Liquid Paperboard Market Size 2024-2028

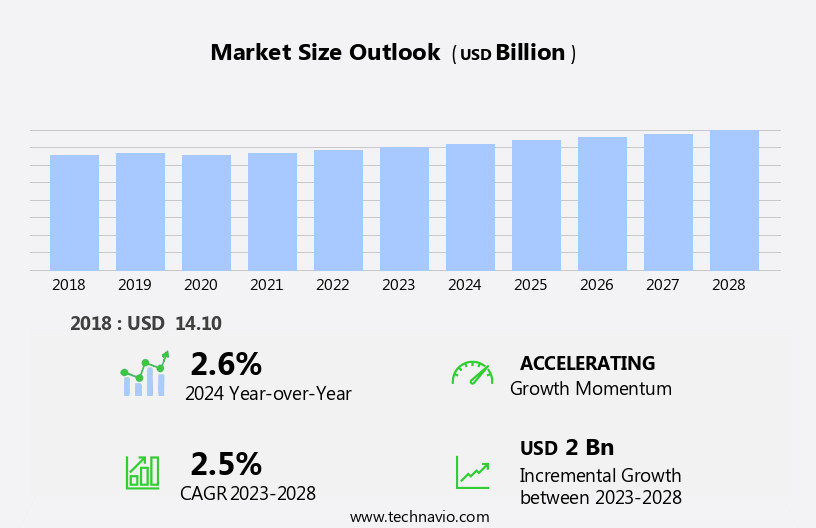

The liquid paperboard market size is forecast to increase by USD 2 billion at a CAGR of 2.5% between 2023 and 2028.

What will be the Size of the Liquid Paperboard Market During the Forecast Period?

How is this Liquid Paperboard Industry segmented and which is the largest segment?

The liquid paperboard industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Dairy products

- Juice products

- Others

- Geography

- APAC

- China

- Europe

- Germany

- UK

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

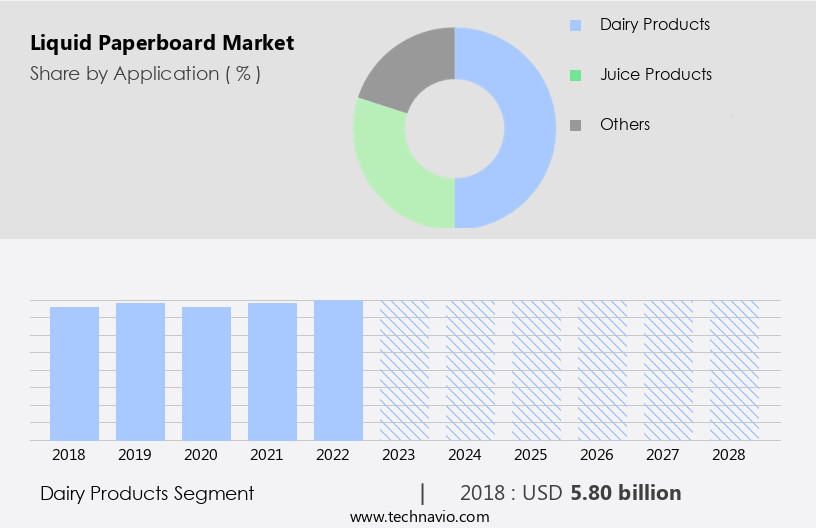

The dairy products segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing demand for dairy products in both developed and developing countries, particularly China, India, Japan, and the UK. Dairy products, a crucial source of essential nutrients, have driven the market's growth, fueled by changing lifestyles and food habits that have propelled the packaged food and beverage industry. The industry is witnessing the emergence of flavored milk, soymilk, and other plant-based milk alternatives. Consumer engagement is a critical factor driving market growth, with a focus on natural, recyclable, and cost-efficient packaging solutions. Technological advancements, such as clear messaging through QR codes and RFID tags, have increased transparency and consumer safety.

