Liquified Petroleum Gas (LPG) Tanker Market Size 2025-2029

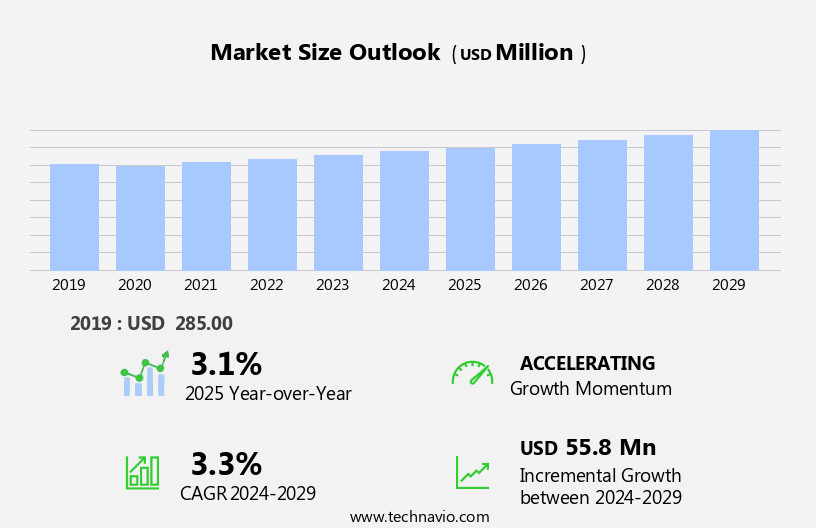

The liquified petroleum gas (lpg) tanker market size is forecast to increase by USD 55.8 million, at a CAGR of 3.3% between 2024 and 2029.

- The LPG tanker market is experiencing significant shifts, driven by the increasing supply of natural gas and advancements in technology. Natural gas, a key feedstock for LPG production, has seen a surge in availability, leading to increased LPG production and, consequently, higher demand for LPG tankers. This trend is expected to continue, providing a promising outlook for market growth. However, the market is not without challenges. Fluctuating crude oil prices pose a significant threat to market stability. As a key input in LPG production, price volatility in crude oil can significantly impact the profitability of LPG tanker operators. Additionally, the industry faces the challenge of adhering to stringent safety regulations, which require substantial investments in technology and infrastructure to ensure safe and efficient operations.

- Companies seeking to capitalize on market opportunities must stay abreast of these trends and challenges, implementing strategic initiatives to navigate the dynamic market landscape effectively.

What will be the Size of the Liquified Petroleum Gas (LPG) Tanker Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The liquefied petroleum gas (LPG) tanker market is characterized by its continuous evolution and dynamic nature. Entities such as inert gas systems, tank design, truck transportation, repair procedures, energy security, charter rates, crew training, petrochemical feedstock, pressure vessels, maintenance procedures, quality control, LPG terminals, vapor recovery systems, LPG tankers, pumping systems, ballast water management, and various other components play integral roles in this market. Inert gas systems ensure the safe transport of LPG by maintaining an inert atmosphere within the tank to prevent the formation of explosive mixtures. Tank design continues to advance, with innovations in hull construction, material selection, and insulation systems enhancing operational efficiency and safety.

Truck transportation and repair procedures enable the distribution of LPG to various sectors, including industrial and domestic applications. Energy security is a significant factor, with charter rates influenced by supply chain disruptions and geopolitical tensions. Crew training and safety systems are essential for ensuring the safe operation of LPG tankers and preventing accidents. Petrochemical feedstock demand drives the production and transportation of LPG, with pressure vessels and maintenance procedures ensuring the integrity of the supply chain. Quality control measures and LPG terminals facilitate the efficient handling and storage of LPG, while vapor recovery systems minimize emissions and improve operational efficiency.

LPG tankers, pumping systems, and ballast water management systems enable the safe and efficient transportation and handling of LPG. The market for LPG derivatives, such as propane and butane, continues to grow, with vaporization systems and cargo monitoring systems ensuring the safe and efficient handling of these products. The energy transition towards renewable energy sources is influencing the LPG market, with LNG tankers and pipeline infrastructure providing alternative transportation and storage solutions. Maritime security and Solas regulations ensure the safe and secure transportation of LPG, while cargo handling systems and rail transportation offer additional transportation options.

