Medical Device Testing Market Size 2025-2029

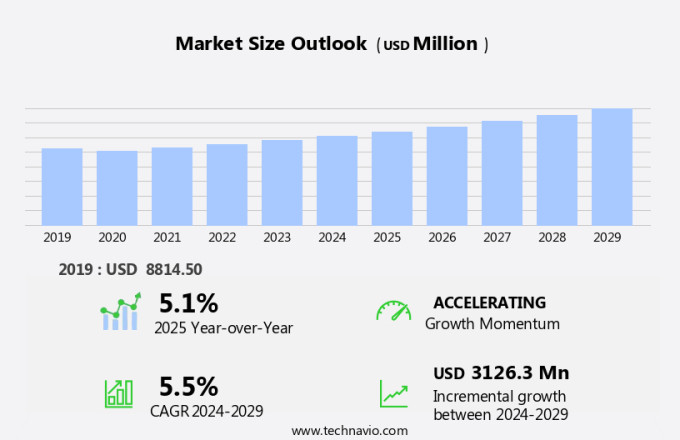

The medical device testing market size is forecast to increase by USD 3.13 billion, at a CAGR of 5.5% between 2024 and 2029.

- The market is driven by stringent regulatory requirements and the increasing adoption of advanced technologies, such as artificial intelligence (AI), in medical device testing. Regulatory bodies demand rigorous testing to ensure the safety and efficacy of medical devices, leading companies to invest significantly in testing processes. Moreover, the integration of AI in medical device testing is a significant trend, enabling faster and more accurate testing results. This technology allows for automated analysis of test data, reducing the need for manual intervention and shortening testing cycles. However, the prolonged testing and approval processes pose a challenge to market growth.

- Companies must navigate these obstacles by optimizing their testing procedures and collaborating with regulatory bodies to streamline the approval process. Innovative medical device testing solutions are being developed for various applications, including in vitro diagnostics, medical imaging, and surgical instruments. For instance, AI-powered diagnostic systems can analyze medical images and provide accurate results, while advanced testing methods for surgical instruments ensure their durability and functionality under various conditions. Companies focusing on these applications can capitalize on the growing demand for reliable and efficient medical device testing solutions. In conclusion, the market is characterized by stringent regulatory requirements, the adoption of advanced technologies like AI, and the challenge of prolonged testing and approval processes.

- Companies seeking to capitalize on market opportunities must optimize their testing procedures, collaborate with regulatory bodies, and focus on innovative testing solutions for in vitro diagnostics, medical imaging, and surgical instruments.

What will be the Size of the Medical Device Testing Market during the forecast period?

The market is characterized by its continuous evolution and dynamic nature, with various entities playing integral roles in ensuring the safety, efficacy, and quality of medical devices. These entities include, but are not limited to, design verification, durability testing, safety testing, environmental testing, implant testing, chemical analysis, reliability testing, endotoxin testing, design validation, medical device validation, material testing, non-clinical studies, and animal studies. Design verification and validation processes are essential to ensure medical devices meet the intended specifications and perform effectively under various conditions. Durability testing assesses the device's ability to withstand the rigors of use, while safety testing evaluates potential risks and hazards.

Environmental testing exposes devices to extreme temperatures, humidity, and other environmental factors to assess their performance and durability. Implant testing and biocompatibility testing are crucial for assessing the safety and efficacy of medical devices that come into direct contact with the body. Chemical analysis and material testing determine the composition and properties of materials used in medical devices, ensuring they meet regulatory requirements and are safe for use. Reliability testing and data analysis assess the device's ability to function consistently over time, while cybersecurity testing ensures the protection of sensitive patient data. Quality control, regulatory affairs, and clinical trial management are also essential components of the market, ensuring compliance with regulatory requirements and maintaining the integrity of clinical trials.

The market is a complex and ever-evolving landscape, with ongoing research and development leading to new testing methodologies and technologies. As medical devices become more sophisticated, the testing requirements continue to evolve, necessitating a comprehensive approach to medical device testing and validation.

How is this Medical Device Testing Industry segmented?

The medical device testing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Testing

- Inspection

- Certification

- Type

- In-house

- Outsourced

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Service Insights

The testing segment is estimated to witness significant growth during the forecast period.

