India Mouthwash Market Size 2025-2029

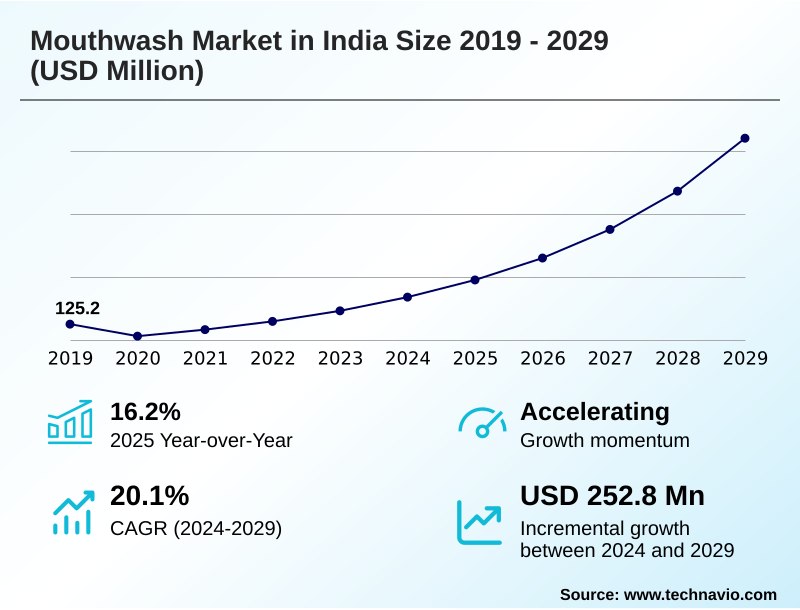

The india mouthwash market size is valued to increase by USD 252.8 million, at a CAGR of 20.1% from 2024 to 2029. Increase in awareness about oral health will drive the india mouthwash market.

Major Market Trends & Insights

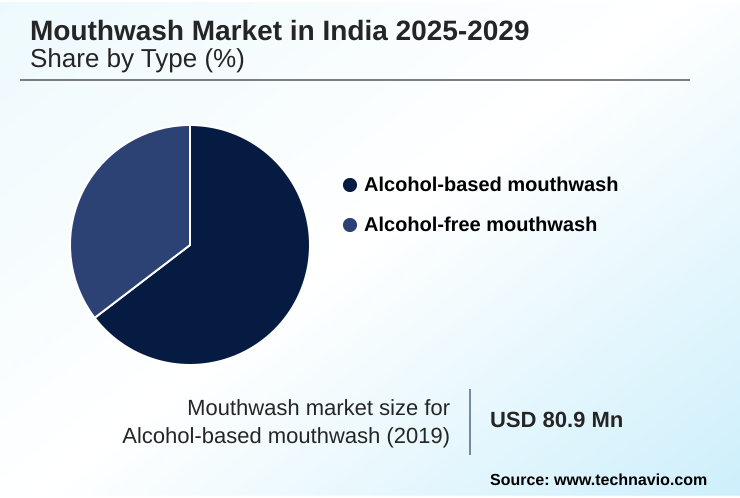

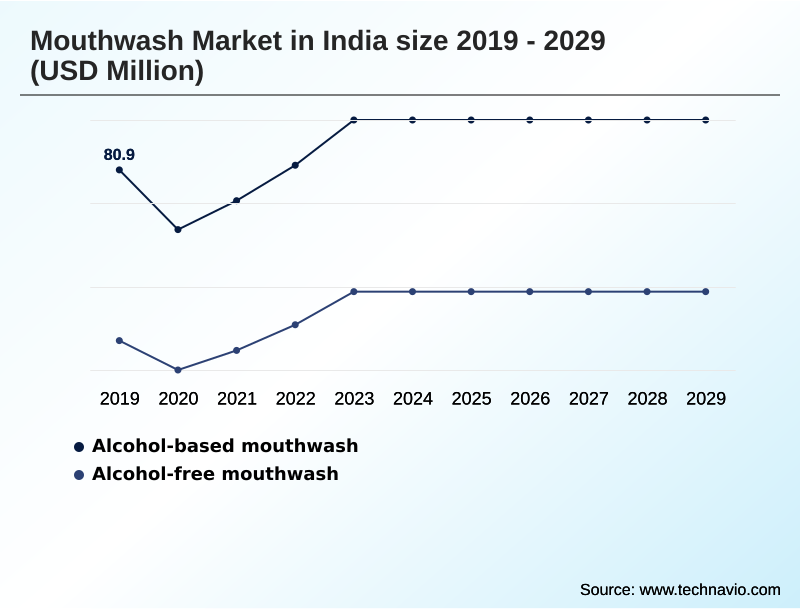

- By Type - Alcohol-based mouthwash segment was valued at USD 91.6 million in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 295.8 million

