Land Mobile Radio (LMR) Market Size 2025-2029

The land mobile radio (LMR) market size is forecast to increase by USD 49.27 billion at a CAGR of 21.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing importance of efficient critical communication operations in various industries, including public safety, transportation, and energy. This demand is driven by the need for seamless, real-time communication to enhance safety, productivity, and operational efficiency. However, the upgradation of land mobile radios from analog to digital technology presents both opportunities and challenges. On the one hand, digital LMR systems offer improved voice quality, greater capacity, and enhanced security features. On the other hand, the transition requires substantial investment in infrastructure, training, and interoperability solutions. Moreover, the LMR market faces several challenges that impact its growth potential.

- The market is experiencing significant potential for growth due to the increasing importance of efficient critical communication operations. One trend driving market expansion is the upgrading of land mobile radios from analog to digital technology. Regulatory hurdles, such as licensing requirements and frequency allocation, can hinder market penetration. Supply chain inconsistencies and the high cost of components, particularly semiconductors, can also temper growth. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on developing innovative solutions that address these issues while delivering superior performance and value. By staying abreast of market trends and regulatory developments, and collaborating with industry partners, they can position themselves for long-term success in the dynamic and evolving LMR market.

What will be the Size of the Land Mobile Radio (LMR) Market during the forecast period?

- In the dynamic US market for Land Mobile Radios (LMR), critical communication plays a pivotal role in various sectors, including emergency response and fleet management. The demand for reliable and efficient radio solutions continues to grow, driving the market's expansion. Traditional analog radio systems are being replaced by digital radios, offering enhanced voice and data capabilities, improved battery life, and better network infrastructure. These organizations, including law enforcement agencies, fire departments, ambulance services, and transportation organizations, require reliable and efficient wireless communication to ensure effective coordination during critical situations. Fleet monitoring and management applications are increasingly adopting LMR technology, ensuring real-time communication and increased productivity. Radio integration with network infrastructure and compliance with industry regulations are essential considerations for businesses. Audio quality is a critical factor in mission-critical communication, and advanced radio technology delivers clearer, more consistent sound.

- Radio consulting and services are essential for optimizing system performance and ensuring radio system reliability. Industrial communication requires robust and secure radio solutions, with an emphasis on voice and data transmission. Radio innovation, including radio integration, radio training, and radio upgrades, is vital for businesses to stay competitive. Compliance with stringent industry standards and regulations is essential for public safety organizations to ensure secure and reliable communication. Enterprise communication relies on LMR for efficient and reliable communication, particularly in public safety and emergency response situations. The market's future growth is driven by the need for advanced radio technology, network infrastructure, and compliance with industry regulations. Radio maintenance, licensing, and consulting services are essential components of the LMR ecosystem, ensuring optimal system performance and longevity.

How is this Land Mobile Radio (LMR) Industry segmented?

The land mobile radio (LMR) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- DMR

