Microwave Radio Market Size 2025-2029

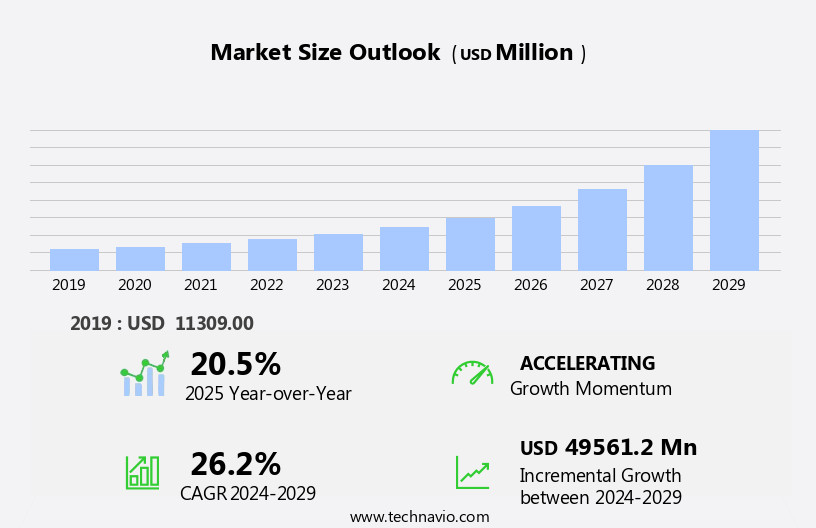

The microwave radio market size is forecast to increase by USD 49.56 billion, at a CAGR of 26.2% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for point-to-point communication networks. This trend is being fueled by the rapid adoption of 5G technology, which requires high-capacity, reliable, and flexible connectivity solutions. However, the market faces challenges related to spectrum allocation issues. Microwave radio technology, with its ability to provide high-speed, wireless connectivity over long distances, is becoming increasingly essential in the era of digital transformation. The growing need for seamless and uninterrupted communication networks, especially in remote and hard-to-reach areas, is further boosting the market's potential.

- On the other hand, spectrum allocation remains a significant challenge, as regulatory bodies grapple with managing the limited available spectrum to accommodate the increasing demand for wireless communication services. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on innovation, collaboration, and regulatory compliance to stay ahead of the competition.

What will be the Size of the Microwave Radio Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by continuous evolution and dynamic market activities. Phasers and adaptive antennas are integral components in this domain, enhancing signal transmission and reception in mobile communication, satellite communication, and scientific instrumentation applications. The ongoing unfolding of market trends encompasses the integration of these technologies in various sectors. Mobile communication relies on frequency hopping and power efficiency to mitigate intermodulation distortion and enhance signal quality. In satellite communication, power dividers and frequency converters facilitate the distribution and conversion of microwave signals. Meanwhile, scientific instrumentation leverages phase shifters and adaptive antennas for precise signal processing and directionality. The applications of microwave radio technology extend to military and medical sectors, where reliability testing and error correction coding ensure optimal performance.

Antenna arrays, microstrip antennas, and reflector antennas are employed for diverse applications, from point-to-point links to radar systems. In the realm of microwave radio, technological advancements are a constant. Solid-state amplifiers and traveling-wave tubes (TWTs) offer high-power amplification, while coaxial cables and RF filters ensure signal integrity. Spurious emissions and modulation techniques are addressed through thermal management and signal processing. The market's dynamism is further accentuated by the integration of packaging technologies and the development of horn antennas. As the market continues to evolve, it presents ample opportunities for innovation and growth.

How is this Microwave Radio Industry segmented?

The microwave radio industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Hybrid microwave radio

- Packet microwave radio

- TDM microwave radio

- Application

- Communication

- Power utilities

- Others

- Technology

- Point-to-point

- Point-to-multipoint

- Millimeter wave radio

- Frequency Range

- Ku band

- C band

- Ka band

- V band

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

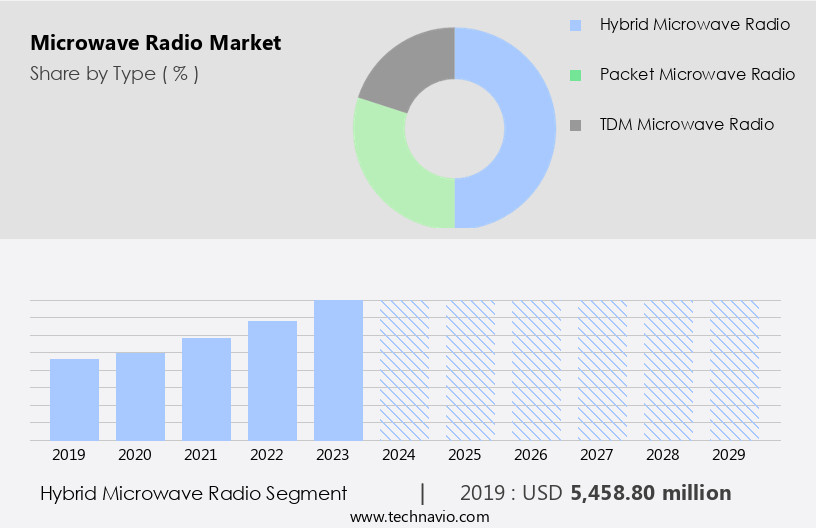

The hybrid microwave radio segment is estimated to witness significant growth during the forecast period.

The hybrid microwave radio (HMR) market is experiencing significant growth due to the increasing demand for high-speed and reliable point-to-point connectivity in various industries. HMR technology, which combines the advantages of microwave and packet-switched networks, utilizes point-to-point links to transmit data over radio frequencies. This solution is particularly beneficial in remote or rural areas where traditional wired connections may be unavailable or impractical. The expansion of industries such as telecommunications, transportation, oil and gas, and defense, which require high-speed data transmission, is driving the demand for HMR. Furthermore, the proliferation of connected devices and applications, such as the Internet of Things (IoT), necessitates efficient and dependable data transfer solutions.

According to recent research, the number of global IoT connections reached 16 billion in 2020 and is projected to grow exponentially. HMR technology employs various components, including RF filters, thermal management systems, solid-state amplifiers, traveling-wave tubes (TWTS), high-power amplifiers, microwave tubes, coaxial cables, and frequency converters. These components ensure optimal signal quality, minimize spurious emissions, and provide power efficiency. Advanced modulation techniques, such as error correction coding, spread spectrum, and frequency hopping, enhance the reliability and security of HMR systems. Additionally, HMR technology incorporates various antenna types, including microstrip, reflector, parabolic, horn, and adaptive antennas, to optimize signal coverage and directionality.

Phase shifters and power dividers facilitate beamforming and adaptive array configurations, further improving system performance. The HMR market also caters to diverse applications, such as military communications, scientific instrumentation, satellite communication, and radar systems. Ensuring the reliability and durability of these systems through rigorous testing and robust packaging technologies is crucial. In conclusion, the hybrid the market is witnessing substantial growth due to the increasing need for high-speed and reliable connectivity across various industries and applications. The integration of advanced components, modulation techniques, and antenna designs, along with stringent reliability testing and packaging technologies, is driving the market's evolution.

The Hybrid microwave radio segment was valued at USD 5.46 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

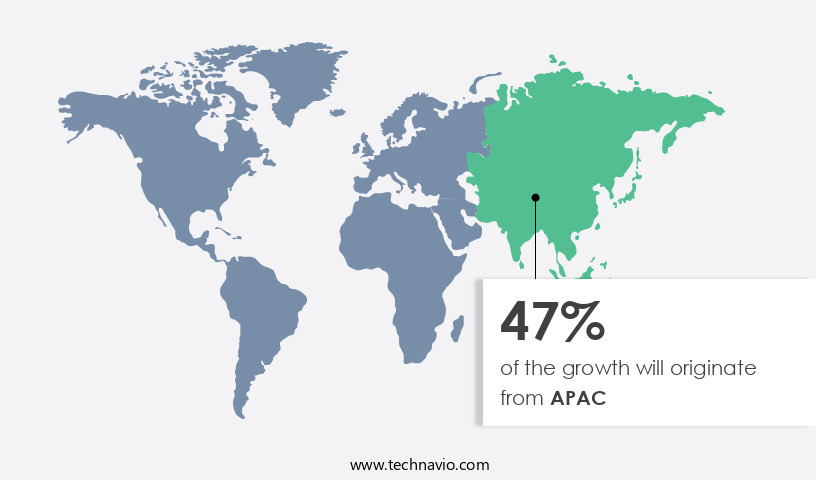

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing dynamic growth, with key segments including frequency bands, RF filters, thermal management, solid-state amplifiers, traveling-wave tubes (TWTs), high-power amplifiers, microwave tubes, point-to-point links, frequency multipliers, low-noise amplifiers, coaxial cables, spurious emissions, modulation techniques, microstrip antennas, reflector antennas, signal processing, packaging technologies, reliability testing, military applications, medical applications, parabolic antennas, radar systems, wireless communication, antenna arrays, error correction coding, spread spectrum, horn antennas, phase shifters, adaptive antennas, mobile communication, scientific instrumentation, satellite communication, frequency hopping, power efficiency, intermodulation distortion, power dividers, and frequency converters. The Ku band, operating between 12 and 18 GHz, is a significant market driver due to its role in high-capacity communication solutions.

Widely used in satellite communications for broadcasting and broadband services, the Ku band ensures reliable performance and minimal interference. Its utility in geographically remote or underserved areas, where dependable communication links are essential, makes it a preferred choice for both commercial and governmental applications. The maritime and aviation industries, in particular, have embraced the Ku band for their critical communication needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving industry that caters to the communication needs of various sectors, including telecom, broadcast, and defense. Microwave radio systems employ high-frequency electromagnetic waves for wireless transmission, offering advantages such as high data rates, low latency, and extensive coverage. Key players in this market include manufacturers, integrators, and providers of microwave radio solutions. These entities focus on innovations in areas like frequency bands, modulation techniques, and antenna technologies to enhance system performance and expand their market reach. The market is witnessing significant growth due to factors like increasing demand for high-speed wireless connectivity, ongoing infrastructure development, and advancements in technology. Applications encompass point-to-point and point-to-multipoint networks, backhaul and fronthaul solutions, and satellite uplink and downlink systems. Microwave radio systems are also essential components of 5G networks, further fueling market growth. Additionally, the market is witnessing a shift towards compact, lightweight, and energy-efficient solutions, as well as the integration of artificial intelligence and machine learning for improved network management and optimization.

What are the key market drivers leading to the rise in the adoption of Microwave Radio Industry?

- The surge in demand for point-to-point communication networks serves as the primary market catalyst.

- Microwave radio systems have become essential for businesses and industries seeking high-speed, reliable, and cost-effective communication networks. These systems offer point-to-point communication with low latency, making them the preferred choice for real-time process control, transaction processing, video conferencing, and data transmission. The increasing digitization and automation across various industries are fueling the demand for such networks. Furthermore, urbanization, the need for high-speed communication in rural areas, and government initiatives to enhance communication infrastructure in outlying regions are significant growth drivers. Key components of microwave radio systems include low-noise amplifiers, coaxial cables, modulation techniques, microstrip antennas, reflector antennas, signal processing, packaging technologies, and reliability testing.

- These components ensure the efficient and reliable transmission of data over long distances. Low-noise amplifiers enhance the signal strength, while coaxial cables provide a reliable and low-loss connection between components. Modulation techniques enable efficient data transmission, while microstrip and reflector antennas ensure a wide coverage area. Signal processing and packaging technologies optimize system performance and reliability, while reliability testing ensures the system's durability and ability to withstand harsh environmental conditions. In summary, microwave radio systems offer a high-speed, low-latency communication solution that is essential for businesses and industries seeking to digitize and automate their operations. The demand for such systems is increasing due to urbanization, the need for high-speed communication in rural areas, and government initiatives to improve communication infrastructure.

- Key components, such as low-noise amplifiers, coaxial cables, modulation techniques, microstrip antennas, reflector antennas, signal processing, packaging technologies, and reliability testing, ensure the efficient and reliable transmission of data over long distances.

What are the market trends shaping the Microwave Radio Industry?

- The adoption of 5G technology is gaining momentum and is becoming the prevailing market trend. This technological advancement is set to reshape various industries by offering faster data transfer rates, lower latency, and increased connectivity.

- The market is experiencing significant growth due to the increasing demand for high-speed wireless communication solutions. The adoption of 5G technology is a key driver, as the higher frequency bands used in 5G require more fiber backhaul and microwave radio links to deliver higher speeds and lower latency. Microwave radio technology is a crucial element of 5G infrastructure, providing a cost-effective way to connect remote 5G nodes and offer high-speed wireless backhaul links. Moreover, various industries, including military applications and medical services, are increasingly relying on microwave radio technology for wireless communication. Parabolic antennas and antenna arrays are commonly used in military applications for radar systems and secure communication.