Non-destructive testing (NDT) and risk assessment are crucial for maintaining the integrity of LPG infrastructure and ensuring operational safety. Temperature sensors and pressure sensors enable real-time monitoring of LPG storage and transportation, while emergency shut-off valves and pressure relief valves prevent potential accidents. The LPG market is a complex and dynamic system, with ongoing activities and evolving patterns shaping its future. From tank design and transportation to energy security and safety systems, each component plays a critical role in ensuring the safe and efficient production, transportation, and use of LPG.

How is this Liquified Petroleum Gas (LPG) Tanker Industry segmented?

The liquified petroleum gas (lpg) tanker industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Residential

- Commercial

- Type

- Very large gas carrier

- Large gas carrier

- Medium gas carrier

- Small gas carrier

- Variant

- Semi-pressurized

- Fully pressurized

- Fully refrigerated

- Propulsion Type

- Conventional Fuel

- Dual-Fuel

- LNG-Powered

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- The Netherlands

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

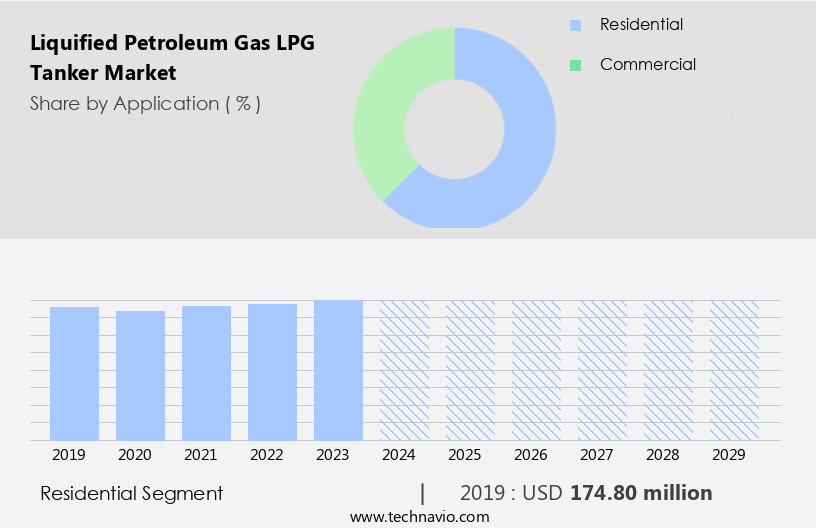

The residential segment is estimated to witness significant growth during the forecast period.

The LPG tanker market caters to the demand for liquefied petroleum gas (LPG) from residential end-users, including households, apartments, and private homes. This market's growth is driven by the global shift towards cleaner, more sustainable energy sources. LPG, a versatile energy source, is employed in various applications, such as water and space heating and cooling in the residential sector. In developing countries, LPG serves as an alternative to electricity for lighting. In developed nations, LPG is popular for outdoor activities like barbecues and camping. The preference for LPG among residential consumers stems from its reliability, cost-effectiveness, and efficiency in power generation.

Ship design and construction play a crucial role in ensuring safe and efficient LPG transportation. Compliance with International Maritime Organization (IMO) regulations is essential to maintain safety standards. Gas detection systems, flame arresters, safety systems, and emergency shut-off valves are integral components of LPG tanker design. Hull construction materials and insulation systems are carefully selected based on material properties and operational efficiency. LPG carriers employ various technologies, such as inert gas systems, vapor recovery systems, and cargo monitoring systems, to optimize operational efficiency and minimize environmental impact. Cryogenic tanks, pressure vessels, and level sensors are used for LPG storage and distribution.

Unloading systems, filling systems, and welding techniques ensure safe and efficient transfer of LPG from tanker to end-user. The supply chain involves various stakeholders, including LPG bottling and cylinder manufacturers, freight rate negotiators, fleet management companies, and distribution network operators. Pressure relief valves, temperature sensors, and pressure sensors are critical components in managing the LPG supply chain. Risk assessment, maintenance procedures, and quality control are essential to ensure safety and reliability. LPG tankers are also used as petrochemical feedstock carriers and as components of pipeline infrastructure. The energy transition and emission control regulations have led to the development of alternative energy sources, such as natural gas and renewables, which may impact the LPG tanker market's future growth.