- Project 25

- TETRA

- Others

- Type

- Hand portable

- In-vehicle

- Frequency Range

- 25-174 MHz

- 200-512 MHz

- 700 MHz and above

- Application

- Commercial

- Mining

- Oil and gas

- Defense

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

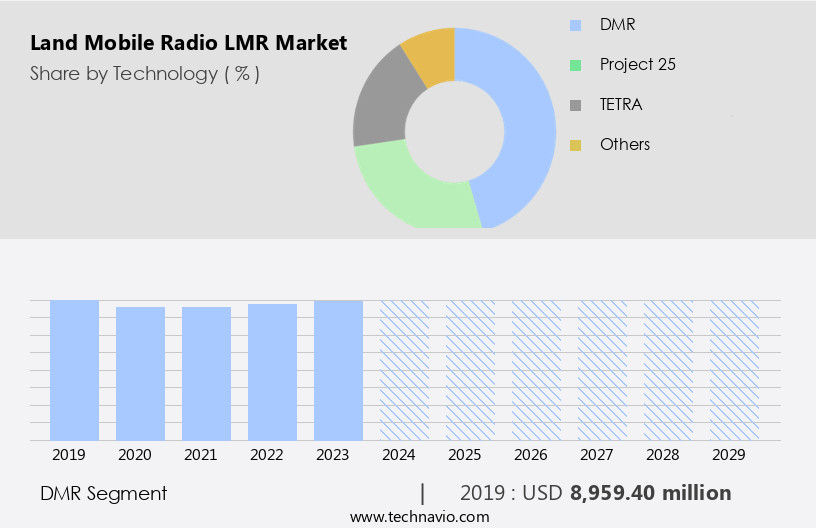

By Technology Insights

The DMR segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing adoption of digital radio technologies, such as Digital Mobile Radio (DMR), among various industries, particularly public safety and law enforcement. DMR, a digital radio standard developed by the European Telecommunications Standards Institute, offers numerous advantages over analog radio systems, including improved voice quality, enhanced functionality, increased channel efficiency, and heightened security. DMR devices are also cost-effective, making them an attractive alternative for businesses seeking to upgrade from analog radio systems. The DMR standard is compatible with most used analog solutions, enabling a seamless migration path from analog to digital radio systems. The standard enables users to implement DMR radio infrastructure over existing analog networks, reusing sites, antennas, power supplies, and frequency licenses.

Existing radio infrastructure, including sites, antennas, power supplies, and frequency licenses, can be reused during the transition. DMR technology supports various communication protocols, ensuring interoperability with different systems and devices. Network infrastructure plays a crucial role in the LMR market, with the need for robust and reliable networks to support mission-critical voice and data communication. Integration of IP connectivity and radio systems is becoming increasingly important, allowing for remote monitoring, fleet management, and data communication. Charging stations, maintenance, and support services are essential to ensure the uninterrupted operation of LMR systems. First responders and emergency response teams rely on LMR systems for critical voice communication and data exchange.

Location tracking and safety compliance are essential features for these teams to effectively respond to emergencies. Regulatory compliance and frequency allocation are also significant factors influencing the LMR market. Operational efficiency and workforce optimization are key drivers for businesses adopting LMR systems. Digital radio technologies, such as DMR, offer significant cost savings through increased battery life and reduced maintenance requirements. Portable and two-way radios are popular choices for businesses seeking flexibility and mobility. In conclusion, the LMR market is witnessing considerable growth due to the adoption of digital radio technologies, such as DMR, and the increasing demand for reliable and efficient communication systems across various industries.

The market is characterized by the integration of various entities, including network infrastructure, charging stations, maintenance and support, communication protocols, public safety, law enforcement, and emergency response teams. The focus on operational efficiency, workforce optimization, and cost savings is driving the market forward.

The DMR segment was valued at USD 8.96 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

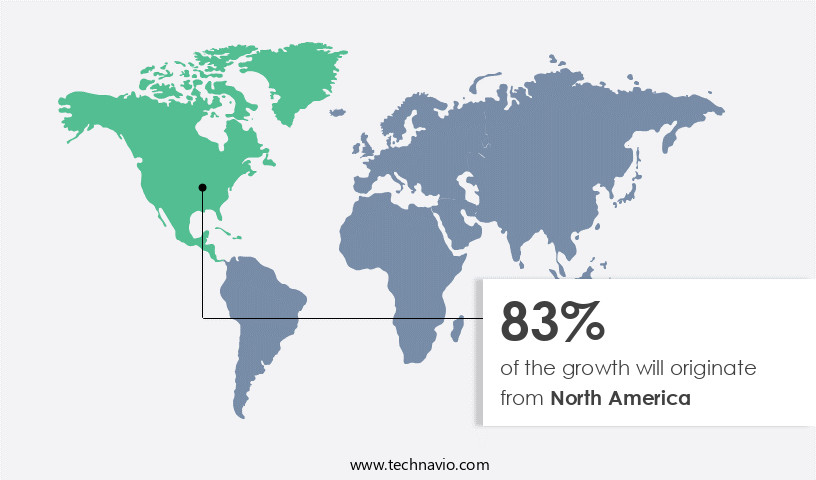

North America is estimated to contribute 83% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market encompasses the 25-174 MHz frequency range, a crucial segment of the electromagnetic spectrum for communication. This frequency range supports voice and data transmission, essential for public safety, law enforcement, and emergency response. The integration of ip connectivity enhances communication capabilities, enabling data exchange and real-time location tracking. Radio system integration ensures seamless communication between different agencies and fleets, while charging stations maintain uninterrupted usage. Radio management software optimizes workforce efficiency, offering maintenance and support services to ensure operational readiness. Communication protocols ensure interoperability between different systems, enabling first responders to collaborate effectively. Digital radio technology and accessories offer improved audio quality and battery life, while fleet management solutions boost operational efficiency. However, the market share of LMR in North America is projected to decrease significantly during the forecast period due to the emergence of new cellular technologies like 5G and the maturity of 3G and 4G networks.