- Market Future Opportunities: USD 252.8 million

- CAGR from 2024 to 2029 : 20.1%

Market Summary

- The mouthwash market in India is undergoing a significant transformation, driven by heightened consumer oral health awareness and evolving product preferences. The market is increasingly defined by the demand for specialized oral care solutions that go beyond basic hygiene to address specific issues like dentin hypersensitivity, gum disease prevention, and halitosis treatment.

- A key business scenario involves manufacturers reformulating products to meet this demand, such as developing alcohol-free formulations with plaque-inhibiting compounds to cater to users with burning mouth syndrome or a dry mouth condition. This trend toward therapeutic benefits and sensitivity care is reshaping product portfolios.

- Concurrently, the omnichannel distribution strategy is critical for ensuring broad market access, from urban pharmacies to online platforms reaching rural consumers. However, the industry faces challenges from the impact of counterfeit products, which can degrade brand value and pose health risks, necessitating robust supply chain and brand protection strategies.

- The emphasis on natural ingredient focus and herbal oral care also reflects a broader shift towards preventive and consumer-friendly oral care products, compelling companies to innovate in both formulation and marketing.

What will be the Size of the India Mouthwash Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the India Mouthwash Market Segmented?

The india mouthwash industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Alcohol-based mouthwash

- Alcohol-free mouthwash

- Distribution channel

- Offline

- Online

- Flavor

- Mint

- Citrus

- Herbal

- Others

- Geography

- APAC

- India

- APAC

By Type Insights

The alcohol-based mouthwash segment is estimated to witness significant growth during the forecast period.

The mouthwash market in India is segmented by type, distribution channel, and flavor. A key market dynamic is the distinction between alcohol-based and alcohol-free formulations.

The alcohol-based segment, traditionally dominant, includes products with an ethanol concentration as high as 25%, valued for their strong antiseptic formulations and germ protection. However, concerns regarding oral mucosa permeability and dry mouth condition are influencing a consumer preference shift.

The alcohol-free segment is gaining traction, featuring plaque-inhibiting compounds and fluoride components without causing a burning sensation.

This segment focuses on specialized oral care solutions and functional benefits for consumers with dentin hypersensitivity or oral ulcers, reflecting a broader move toward gentle formulations and health-conscious positioning in the market.

The Alcohol-based mouthwash segment was valued at USD 91.6 million in 2023 and showed a gradual increase during the forecast period.

Market Dynamics

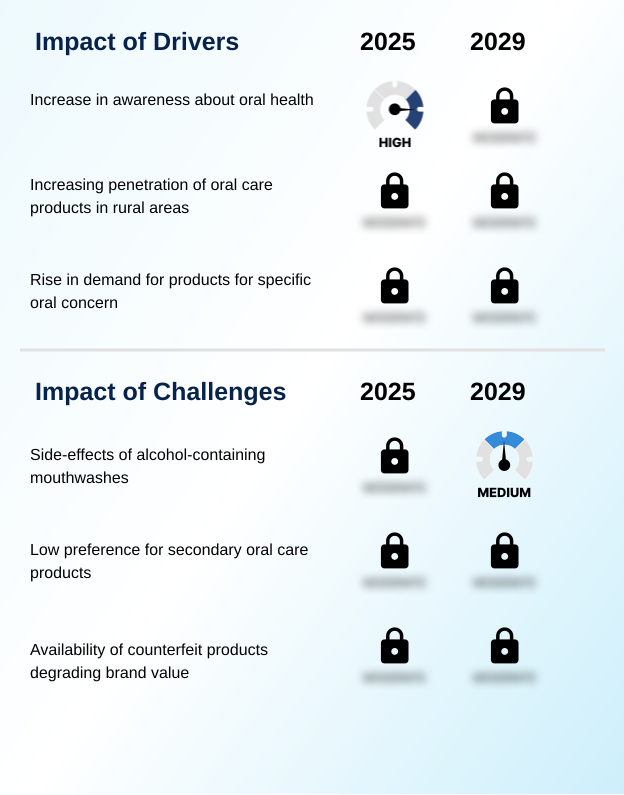

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- The strategic direction of the mouthwash market in India is increasingly shaped by nuanced consumer demands and targeted product development. A primary focus is on mouthwash for specific oral concerns, moving beyond general hygiene to address targeted needs. This has intensified research into the impact of alcohol on oral mucosa, leading to a notable consumer preference for alcohol-free mouthwash.

