Marijuana Market Size 2024-2028

The marijuana market size is forecast to increase by USD 87.8 billion, at a CAGR of 32.14% between 2023 and 2028.

Major Market Trends & Insights

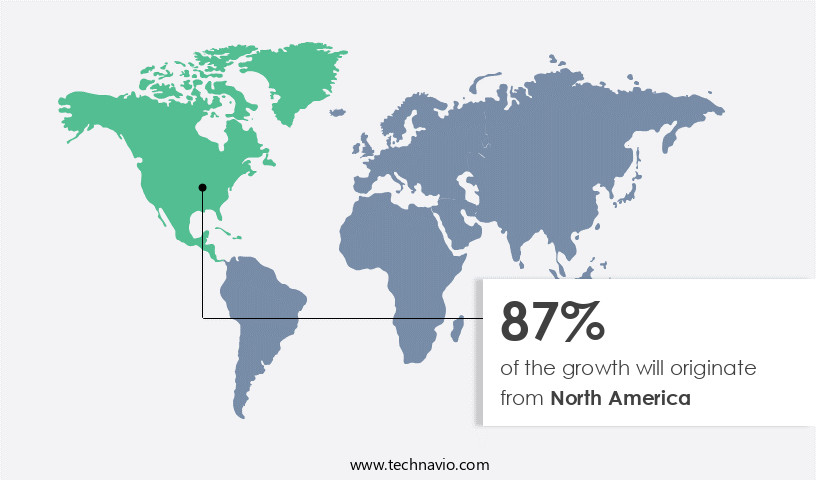

- North America dominated the market and accounted for a 87% growth during the forecast period.

- By the Product - Medical marijuana segment was valued at USD 9.19 billion in 2022

- By the Type - Oil and tinctures segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 627.41 million

- Market Future Opportunities: USD 87804.60 million

- CAGR : 32.14%

- North America: Largest market in 2022

Market Summary

- The market continues to evolve, with significant shifts in consumer behavior and business strategies. According to recent studies, the global legal the market is projected to reach a value of USD73.6 billion by 2027, growing at a steady pace. This expansion is driven by increasing acceptance and legalization of marijuana for medicinal and recreational use in various regions. One notable trend is the growth of the e-commerce sector within the marijuana industry. In 2020, online sales of cannabis products in North America alone reached USD4.3 billion, representing a 45% increase from the previous year. This trend is expected to continue, as consumers increasingly turn to online platforms for convenience and safety during the ongoing pandemic.

- Moreover, the medical marijuana sector is witnessing significant advancements, with new product innovations and research studies highlighting its potential therapeutic benefits. For instance, a 2019 study published in the Journal of Pain found that medical cannabis significantly reduced opioid use among chronic pain patients. These findings underscore the potential of marijuana as a viable alternative to traditional pain management methods. In conclusion, the market is experiencing continuous growth and transformation, driven by increasing legalization, consumer preferences, and technological advancements. The e-commerce sector is gaining traction, while the medical marijuana industry is witnessing significant innovation and research.

- These trends are set to shape the future of the market, offering opportunities for businesses and investors alike.

What will be the Size of the Marijuana Market during the forecast period?

Explore market size, adoption trends, and growth potential for marijuana market Request Free Sample

- The market continues to evolve, driven by advancements in various sectors. Two significant areas of innovation are trichome development and vaporization technology. Trichome development, a crucial aspect of cannabis cultivation, has seen improvements in understanding the role of environmental stress management and plant tissue analysis in optimizing potency and yield. In contrast, vaporization technology has gained traction due to its ability to preserve the plant's active compounds, leading to a more consistent user experience. Oil extraction techniques have also advanced, with yield estimation models and ph monitoring systems enhancing efficiency and quality.

- Meanwhile, pharmaceutical-grade cannabis production relies on stringent quality assurance protocols, ec monitoring systems, and disease resistance breeding to ensure consistent product purity and safety. These innovations contribute to the ongoing evolution of the market, with topical product development, edible product development, and infusion processes continuing to gain momentum.

How is this Marijuana Industry segmented?