The market encompasses various testing types that ensure the safety, efficacy, and regulatory compliance of medical devices. Biocompatibility testing is a crucial aspect, assessing potential harmful biological reactions to body tissues or fluids. This includes cytotoxicity, sensitization, and intracutaneous reactivity tests. Quality control, electrical testing, good laboratory practices, software testing, test equipment calibration, and regulatory affairs are integral to the testing process. Pre-clinical testing, such as in-vivo and in-vitro testing, non-clinical studies, and animal testing, are essential for evaluating device safety and performance before human use. Performance testing, drop testing, shock testing, accelerated aging, vibration testing, wear and tear, and thermal cycling are necessary to assess device durability and functionality under various conditions.

Additionally, microbiological testing, sterility assurance, and endotoxin testing ensure device sterility and bioburden control. Risk management, data integrity, data security, and cybersecurity testing are essential to protect patient safety and confidentiality. Material characterization, mechanical testing, and reliability testing are also vital for understanding device properties and performance over time. Design verification, design validation, and clinical trial protocols are critical steps in the medical device development process, requiring rigorous testing and documentation. Overall, the market is characterized by its complexity and the need for stringent regulations, driving the demand for various testing types and services.

The Testing segment was valued at USD 5.27 billion in 2019 and showed a gradual increase during the forecast period.

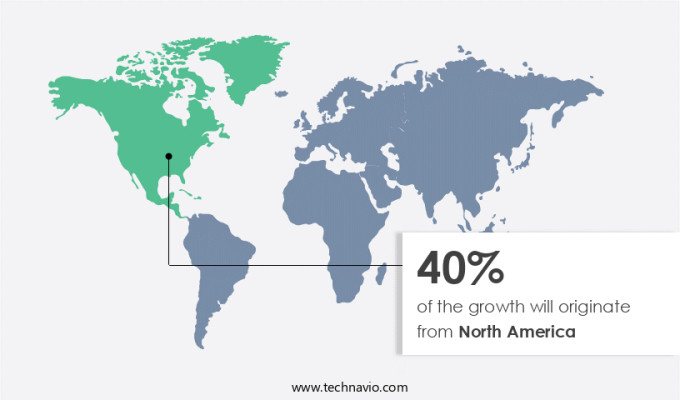

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is marked by stringent regulatory requirements and advanced testing techniques to ensure the safety and efficacy of medical devices. In North America, the U.S. And Canada lead the market, with the U.S. Food and Drug Administration (FDA) and Health Canada enforcing rigorous testing standards under regulations such as 21 CFR Part 820, ISO 13485, and the Medical Device Regulations (SOR/98-282). These regulations mandate comprehensive testing services, including sterility assurance, pre-clinical testing, impact testing, human factors engineering, microbiological testing, device compatibility, electrical testing, good laboratory practices, software testing, test equipment calibration, regulatory affairs, clinical trial management, quality assurance, performance testing, drop testing, sensitization testing, data integrity, in-vivo testing, clinical trial protocols, shock testing, accelerated aging, in-vitro testing, biocompatibility testing, bioburden testing, cybersecurity testing, quality management systems, system integration, software validation, thermal cycling, data analysis, vibration testing, wear and tear, data security, risk management, material characterization, mechanical testing, cytotoxicity testing, clinical data management, report writing, good manufacturing practices, statistical analysis, humidity testing, design verification, durability testing, safety testing, environmental testing, implant testing, chemical analysis, reliability testing, endotoxin testing, design validation, medical device validation, material testing, non-clinical studies, and animal studies.

The presence of leading medical device manufacturers specializing in advanced technologies, such as implantable devices, robotic surgical systems, and AI-powered diagnostic tools, further drives the demand for these testing services in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Medical Device Testing Industry?

- The stringent regulatory requirements serve as the primary catalyst for market growth and innovation in this industry.

- The market is driven by stringent regulatory requirements, with recent regulations imposing stricter compliance standards to ensure patient safety and device efficacy. One notable development is the FDA's final rule classifying laboratory-developed tests (LDTs) as medical devices under the Federal Food, Drug, and Cosmetic Act (FD&C Act), effective July 5, 2024. This rule, phased in over four years, mandates compliance with medical device reporting (MDR), quality system (QS) regulations, and premarket review for high-risk in vitro diagnostics (IVDs) by May 2028. This regulatory shift reflects growing concerns over the complexity, high-volume use, and critical role of LDTs in treatment decisions, such as diagnosing serious conditions like cancer or predicting disease risk.

