North America Lottery Market Size 2024-2028

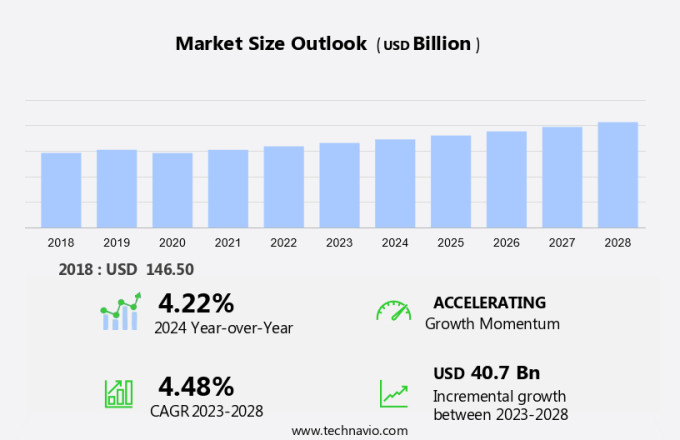

The North America lottery market size is forecast to increase by USD 40.7 billion at a CAGR of 4.48% between 2023 and 2028. The North American lottery market is experiencing significant evolution, driven by the integration of advanced technologies and shifting consumer preferences. Online platforms are increasingly popular, offering convenience and accessibility to players. Sports platforms and fantasy team leagues have gained traction, capitalizing on the popularity of sports and fan engagement. Social media platforms are also being leveraged to boost ticket sales through targeted marketing and promotions. Analytics platforms are being adopted to enhance player experience and improve operational efficiency. Traditional casinos are expanding their offerings to include lotteries, while blockchain-based platforms and cryptocurrencies are emerging as innovative alternatives. However, security and credibility remain key challenges, requiring strong solutions to ensure player trust and protect against fraud.

Market Analysis

The market is witnessing significant advancements, driven by the integration of technology into traditional lottery systems. This transformation is revolutionizing the way lotteries are played, with financial lotteries emerging as a key segment. Audio-visual technologies and touch displays are increasingly being adopted to enhance the user experience. Actuators and augmented reality are being employed to create more interactive and engaging games. Digital tools are enabling seamless transactions and real-time results, making lotteries more accessible than ever before. The gaming sector is embracing technology to cater to various demographics. Smart devices and online platforms are popular among tech-savvy consumers, while sports platforms and fantasy team leagues appeal to sports enthusiasts. Social media platforms and analytics platforms offer new avenues for engagement and data-driven insights.

Additionally, casinos are also leveraging technology to offer lottery-like games, blurring the lines between traditional casino games and lotteries. Blockchain-based platforms are gaining traction for their transparency and security, providing a new level of trust in the lottery industry. Lotteries are not just limited to charitable purposes and public services anymore. They are increasingly being used as a source of revenue for retail stores, internet marketplaces, and mobile applications. Powerball and Lotto are popular digital options, with online lotteries offering convenience and flexibility. The integration of technology in the lottery industry is transforming the way prizes are claimed and distributed. Smart devices and mobile applications are making it easier for winners to access their winnings. The use of analytics platforms is enabling more personalized and targeted promotions, enhancing the overall customer experience. In conclusion, the North American lottery market is undergoing a digital transformation, driven by the integration of technology into traditional lottery systems. The use of audio-visual technologies, touch displays, actuators, augmented reality, digital tools, and analytics platforms is revolutionizing the way lotteries are played and won. The gaming sector is embracing technology to cater to various demographics, offering new avenues for engagement and revenue generation.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Platform