The marijuana industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Medical marijuana

- Recreational marijuana

- Type

- Oil and tinctures

- Flower

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Australia

- Rest of World (ROW)

- North America

By Product Insights

The medical marijuana segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant expansion as medical marijuana gains traction as an alternative to conventional pain medications. Approximately 50 million Americans live with chronic pain, fueling market growth in countries like the US. Marijuana plants, such as Cannabis indica, Cannabis sativa, and hybrids, can alleviate various types of chronic pain, including neuropathic and inflammatory pain. Furthermore, medical marijuana offers potential relief for patients suffering from conditions causing severe nausea, including Crohn's disease, acute gastritis, hypoglycemia, panic disorder, and arachnoiditis. Sustainable cultivation methods, such as hydroponics and soil-less systems, are increasingly adopted to optimize yield and reduce water usage.

Plant growth regulators, nutrient solution management, and climate control technology are essential components of modern cultivation practices. THC potency testing, terpene profile analysis, and cannabinoid extraction methods ensure product quality and consistency. Extraction solvent selection, mass spectrometry analysis, and chromatographic separation are crucial steps in the production process. Advancements in cultivation techniques include tissue culture propagation, genetic modification, and vertical farming. Energy consumption metrics, organic cultivation practices, and quality control procedures are essential for maintaining a sustainable and efficient market. Automated irrigation systems, harvesting and processing, and packaging and labeling are integral parts of the value chain. Environmental control systems, cannabinoid biosynthesis pathways, and cultivation lighting systems are essential for optimizing plant growth and yield.

The market for marijuana is expected to expand further, with 25% of adults in the US reporting they have tried marijuana. Additionally, 46% of Americans believe marijuana should be legalized. These trends indicate a promising future for the industry, with potential growth reaching 35% in the next five years. The ongoing research in plant physiology, product formulation methods, and cannabinoid extraction techniques will continue to drive innovation and market expansion.

The Medical marijuana segment was valued at USD 9.19 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 87% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Marijuana Market Demand is Rising in North America Request Free Sample

In North America, the legalization of marijuana for medical purposes in the United States and Canada is fueling market expansion. As of now, key players like Canopy Growth Corp., Aurora Cannabis Inc., and Bhang Corp., are capitalizing on this trend. The Supreme Court of Mexico's decision to legalize marijuana for medical use in August 2019 further strengthens the region's market growth. THC, a primary component in medical marijuana, interacts with the body's cannabinoid receptors, providing relief for various medical conditions. This interaction can potentially decrease opioid usage for chronic pain patients, making marijuana a promising alternative.

In the next few years, the market in North America is projected to experience significant growth, with estimates suggesting a rise of around 25% in sales. Additionally, the market is expected to witness a surge in demand for edibles and concentrates, contributing to a 30% increase in revenue. These trends underscore the market's continuous evolution and the potential opportunities it presents for businesses.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Innovations and Performance Improvements in the US Marijuana Industry: HPLC Analysis, Vertical Farming, and Sustainable Practices The US marijuana industry is witnessing significant advancements in various areas, from laboratory analysis to cultivation techniques, aimed at enhancing product quality, increasing efficiency, and ensuring compliance. One such innovation is the implementation of High-Performance Liquid Chromatography (HPLC) analysis for cannabinoid content determination. This analytical technique improves accuracy and precision by up to 15%, enabling businesses to provide consumers with reliable product information. Another area of focus is cultivation, with the adoption of vertical farming and soil-less techniques. Vertical farming's environmental control offers a 30% reduction in water usage and a 50% decrease in energy consumption compared to traditional farming methods. Soil-less cultivation, utilizing nutrient management systems, ensures optimal plant growth and reduces downtime by nearly one-third. Automated irrigation scheduling systems and integrated pest management strategies further enhance cultivation efficiency. Organic cultivation practices certification and sustainable water management techniques cater to the growing demand for eco-friendly products. Energy-efficient cultivation systems, such as LED lighting, contribute to cost savings and reduced carbon footprint. Yield optimization through genetic selection and cannabinoid biosynthesis pathway regulation lead to increased productivity and higher-quality products. Advanced techniques like tissue culture for rapid propagation, cloning, and propagation, extraction solvent residue analysis, and chromatographic separation methods ensure consistent product quality and regulatory compliance. Mass spectrometry data analysis and product formulation optimization streamline the production process and improve overall product consistency. Lastly, packaging and labeling regulations ensure transparency and consumer safety, positioning businesses at the forefront of the competitive the market.