- Consequently, innovation in mouthwash formulations for sensitive teeth has become a key competitive differentiator. Marketing strategies for oral care products now emphasize consumer education on comprehensive oral hygiene, often facilitated by AI-powered tools for dental screenings. Success is also tied to effective distribution channel expansion in rural areas, which presents a larger logistical challenge compared to urban centers.

- The role of mouthwash in secondary oral care is being reinforced through public-private partnerships in oral health. Simultaneously, companies are exploring innovation in mouthwash flavor profiles to attract new user segments. However, the market's integrity is threatened by brand value degradation from counterfeit products, prompting stricter regulatory frameworks for oral care products.

- Firms are pursuing strategic product diversification in mouthwash, balancing traditional formulations with new therapeutic options. This is evident as alcohol-free variants now account for a market share that is growing at a rate approximately 1.5 times faster than their alcohol-based counterparts, influencing operational planning and inventory management.

What are the key market drivers leading to the rise in the adoption of India Mouthwash Industry?

- The primary driver for the market is the increasing consumer awareness regarding the importance of comprehensive oral health and hygiene.

- Market growth is primarily driven by rising consumer oral health awareness, supported by targeted educational campaigns and digital engagement.

- Corporate initiatives, such as programs offering free dental screenings via AI-powered tools to a network of 50,000 dentists, have significantly boosted consumer engagement and underscored the importance of preventive oral care.

- This heightened awareness is catalyzing the adoption of secondary oral care products, which now see adoption rates increasing by approximately 15% annually in urban areas. Furthermore, aggressive rural market penetration strategies are expanding product accessibility.

- Manufacturers are focusing on science-based products and consumer-friendly oral care solutions to build trust, ensuring their product portfolio expansion aligns with the demand for effective and safe daily use mouth rinse options.

What are the market trends shaping the India Mouthwash Industry?

- A significant trend influencing the market is the rising consumer demand for alcohol-free mouthwash formulations. This is driven by a growing preference for milder products that cater to sensitivity and wellness concerns.

- Key trends are reshaping the competitive landscape, driven by a pronounced consumer preference shift toward wellness-oriented products. The demand for alcohol-free formulations is accelerating, with these products demonstrating a market share growth nearly 40% faster than traditional variants.

- This movement is coupled with a rising natural ingredient focus, where herbal oral care solutions are increasingly sought for their perceived gentle formulations and therapeutic personal care attributes. An effective omnichannel distribution strategy is now essential for market penetration, as online sales channels have grown by over 25% in the last year.

- This diversification allows brands to engage with consumers directly, promoting products with specialized sensitivity care and highlighting health-conscious positioning. The expansion of private-label brands also adds a new layer of competition.

What challenges does the India Mouthwash Industry face during its growth?

- A key challenge affecting market growth stems from consumer concerns over the potential side effects associated with alcohol-containing mouthwashes.

- The market faces significant challenges related to product formulation and market integrity. Concerns over the side effects of formulations with high ethanol concentration, sometimes reaching up to 25%, are a primary restraint. These products can disrupt the oral microbiome balance and cause a dry mouth condition, leading to oral disputes and consumer dissatisfaction.

- This has directly fueled the demand for milder alternatives. Another major challenge is the counterfeit product impact, which degrades brand value and undermines consumer trust. The presence of such products requires companies to invest an additional 10-15% of their marketing budgets in anti-counterfeiting measures and brand protection campaigns.

- Addressing these issues through innovation in antiseptic formulations and transparent communication is critical for sustained growth.

