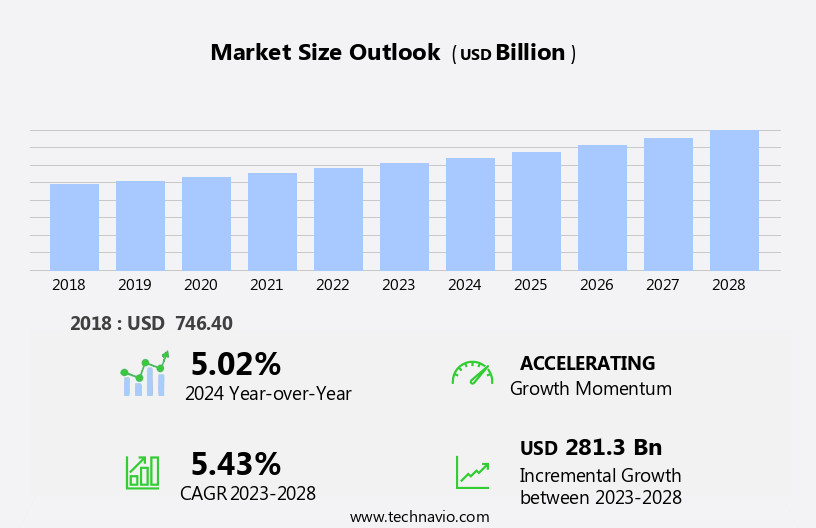

The non-alcoholic beverages market size is forecast to increase by USD 294.8 billion at a CAGR of 5.4% between 2024 and 2029.

- The market is characterized by a dynamic business landscape, driven by several key factors. Firstly, the market witnesses frequent product launches by companies, reflecting the intense competition and innovation-driven approach. This trend underscores the importance of staying abreast of consumer preferences and trends. Secondly, there is an increased focus on sustainable packaging in the non-alcoholic beverages industry. As consumers become more environmentally conscious, companies are responding by adopting eco-friendly packaging solutions. The market also caters to various dietary preferences, with dairy-free milk alternatives and sugar substitutes gaining traction. This shift not only appeals to the growing eco-conscious consumer base but also positions brands as responsible market players. However, the market is not without challenges.

- To counter this, non-alcoholic beverage companies must differentiate themselves by offering unique flavors, health benefits, and innovative product formats. Health and wellness trends have led to the growth of plant-based beverages, energy drinks, and ph-balanced options. The market is a vibrant and evolving industry, shaped by consumer preferences, sustainability trends, and intense competition. Companies seeking to capitalize on market opportunities must stay agile, innovative, and responsive to changing consumer demands while navigating the challenges posed by competition and shifting market dynamics.

What will be the Size of the Non-Alcoholic Beverages Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The non-alcoholic beverage market is witnessing significant trends, with coffee extracts and tea extracts gaining popularity due to their rich flavors and health benefits. Responsible and ethical sourcing is a priority for retailers, leading to partnerships with suppliers who use natural extracts and fruit concentrates. Nutritional labeling and product lifecycle management are essential for meeting consumer demands and regulatory compliance. Sales forecasting and inventory management help companies optimize supply chain operations and reduce water usage. Pricing models and quality control testing ensure profitability and customer satisfaction. Sustainability initiatives, such as recycling programs and carbon footprint reduction, are crucial for minimizing environmental impact.

Herbal extracts, vegetable juices, and flavor compounds add diversity to the market. Digital and social media marketing strategies expand reach, while distribution networks and supply chain optimization streamline logistics. Health claims and sensory evaluation drive innovation, with aseptic processing, high-pressure processing, and UV sterilization ensuring product safety and shelf life. Market research and packaging innovations keep pace with consumer preferences, while energy consumption and waste management remain key areas for improvement. The competition from alcoholic beverages poses a significant threat, as consumers often perceive these as more exciting and indulgent alternatives.

How is this Non-Alcoholic Beverages Industry segmented?