Truck transportation, rail transportation, and ballast water management are other aspects of the LPG tanker market. In conclusion, the LPG tanker market is a dynamic and complex industry that plays a vital role in providing clean, reliable, and cost-effective energy to residential end-users. The market's growth is driven by various factors, including the global energy transition, increasing demand for sustainable energy sources, and the versatility of LPG as an energy source. The market's success depends on the efficient design, construction, and operation of LPG tankers, as well as the effective management of the supply chain and adherence to safety regulations.

The Residential segment was valued at USD 174.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

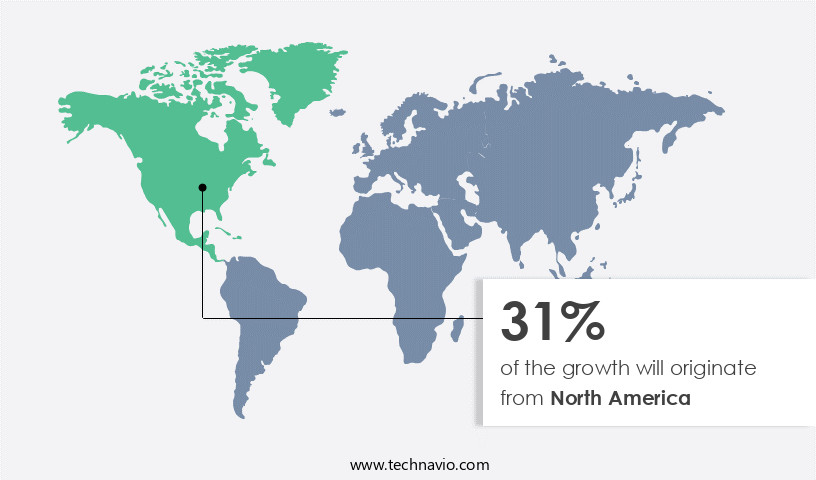

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing steady growth, driven by the expansion of petroleum production and crude oil imports. The transport sector, which accounts for over 60% of oil product consumption, plays a significant role in market growth. Partnerships in the LPG tanker industry foster infrastructure development, cost reduction, enhanced safety, expanded market reach, and innovation. For instance, BP and Apollo's collaboration in BP Pipelines (TANAP) Ltd. Fortifies Europe's energy infrastructure and supply security, indirectly boosting the LPG tanker market by optimizing distribution networks and encouraging investments in sustainable fuel transportation. Ship designs prioritize safety systems, including gas detection systems, flame arresters, emergency shut-off valves, and pressure relief valves.

Hull construction materials undergo rigorous material selection processes to ensure durability and resistance to corrosion. Operational efficiency is maximized through the integration of inert gas systems, tank design, and welding techniques. LPG carriers transport various types of gases, such as propane and butane, to industrial and domestic consumers. LPG bottling and cylinder filling systems are essential components of the supply chain, ensuring the safe and efficient distribution of LPG. Unloading and filling systems employ advanced technology, such as cargo monitoring systems and vapor recovery systems, to minimize emissions and maintain operational efficiency. Fleet management strategies optimize fuel consumption and maintenance procedures, ensuring that LPG tankers remain in optimal condition.

Pressure vessels and cargo handling systems are subjected to regular inspections and non-destructive testing (NDT) to maintain quality control and safety standards. The energy transition towards cleaner fuels influences the LPG tanker market, with LPG derivatives, such as LPG vaporization systems and LNG tankers, gaining popularity. Maritime security and Solas regulations ensure the safe transport of LPG, while pipeline infrastructure and rail transportation offer alternative methods for LPG transportation. Energy security and charter rates influence the market dynamics, with crew training and cargo handling systems prioritized to maintain operational efficiency. Emergency shut-off valves, pressure relief valves, level sensors, and temperature sensors are essential safety features for LPG tankers, ensuring the safe transport of LPG to industrial and domestic consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Liquified Petroleum Gas (LPG) Tanker Industry?

