Mooring Systems Market Size 2024-2028

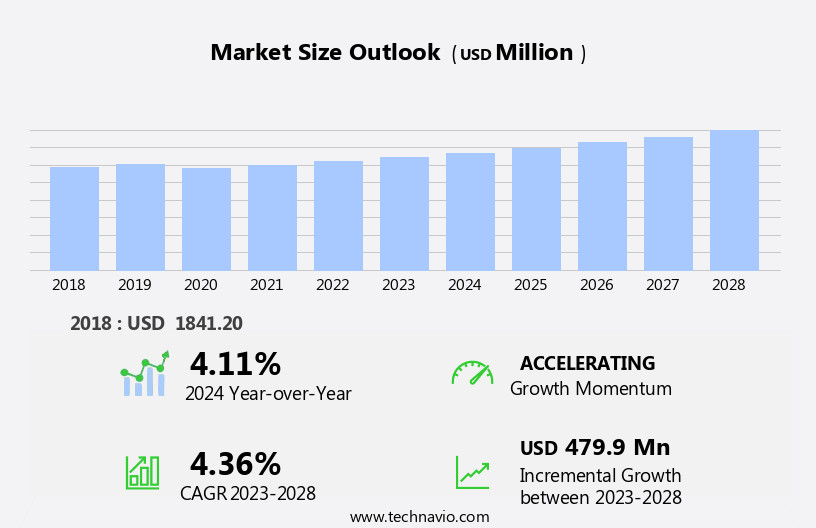

The mooring systems market size is forecast to increase by USD 479.9 million at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth due to the surge in offshore oil and gas exploration activities worldwide. The rise in deepwater and ultra-deep-water E and P activities is a key driving factor, as these projects require advanced mooring systems to ensure stability and safety. Additionally, environmental concerns associated with offshore E and P activities are leading to the adoption of eco-friendly mooring solutions. These trends are expected to continue, with the market poised for steady growth In the coming years. The increasing focus on renewable energy, such as wind energy and wave energy, is also creating new opportunities for mooring systems providers.

- Despite these opportunities, challenges remain, including the high cost of installation and maintenance, as well as the need for reliable and durable systems that can withstand harsh marine conditions. Overall, the market is an essential component of the global energy industry, and its growth is closely tied to the expansion of offshore E and P activities.

What will be the Size of the Mooring Systems Market During the Forecast Period?

- The market encompasses the production, supply, and installation of mooring solutions for floating production, storage, and offloading (FPSO), spars, and other offshore structures. This market is driven by the increasing demand for floating structures in independent oil and gas exploration and production, particularly in deep water regions. Mooring systems include various components such as anchors, shackles, mooring lines, wires, chains, and connectors.

- The market is influenced by environmental conditions, including waves, currents, and winds, as well as vessel type and water depth. Mooring systems are essential for securing floating structures in anchorage, enabling rig activity and offshore drilling. Single point mooring and taut leg systems are commonly used mooring types in the industry.

- The market for mooring systems is expected to grow due to the expanding use of floating structures for oil and gas production and the advancements in mooring technology, including the adoption of synthetic mooring lines and anchors.

How is this Mooring Systems Industry segmented and which is the largest segment?

The mooring systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Single point

- Spread mooring

- Dynamic positioning

- Others

- Application

- Tension leg platform

- FPSO

- Semi-submersible

- SPAR

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Type Insights

- The single point segment is estimated to witness significant growth during the forecast period.

Mooring systems play a crucial role in securing floating production, storage, and offloading (FPSO) structures, SPARs, semisubmersibles, and other offshore installations. Single point mooring systems, a type of mooring, involve a permanently moored buoy or jetty anchored offshore, serving as a loading or offloading point for tankers. Their adoption in oil and gas transportation is increasing due to the growing number of crude oil refineries In the Asia Pacific region utilizing this technology. For instance, Kochi Refineries Ltd (BPCl-KRL) installed a single point mooring system in February 2022 for captive crude oil import. Mooring systems are essential for various floating structures, including FPSOs, independent oil platforms, and offshore drilling rigs, as they ensure stability and safety in challenging environmental conditions, such as deep water and harsh weather.

The market for mooring systems is expected to expand due to the rising demand for offshore energy production, including oil and gas discoveries In the Ivory Coast and the global energy crisis. Key components of mooring systems include mooring lines, anchors, shackles, and connectors. The choice of mooring type, such as catenary, taut leg, dynamic positioning, or spread mooring systems, depends on water depth, anchorage requirements, vessel type, and environmental conditions. Companies like DNV GL are investing in research and development to improve the efficiency and durability of mooring systems. The market encompasses floating liquefied natural gas vessels, offshore wind farms, tidal energy platforms, and floating solar plants.

