Nitro Infused Beverages Market Size 2024-2028

The nitro infused beverages market size is forecast to increase by USD 142.55 million at a CAGR of 19.44% between 2023 and 2028.

- Nitro infused beverages, including soft drinks, tea, cold brew coffee, and energy drinks, have gained significant traction In the beverage market due to the growing consumer preference for premium and innovative options. The expansion of nitro-infusion technology across various beverage categories has led to the creation of unique and distinctive flavors, textures, and health benefits. However, the limited availability of specialized equipment and the technological expertise required to produce these beverages pose challenges for market growth. In the US, this trend is particularly prominent in specialty coffee shops and convenience stores, where consumers are willing to pay a premium for these on-trend, antioxidant-rich beverages. The increasing popularity of nitro-infused beverages among health-conscious consumers, particularly those focused on weight management, has led to an increase in sales through e-commerce channels as well. The convenience of ordering these beverages online and having them delivered directly to consumers' doors has further fueled market growth. With the rise of smartphone usage and social media, consumers are able to easily discover and share their experiences with these beverages, driving further demand.

What will be the Size of the Nitro Infused Beverages Market During the Forecast Period?

- The nitro-infused beverages market encompasses a range of ready-to-drink (RTD) beverages, including coffee, tea, and soft drinks, that are infused with nitrogen gas. This innovative process creates a unique drinking experience, characterized by the presence of small, fine nitrogen bubbles, resulting in a rich, silky texture, creamy foam head, and a smooth, velvety mouthfeel. Nitro coffee and tea, in particular, have gained significant popularity due to their ability to reduce acidity and bitterness, enhancing the overall flavor profile of these beverages. The use of nitrogen gas instead of carbonated bubbles contributes to the distinctive taste and texture, setting nitro-infused beverages apart from traditional offerings.

- Furthermore, the nitro tank system employed In the production of these beverages ensures consistent quality and a consistent nitrogen infusion, further adding to their appeal. The nitro-infused beverages market continues to grow, driven by consumer demand for unique and innovative beverage experiences.

How is this Nitro Infused Beverages Industry segmented and which is the largest segment?

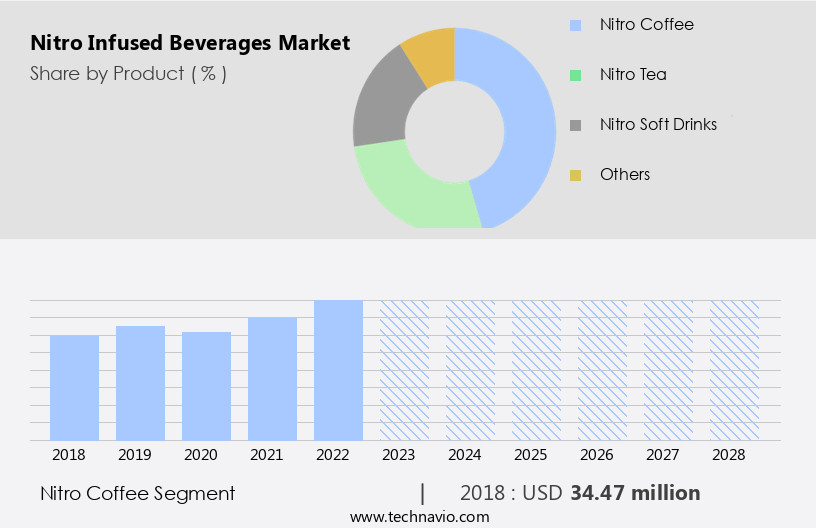

The nitro infused beverages industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Nitro coffee

- Nitro tea

- Nitro soft drinks

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Product Insights

- The nitro coffee segment is estimated to witness significant growth during the forecast period.

Nitro infused beverages, including nitro coffee and nitro soft drinks, have gained popularity for their unique sensory experience. Infused with nitrogen gas, these beverages offer a rich, silky texture and a thick, frothy head, resembling the texture of beer. Nitro coffee, in particular, is served cold and often straight from a tap, providing a refreshing alternative to traditional iced coffee. The infusion of nitrogen enhances the natural flavors, resulting in a smoother, less acidic taste profile. Major brands and cafes have embraced this innovation, contributing to its rapid growth and widespread availability. Nitro soft drinks also benefit from this process, offering a creamy texture and a smooth, effervescent mouthfeel.

