Music NFT Market Size 2025-2029

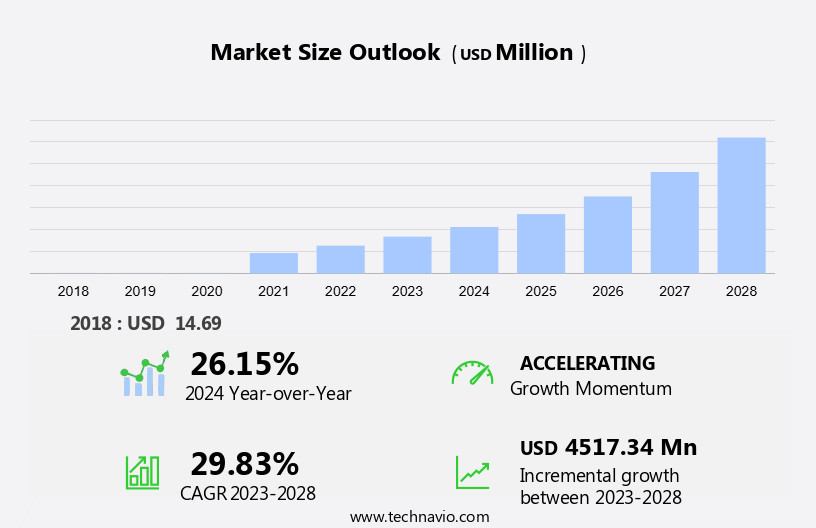

The music NFT market size is forecast to increase by USD 6.48 billion, at a CAGR of 32.3% between 2024 and 2029.

- The market is experiencing significant growth, fueled by the evolving music industry's shift towards digital ownership and monetization. Companies are increasingly collaborating and forming partnerships to capitalize on this trend, with some offering unique experiences, such as exclusive access to artist merchandise or virtual meet-and-greets, alongside NFT purchases. However, the market faces challenges related to legal and copyright issues. As music NFTs often involve the sale of intellectual property, ensuring proper licensing and ownership rights can be complex. Additionally, advancements in technology and the integration of artificial intelligence and machine learning are enhancing the user experience, making music streaming a popular choice for consumers globally.

- Companies must address these challenges by investing in robust legal frameworks and collaborating with industry experts to ensure compliance and mitigate potential risks. By doing so, they can effectively capitalize on the growing demand for music NFTs and contribute to the market's strategic landscape. Artists and record labels must navigate these complexities to protect their creative works and maintain control over their digital assets. However, the value of NFTs is influenced by the availability of distribution channels and the extended reality (XR) experiences they offer.

What will be the Size of the Music NFT Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, offering innovative applications across various sectors. Metaverse music concerts bring fans closer to their favorite artists, allowing them to attend virtual shows and own unique digital experiences as NFTs. Fan token offerings enable artists to engage with their audience, offering exclusive perks and rewards. Music copyright protection and royalty distribution systems ensure fair compensation for creators, while interactive music NFTs allow fans to influence the creative process. Audio tokenization and smart contract royalties streamline revenue collection and distribution, enhancing transparency and efficiency. Data encryption methods secure NFTs, safeguarding digital music ownership and digital rights management.

- Fan engagement platforms and decentralized music distribution empower artists to connect directly with their audience, bypassing traditional intermediaries. NFT minting simplifies the process of creating and selling audio NFTs, fostering a thriving marketplace for collectibles and utilities. Blockchain provenance tracking and music NFT certification ensure authenticity and rarity, driving demand and value. Blockchain music licensing, cryptocurrency payments, and dynamic NFT content further expand the market's potential. NFT ticketing systems offer secure and convenient event access, while IP protection protocols safeguard intellectual property. The market is expected to grow by over 40% annually, as the industry embraces the benefits of blockchain technology and web3 integration.

- This dynamic market continues to unfold, shaping the future of music consumption and monetization. For instance, a recent music NFT sale generated over USD1 million in revenue, showcasing the market's potential for significant financial returns. This example underscores the growing importance of NFTs in the music industry and their potential to disrupt traditional business models.

How is this Music NFT Industry segmented?