- Traditional

- Online

- Type

- Scratch-off games

- Terminal-based games

- Sports lotteries

- Geography

- North America

- Canada

- Mexico

- US

- North America

By Platform Insights

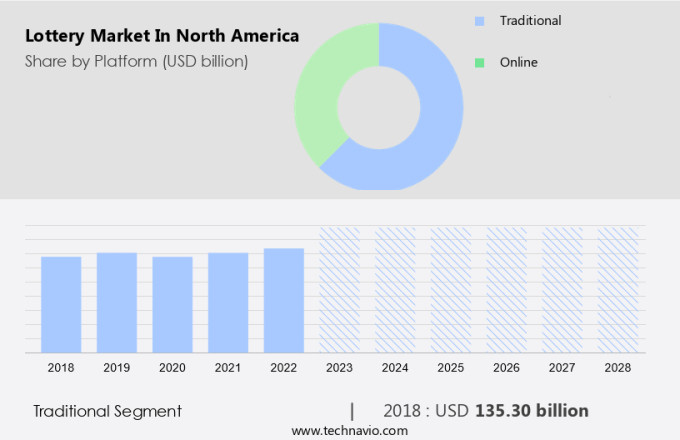

The Traditional segment is estimated to witness significant growth during the forecast period. In North America, the lottery market encompasses both traditional and modern platforms, with instant games and sports games being the most popular offerings. Traditional lottery sales are primarily conducted through lottery stores and retail outlets, such as supermarkets and convenience stores. The growth of this segment can be attributed to the expansion of lottery retailers, rising prize money, and relaxation of government regulations. companies are also exploring new sales strategies, including the deployment of slot machines and partnerships with retailers, to broaden their reach. On the other hand, online lottery sales are gaining traction due to the convenience offered by e-commerce channels and the increasing availability of internet connectivity.

Further, big data and marketing channels are being leveraged to target consumers effectively and enhance their entertainment experience. As technology advances, it is expected that online lottery sales will continue to grow, providing a significant opportunity for market expansion. In conclusion, the North American lottery market is witnessing a shift towards digital platforms, with online lottery sales and instant games leading the charge. The traditional lottery segment, however, remains a significant contributor to the market's growth, driven by strategic partnerships and the expansion of retail outlets. With the increasing availability of internet connectivity and the growing popularity of e-commerce channels, the online lottery segment is poised for significant growth in the coming years.

Get a glance at the market share of various segments Request Free Sample

The traditional segment accounted for USD 135.30 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage..

Market Driver

The growing adoption of marketing strategies to increase ticket sales is notably driving market growth. The market encompasses various types of lotteries, including financial lotteries, which have gained significant traction in the gaming sector. Advanced audio-visual technologies, touch displays, actuators, and augmented reality are increasingly being integrated into lottery games to enhance the user experience. Digital tools, such as the Internet and mobile phone technology, have enabled the proliferation of online games, with the online lottery sub-segment witnessing substantial growth. National lotteries and lotto lotteries are available in both online and offline modes, offering Free Bet Bonuses, Joker Ball, and jackpots to players. Smartphones and other smart devices facilitate access to online platforms, sports platforms, fantasy team leagues, social media platforms, and analytics platforms. Blockchain technology, databases, and cryptocurrencies are being adopted for secure and transparent transactions. Instant games, sport games, and draw-based games continue to dominate the market, with casinos and blockchain-based platforms also gaining popularity. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

The integration of artificial intelligence (AI) in lottery platforms is the key trend in the market. The market encompasses various types of lotteries, including financial lotteries, which are gaining popularity in the gaming sector. Advanced technologies such as audio-visual technologies, touch displays, actuators, and augmented reality are being integrated into lottery games to enhance the user experience. Digital tools like the Internet, online games, and mobile phone technology have revolutionized the lottery industry, enabling players to access lotto sub-segments like national lotteries and lotto lotteries in the online mode. Free Bet Bonuses, Joker Ball, and jackpots continue to attract a large player base. The online lottery sub-segment is witnessing significant growth due to the widespread use of smartphones and smart devices. Online platforms, sports platforms, fantasy team leagues, social media platforms, and analytics platforms are increasingly being used to offer lottery games. Blockchain, databases, and cryptocurrencies are being adopted to ensure transparency and security. Draw-based games and instant games, including sport games, are available on various online lottery platforms. Casinos and blockchain-based platforms are also offering lottery games to cater to the evolving preferences of players. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