Get a glance at the Mooring Systems Industry report of share of various segments Request Free Sample

The Single point segment was valued at USD 583.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The offshore wind energy sector is experiencing significant growth, with China leading the way in installed capacity. In 2021, China installed 16.9 GW of offshore wind capacity, a quadrupling from the previous year. This trend is expected to continue, with annual installations potentially reaching 5 GW or more, according to the Global Wind Energy Council. Consequently, the demand for mooring systems in offshore wind power is increasing rapidly. Mooring systems, including anchors, shackles, mooring lines, wires, and chains, are essential for securing floating structures in challenging marine conditions. Factors such as waves, currents, and winds necessitate robust and reliable mooring solutions.

The market expansion is driven by increasing energy demand, offshore exploration and production operations, and commercial developments in floating wind farms, tidal energy platforms, and deepwater oil and gas discoveries. Key markets include the Ivory Coast, Global energy crisis, offshore oil and gas, renewable energy projects, and strategic plans for collaboration, mergers, and acquisitions. Mooring systems are used in various offshore structures, including TLPs, semi-submersible platforms, and floating production, storage, and offloading (FPSOs). Mooring types include catenary mooring systems, taut leg mooring, dynamic positioning, and spread mooring systems. The market is expected to grow, with key players focusing on product line expansion, technical understanding, and addressing the challenges of deep sea habitats.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Mooring Systems Industry?

Increase in global offshore oil and gas exploration activities is the key driver of the market.

- The global offshore energy market, including oil and gas production and renewable energy projects, has seen significant growth due to increasing exploration activities and government initiatives. For instance, Russia's Energy Strategy up to 2035 aims to strengthen its role In the global energy market and promote the use of LNG and gas engine fuel. In India, the Ministry of Petroleum and Natural Gas approved oil and gas projects worth approximately USD13 billion. Mooring systems play a crucial role in offshore energy production, particularly for floating production, storage, and offloading (FPSO) structures, such as SPARs, semisubmersibles, and TLPs. These structures require various types of mooring systems, including anchors, shackles, mooring lines, wires, and chains, which are designed to withstand environmental conditions in shallow and deep waters.

- Mooring systems for offshore wind farms and floating solar plants also utilize similar technologies. The market expansion In these areas is driven by the global energy crisis and the increasing demand for clean energy. Floating constructions, such as anchor lines and radial patterns, are used to secure offshore vessels and floating liquefied natural gas vessels. The market dynamics for mooring systems are influenced by factors such as water depth, anchorage, mooring type, and energy consumption. Catenary mooring systems, taut leg mooring, and dynamic positioning are commonly used mooring types. Environmental conditions, including waves, currents, and winds, also impact the design and functionality of mooring systems.

- Collaborations, mergers, acquisitions, political support, and strategic plans are essential for the growth and development of the market. Companies are investing in research and development to improve the technical understanding of deep sea habitats and create innovative solutions for various anchoring options. The market is expected to continue growing as offshore exploration and production operations expand, and renewable energy projects increase in commercial developments.

What are the market trends shaping the Mooring Systems Industry?

Rise in deepwater and ultra-deep-water E and P activities is the upcoming market trend.

- Offshore rigs are reaching maturity or nearing depletion, causing upstream oil and gas companies to explore deepwater and ultra-deep-water projects for their substantial reserves and untapped potential. However, the commercial feasibility of these projects necessitates an average crude oil price of USD60/barrel. The production of oil, particularly in ultra-deep-water environments, is more costly than conventional methods due to the challenging conditions of extreme climates at sea. Mooring systems, including anchors, shackles, mooring lines, wires, and chains, are essential components of offshore projects, especially in deep and ultra-deep-water environments. Mooring systems must withstand environmental conditions such as waves, currents, and winds.

- Mooring systems vary depending on vessel type, including single point mooring, taut leg system, semi-taut leg system, spread mooring, dynamic positioning mooring, suction anchors, vertical load anchors, and drag embedment anchors. Mooring types include catenary mooring systems, taut leg mooring, dynamic positioning, and floating production, storage, and offloading (FPSO) systems. Deepwater and offshore wind farms, floating solar plants, and deepwater oil and gas discoveries are expanding the market for mooring systems. DNV GL sets the standards for mooring systems to ensure safety and reliability. The market for mooring systems is expected to grow due to the increasing demand for energy and the expansion of offshore exploration and production operations.

- The initial cost of deep sea habitats and the need for a technical understanding of mooring systems are challenges. Collaborations, mergers, acquisitions, political support, and strategic plans are driving market expansion. Floating structures, including TLPs, semi-submersible platforms, and floating liquefied natural gas vessels, consume significant energy, making energy efficiency a crucial consideration. Wind turbines and floating production, offloading boats are essential components of offshore wind resources and floating oil and gas platforms. Marine territories and the wind energy business are key areas of focus for market expansion.

What challenges does the Mooring Systems Industry face during its growth?

Environmental concerns associated with offshore E and P activities is a key challenge affecting the industry growth.