Get a glance at the Nitro Infused Beverages Industry report of share of various segments Request Free Sample

The nitro coffee segment was valued at USD 34.47 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for nitro infused beverages is experiencing significant growth due to increasing consumer demand for high-quality, sensory-rich drinks. This trend is reflected In the rising popularity of craft and artisanal beverages, which prioritize innovation and unique flavor profiles. Nitro-infused beverages, which incorporate nitrogen gas to create a rich, silky texture with a creamy foam head, have gained popularity among both coffee and soft drink consumers. Brands such as PepsiCo Inc. And Starbucks have capitalized on this trend with the introduction of Nitro Pepsi and expanded nitro cold brew coffee offerings, respectively. The convenience of ready-to-drink beverages, innovative packaging, and the availability of nitro-infused beverages on e-commerce platforms, as well as in supermarkets and convenience stores, have further fueled market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Nitro Infused Beverages Industry?

Growing consumer demand for premium and innovative beverages is the key driver of the market.

- The market experiences significant growth due to increasing consumer preferences for premium and innovative ready-to-drink options. Millennials and young professionals seek unique drinking experiences, and nitro-infused beverages, such as nitro coffee, tea, and soft drinks, cater to this demand. Nitrogen gas infusion creates tiny bubbles, resulting in a rich, silky texture and a thick, frothy head. This enhances the flavor profile and aroma, providing a distinct experience compared to traditional beverages. Nitro-infused beverages are not limited to coffee; they also extend to soft drinks, tea, and even beer, offering a wide range of choices for consumers. The convenience of ready-to-drink beverages, coupled with the novelty of nitrogen infusion, makes them increasingly popular.

- Additionally, the availability of nitro-infused beverages on e-commerce platforms, the internet, and smartphones further increases accessibility. Consumers also appreciate the freshness, mouthfeel, and natural ingredients In these beverages, which cater to personal health, weight management, and changing beverage consumption patterns. The market offers a variety of flavors, textures, and mixology possibilities, as well as low-calorie options in cans, making nitro infused beverages an attractive choice for a diverse range of consumers.

What are the market trends shaping the Nitro Infused Beverages Industry?

Expansion of nitro-infusion technology across different beverage categories is the upcoming market trend.

- Nitro infusion technology, which involves infusing beverages with nitrogen gas to create a rich, silky texture and creamy foam head, is driving growth In the global ready-to-drink (RTD) beverages market. Originally popularized In the coffee and beer industries, this innovative technology is now extending to soft drinks, tea, and other non-alcoholic beverages. For instance, nitro coffee and nitro tea offer a smoother and creamier alternative to traditional hot or iced beverages, while nitro soft drinks provide a unique drinking experience with carbonated bubbles and a thick texture. The convenience of nitro-infused beverages, combined with their premium and unique taste and aroma, aligns with changing consumer preferences.

- In addition, nitro-infused beverages are available on various e-commerce platforms, making them easily accessible to consumers through the internet and smartphones. The freshness and mouthfeel of these beverages are preserved through innovative packaging, such as nitro tanks and specialized cans. Consumer preferences for personal health, weight management, and low-calorie offerings have also influenced the market. Nitro-infused beverages, with their natural ingredients and potential antioxidant benefits, cater to these preferences. The market is expected to continue growing as consumers seek out unique and convenient beverage options. The nitro-infused beverages market encompasses a wide range of flavors, textures, and mixology possibilities, making it an exciting and dynamic industry.

What challenges does the Nitro Infused Beverages Industry face during its growth?

Limited availability of specialized equipment and technological expertise needed to make nitro-infused beverages is a key challenge affecting the industry growth.

- The market faces a challenge due to the high investment and expertise required for production. Nitro-infusion technology, which creates the distinctive thick texture, frothy head, and enhanced flavor profile in nitro-infused beverages, necessitates specialized equipment. This equipment, which uses nitrogen gas to infuse beverages with tiny nitrogen bubbles, can be costly for smaller beverage producers. Moreover, the technical know-how to operate the equipment effectively and consistently may be lacking, making it a significant barrier to entry. The high initial investment and ongoing operational costs, coupled with the need for specialized knowledge, limit the market's accessibility for smaller players.