Network infrastructure and service level agreements ensure reliable voice communication, with frequency allocation and regulatory compliance ensuring safety and security. Mobile radios, including portable models, offer flexibility and cost savings, making them a popular choice for various industries. The LMR market's evolution emphasizes the importance of clear, reliable, and efficient communication, as well as data communication capabilities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Land Mobile Radio (LMR) market drivers leading to the rise in the adoption of Industry?

- The growing significance of efficient critical communication operations serves as the primary driver in the market, underlining the importance of effective and professional communication solutions. The market has evolved significantly, transitioning from traditional, analog voice systems to sophisticated trunking and digital solutions. These advanced systems offer benefits such as short call setup times, high-quality audio, group calling, and priority access. The LMR technology's acceptance is expanding across various sectors, including commercial and public safety applications. One of the key drivers for this growth is the increasing priority given to effective public safety communication networks due to the growing security threats and the need for improved efficiency and information sharing. The LMR market also caters to the demand for high-speed data services without requiring broadband data, making it an attractive option for organizations.

- Furthermore, the integration of IP connectivity, radio system integration, and radio management software, along with maintenance and support services, enhances the functionality and reliability of LMR systems. Overall, the LMR market's growth is fueled by the importance of seamless communication and the need for secure, efficient, and reliable communication solutions.

What are the Land Mobile Radio (LMR) market trends shaping the Industry?

- The transition from analog to digital upgradation is a mandated trend in the land mobile radio market. This technological advancement is essential for enhanced communication clarity, security, and capacity. The market has experienced notable growth and transformation since the 1990s, with a shift from analog to digital radio technology. Traditional two-way analog radios, commonly used in military services, have been surpassed by digital radios due to their superior functionalities. Digital LMR systems offer enhanced audio quality, eliminating background noise and maintaining consistent voice transmission within the radio's range.

- Additionally, they provide advanced features such as GPS tracking, data transmission, simultaneous conversations, text messaging, and emergency alerts. In 2024, the market is witnessing further digital transformation with the increasing adoption of hybrid LMR-LTE systems. These systems combine the benefits of LMR and Long-Term Evolution (LTE) networks, offering extended coverage, improved battery life, and seamless integration with fleet management and emergency response systems. Digital radio accessories, including batteries, antennas, and speakers, further enhance the functionality and efficiency of these systems. Network infrastructure advancements continue to support the market's growth, enabling better connectivity and interoperability among various LMR systems.

How does Land Mobile Radio (LMR) market faces challenges face during its growth?

- The expansion of the land mobile radio industry is hindered by the technological limitations inherent in this communication technology. Land mobile radio (LMR) technology is a vital communication solution for various industries, particularly for public safety services such as police, fire, and ambulance departments. This technology enables wireless, two-way voice communications, ensuring effective and private communications for daily operations and critical missions. However, LMR technology faces limitations, including bandwidth constraints and compatibility with only voice and select data applications, such as location tracking. The lack of interoperability among incompatible LMR systems hampers unified communications across agencies, posing challenges during large-scale incidents. For instance, during complex crisis events like Hurricane Katrina and 9/11, multiple jurisdictions collaborated, and the inability to communicate seamlessly hindered efficient coordination and response efforts.

- To address these challenges, there is a growing demand for advanced LMR solutions that offer high-speed data communication and improved operational efficiency. Service level agreements (SLAs) play a crucial role in ensuring reliable and uninterrupted communication services. With the increasing importance of workforce optimization, LMR systems that integrate with other communication tools and technologies are gaining popularity. Investing in LMR technology can yield significant returns on investment (ROI) by enhancing operational efficiency, improving workforce productivity, and ensuring effective communication during critical situations. Frequency allocation remains a critical factor in the successful implementation and utilization of LMR systems.

Exclusive Customer Landscape

The land mobile radio (LMR) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the land mobile radio (LMR) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, land mobile radio (LMR) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anritsu Corp. - The company offers land mobile radio such as S412E, MA8100A, and MS2090A.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anritsu Corp.

- BK TECHNOLOGIES CORP.

- Burk Technology

- Codan Communications

- Crescend Technologies LLC

- Helios Power Solutions

- Hytera Communications Corp. Ltd.

- Icom America Inc.