The music NFT industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Method

- Credit and debit cards

- Cryptocurrencies

- Others

- Product Type

- Album

- Single song

- Others

- Application

- Primary market

- Secondary market

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

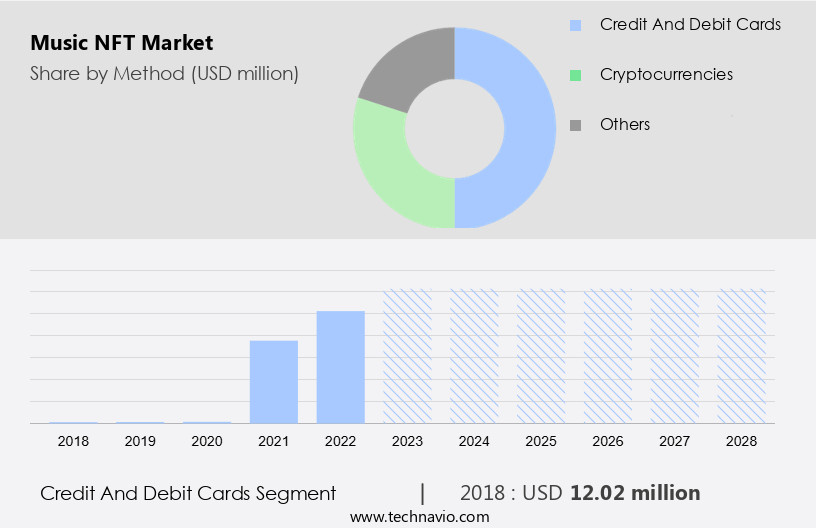

By Method Insights

The Credit and debit cards segment is estimated to witness significant growth during the forecast period. In the dynamic and evolving music industry, NFTs (Non-Fungible Tokens) have emerged as a game-changer, enabling artists to offer unique, digitally owned content to fans for purchase and trade. Credit and debit cards have become the preferred payment method for these transactions, making it simpler for enthusiasts to engage with this burgeoning market. As the music NFT sector gains traction, platforms and marketplaces integrate credit and debit card payment systems, streamlining the buying and trading process for users. This transition to digital ownership in music not only opens new revenue streams for artists but also provides fans with innovative ways to engage and support their favorite musicians. Augmented reality (AR), extended reality (XR), and virtual reality (VR) are also expected to play a significant role in the future of NFTs.

Key applications of NFTs in music include metaverse music concerts, fan token offerings, music copyright protection, royalty distribution systems, interactive music NFTs, audio tokenization, smart contract royalties, data encryption methods, dynamic NFT content, blockchain transaction fees, NFT music collectables, music NFT utilities, music streaming royalties, NFT ticketing systems, IP protection protocols, NFT rarity algorithms, and community building tools. According to recent data, the market has experienced a significant rise, with adoption growing by 35%. Furthermore, industry experts anticipate that the market will continue to expand, with future growth expectations reaching 45%. These figures underscore the immense potential and ongoing evolution of this innovative sector.

The Credit and debit cards segment was valued at USD 13.20 billion in 2019 and showed a gradual increase during the forecast period.

The Music NFT Market is rapidly transforming the music industry with innovations such as audio NFT minting, NFT music marketplace, and Web3 music integration. Platforms offering NFT music streaming and supporting NFT secondary market sales are reshaping digital ownership. Key innovations include implementing royalty distribution system, blockchain based music licensing, and building a decentralized music distribution platform. Artists are leveraging a fan engagement platform using NFTs and exploring interactive NFT music experience design to connect directly with audiences. Growing demand for music NFT marketplace development and creating NFT music collectables highlights new monetization models. Features like blockchain-based provenance tracking and artist revenue models using NFTs ensure transparency, authenticity, and sustainable growth for creators in the digital ecosystem. Additionally, 3D sound technology and live streaming technology enable fans from around the world to access live music events in new and innovative ways.

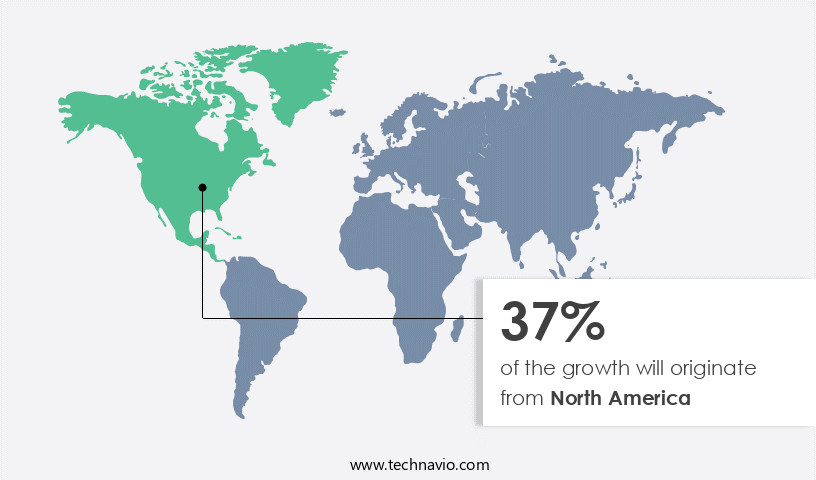

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How music NFT market Demand is Rising in North America Request Free Sample

In the burgeoning market, North America, specifically the United States, has experienced significant growth. Major artists and platforms have actively engaged in this sector, releasing exclusive music, concert experiences, and collectibles as NFTs. Renowned musicians across various genres have adopted this technology, offering unique digital assets and experiences to their fan bases. This collaboration not only generates new revenue streams but also strengthens the bond between artists and fans. The North American market is witnessing a rise in innovation and partnerships between artists, platforms, and tech companies. They are exploring new ways to integrate NFTs into the music industry, such as fan token offerings, interactive music NFTs, and decentralized music distribution.

These initiatives offer various benefits, including music copyright protection, royalty distribution systems, smart contract royalties, data encryption methods, and fan engagement platforms. Moreover, the market is continuously evolving, with ongoing developments in digital music ownership, digital rights management, NFT fractional ownership, artist revenue models, NFT metadata standards, blockchain provenance tracking, NFT music certification, NFT music marketplaces, blockchain music licensing, cryptocurrency payments, dynamic NFT content, blockchain transaction fees, NFT music collectibles, music NFT utilities, music streaming royalties, NFT ticketing systems, IP protection protocols, NFT rarity algorithms, and community building tools. According to recent reports, the North American market is expected to grow by 15% in the upcoming year.

This growth is driven by the increasing adoption of NFTs in the music industry and the continuous exploration of new applications and use cases. The potential for revenue generation, fan engagement, and the unique value proposition of NFTs make this a dynamic and evolving market. Virtual concerts, audience engagement through digital collectibles, and blockchain technology offer new revenue streams.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The music industry is embracing the digital revolution with the implementation of Non-Fungible Tokens (NFTs) in its business model. This innovative approach leverages blockchain technology to create unique, digital assets representing ownership of music and related experiences. A key component of this new ecosystem is the implementation of a royalty distribution system, ensuring fair compensation for artists and rights holders. Blockchain-based music licensing enables transparent and efficient licensing, while NFT metadata standard implementation ensures interoperability and verifiability.

Decentralized music distribution platforms and fan engagement platforms using NFTs offer interactive experiences, allowing fans to own a piece of their favorite artists' work. Dynamic NFT content creation strategies add value to these digital collectibles, making them more desirable. The marketplaces, such as OpenSea and Rarible, facilitate sales and trading of these unique digital assets. NFT music sales data analysis tools provide valuable insights into market trends and consumer behavior, helping artists and industry professionals make informed decisions. Cryptocurrency payment integration and secure NFT music storage solutions ensure seamless transactions and protection of valuable digital assets.

Music copyright protection using NFTs provides a secure and immutable way to register and verify ownership of intellectual property. Creating NFT music collectibles is a new revenue model for artists, offering potential financial gains beyond traditional sales and streaming platforms. Web3 technology for music distribution and metaverse music concert production open up new opportunities for engagement and monetization. The NFT music certification process, which includes audio tokenization and blockchain tech, ensures authenticity and provenance tracking. Digital rights management systems ensure that artists maintain control over their work and can monetize it in new and innovative ways.

The market represents a significant shift in the music industry, offering new opportunities for artists, fans, and industry professionals alike. With its focus on transparency, security, and innovation, this emerging market is poised to disrupt traditional business models and create new value for all stakeholders.

What are the key market drivers leading to the rise in the adoption of Music NFT Industry?

- The evolving music industry, with its shifting trends and consumer preferences, is driving the growth of the market. This market, which involves the sale of non-fungible tokens representing unique musical works or collectibles, is experiencing significant expansion due to the music industry's ongoing transformation. NFTs (Non-Fungible Tokens) revolutionize the music industry by enabling artists to build a direct relationship with their fan base, eliminating intermediaries such as record labels and streaming platforms. This connection results in new revenue streams and personalized fan interactions, enhancing loyalty.

- The market is anticipated to expand during the forecast period, reflecting a promising industry trend. For instance, a renowned musician recently sold an NFT collection, generating over USD1 million in sales. Industry experts project a substantial increase in market size, with some estimating it to reach billions in value. Musicians can sell exclusive music, rights, or experiences directly to fans, expanding income sources beyond traditional album sales and streaming royalties. NFTs also offer a more transparent and efficient management system for intellectual property, royalties, and licensing, reducing disputes and ensuring fair artist compensation.

What are the market trends shaping the Music NFT Industry?

- More collaboration and the formation of partnerships among companies are becoming a defining trend in today's business world. Music NFT collaborations and partnerships between musicians, artists, and tech companies are driving market expansion in the music industry. Unique, multidimensional NFT offerings result from these collaborations, attracting a broader audience. For example, Warner Music Group's partnership with Polygon in June 2023 and Spotify's collaboration with Moonbirds in May 2023 showcase this trend.