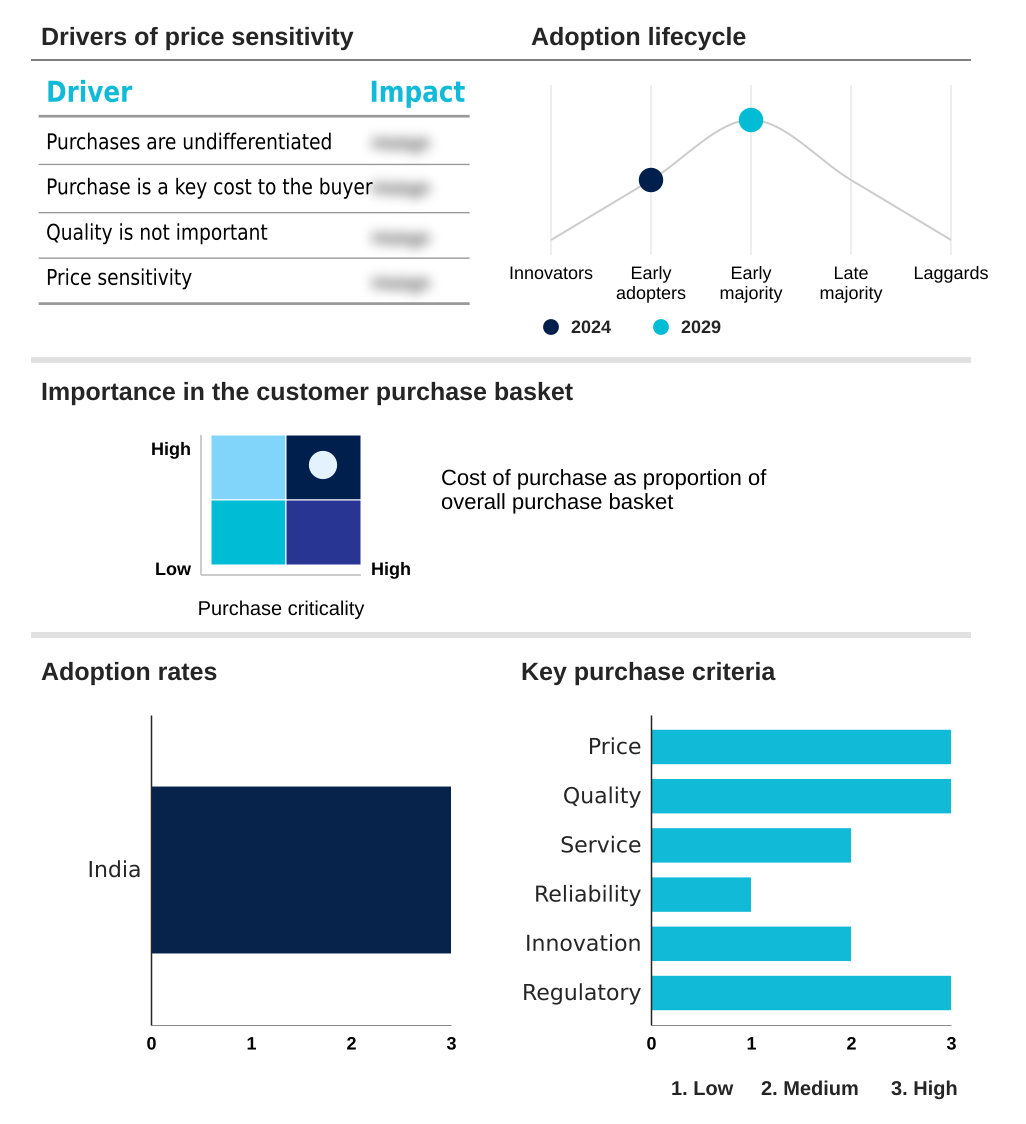

Exclusive Technavio Analysis on Customer Landscape

The india mouthwash market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the india mouthwash market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of India Mouthwash Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, india mouthwash market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - Analysis indicates a focused portfolio of science-based products within consumer healthcare, emphasizing solutions for oral health and sensitivity care through continuous product innovation and portfolio expansion.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Amway Corp.

- Church and Dwight Co. Inc.

- Cipla Inc.

- Colgate Palmolive Co.

- Dabur India Ltd.

- Dr. Harold Katz LLC

- GlaxoSmithKline Plc

- Idem Health Products Pvt. Ltd.

- IPCA Health Products Ltd.

- Johnson and Johnson Services

- Koninklijke Philips NV

- Little Greave Pharmaceuticals Pvt. Ltd.

- Reckitt Benckiser Group Plc

- Sanat Products Ltd.

- Sandika Pharmaceuticals Pvt. Ltd.

- The Himalaya Drug Co.

- Procter and Gamble Co.