Lightweight liquid paperboard packaging, produced using renewable raw materials and sustainable production processes, reduces carbon footprint and contributes to environmental responsibility. Barrier layers and composite materials ensure the freshness and shelf life of liquid products, such as soups and sauces. The recycling infrastructure's development and the adoption of recycling technologies are essential for reducing waste and promoting sustainability. Liquid paperboard's minimalistic design, contents in glass, and alternatives to metal packaging contribute to cost savings for consumer brands. The liquid paperboard industry's investment prospects are promising, with new business ventures and service classifications focusing on anti-counterfeiting technologies, bio-based and biodegradable materials, and barrier coatings.

These advancements cater to the prevailing trends of clean-label packaging, environmental impact, and sustainable packaging solutions.

Get a glance at the market report of various segments Request Free Sample

The Dairy products segment was valued at USD 5.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

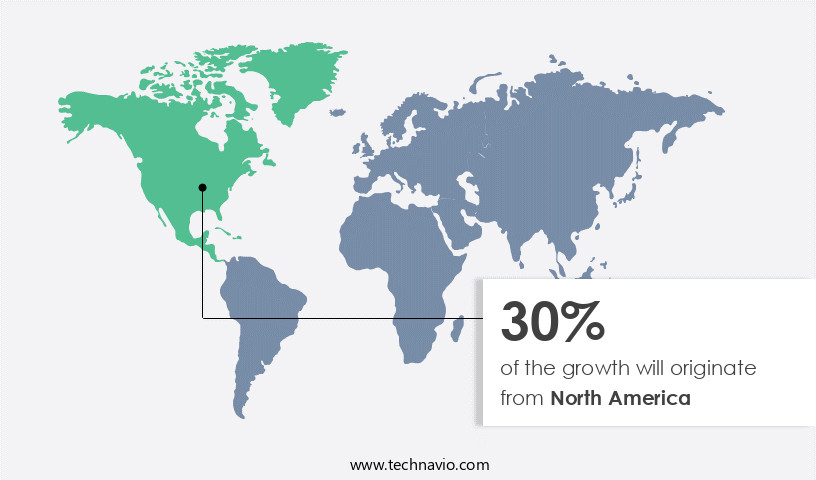

North America is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) is witnessing significant growth due to the increasing demand for sustainable packaging solutions In the food and beverage sector. With a large and growing population, urbanization, and rising disposable income, countries like China, India, Japan, and Southeast Asian nations are experiencing a surge in consumption of packaged liquids such as milk, juices, and ready-to-drink products. This trend is further fueled by shifting consumer preferences towards eco-friendly and recyclable packaging options. In response to sustainability concerns and government initiatives to reduce plastic waste, there is a growing preference for liquid paperboard packaging that is renewable, recyclable, and biodegradable.

Technological advancements, such as clear messaging through QR codes, RFID tags, and minimalistic designs, are also driving market growth. Production capacities are expanding to meet the demand for lightweight and cost-efficient liquid paperboard packaging. The market is further propelled by the adoption of alternative materials, such as bio-based and biodegradable materials, barrier layers, and composite materials, In the production of liquid cartons. The recycling infrastructure is also improving, enabling the recycling of liquid paperboard and reducing waste. The market's environmental responsibility and sustainability are key factors, with companies investing in nanotechnology, material usage, and lightweight production processes to reduce carbon footprint and transportation costs.

The liquid paperboard industry's future looks promising, with increasing investment prospects and new business ventures.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Liquid Paperboard Industry?

- Increase in demand for recyclable and sustainable packaging is the key driver of the market.The market is witnessing significant growth as food and beverage manufacturers shift towards more sustainable packaging solutions in response to increasing environmental concerns and stringent regulations. Countries such as the US, China, India, the UK, Argentina, and Brazil are leading the charge in reducing plastic packaging usage. For instance, the UK aims to eliminate all avoidable plastic waste by 2042, while India has banned single-use plastics in several states, including Karnataka in 2021. Liquid paperboard, a composite material made from renewable and biodegradable materials, offers several advantages over plastic. It is lightweight, recyclable, and can be sourced from natural products.