- Mooring systems play a crucial role In the offshore energy industry, enabling the secure anchoring of floating production, storage, and offloading (FPSO) units, SPARs, semisubmersibles, and other floating structures. These systems consist of anchors, mooring lines, shackles, wires, chains, and connectors, designed to withstand various environmental conditions in shallow and deep waters. The choice of mooring type depends on the vessel type, including single point mooring, taut leg system, semitaut leg system, spread mooring, dynamic positioning mooring, and suction anchors or vertical load anchors. Mooring systems are essential for offshore oil and gas production, as well as renewable energy projects such as offshore wind farms and floating solar plants.

- In the oil and gas sector, mooring systems facilitate deepwater oil and gas discoveries In the Ivory Coast and other regions, contributing to the global energy crisis and offshore exploration and production operations. In the renewable energy sector, mooring systems enable the deployment and operation of floating wind turbines and tidal energy platforms. The market for mooring systems is driven by increasing energy demand, offshore exploration and production activities, and the expansion of offshore wind farms and other renewable energy projects. The market also faces challenges related to the initial cost and capital expenditure of mooring systems, as well as the need for technical understanding of deep sea habitats and bottom conditions.

- Strategic plans, collaborations, mergers, acquisitions, and political support are crucial for market expansion. Mooring systems are used in various applications, including floating liquefied natural gas vessels, energy consumption in wind turbines, and floating production and offloading boats. The market for mooring systems is expected to grow significantly due to the increasing demand for clean energy and the need for innovative solutions for offshore energy production and exploration.

Exclusive Customer Landscape

The mooring systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mooring systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mooring systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acteon Group Ltd.

- Anchor Industries PTY Ltd.

- Bluewater Energy Services BV

- BW Offshore Ltd.

- Cargotec Corp.

- Grup Servicii Petroliere SA

- Hazelett Marine

- Kobelt Manufacturing Co. Ltd.

- Mampaey Offshore Industries B.V.

- MODEC Inc.

- Mooring Systems Inc.

- NOV Inc.

- Offspring International Ltd.

- Qingdao Waysail Ocean Technology Co. Ltd.

- SBM Offshore NV

- SOFEC Inc.

- Timberland Equipment Ltd.

- Trelleborg AB

- Vryhof

- Whittaker Engineering Stonehaven Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the design, manufacturing, and installation of mooring solutions for various floating structures In the energy sector. These structures include, but are not limited to, production platforms, storage and offloading vessels, and renewable energy installations. Mooring systems play a crucial role in ensuring the stability and safety of these structures, particularly in challenging environmental conditions. Floating production, storage, and offloading (FPSO) vessels require robust mooring systems to withstand the forces of waves, currents, and winds. The choice of mooring components, such as anchors, shackles, and mooring lines, depends on the water depth, vessel type, and environmental conditions.

Steel and synthetic anchors, along with various types of mooring lines, are commonly used in deep water applications. Offshore mooring systems can be categorized based on the vessel type and mooring configuration. Single point mooring (SPM) systems, for instance, utilize a single anchor and a tether to secure the vessel. Taut leg systems and semitaut leg systems are other popular options, offering greater flexibility and stability. Spread mooring systems, which use multiple anchors and mooring lines, are suitable for larger structures, such as floating production, storage, and offloading systems for deepwater oil and gas discoveries. Dynamic positioning mooring systems employ thrusters and sensors to maintaIn the position of the vessel, reducing the need for traditional anchoring.

Suction anchors and vertical load anchors are alternative anchoring options for shallow water applications. The energy landscape is evolving, with a growing focus on renewable energy projects, including offshore wind farms and floating solar plants. These projects also require specialized mooring systems to ensure the stability and safety of the installations. The market expansion for mooring systems is driven by increasing energy demand, offshore exploration, and production operations. Initial costs and capital expenditure are significant factors In the selection of mooring systems. Technical understanding of the environmental conditions and bottom conditions is essential to design and install effective mooring systems.

Collaborations, mergers, and acquisitions among industry players and research organizations, such as DNV GL, contribute to the advancement of mooring technology and innovation. Political support and strategic plans are also essential for the growth of the market. The market is expected to witness continued expansion as the energy sector shifts towards cleaner, more sustainable energy sources and deeper offshore discoveries. In conclusion, the market plays a vital role in enabling the deployment and operation of floating structures In the energy sector. The choice of mooring components and configurations depends on various factors, including water depth, environmental conditions, and vessel type. The market is driven by increasing energy demand, offshore exploration, and production operations, and is expected to continue growing as the energy landscape evolves towards renewable energy sources and deeper offshore discoveries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 479.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mooring Systems Market Research and Growth Report?

- CAGR of the Mooring Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mooring systems market growth of industry companies

We can help! Our analysts can customize this mooring systems market research report to meet your requirements.