- In the medical sector, microwave radio technology is employed for wireless communication between medical devices and healthcare networks. Error correction coding, spread spectrum, and advanced antenna technologies like horn antennas are essential components of microwave radio systems, ensuring reliable and efficient data transmission. The market's growth is further propelled by the increasing need for immersive and harmonious wireless communication experiences, with a focus on strike-through error rates and thematic throughput. As the demand for high-speed and high-bandwidth networks continues to rise, the market is poised for continued growth.

What challenges does the Microwave Radio Industry face during its growth?

- Microwave radio spectrum allocation is a significant challenge that impedes the growth of the industry due to the limited availability and increasing demand for frequencies in this band.

- The market faces ongoing challenges related to spectrum allocation, which significantly impacts industry growth. The radio frequency spectrum is a limited resource, and regulatory authorities' decisions on frequency allocation play a critical role in market expansion. The competition for spectrum among various wireless technologies, including mobile communication, scientific instrumentation, and satellite communication, results in congestion, interference, and signal degradation. This, in turn, negatively affects connectivity. Regulatory bodies struggle to keep pace with the demands and innovations of the wireless industry, leading to spectrum scarcity for microwave radio users.

- Technological advancements, such as phase shifters, adaptive antennas, frequency hopping, power efficiency, intermodulation distortion mitigation, and power dividers, are being employed to address these challenges and improve the overall performance and efficiency of microwave radio systems.

Exclusive Customer Landscape

The microwave radio market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the microwave radio market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, microwave radio market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aviat Networks Inc. - This company specializes in advanced microwave communication solutions, showcasing the Aviat Eclipse radio as a premier offering.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aviat Networks Inc.

- Axxcss Wireless Solutions Inc.

- Cambium Networks Corp.

- Ceragon Networks Ltd.

- Comba Telecom Systems Holdings Ltd.

- Curvalux UK Ltd.

- DragonWave X

- Extreme Networks Inc.

- Fujitsu Ltd.

- Huawei Technologies Co. Ltd.

- Intracom SA Telecommunications Solutions

- NEC Corp.

- NETGEAR Inc.

- Nokia Corp.

- Proxim Wireless Corp.

- RAD Data Communications Ltd.

- SIAE MICROELETTRONICA Spa

- Telefonaktiebolaget LM Ericsson

- Ubiquiti Inc.

- ZTE Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Microwave Radio Market

- In January 2024, Nokia announced the launch of its new microwave radio product, the AirScale Microwave Portfolio, featuring advanced beamforming technology and increased capacity. This development aimed to enhance network performance and efficiency for telecom operators (Nokia Press Release, 2024).

- In March 2024, Intel and Samsung Electronics formed a strategic partnership to collaborate on the development of 700 GHz millimeter-wave (mmWave) technology for 5G networks. This collaboration aimed to combine Intel's expertise in mmWave technology with Samsung's semiconductor manufacturing capabilities (Intel Press Release, 2024).

- In May 2024, Cisco Systems acquired privately held microwave radio solutions provider, Radware, for approximately USD 1.1 billion. This acquisition aimed to strengthen Cisco's wireless networking portfolio and expand its offerings in the market (Cisco Press Release, 2024).

- In February 2025, the European Union (EU) approved the deployment of 5G networks using microwave radio technology, paving the way for the widespread implementation of 5G networks across the EU. This approval marked a significant milestone in the rollout of 5G networks in Europe (European Commission Press Release, 2025).

Research Analyst Overview

- The market is characterized by continuous advancements in high-frequency electronics, driven by the demand for faster data transfer rates and improved network performance. Network analysis plays a crucial role in ensuring signal integrity and system integration, while antenna design and electromagnetic compatibility (EMC) are essential for optimizing RF performance and reducing interference. Technical support and training programs are vital for maintaining the complex systems, with manufacturing processes and spectrum analysis essential for ensuring compliance with safety standards. RF simulation, microwave switches, and power handling are key considerations for circuit design, while deployment strategies require careful consideration of environmental impact and component testing.

- Service contracts and maintenance protocols are important for minimizing downtime and maximizing system uptime. Material science advances continue to impact microwave detector design, while life cycle assessment and cost analysis are critical for optimizing supply chain management. Microwave oscillators are a critical component in many applications, requiring rigorous testing and adherence to safety standards.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Microwave Radio Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26.2% |

|

Market growth 2025-2029 |

USD 49561.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

20.5 |

|

Key countries |

US, China, Germany, Japan, UK, India, France, Canada, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Microwave Radio Market Research and Growth Report?

- CAGR of the Microwave Radio industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the microwave radio market growth of industry companies

We can help! Our analysts can customize this microwave radio market research report to meet your requirements.