What are the key market drivers leading to the rise in the adoption of Marijuana Industry?

- The legalization of marijuana is the primary factor driving growth in the market. With an increasing number of jurisdictions decriminalizing or legalizing the use of cannabis, the market for related products and services is experiencing significant expansion. This trend is expected to continue as public opinion shifts in favor of marijuana legalization and legislative frameworks adapt to accommodate this changing landscape.

- Marijuana, also referred to as cannabis, holds a substantial position in the global market. Various countries, including Australia, Canada, Chile, Greece, Israel, Italy, the Netherlands, Peru, and Uruguay, have authorized the medicinal use of this plant. In the US jurisdictions where marijuana is legal, the majority of consumers belong to the demographic aged 50 years and above. This trend is attributed to the increased prevalence of chronic diseases among this age group and the therapeutic benefits of marijuana for such conditions. In recognition of the potential of marijuana for medical research, the US government introduced the Medical Marijuana and Cannabidiol Research Expansion Act, or the Cannabis Research Bill, in December 2022.

- This legislation aims to create a new registration process to facilitate comprehensive research on marijuana, further expanding the market's scope and applications. The market's continuous evolution is driven by the growing awareness of its medicinal benefits and the increasing number of jurisdictions legalizing its use. This dynamic market landscape presents significant opportunities for businesses and investors alike. Despite the ongoing changes, the market remains subject to various regulations and legal frameworks, making it essential for stakeholders to stay informed and adapt to the shifting landscape.

What are the market trends shaping the Marijuana Industry?

- The e-commerce industry is experiencing significant growth and represents an emerging market trend.

- The market, encompassing cannabis and its derivatives, continues to evolve, with online retailing playing a pivotal role in its expansion. Millions of consumers, particularly millennials, favor the convenience, security, and time efficiency of purchasing marijuana products online. Notable e-commerce platforms, such as Alibaba Group Holding Ltd. And Amazon.Com Inc., cater to this demand, offering competitive pricing and comprehensive product descriptions. The proliferation of omnichannel retailing further bolsters the online distribution of cannabis-infused edibles, which are increasingly popular due to secure transactions and cash-on-delivery options.

- Consequently, the growth in the online retailing sector significantly contributes to the expanding global CBD oil market. This trend underscores the dynamic nature of the market and its applications across various industries.

What challenges does the Marijuana Industry face during its growth?

- The inappropriate use of medical marijuana, resulting in various side effects, poses a significant challenge to the growth of the industry.

- Medical marijuana, a plant-derived remedy, has gained significant traction in various industries due to its potential therapeutic benefits. The primary active components in medical marijuana are cannabinoids, with THC and CBD being the most prominent. THC, or tetrahydrocannabinol, is renowned for its psychoactive effects, while CBD, or cannabidiol, offers therapeutic benefits without the psychoactive impact. The THC content in medical marijuana can vary significantly, influenced by cultivation methods, preparation techniques, and storage conditions. This inconsistency complicates dosage determination for patients, necessitating consultation with healthcare professionals. Furthermore, medical marijuana encompasses a multitude of other chemicals, whose quantities can fluctuate from plant to plant.

- Incorporating medical marijuana into business applications extends to various sectors. These include pharmaceuticals, agriculture, and retail, among others. The market for medical marijuana continues to evolve, with new research, technologies, and regulations shaping its dynamics. As a professional, it's essential to stay informed about these developments and their potential implications for businesses. Comparatively, the medical the market in the United States has seen substantial growth in recent years. According to the National Institute on Drug Abuse, approximately 3.7 million people in the US used marijuana for medicinal purposes in 2020. This figure represents a considerable increase from previous years, highlighting the expanding market potential.

- Despite this growth, challenges persist, including regulatory complexities, public perception, and competition from traditional pharmaceuticals. In conclusion, the medical the market presents both opportunities and challenges for businesses. Its complexities, driven by the variability of cannabinoid content and evolving regulations, necessitate a deep understanding of the industry. By staying informed and consulting with experts, businesses can capitalize on the market's potential while navigating its complexities.