The security and credibility issues related to lotteries is the major challenge that affects the growth of the market. The market encompasses various types of lotteries, including financial lotteries and national lotteries, which are gaining popularity in the gaming sector. Advanced audio-visual technologies, touch displays, actuators, and augmented reality are being integrated into lotteries to enhance the user experience. Digital tools such as the Internet, online games, and mobile phone technology have significantly expanded the reach of lotteries, leading to the growth of the online lottery sub-segment. Online gambling platforms offer Free Bet Bonuses, Joker Ball, and jackpots, attracting a large customer base. Blockchain technology, databases, and smart devices are being employed to ensure transparency and security. The online mode of playing lotteries is increasingly preferred due to its convenience and accessibility. Sports platforms, fantasy team leagues, social media platforms, and analytics platforms are also leveraging lotteries to engage users. Casinos and blockchain-based platforms are exploring the use of cryptocurrencies for lottery transactions. Draw-based games and instant games continue to dominate the market, with sport games and online lottery gaining traction. Lottery stores remain an essential part of the market, but the shift towards online platforms is evident. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Arizona Lottery - The company offers lottery such as mega millions, powerball, the pick and triple twist.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Camelot UK Lotteries Ltd.

- Colorado Lottery

- Connecticut Lottery Corp.

- Delaware State Lottery

- Florida Lottery

- Flutter Entertainment Plc

- Georgia Lottery Corp.

- Hoosier Lottery

- Missouri Lottery

- New York State Gaming Commission

- Pennsylvania Lottery

- Pollard Banknote Ltd.

- Scientific Games LLC

- STRATACACHE

- Texas Lottery Commission

- The California State Lottery

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The lottery market in North America is witnessing significant growth due to the increasing popularity of financial lotteries in the gaming sector. The integration of advanced technologies such as audio-visual technologies, touch displays, actuators, and augmented reality in lotteries is driving the market. The online mode of playing lotteries through the internet, mobile phone technology, and online gambling platforms is gaining traction among young adults and older generations. The market is segmented into lotto sub-segment and online lottery sub-segment. The lotto sub-segment includes national lotteries and lotto lotteries, while the online lottery sub-segment includes online games, sports platforms, fantasy team leagues, social media platforms, analytics platforms, casinos, and blockchain-based platforms. The use of digital tools and cryptocurrencies in online lotteries is a growing trend. The internet connectivity and e-commerce channels provide convenience and accessibility to players.

Further, the lottery industry is also utilizing big data and marketing channels to enhance customer engagement and increase sales. Responsible gambling measures are being implemented to ensure that lotteries are accessible only to adults and to prevent problem gambling. Scratch-off tickets and draw-based games continue to be popular, but instant games and sport games are gaining popularity among younger generations. Retailers, including lottery stores and retail outlets, continue to play a significant role in the lottery market. The integration of smart devices and mobile applications is making it easier for players to access lotteries and check their winnings. Charitable purposes and public services are also driving the market. Powerball and lotto are some of the popular lottery games in the region. The market is expected to continue growing due to the increasing adoption of digital options and the expanding reach of online lotteries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.48% |

|

Market Growth 2024-2028 |

USD 40.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.22 |

|

Key companies profiled |

Arizona Lottery, Camelot UK Lotteries Ltd., Colorado Lottery, Connecticut Lottery Corp., Delaware State Lottery, Florida Lottery, Flutter Entertainment Plc, Georgia Lottery Corp., Hoosier Lottery, Missouri Lottery, New York State Gaming Commission, Pennsylvania Lottery, Pollard Banknote Ltd., Scientific Games LLC, STRATACACHE, Texas Lottery Commission, and The California State Lottery |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles,market forecast , fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch