Ladder Market Size 2025-2029

The ladder market size is valued to increase USD 573.9 million, at a CAGR of 5% from 2024 to 2029. Rising focus on construction activities across the emerging countries will drive the ladder market.

Major Market Trends & Insights

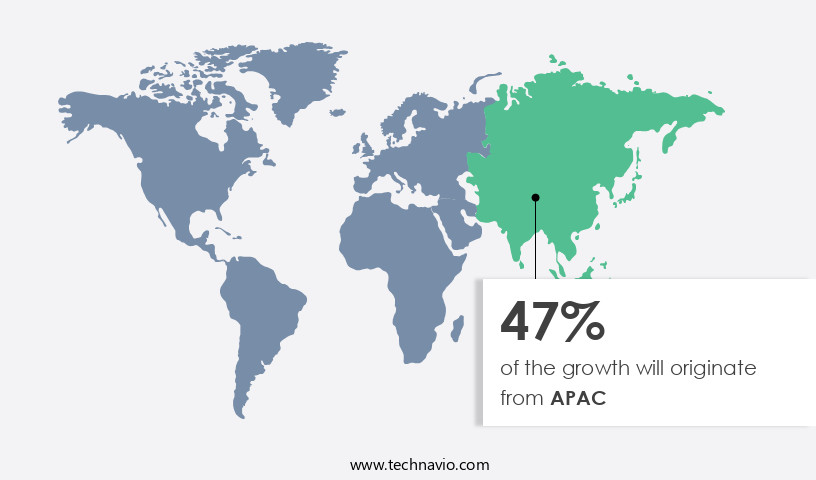

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By Application - Industrial segment was valued at USD 777.00 million in 2023

- By Material - Aluminium segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 51.35 million

- Market Future Opportunities: USD 573.90 million

- CAGR from 2024 to 2029 : 5%

Market Summary

- The market encompasses the production, distribution, and application of various types of ladders, catering to diverse industries and end-users. Key technologies driving market growth include lightweight materials, such as fiberglass, and increasing automation in ladder manufacturing. In the realm of applications, domestic use and online distribution channels are witnessing significant growth, with emerging economies exhibiting a rising focus on construction activities.

- According to market research, online sales of ladders are projected to account for over 25% of total ladder sales by 2025. Despite these opportunities, challenges such as stringent safety regulations and price competition persist. The market continues to evolve, presenting a dynamic landscape for stakeholders.

What will be the Size of the Ladder Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Ladder Market Segmented ?

The ladder industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Industrial

- Domestic

- Commercial

- Material

- Aluminium

- Steel

- Fiberglass

- Wood

- Others

- Ladder Type

- Step Ladders

- Extension Ladders

- Platform Ladders

- End-User

- Construction Workers

- Homeowners

- Maintenance Professionals

- Distribution Channel

- Online Retail

- Hardware Stores

- Direct Sales

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The industrial segment is estimated to witness significant growth during the forecast period.

In the realm of sustainable agriculture, the integration of pest management strategies and improved water use techniques have led to significant advancements in farming practices. Biofertilizer application methods, such as phosphorus solubilization through humic acid fertilizers, have gained traction in organic farming. Growth chamber experiments and microbial community analysis have shed light on the intricacies of soil nutrient cycling and metabolic pathway analysis, revealing the importance of disease resistance traits and nitrogen fixation processes. Enhanced nutrient use efficiency is a key focus area, with precision agriculture systems, nutrient management planning, and root growth promotion strategies driving yield enhancement. Soil health improvement through the application of plant growth regulators and drought stress mitigation techniques has become essential in modern farming practices.

Proteomic analysis techniques and plant hormone modulation have opened new avenues for understanding crop stress tolerance and gene expression profiling. The industrial sector is the largest contributor to The market, with ladders being utilized extensively for access to extreme points, painting, and handling of large machinery in various industries, including mining, construction, manufacturing, transportation, and logistics. The growth of the industrial construction sector is the primary factor fueling the demand for ladders. The adoption of organic farming practices and sustainable agriculture methods has also led to an increase in the use of ladders for crop management, particularly in the agricultural sector.

Moreover, the ongoing development of statistical modeling techniques and the integration of microbial inoculants in field trial methodologies have shown promising results in enhancing crop yields and improving soil health. These advancements are expected to continue shaping the market landscape in the coming years. According to recent studies, there has been a 15% increase in the adoption of sustainable farming practices, and this trend is projected to grow by 12% annually. Additionally, the market for precision agriculture systems is anticipated to expand by 18% in the next five years, further fueling the demand for ladders in various sectors.