The non-alcoholic beverages industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Non-carbonated

- Carbonated

- Distribution Channel

- Offline

- Online

- Packaging

- Bottles

- Cans

- Tetra pak

- Pouches

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

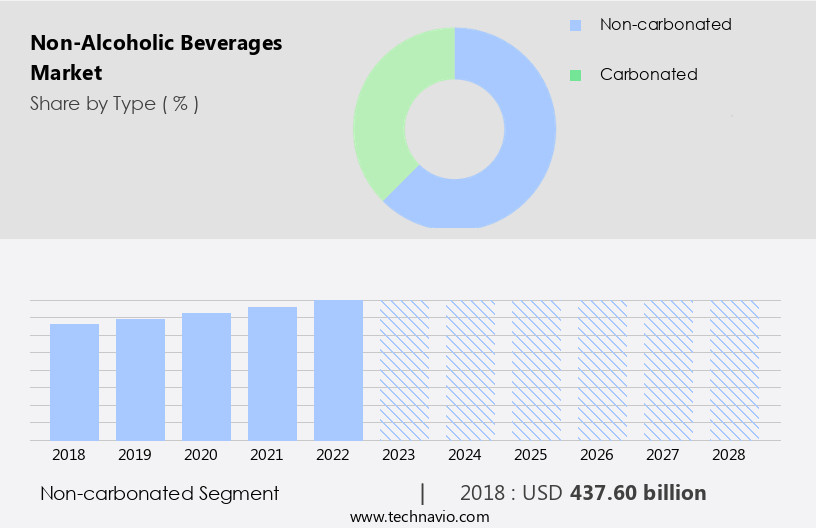

By Type Insights

The non-carbonated segment is estimated to witness significant growth during the forecast period. The non-carbonated segment of the market is witnessing notable growth due to evolving consumer preferences towards healthier, natural drink options. Juices and juice concentrates, a significant part of this category, have gained traction among health-conscious consumers seeking alternatives to sugary sodas and alcoholic beverages. The increasing awareness of the health implications of sugar consumption and artificial ingredients is driving this trend. Consumers are now drawn to beverages perceived as more natural, with clear labels and functional benefits, which often align with ethical and environmental concerns. Innovative flavors and premium positioning have further elevated non-alcoholic beverages, making them appealing alternatives in social settings where alcohol might typically be consumed.

Pricing strategies, shelf appeal, brand loyalty, and customer segmentation are essential marketing considerations. The premium segment of the market, catering to niche demographics, highlights unique taste profiles and sustainable sourcing. Ingredient sourcing, production processes, and supply chain management are crucial elements in delivering high-quality products. The food service industry and online retailers are significant distribution channels for non-alcoholic beverages. Product innovation and consumer behavior continue to shape the market, with a focus on meeting diverse consumer needs and preferences.

The Non-carbonated segment was valued at USD 457.10 billion in 2019 and showed a gradual increase during the forecast period.

The non-alcoholic beverages market is witnessing robust growth, driven by evolving consumer preferences and insights from consumer surveys. Brands are tapping into digital marketing to better connect with health-conscious consumers, while content marketing helps educate and engage audiences on wellness trends. Strategic retail partnerships are expanding shelf visibility and accessibility. There's a growing demand for ethically produced goods, pushing companies toward responsible sourcing practices. Simultaneously, local sourcing is gaining traction, appealing to eco-aware buyers who value community support and reduced carbon footprints.

Brand positioning plays a crucial role in the market, with many companies focusing on quality assurance and organic ingredients to cater to consumer demands. Ready-to-drink tea and coffee, sparkling water, and dairy-free milk alternatives are popular choices. Quality control and manufacturing efficiency are essential in maintaining consumer trust and ensuring product consistency. Packaging materials, shelf life, and distribution channels are also critical factors in the market. Functional beverages, including probiotic drinks and herbal infusions, are gaining popularity due to their health benefits. Consumer preferences for natural sweeteners over artificial ones have led to a decrease in the use of high-fructose corn syrup.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven by health-conscious consumers, particularly Millennials and Gen Z. These consumers are seeking alternatives to traditional alcoholic drinks and sugary sodas, leading to the popularity of organic juices and ready-to-drink (RTD) options. Organic juices, which offer health benefits and cater to vegans and those with lactose intolerance, have seen rapid growth. RTD options, such as cold brew coffee, energy drinks, and flavored waters, have rised in popularity due to their convenience and sophistication. Consumers value the seamless integration of these beverages into their on-the-go lifestyles.

Quality assurance and fair trade ingredients are essential for brand positioning, as consumers prioritize health and wellness. Manufacturing efficiency and production processes are crucial to meet the demand for these beverages, with bottling plants and distribution channels optimized for mass market appeal. Consumer preferences for probiotic drinks, natural sweeteners, and herbal infusions continue to influence product innovation. Packaging design, shelf appeal, and brand loyalty are essential factors in marketing campaigns, with various pricing strategies employed to cater to different customer segments. Shelf life and sugar content are critical considerations for niche markets, while ph levels and taste profiles are important for various beverage categories, including sports drinks and bottled water.

Aluminum cans and pet bottles are common packaging materials, with glass bottles used for premium segments. The food service industry and online retailers are significant distribution channels. Consummer behavior and trends shape the market, with carbonation levels, artificial sweeteners, and aroma profiles influencing consumer preferences. The market also includes energy drinks, functional beverages, and plant-based beverages, with various production processes and ingredient sourcing strategies employed to meet consumer demands.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Non-Alcoholic Beverages market drivers leading to the rise in the adoption of Industry?

- Companies' consistent product launches serve as the primary catalyst for market growth. The market is witnessing significant growth due to increasing consumer preferences for healthier and functional drink options. Companies are responding to this trend by introducing innovative products with dairy-free milk alternatives, natural sweeteners, and functional ingredients like probiotics.

- Parle Agro Pvt Ltd., an Indian beverage brand, recently launched Dhishoom, a jeera masala-flavored carbonated drink, expanding their product portfolio and appealing to diverse consumer tastes. These offerings cater to the mass market and prioritize nutritional value, supply chain management, and fair trade ingredients. Carbonation levels continue to be popular, with both carbonated soft drinks and functional beverages gaining traction. Marketing campaigns highlight the health benefits and unique flavors of these beverages, further driving demand.

What are the Non-Alcoholic Beverages market trends shaping the Industry?

- Sustainable packaging is gaining significant attention in the market, with an increasing number of companies focusing on eco-friendly solutions to reduce their environmental footprint. This trend is expected to continue as consumers become more conscious of the impact of their purchases on the environment. The market is witnessing notable growth due to shifting consumer preferences towards sustainable packaging. Eco-conscious consumers are demanding more environmentally friendly options, leading beverage companies to invest in innovative, recyclable, and biodegradable solutions. For instance, plant-based bottles, aluminum cans with increased recycled content, and packaging made from ocean-bound plastics are gaining popularity. Coca-Cola, for example, has introduced 100% recyclable PET bottles, which are lighter and have a lower carbon footprint compared to glass. Brand loyalty is another crucial factor driving market growth. Consumers are drawn to brands that cater to their specific needs and preferences, such as sugar substitutes, long shelf life, and aroma profiles.

- Sports drinks continue to dominate the market due to their association with an active lifestyle and health and wellness. Customer segmentation plays a significant role in market dynamics. Beverage companies are targeting various demographics, including children, millennials, and health-conscious individuals, with product innovation. Plant-based beverages, such as almond milk and soy milk, are gaining popularity due to their health benefits. The food service industry is also contributing to market growth, as restaurants and cafes offer a wide range of non-alcoholic beverage options. Distribution channels, including supermarkets, convenience stores, and online retailers, are expanding their offerings to meet consumer demand. Overall, the market is expected to continue growing as consumers seek out sustainable and health-conscious options.

How does Non-Alcoholic Beverages market faces challenges during its growth?

- The growth of the industry is significantly impacted by intense competition from alcoholic beverages. Non-alcoholic beverages represent a dynamic market driven by various factors, including health consciousness and consumer preferences. Energy drinks, a popular segment, continue to gain traction due to their ability to provide an energy boost. However, ph levels and sugar content remain key considerations for consumers. Packaging design and the use of pet bottles and aluminum cans are essential elements in this market, catering to diverse consumer demographics. Ingredient sourcing and the addition of flavor enhancers are crucial aspects of product development. The non-alcoholic beverage market is a niche sector, with online retailers playing a significant role in distribution.