- Medical device testing encompasses various techniques, including software validation, thermal cycling, data analysis, vibration testing, wear and tear, data security, risk management, material characterization, mechanical testing, cytotoxicity testing, clinical data management, report writing, and good manufacturing practices. Statistical analysis and humidity testing are also crucial components of the testing process. Device manufacturers must adhere to these testing standards to ensure the safety, efficacy, and reliability of their medical devices. The testing process helps identify potential issues, such as software glitches, material degradation, or mechanical failures, and addresses them before market release. By prioritizing rigorous testing, manufacturers can build trust with healthcare providers and patients, ultimately contributing to improved patient outcomes.

What are the market trends shaping the Medical Device Testing Industry?

- The use of artificial intelligence (AI) in medical device testing is an emerging market trend. This innovative approach enhances testing efficiency and accuracy, ensuring the delivery of safe and effective medical devices.

- Medical device testing is undergoing a significant transformation with the integration of artificial intelligence (AI) technologies. AI solutions are streamlining and enhancing various testing processes, making them more efficient and accurate. These technologies are particularly beneficial in handling complex and time-consuming aspects of medical device testing, such as design verification, durability testing, safety testing, environmental testing, implant testing, chemical analysis, reliability testing, endotoxin testing, design validation, and medical device validation. AI can analyze vast amounts of data more quickly and accurately than traditional methods, identifying potential issues and ensuring devices meet stringent regulatory standards. This capability accelerates the testing process and reduces the likelihood of errors, leading to safer and more reliable medical devices.

- Moreover, AI solutions are improving predictive maintenance, enabling early detection of potential issues and reducing downtime. Furthermore, AI technologies are helping to streamline regulatory compliance, ensuring medical devices meet the necessary safety and efficacy requirements. This is crucial in an industry where safety and reliability are paramount. Overall, the integration of AI in medical device testing is driving innovation, improving efficiency, and enhancing safety and reliability.

What challenges does the Medical Device Testing Industry face during its growth?

- The prolonged testing and approval processes pose a significant challenge to the industry's growth, as they consume valuable time and resources.

- The market encompasses various types of testing to ensure the safety, efficacy, and compatibility of medical devices. Prolonged approval processes pose a significant challenge in this market, with the duration and complexity varying based on device class and testing requirements. Class 1 devices, which have the least regulatory oversight, can be self-registered and approved in a matter of days. In contrast, Class 2 and Class 3 devices undergo more rigorous testing and approval processes. Class 2 devices typically require a 510(k) application to demonstrate substantial equivalence to an existing device. The U.S. Food and Drug Administration (FDA) takes an average of 177 days to clear these devices, with only a small percentage approved in less than three months.

- Testing for these devices includes fatigue testing, impact testing, human factors engineering, sterility assurance, pre-clinical testing, irritation testing, device compatibility, microbiological testing, quality control, electrical testing, good laboratory practices, software testing, and test equipment calibration. Regulatory affairs and clinical trial management are also crucial aspects of the market. Ensuring compliance with these testing requirements is essential for market entry and maintaining product quality. The testing process emphasizes the importance of robust design, immersive user experience, and harmonious integration of various device components. In conclusion, recent research indicates that the market will continue to grow, driven by advancements in technology and increasing regulatory scrutiny.

- Adherence to testing standards and efficient regulatory processes are crucial for medical device manufacturers to bring their products to market and maintain customer trust.