- The primary factor driving the natural gas market is the increase in its supply.

- The global LPG tanker market is experiencing significant growth due to the increasing demand for liquefied petroleum gas (LPG) as a cleaner alternative to traditional fossil fuels. The IEA reports a 2.7% increase in gas demand in 2024, with over 115 billion cubic meters (bcm) consumed. Gas demand for electricity generation grew by nearly 2.8% year-on-year, driven by expanding Asian markets and North America. However, European gas-fired power generation declined. To ensure safe and efficient transportation and storage of LPG, advanced technologies such as pressure relief valves, level sensors, pressure sensors, temperature sensors, unloading systems, and filling systems are crucial.

- Material selection, welding techniques, and insulation systems are essential for the construction of LPG storage tanks, including cryogenic tanks, to maintain optimal temperature and prevent leaks. Operational efficiency is a key focus in the LPG supply chain, with fuel consumption minimization and risk assessment being critical factors. The integration of these technologies and systems contributes to the overall safety, reliability, and efficiency of LPG distribution networks.

What are the market trends shaping the Liquified Petroleum Gas (LPG) Tanker Industry?

- The current market trend is shaped by significant technological advances. It is essential to stay informed about these innovations to maintain a professional edge.

- LPG tankers have seen significant advancements in technology, leading to enhanced efficiency and safety. Inert gas systems, a crucial safety feature, ensure the prevention of explosions by maintaining an inert atmosphere in the tanks. Tank design has evolved with the introduction of pressure vessels, which can withstand higher pressures and transport larger volumes. The logistics sector has witnessed the rise of truck transportation for last-mile delivery, complementing the role of LPG tankers. Repair procedures and maintenance have been streamlined through digitalization and advanced diagnostic tools. Energy security is a key focus, with charter rates remaining competitive to ensure a consistent supply of LPG as a petrochemical feedstock.

- Quality control is ensured through stringent regulations and adherence to industry standards. Vapor recovery systems and pumping systems have been optimized for efficient operations and reduced emissions. Ballast water management systems are essential for maintaining the stability and safety of the tanker. Innovations in LPG tanker technology include the use of controllable pitch propellers (CPP) for improved maneuverability and power generation. These advancements enable the transportation of larger volumes and contribute to the overall growth of the LPG market.

What challenges does the Liquified Petroleum Gas (LPG) Tanker Industry face during its growth?

- The volatility in crude oil prices poses a significant challenge to the growth of the industry.

- The LPG tanker market is influenced by the volatility in global crude oil prices, which can disrupt the oil and gas industry and impact investment in LPG tankers. Fluctuations in crude oil prices can adversely affect end-user industries, leading to uncertainty in the demand for LPG derivatives such as butane and propane. To mitigate risks, LPG tankers are equipped with advanced technologies like vaporization systems, refrigeration systems, cargo monitoring systems, and non-destructive testing (NDT). These systems ensure the safe and efficient transportation of LPG. Moreover, the increasing focus on maritime security and emission control has led to the implementation of SOLAS regulations and the use of cargo handling systems.

- In addition, pipeline infrastructure and rail transportation are also utilized to transport LPG, offering alternative options to maritime transportation. Despite these challenges, the LPG tanker market continues to grow due to the increasing demand for LPG derivatives and the need for reliable and efficient transportation solutions. LPG tankers are essential for the transportation of LPG derivatives such as butane and propane. However, the frequent volatility in crude oil prices can disrupt the oil and gas industry, ultimately impacting investment in the global LPG tanker market. The implementation of advanced technologies like vaporization systems, refrigeration systems, cargo monitoring systems, and non-destructive testing (NDT) is mandatory to ensure safe and efficient transportation.

- Furthermore, the increasing focus on maritime security and emission control has led to the implementation of SOLAS regulations and the use of cargo handling systems. In addition, pipeline infrastructure and rail transportation offer alternative options to maritime transportation. Despite these challenges, the LPG tanker market is expected to grow due to the increasing demand for LPG derivatives and the need for reliable and efficient transportation solutions.