Consumers are increasingly engaged with brands that prioritize sustainability, transparency, and minimalistic design. Liquid paperboard's clear messaging, QR codes, RFID tags, and authentication features enhance consumer safety and convenience. Production processes for liquid paperboard are cost-efficient and can be produced using technological advancements such as nanotechnology and barrier layers. These features extend the shelf life of liquid products, such as soups, sauces, milk, and single servings, while minimizing waste. The use of biopolymers and biodegradable materials in liquid paperboard production reduces the carbon footprint and environmental impact. Packaging manufacturers are investing in sustainable packaging solutions, including liquid paperboard, to meet consumer demands and regulatory requirements.

The market's growth is further fueled by the prevaling trends towards cost savings, clean-label packaging, and alternative materials. The liquid paperboard industry's investment prospects are promising, with service classification offerings ranging from design and production to recycling and transportation. New business ventures are emerging as technological advancements continue to improve the material usage, barrier properties, and recycling infrastructure.

What are the market trends shaping the Liquid Paperboard market?

- Technological innovations in liquid packaging is the upcoming market trend.The market is experiencing significant growth due to increasing consumer demand for sustainable and cost-efficient packaging solutions. Natural, recyclable, and renewable ingredients are becoming essential for consumer engagement. Technological advancements In the industry include clear messaging through QR codes and RFID tags, as well as lightweight production capacities. Liquid paperboard, a composite material made from paperboard and alternative materials, offers minimalistic design, barrier layers, and longer shelf life for various liquid products such as soups, sauces, milk, and juices. Manufacturers are investing in sustainable production processes, using bio-based and biodegradable materials like bio-polymers, nanotechnology, and barrier coatings. These innovations address consumer safety and authentication concerns while reducing the carbon footprint.

The market also focuses on transparency, minimalistic design, and convenience, with compact designs and ultra-thin, lightweight packages. Sustainability is a key priority, with recycling infrastructure and recycling technologies essential for reducing waste. Cost savings are a significant factor for consumer brands, leading to increased investment prospects In the liquid paperboard industry. As the market continues to evolve, it is essential to consider the environmental impact and the sourcing of raw materials, ensuring minimal moisture and oxygen contamination. The use of clean-label packaging and anti-counterfeiting technologies further enhances consumer trust and brand loyalty.

What challenges does the Liquid Paperboard Industry face during its growth?

- Fluctuations in raw material prices is a key challenge affecting the industry growth.Liquid paperboard, a key packaging material for various consumer goods, is primarily manufactured using paper pulp as a raw material. Recycled fiber and virgin fibers derived from hardboard and softwoods are also employed in its production. However, the fluctuating prices of paper pulp have resulted in increased costs for liquid paperboards, negatively impacting demand. For instance, the US Producer Price Index (PPI) for pulp, paper, and allied products experienced a 4.79% increase from August 2018 to August 2022. Additionally, escalating transportation costs, represented by an average global diesel price of USD1, further add to the expense. To cater to evolving consumer preferences, the liquid paperboard industry is focusing on natural, renewable, and recyclable alternatives.

This shift is reflected In the growing popularity of bio-based and biodegradable materials, such as biopolymers, for barrier layers in liquid cartons. Technological advancements, including QR codes and RFID tags, are being integrated to enhance consumer engagement and ensure product authentication and consumer safety. Minimalistic design, lightweight composites, and compact, ultra-thin packages are also gaining traction, offering cost savings for consumer brands while reducing environmental impact. Sustainable packaging solutions, such as liquid paperboard made from recycled materials, are becoming increasingly important as consumers demand greater transparency and environmental responsibility. Investment prospects In the liquid paperboard industry remain strong, with service classification offerings expanding to include new business ventures and innovative technologies, such as nanotechnology and clean-label packaging.