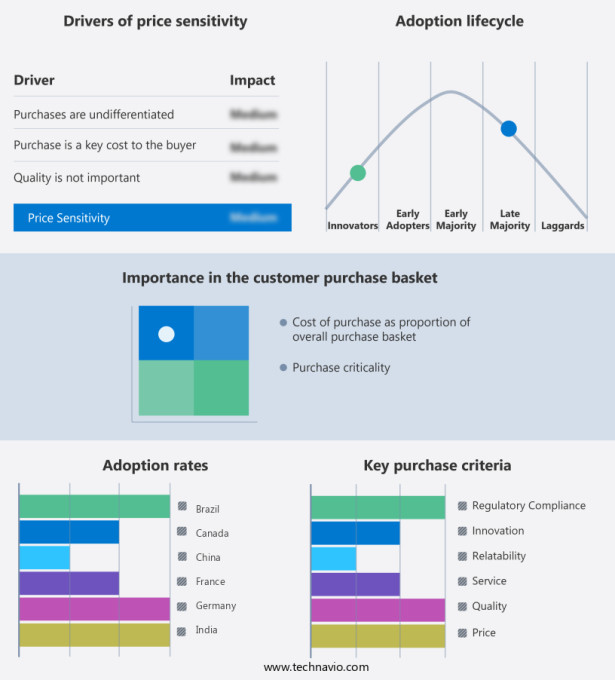

Exclusive Customer Landscape

The medical device testing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical device testing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical device testing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bureau Veritas SA - The company specializes in medical device testing and certification, adhering to internationally recognized standards such as ANSI UL 2900 and IEC 62443. Our rigorous process ensures the highest level of security and safety for medical devices. We utilize advanced testing methodologies to evaluate cybersecurity vulnerabilities and physical security risks. By partnering with US, clients can confidently bring their medical devices to market, knowing they meet the stringent requirements of these standards. Our expertise in medical device testing and certification enables US to help clients navigate the complex regulatory landscape and bring innovative solutions to patients around the world.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bureau Veritas SA

- Charles River Laboratories International Inc.

- DEKRA SE

- Element Materials Technology

- Eurofins Scientific SE

- F2 Labs

- Intertek Group Plc

- Laboratory Corp. of America Holdings

- LRQA Group Ltd.

- Medistri SA

- Nelson Laboratories LLC

- North American Science Associates LLC

- SGS SA

- TUV SUD

- UL LLC

- UX Firm

- WuXi AppTec Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Device Testing Market

- In March 2024, Siemens Healthineers, a leading medical technology company, introduced its new in vitro diagnostic (IVD) testing platform, Atellica Solution, which combines laboratory diagnostics with IT and automation solutions (Siemens Healthineers Press Release, 2024). This innovative platform aims to streamline laboratory workflows and improve diagnostic accuracy.

- In July 2024, Thermo Fisher Scientific and Illumina, two major players in the medical device testing industry, announced a definitive agreement to merge their laboratory diagnostics businesses (Thermo Fisher Scientific Press Release, 2024). This strategic partnership is expected to create a leading diagnostics company, expanding their product offerings and enhancing their capabilities in the genetic testing market.

- In January 2025, the European Union (EU) approved the new European Medical Devices Regulation (MDR), which significantly impacts the market by introducing stricter regulations and requirements for medical device manufacturers (European Commission, 2020). This regulatory change will lead to increased demand for comprehensive testing services to ensure compliance with the new regulations.

- In March 2025, F. Hoffmann-La Roche Ltd, a leading healthcare company, unveiled its new cobas 6800 and cobas 8800 systems, which offer expanded testing menus and increased capacity for high-throughput molecular testing (Roche Press Release, 2025). These technological advancements are expected to revolutionize laboratory diagnostics, enabling faster and more accurate test results.

Research Analyst Overview

- The market encompasses various aspects of ensuring product safety, efficacy, and compliance with regulations. Design control and test planning are crucial elements of the development process, while data security practices and cybersecurity risk management are essential for safeguarding sensitive information. FDA regulations mandate good documentation practices, including the creation of test reports, to demonstrate device efficacy and compliance with risk assessment and data integrity assurance. Validation plans and software qualification are integral parts of the testing process, with statistical significance and device traceability ensuring accurate and reliable results. Device usability, clinical outcomes, and clinical study oversight are key considerations for patient safety and GLP compliance.

- Post-market surveillance and device recall are essential for addressing adverse events and maintaining GMP compliance. System integration testing, process validation, and device performance are critical components of ensuring a comprehensive testing strategy. Hazard analysis and root cause analysis are essential for identifying and mitigating potential risks, while validation summary reports provide a clear understanding of the testing process and results. The EU MDR and clinical trial data requirements necessitate rigorous data integrity monitoring and adherence to regulatory guidelines.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Device Testing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 3126.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, France, India, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Medical Device Testing Market Research and Growth Report?

- CAGR of the Medical Device Testing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the medical device testing market growth of industry companies

We can help! Our analysts can customize this medical device testing market research report to meet your requirements.