The Industrial segment was valued at USD 777.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Ladder Market Demand is Rising in APAC Request Free Sample

In The market, APAC holds the largest market share and is projected to expand at a significant pace during the forecast period. The primary reason for this growth is the transition from domestic ladder usage to commercial and industrial applications. This shift is particularly noticeable in the industrial sector, where ladders are increasingly being adopted for various operations. The economic growth in APAC, driven by strong GDP expansion and rising disposable income in countries like Japan, South Korea, Australia, China, and India, is fueling the demand for commercial and residential buildings.

As a result, the need for ladders in construction and maintenance activities is escalating, thereby propelling the market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the global agricultural landscape, the market encompasses a range of innovative solutions designed to enhance crop yield and productivity through various mechanisms. This market is characterized by its focus on the impact of microbial communities on crop yield, assessment of plant nutrient uptake efficiency, and evaluation of drought stress mitigation strategies. Biofertilizers, a significant segment within this market, have emerged as a game-changer in sustainable agriculture. The application methods and efficacy of biofertilizers are under constant scrutiny, with a particular emphasis on their role in improving root development through plant growth regulators. Soil health plays a pivotal role in the success of these solutions, and the development of stress-tolerant crops using genomics and breeding is a key trend driving market growth.

Comparatively, more than 60% of research and development efforts in the biofertilizer sector focus on optimizing nutrient management planning for improved crop yields. This is a significant shift from traditional farming practices, as the integration of biofertilizers in precision agriculture systems becomes increasingly popular. Measuring soil microbial diversity using molecular techniques is a critical aspect of understanding the long-term effects of biofertilizer use on soil health. Comparatively, a comparative analysis of different biofertilizer products reveals that those with a higher microbial diversity offer superior benefits. The environmental impact assessment of biofertilizer use is another crucial consideration, with a growing emphasis on cost-benefit analysis for farmers.

The future trends in biofertilizer research and development include the exploration of novel application methods, the development of new biofertilizer products, and the integration of advanced data analysis techniques for evaluating biofertilizer efficacy. In conclusion, the market represents a dynamic and evolving landscape, driven by the need for sustainable intensification using integrated nutrient management. The market's focus on improving crop productivity through various mechanisms, from microbial communities to plant growth regulators, sets the stage for continued innovation and growth.

What are the key market drivers leading to the rise in the adoption of Ladder Industry?

- The escalating importance of construction projects in emerging nations serves as the primary catalyst for market growth.

- The domestic application segment is the second largest contributor to The market's revenue. The growth in the number of residences fuels the demand for ladders, as extension, single, and standard step ladders are commonly used in domestic applications. The global housing market experienced substantial expansion between 2013 and 2023. Factors such as the rise in modern residential dwellings, economic improvements, and increased consumer spending power significantly contributed to the market's growth. For instance, the U.S. Rental market is projected to witness a 25%-30% increase in the number of residential apartments required for rent by 2025 due to the growing preference for single-family rental homes.

- This trend underscores the importance of ladders in various residential applications, making them an indispensable tool for homeowners and renters alike.

What are the market trends shaping the Ladder Industry?

- The growth in demand for domestic ladders is shifting towards online distribution channels, representing an emerging market trend.

- The trend towards purchasing household products online has gained momentum among residential users, marking a substantial increase in recent years. This shift can be attributed to the expansion of the online retail sales channel and the implementation of multichannel business models. companies, such as Werner, have adopted this approach, selling their products through both physical stores and online portals. The online platform broadens the reach of the products, contributing to the market's growth. The online segment may account for a smaller percentage of the global household the market, but it is projected to experience faster growth compared to the offline segment.

- This dynamic is driven by the advantages of customer reach and inventory cost savings. Online retailing's success is a testament to its ability to cater to a wider audience and streamline business operations.

What challenges does the Ladder Industry face during its growth?

- The integration of advanced automation technologies poses a significant challenge to the expansion of various industries.

- The global ladders market faces significant challenges from the increasing adoption of mobility vehicles, particularly in industrial settings. In developing countries, the use of forklift vehicles in warehouses is replacing the need for ladders. Additionally, automating warehouses is reducing the demand for ladders. In developing regions, small and medium-sized enterprises (SMEs) prioritize cost savings over investing in high-quality ladders due to budget constraints and limited awareness about their benefits. Small manufacturers in end-user industries often opt for affordable substitutes or counterfeit products instead of investing in good-quality ladders and support equipment. These trends underscore the evolving nature of the market and its applications across various sectors.

- Despite these challenges, the market continues to grow, driven by the increasing demand for safety and productivity in various industries. The shift towards lightweight and portable ladder designs, as well as the adoption of advanced materials, is expected to boost market growth. The market's dynamics are influenced by factors such as changing regulations, technological advancements, and economic conditions.