As market dynamics continue to evolve, liquid paperboard manufacturers are focusing on material usage efficiency, lightweight designs, and barrier properties to maintain cost savings and shelf life while minimizing waste and carbon footprint.

Exclusive Customer Landscape

The liquid paperboard market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the liquid paperboard market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, liquid paperboard market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Asia Pulp and Paper APP Sinar Mas - Liquid paperboard is a versatile packaging solution that maintains the integrity of liquid contents in both ambient and chilled conditions. This product caters to the dual requirements of preservation and printing, making it an ideal choice for various industries. By utilizing advanced technology and materials, the company ensures the highest quality and consistency in its liquid paperboard offerings. The product's ability to protect and present liquid contents effectively sets it apart In the market, making it a preferred choice for businesses seeking reliable and efficient packaging solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asia Pulp and Paper APP Sinar Mas

- BillerudKorsnas AB

- Bulleh Shah Packaging Pvt. Ltd.

- Clearwater Paper Corp.

- Elopak ASA

- Georgia Pacific

- Graphic Packaging Holding Co.

- International Paper Co.

- Klabin S.A.

- Nippon Paper Industries Co. Ltd.

- Pactiv Evergreen Inc.

- PaperWorks Industries Inc.

- Rengo Co. Ltd.

- Stora Enso Oyj

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a dynamic and evolving industry that caters to the packaging needs of various consumer goods, particularly those with liquid contents. This sector has witnessed significant growth in recent years due to the increasing demand for sustainable, cost-efficient, and technologically advanced packaging solutions. One of the key trends driving the market is the shift towards natural and renewable ingredients in packaging. Consumers are increasingly seeking out eco-friendly and biodegradable materials for their packaging needs. Liquid paperboard, made from renewable resources such as wood pulp, is an attractive option due to its recyclable and biodegradable nature. Clear messaging and authentication are crucial considerations In the liquid paperboard industry.

QR codes and RFID tags are commonly used to provide consumers with information about the product and ensure its authenticity. This is particularly important for consumer brands looking to maintain consumer safety and transparency. Minimalistic design is another trend that has gained popularity In the market. Lightweight and compact designs are preferred for their convenience and reduced transportation costs. Technological advancements, such as nanotechnology and barrier layers, are also being employed to enhance the barrier properties of liquid paperboard and extend the shelf life of the packaged products. Sustainability is a major concern for both consumers and manufacturers In the liquid paperboard industry.

The use of alternative materials, such as bio-based and biodegradable materials, is becoming increasingly common. Barrier coating and recycling technologies are also being employed to reduce the environmental impact of liquid paperboard production and improve the recycling infrastructure. The production processes used In the liquid paperboard industry are also undergoing significant changes. The use of clean-label packaging and the elimination of raw materials with undesirable additives is a prevailing trend. The industry is also exploring the use of sustainable production processes and reducing material usage to minimize the carbon footprint. The liquid paperboard industry presents significant investment prospects for new business ventures.

The market is expected to grow steadily due to the increasing demand for sustainable and cost-efficient packaging solutions. The industry is also witnessing significant technological advancements, which are expected to drive innovation and growth. In conclusion, the market is a dynamic and evolving industry that caters to the packaging needs of various consumer goods. The market is driven by trends such as sustainability, cost-efficiency, and technological advancements. The use of natural and renewable materials, clear messaging and authentication, minimalistic design, and sustainability are key considerations In the industry. The production processes are also undergoing significant changes to reduce the environmental impact and improve efficiency.

The liquid paperboard industry presents significant investment prospects for new business ventures.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.5% |

|

Market growth 2024-2028 |

USD 2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.6 |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Liquid Paperboard Market Research and Growth Report?

- CAGR of the Liquid Paperboard industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the liquid paperboard market growth of industry companies

We can help! Our analysts can customize this liquid paperboard market research report to meet your requirements.