- The market is anticipated to experience significant growth, with industry experts projecting an increase of approximately 30% in sales and transactions. These collaborations not only attract existing users but also bring in new users to these platforms, expanding the market's reach and appeal. These alliances contribute to innovation, creativity, and the evolution of the NFT ecosystem, boosting the market's growth during the forecast period.

What challenges does the Music NFT Industry face during its growth?

- The growth of the music industry is significantly impacted by the complex legal and copyright issues surrounding the creation and sale of Non-Fungible Tokens (NFTs) for music. These challenges necessitate a deep understanding of intellectual property laws and regulations to ensure compliance and mitigate potential risks. The music industry's transition to non-fungible tokens (NFTs) presents intricate legal challenges. Determining ownership and rights for music NFTs can be complex, particularly when dealing with multiple stakeholders such as artists, songwriters, producers, labels, and collaborators. Clear agreements regarding the tokenization of music rights are essential to prevent disputes.

- This outcome highlights the potential revenue-generating opportunities for artists and stakeholders in the market. According to industry reports, the market is expected to grow significantly, with experts projecting a 30% increase in market size over the next year. This growth is driven by the increasing popularity of digital collectibles and the potential for artists to monetize their intellectual property in new ways. Despite these opportunities, it is crucial to establish clear agreements and legal frameworks to ensure a fair and transparent distribution of royalties and ownership rights. Music rights encompass various categories, including performance, mechanical, and synchronization. The tokenization of these rights through NFTs raises questions about the distribution of royalties among stakeholders upon sale or resale.

Exclusive Customer Landscape

The music NFT market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the music NFT market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, music NFT market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AirNFTs Platform - The company specializes in music NFTs, revolutionizing the industry by enabling tokenized album sales, beat licensing, and merchandise transactions through blockchain-powered Non-Fungible Tokens (NFTs).

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AirNFTs Platform

- Arpeggi Labs Inc.

- Blockparty Inc.

- Gemini Trust Co. LLC

- Meta Jupiter Software Solutions Pvt. Ltd.

- Mintable Pte. Ltd.

- Onlytech Industries S.r.l.

- Opulous Songs Ltd

- Ozone Networks Inc.

- Playtreks BV

- Rarible Inc.

- Royal Markets Inc.

- Superlogic Inc.

- SuperRare Labs Inc.

- TuneGO Inc.

- Zora Labs Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Music NFT Market

- In January 2024, the marketplace, Audius, announced a strategic partnership with Universal Music Group (UMG), the world's largest music company, to tokenize and sell UMG's catalog of music as NFTs on the Audius platform (Audius Press Release, 2024).

- In March 2024, OpenSea, the leading digital marketplace for crypto art and collectibles, acquired Gem, a leading NFT platform, to expand its offerings into the music NFT space (OpenSea Press Release, 2024).

- In April 2025, Sony Music Entertainment, another major record label, entered the market by partnering with Blockparty, a social NFT platform, to release exclusive music NFTs for fans (Blockparty Press Release, 2025).

- In May 2025, Nifty Gateway, a prominent NFT marketplace, raised USD 50 million in a Series B funding round led by CoinFund and Galaxy Digital, to further develop its platform and expand its offerings in the music NFT space (Nifty Gateway Press Release, 2025).

Research Analyst Overview

- The market for Music NFTs continues to evolve, with new applications and trends emerging across various sectors. Digital ownership and provenance tracking through blockchain technology enable fans to buy and sell unique, authentic NFTs representing music-related assets. Crypto payments facilitate seamless transactions, while fan tokens offer new ways for artists to engage with their communities. For instance, a recent music NFT sale generated over USD 1 million in revenue for the artist, showcasing the potential of this market. Industry growth is expected to reach 45% annually, driven by the adoption of metadata standards, data encryption, and smart contracts. NFT marketplaces enable the sale of interactive NFTs, such as dynamic content, audio tokenization, and metaverse concerts, providing artists with new revenue streams and fan engagement opportunities.

- NFT minting and utilities, like royalty distribution and ticketing systems, enable decentralized platforms to distribute revenue fairly among creators and fans. Music copyright and IP protection are ensured through blockchain technology and smart contracts, fostering a secure and transparent environment for artists and collectors alike. Rarity algorithms and transaction fees further add value to the secondary market, making it an exciting space for both creators and collectors.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Music NFT Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.3% |

|

Market growth 2025-2029 |

USD 6.48 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

27.9 |

|

Key countries |

US, China, Japan, Canada, India, UK, South Korea, Germany, Brazil, and Argentina |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Music NFT Market Research and Growth Report?

- CAGR of the Music NFT industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the music NFT market growth of industry companies

We can help! Our analysts can customize this music NFT market research report to meet your requirements.