- JNB Electronics Pty Ltd.

- JVCKENWOOD Corp.

- L3Harris Technologies Inc.

- Leonardo USA

- Motorola Solutions Inc.

- PowerTrunk Inc.

- Puget Sound Instrument

- Scottish Communications Group

- Sepura Ltd.

- Tait Communications

- Texas Instruments Inc.

- Thales Group

- Viavi Solutions Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Land Mobile Radio (LMR) Market

- In February 2024, Motorola Solutions, a leading provider of mission-critical communication solutions, introduced the next generation of its land mobile radio (LMR) portfolio, the MotoTRBO T7 Portable Radio. This new product offers enhanced features, including extended battery life and improved audio quality (Motorola Solutions Press Release, 2024).

- In July 2025, Nokia and TETRA + Critical Communications Association (TCCA) announced a strategic partnership to drive the adoption of mission-critical communications in the transportation sector. The collaboration aims to integrate Nokia's mission-critical broadband solutions with TCCA's TETRA technology, providing seamless connectivity for public safety and transportation organizations (Nokia Press Release, 2025).

- In October 2024, Sepura, a leading LMR technology provider, secured a significant investment of â¬35 million from its parent company, U.S. Investment firm, TPG Capital. The funding will support Sepura's continued growth in the LMR market and the development of new technologies (Sepura Press Release, 2024).

- In December 2025, the European Union (EU) approved the European Public Safety Communications Network (EPSCN) project, which aims to create a unified, interoperable communication network for public safety agencies across Europe. The network will utilize LMR technology, enabling seamless communication between agencies in different countries (European Commission Press Release, 2025).

Research Analyst Overview

Land Mobile Radio (LMR) systems have long been the backbone of critical communication for various industries, including public safety, law enforcement, and fleet management. The LMR market is witnessing ongoing dynamics and evolving patterns, shaped by the integration of advanced technologies and the shifting demands of users. IP connectivity is a significant trend in the LMR market, as radio systems are increasingly being integrated with IP networks to enable data communication and enhance operational efficiency. This integration allows for seamless information sharing between different communication platforms, improving workforce optimization and situational awareness.

Radio system integration is another critical aspect of the LMR market, as organizations seek to streamline their communication infrastructure. This integration goes beyond simple interoperability, with the adoption of common communication protocols ensuring that various radio systems can work together harmoniously. Public safety agencies and law enforcement entities are major consumers of LMR systems, with their communication needs often dictating the market's evolution. First responders require reliable, high-quality communication to ensure safety and efficiency in emergency response situations. This need for safety compliance drives the development of advanced features, such as location tracking and service level agreements, which help ensure that responders can effectively coordinate their efforts.

Charging stations and maintenance and support services are essential components of the LMR market, ensuring that radios remain operational and effective. Battery life is a crucial factor in the selection of LMR systems, with longer battery life enabling extended use in the field. The LMR market is also witnessing the transition from analog to digital radio systems. Digital radio offers improved audio quality, data communication capabilities, and frequency allocation efficiency. However, this transition comes with its challenges, including the need for regulatory compliance and radio licensing. Fleet monitoring is another area where LMR systems are making a significant impact.

Radio communication plays a vital role in ensuring the operational efficiency of fleet operations, with two-way radios enabling real-time communication between drivers and dispatchers. Portable radios offer the flexibility to communicate on the go, while return on investment is a key consideration for organizations looking to implement these systems. Network infrastructure is a critical factor in the success of LMR systems, with organizations requiring robust, reliable, and scalable networks to support their communication needs. Cost savings are a significant driver of innovation in the LMR market, with companies seeking to offer cost-effective solutions without compromising on performance or functionality.

In conclusion, the LMR market is a dynamic and evolving landscape, shaped by the integration of advanced technologies, the shifting demands of users, and regulatory requirements. From IP connectivity and radio system integration to public safety, fleet management, and network infrastructure, the LMR market is poised for continued growth and innovation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Land Mobile Radio (LMR) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

244 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.1% |

|

Market growth 2025-2029 |

USD 49.27 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.1 |

|

Key countries |

US, China, Germany, Japan, UK, India, Canada, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Land Mobile Radio (LMR) Market Research and Growth Report?

- CAGR of the Land Mobile Radio (LMR) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the land mobile radio (LMR) market growth and forecasting

We can help! Our analysts can customize this land mobile radio (LMR) market research report to meet your requirements.