- Unilever PLC

- Unimarck Pharma India Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in India mouthwash market

- In November, 2024, Colgate-Palmolive (India) Ltd. launched its Oral Health Movement, a nationwide initiative in partnership with the Indian Dental Association that utilizes an AI-powered tool for free dental screenings.

- In February, 2025, GlaxoSmithKline Plc's brand, Sensodyne, introduced its first mouthwash in India, the alcohol-free Complete Protection+ Mouthwash, specifically formulated for individuals with sensitive teeth.

- In September, 2024, Dabur India Ltd. announced an expansion of its herbal oral care range with the launch of a new clove and mint-based mouthwash aimed at consumers seeking natural ingredient focus and traditional wellness benefits.

- In April, 2025, Johnson and Johnson Services revealed a new strategic partnership with a major e-commerce aggregator to bolster the online distribution of its Listerine brand, improving accessibility in tier-2 and tier-3 cities across India.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled India Mouthwash Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 181 |

| Base year | 2024 |

| Historic period | 2019-2023 |

| Forecast period | 2025-2029 |

| Growth momentum & CAGR | Accelerate at a CAGR of 20.1% |

| Market growth 2025-2029 | USD 252.8 million |

| Market structure | Fragmented |

| YoY growth 2024-2025(%) | 16.2% |

| Key countries | India |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- An analysis of the mouthwash market in India reveals a dynamic environment where product innovation is directly tied to evolving consumer health paradigms. The discourse is shifting from basic germ protection to a more sophisticated focus on oral microbiome balance and the therapeutic benefits of specialized ingredients.

- Formulations now actively incorporate cetylpyridinium chloride and other plaque-inhibiting compounds for tartar accumulation control and gum disease prevention. There is a marked emphasis on addressing conditions like dentin hypersensitivity and halitosis treatment, with products offering tangible functional benefits.

- A key boardroom consideration is the strategic response to concerns about ethanol concentration and its effect on oral mucosa permeability, which drives investment in alcohol-free alternatives to mitigate issues like burning mouth syndrome and oral ulcers.

- Companies are leveraging science-based products to build consumer trust, with one leading player expanding its retail network to 7.9 million outlets to improve access to these advanced antiseptic formulations.

- This strategic expansion underscores the importance of a robust distribution infrastructure to support product portfolio expansion and cater to a health-conscious consumer base seeking breath freshness and gum-related conditions solutions without adverse effects.

What are the Key Data Covered in this India Mouthwash Market Research and Growth Report?

-

What is the expected growth of the India Mouthwash Market between 2025 and 2029?

-

USD 252.8 million, at a CAGR of 20.1%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Alcohol-based mouthwash, and Alcohol-free mouthwash), Distribution Channel (Offline, and Online), Flavor (Mint, Citrus, Herbal, and Others) and Geography (APAC)

-

-

Which regions are analyzed in the report?

-

APAC

-

-

What are the key growth drivers and market challenges?

-

Increase in awareness about oral health, Side-effects of alcohol-containing mouthwashes

-

-

Who are the major players in the India Mouthwash Market?

-

3M Co., Amway Corp., Church and Dwight Co. Inc., Cipla Inc., Colgate Palmolive Co., Dabur India Ltd., Dr. Harold Katz LLC, GlaxoSmithKline Plc, Idem Health Products Pvt. Ltd., IPCA Health Products Ltd., Johnson and Johnson Services, Koninklijke Philips NV, Little Greave Pharmaceuticals Pvt. Ltd., Reckitt Benckiser Group Plc, Sanat Products Ltd., Sandika Pharmaceuticals Pvt. Ltd., The Himalaya Drug Co., Procter and Gamble Co., Unilever PLC and Unimarck Pharma India Ltd.

-

Market Research Insights

- Market dynamics are shaped by a pronounced consumer preference shift toward specialized and gentler products. The adoption of an omnichannel distribution strategy is critical, with offline channels still commanding a majority of sales, yet online platforms are expanding access, particularly in semi-urban areas.

- This strategic pivot is reflected in operational metrics, where companies expanding their physical retail network have reported an increase in market reach by over 2.5%, enhancing oral hygiene routine enhancement. Furthermore, the growth in private-label brands and a focus on herbal oral care are introducing new competitive pressures.

- The market is also responding to the need for secondary oral care products, with awareness campaigns contributing to a year-over-year market expansion of 16.2% as consumers integrate mouthwash into their daily routines.

We can help! Our analysts can customize this india mouthwash market research report to meet your requirements.