- Despite the growing popularity of non-alcoholic beverages, alcoholic drinks continue to offer unique taste profiles and experiences that appeal to consumers. The complexity of flavors in alcoholic beverages, such as wines, beers, and spirits, provides a more sophisticated drinking experience. Target demographics for non-alcoholic beverages include health-conscious consumers, children, and those abstaining from alcohol for personal or religious reasons. The market is expected to remain competitive, with ongoing innovation in product development and marketing strategies.

Exclusive Customer Landscape

The non-alcoholic beverages market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the non-alcoholic beverages market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, non-alcoholic beverages market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABC Fruits - The company specializes in providing a range of non-alcoholic beverage options, including fruit pulp, puree, IQF, and concentrate.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABC Fruits

- Asahi Group Holdings Ltd.

- Dabur India Ltd.

- Foxtrot Beverages Pvt. Ltd

- Ghousia Food Products Pvt. Ltd.

- Gusto Foods

- Keurig Dr Pepper Inc.

- Manna Beverages and Ventures

- National Beverage Corp.

- Nongfu Spring Co. Ltd.

- Ocean Spray Cranberries Inc.

- Parle Agro Pvt Ltd.

- PepsiCo Inc.

- Rachels Orchard

- Refresco Group

- Sajeeb Corp

- SOURCE DU PAYS S.A

- Sun Impex International Foods LLC

- Suntory Beverage and Food Australia Pty Ltd

- The Coca Cola Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Non-Alcoholic Beverages Market

- In January 2024, PepsiCo, a leading beverage company, introduced a new line of sugar-free, plant-based drinks called "Driftwell," targeting consumers seeking mental wellness and relaxation. This strategic move expanded PepsiCo's non-alcoholic beverage portfolio (Source: PepsiCo Press Release).

- In March 2024, Coca-Cola and Starbucks announced a global partnership to produce and distribute ready-to-drink coffee beverages under the Starbucks brand. This collaboration aimed to strengthen both companies' presence in the non-alcoholic beverage market (Source: Coca-Cola Company Press Release).

- In May 2024, Nestlé, the world's largest food and beverage company, acquired a controlling stake in Blue Bottle Coffee, a premium coffee roaster and retailer, for approximately USD425 million. The acquisition was part of Nestlé's strategy to expand its presence in the specialty coffee market (Source: Nestlé SA Press Release).

- In April 2025, The Coca-Cola Company received regulatory approval from the European Commission to acquire Costa Coffee, the UK's largest coffee chain, for â¬3.9 billion. This acquisition was expected to significantly boost Coca-Cola's presence in the European coffee market (Source: European Commission Press Release).

Research Analyst Overview

The market continues to evolve, with dynamic market activities unfolding across various sectors. Calorie content and nutritional value remain key considerations for consumers, driving innovation in flavored water, juice drinks, ready-to-drink tea, and coffee. The premium segment, with its focus on quality assurance and organic ingredients, is gaining traction. Shelf life and packaging materials are crucial factors in the production processes of ready-to-drink beverages, with glass bottles and aluminum cans offering distinct advantages. Manufacturing efficiency and supply chain management are essential for mass market players, while fair trade ingredients and sustainable sourcing cater to niche markets. Consumer preferences for sugar substitutes, natural or artificial, influence pricing strategies and marketing campaigns.

Carbonation levels, ph levels, and taste profiles are critical elements in the development of carbonated soft drinks, sparkling water, and energy drinks. Probiotic drinks and herbal infusions cater to the health and wellness trend. Product innovation in plant-based beverages and dairy-free milk alternatives is a significant area of growth. Consumer behavior shapes distribution channels, with food service industry partnerships and online retailers gaining prominence. The ongoing evolution of the market reflects the industry's commitment to meeting diverse consumer demands and preferences.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Non-Alcoholic Beverages Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 294.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Germany, Canada, India, UK, France, Italy, Brazil, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Non-Alcoholic Beverages Market Research and Growth Report?

- CAGR of the Non-Alcoholic Beverages industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the non-alcoholic beverages market growth of industry companies

We can help! Our analysts can customize this non-alcoholic beverages market research report to meet your requirements.