Exclusive Customer Landscape

The liquified petroleum gas (lpg) tanker market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the liquified petroleum gas (lpg) tanker market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, liquified petroleum gas (lpg) tanker market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Air and Gas Holdings Pty Ltd. - This company specializes in the transportation of liquefied petroleum gas (LPG) and very large gas carriers, collectively boasting a capacity exceeding 3 million cubic meters. With a focus on efficient and safe operations, the company's fleet plays a significant role in the global energy market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air and Gas Holdings Pty Ltd.

- Bosco India

- BW Group

- DAE SUN SHIPBUILDING and ENGINEERING CO. LTD.

- Dorian LPG Ltd.

- Exmar NV

- GLOBE GAS EQUIPMENTS INDUSTRY PVT. LTD.

- HD Hyundai Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Krison Engineering Works

- Kuwait Oil Tanker Co. SAK

- Mitsubishi Heavy Industries Ltd.

- Nakilat

- Namura Shipbuilding Co. Ltd.

- PT Pertamina Persero

- Solvang ASA

- StealthGas Inc.

- STX Corp.

- Teekay Corp.

- The Great Eastern Shipping Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Liquified Petroleum Gas (LPG) Tanker Market

- In January 2024, Shell and Qatar Petroleum announced a strategic partnership to construct and operate the world's largest LPG carrier, the Q-Max LPG carrier, with a capacity of 84,000 cubic meters. This collaboration aimed to strengthen their positions in the global LPG market and meet the growing demand for cleaner fuels (Shell press release, 2024).

- In March 2024, the European Union (EU) approved the revised Alternative Fuels Infrastructure Directive, mandating a significant increase in LPG refueling infrastructure across EU member states by 2030. This policy change is expected to boost the demand for LPG tankers in Europe (EU Commission press release, 2024).

- In April 2025, ExxonMobil and Cheniere Energy entered into a joint venture to construct a new LPG export terminal in Louisiana, USA. This USD10 billion project, named Sabine Pass LPG Export Terminal, is expected to increase the US's LPG export capacity by 25% (ExxonMobil press release, 2025).

- In May 2025, Mitsui O.S.K. Lines, Ltd. (MOL) and TotalEnergies signed a Memorandum of Understanding (MoU) to collaborate on the development of LPG bunkering infrastructure in Europe. The partnership aims to establish a network of LPG bunkering stations to support the growing number of LPG-powered vessels (MOL press release, 2025).

Research Analyst Overview

- The LPG tanker market is a critical segment of the maritime transport industry, with significant terminal operations and port operations shaping its dynamics. Pressure relief devices and ship repair are essential components of LPG tanker safety standards, ensuring the safe handling and transportation of this flammable gas. As the world transitions to cleaner energy sources, carbon footprint reduction is a growing concern, leading to increased interest in alternative fuels like LNG carriers. Environmental regulations, such as stricter emissions standards and liability insurance requirements, are driving the adoption of advanced refrigeration technology and fuel optimization techniques. Class societies play a vital role in enforcing safety standards and ensuring compliance with international regulations.

- The LPG market analysis indicates a steady increase in LPG production, consumption, and global trade. Gas processing and demand forecasting are crucial for LPG market players to optimize their operations and remain competitive. The integration of autonomous navigation and vessel tracking systems is also transforming the LPG tanker market, enhancing efficiency and reducing operational costs. Sustainable shipping initiatives and supply forecasting are essential for LPG market players to navigate the complexities of the market and mitigate risks associated with insurance claims and price volatility. Overall, the LPG tanker market is a dynamic and evolving industry, requiring continuous innovation and adaptation to meet the changing needs of the global energy market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Liquified Petroleum Gas (LPG) Tanker Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 55.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, Germany, UK, France, Italy, The Netherlands, Canada, China, Spain, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Liquified Petroleum Gas (LPG) Tanker Market Research and Growth Report?

- CAGR of the Liquified Petroleum Gas (LPG) Tanker industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the liquified petroleum gas (lpg) tanker market growth of industry companies

We can help! Our analysts can customize this liquified petroleum gas (lpg) tanker market research report to meet your requirements.