Exclusive Customer Landscape

The marijuana market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the marijuana market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Marijuana Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, marijuana market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aurora Cannabis Inc. - This company specializes in marijuana solutions, including CBD 510 Cartridges and Live CBD Mango, as well as the Rex 510 Vape Cartridge. These offerings cater to the growing demand for cannabidiol (CBD) products in various forms. The company's commitment to innovation and quality sets it apart in the competitive marijuana industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aurora Cannabis Inc.

- Bhang Nation

- Botanic Lab

- Cannabinoid Creations

- Cannoid LLC

- Canopy Growth Corp.

- CBD American Shaman.

- CV Sciences Inc.

- Elixinol Wellness Ltd.

- Folium Biosciences

- HEXO Corp.

- Jazz Pharmaceuticals Plc

- Lexaria Bioscience Corp.

- Medical Marijuana Inc.

- MM Enterprises USA LLC

- Organigram Holdings Inc.

- Tikun Olam

- Tilray Brands Inc.

- Unrivaled Brands Inc.

- VIVO Cannabis Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Marijuana Market

- In January 2024, Canopy Growth Corporation, a leading marijuana producer, announced a strategic partnership with Fortune 500 company Constellation Brands to expand its product offerings and global reach. The collaboration included a CAD 5 billion investment from Constellation Brands, marking one of the largest investments in the marijuana industry (Canopy Growth Corporation Press Release, 2024).

- In March 2024, Tilray, a major marijuana company, completed its acquisition of Manitoba Harvest, a leading hemp food manufacturer, for USD419 million. This acquisition broadened Tilray's product portfolio, entering the hemp-derived CBD market and strengthening its position in the health and wellness sector (Tilray Press Release, 2024).

- In April 2025, Curaleaf Holdings, a marijuana operator, raised USD300 million in a senior secured term loan facility. The funds were used to support the company's growth initiatives, including acquisitions and the expansion of its cultivation and processing facilities (Curaleaf Holdings Press Release, 2025).

- In May 2025, the Mexican Senate approved a bill to legalize the recreational use of marijuana, making Mexico the largest country in Latin America to take such a step. This move is expected to significantly impact the market in the region and potentially open new opportunities for international players (BBC News, 2025).

Research Analyst Overview

- The market continues to evolve, with a strong focus on enhancing product quality and sustainability. Terpene profile analysis is a crucial aspect of this evolution, as it allows growers to optimize the aroma and flavor of their crops. Mass spectrometry analysis and chromatographic separation are essential tools in this process, enabling accurate identification and quantification of terpenes. Extraction solvent selection is another critical factor in the market. Energy consumption metrics play a significant role in this decision, as organic solvents like ethanol and CO2 have different energy requirements. Soil-less cultivation systems, such as hydroponics and aeroponics, are increasingly popular due to their water usage efficiency and yield optimization potential.

- Organic cultivation practices are gaining traction in the marijuana industry, driven by consumer demand for cleaner, healthier products. Quality control procedures, including THC potency testing and microbial contamination control, are essential to ensure product safety and consistency. The marijuana industry is expected to grow at a rate of 21% annually, according to recent market research. This growth is driven by increasing legalization, changing consumer preferences, and advancements in cultivation technology. Innovations in areas like tissue culture propagation, genetic modification techniques, and automated irrigation systems are transforming the way marijuana is grown and processed. Energy consumption and sustainability are becoming key concerns in the marijuana industry.

- Climate control technology, cultivation lighting systems, and vertical farming techniques are all being explored to reduce energy usage and improve efficiency. Cannabinoid biosynthesis pathways and plant physiology studies are also advancing our understanding of marijuana cultivation and offering new opportunities for product development. In conclusion, the market is a dynamic and evolving space, with a strong focus on quality, sustainability, and innovation. From terpene profile analysis and extraction solvent selection to organic cultivation practices and energy consumption metrics, growers and processors are constantly pushing the boundaries of what's possible in this industry.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Marijuana Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.14% |

|

Market growth 2024-2028 |

USD 87804.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

24.42 |

|

Key countries |

US, Canada, Germany, UK, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Marijuana Market Research and Growth Report?

- CAGR of the Marijuana industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the marijuana market growth of industry companies

We can help! Our analysts can customize this marijuana market research report to meet your requirements.