- Despite these challenges, the growing consumer preference for ready-to-drink beverages with unique textures and flavors, such as nitro coffee, tea, soft drinks, and cold brew coffee, continues to fuel the market's growth. Consumers' changing beverage consumption patterns, driven by hectic lifestyles and the convenience of ready-to-drink beverages, further boost demand. Additionally, the increasing popularity of non-alcoholic, low-calorie offerings, natural ingredients, and innovative packaging, including e-commerce platforms, the internet, and smartphones, expand the market's reach. Despite these opportunities, the market's growth remains restrained by the high barriers to entry.

Exclusive Customer Landscape

The nitro infused beverages market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the nitro infused beverages market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, nitro infused beverages market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- B Sweet LLC

- Beanly

- Bona Fide Nitro Coffee and Tea.

- Califia Farms LLC

- Early Bird Nitro Coffee and Tea

- East Forged

- Funkin Cocktails

- La Colombe Coffee Roasters.

- Left Hand Brewing Co.

- Liquid Nitro Beverages

- Monster Energy Co.

- NITRO Beverage Co.

- Nitrobrew

- PepsiCo Inc.

- Pernod Ricard SA

- portal tea

- Quivr

- RISE Brewing Co.

- Starbucks Corp.

- GREENBERRYS COFFEE ROASTERS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Nitro-infused beverages have emerged as a popular trend In the ready-to-drink (RTD) market, offering consumers a unique sensory experience. These beverages, which incorporate nitrogen gas into the brewing or carbonation process, create a rich, silky texture and a creamy foam head. Nitro-infused beverages are not limited to coffee and tea, but also extend to soft drinks and even non-alcoholic versions of beer. The production of nitro-infused beverages involves the use of specific equipment, such as nitro tanks, to infuse the beverage with nitrogen bubbles. This results in a thicker texture and a frothy head, which can enhance the overall taste and aroma of the beverage.

Moreover, the use of nitrogen gas instead of traditional carbonation methods also results in smaller, finer bubbles, which can contribute to a smoother mouthfeel. The market for nitro-infused beverages is driven by several factors. Consumer preferences for unique and innovative beverage experiences have led to a growing demand for these products. The convenience offered by RTD beverages, particularly In the context of hectic lifestyles, has also contributed to their popularity. Additionally, the rise of e-commerce platforms and the increasing use of the internet and smartphones for purchasing goods have made it easier for consumers to access nitro-infused beverages from the comfort of their own homes.

Despite the growing popularity of nitro-infused beverages, there are also challenges associated with their production and consumption. The use of nitrogen gas can result in a higher acidity level, which can lead to stomach discomfort for some consumers. Additionally, the addition of nitrogen bubbles can increase the calorie count of the beverage, as well as the cost of production. To address these challenges, manufacturers have been exploring the use of natural ingredients and low-calorie offerings to create nitro-infused beverages that are both delicious and health-conscious. Canned beverages have also gained popularity as a convenient and sustainable packaging option for nitro-infused beverages.

Furthermore, the market for nitro-infused beverages is expected to continue growing, driven by changing consumer preferences and ongoing innovation In the beverage industry. As the demand for unique and convenient beverage options continues to rise, nitro-infused beverages are likely to remain a popular choice for consumers around the world. The market dynamics for nitro-infused beverages are influenced by several factors, including consumer preferences, beverage consumption patterns, and the availability of innovative packaging solutions. The use of nitrogen gas In the production process creates a unique sensory experience, which can differentiate nitro-infused beverages from traditional offerings. The ability to create a rich, creamy texture and a frothy head can also enhance the overall taste and aroma of the beverage, making it a popular choice for both coffee and tea drinkers, as well as non-alcoholic beverage consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.44% |

|

Market growth 2024-2028 |

USD 142.55 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.76 |

|

Key countries |

US, Canada, China, UK, and Germany |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Nitro Infused Beverages Market Research and Growth Report?

- CAGR of the Nitro Infused Beverages industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the nitro infused beverages market growth of industry companies

We can help! Our analysts can customize this nitro infused beverages market research report to meet your requirements.