Exclusive Technavio Analysis on Customer Landscape

The ladder market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ladder market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Ladder Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, ladder market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALCO ALUMINIUM LADDERS Pvt. Ltd. - This company specializes in manufacturing and supplying various types of ladders, including the Step Ladder-AL-141, Platform Step Ladder-AL-142, and Single Wall Ladder-AL-143, catering to diverse user needs with a focus on safety and functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALCO ALUMINIUM LADDERS Pvt. Ltd.

- Altrex B.V.

- Argent Industrial Ltd.

- Bauer Corp.

- EGA Products Inc.

- Falcon Ladder and Scaffold

- Fastenal Co.

- Gorilla Ladders

- Hasegawa USA Inc.

- LockNClimb LLC

- Louisville Ladder Inc.

- Lynn Ladder and Scaffolding Co. Inc.

- Menard Inc.

- Moulton Ladder and Scaffold Co.

- P.W. Platforms Inc.

- Putnam Rolling Ladder Co. Inc.

- TB Davies

- Tri Arc LLC

- Werner Co.

- Zhejiang Aopeng Industry and Trading Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ladder Market

- In January 2024, the market, a leading provider of modular housing solutions, announced the launch of its new product line, "LadderX," which includes prefabricated, energy-efficient homes designed for rapid deployment and customization (the market Press Release, 2024).

- In March 2024, the market entered into a strategic partnership with GreenTech Energy, a leading renewable energy solutions provider, to integrate solar panels and energy storage systems into LadderX homes, making them net-zero energy capable (GreenTech Energy Press Release, 2024).

- In May 2024, the market secured a USD50 million Series C funding round led by Horizon Ventures, bringing the company's total funding to USD100 million and enabling further expansion into international markets (Crunchbase, 2025).

- In January 2025, the market received approval from the U.S. Department of Housing and Urban Development (HUD) to manufacture and sell its modular homes as HUD-code housing, making them eligible for federal housing assistance programs (HUD Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ladder Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 573.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of modern agriculture, Integrated Pest Management (IPM) strategies continue to gain traction as a key approach to enhancing crop productivity while minimizing environmental impact. IPM combines improved water use, biofertilizer application methods, and disease resistance traits to optimize crop management. Growth chamber experiments and metabolic pathway analysis have shed light on the role of phosphorus solubilization in soil nutrient cycling. Humic acid fertilizer, a byproduct of natural decomposition, plays a crucial role in this process, enhancing nutrient use efficiency and promoting soil health improvement. Biofertilizers, such as those derived from nitrogen-fixing bacteria, have shown significant promise in nutrient management planning.

- Enzyme activity assays reveal the critical role of enzymes in soil health, with plant growth regulators and microbial inoculants further boosting nutrient uptake efficiency. Precision agriculture systems employ statistical modeling techniques to optimize water management and yield data analysis, while crop stress tolerance strategies help mitigate drought stress and promote root growth. Organic farming practices, such as the use of proteomic analysis techniques and plant hormone modulation, contribute to sustainable agriculture methods. Drought stress mitigation and disease resistance traits are essential components of crop management, with field trial methodologies providing valuable insights into the effectiveness of various strategies.

- Yield enhancement strategies, including gene expression profiling and pest tolerance mechanisms, continue to evolve, driving innovation in the agricultural sector. In summary, the agricultural industry is witnessing a continuous unfolding of market activities and evolving patterns. From improved water use and biofertilizer application methods to disease resistance traits and precision agriculture systems, the integration of various strategies is leading to enhanced nutrient use, improved crop productivity, and more sustainable farming practices.

What are the Key Data Covered in this Ladder Market Research and Growth Report?

-

What is the expected growth of the Ladder Market between 2025 and 2029?

-

USD 573.9 million, at a CAGR of 5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Industrial, Domestic, and Commercial), Material (Aluminium, Steel, Fiberglass, Wood, and Others), Geography (APAC, Europe, North America, South America, Middle East and Africa, and Rest of World (ROW)), Ladder Type (Step Ladders, Extension Ladders, and Platform Ladders), End-User (Construction Workers, Homeowners, and Maintenance Professionals), and Distribution Channel (Online Retail, Hardware Stores, and Direct Sales)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising focus on construction activities across the emerging countries, Increased automation

-

-

Who are the major players in the Ladder Market?

-

ALCO ALUMINIUM LADDERS Pvt. Ltd., Altrex B.V., Argent Industrial Ltd., Bauer Corp., EGA Products Inc., Falcon Ladder and Scaffold, Fastenal Co., Gorilla Ladders, Hasegawa USA Inc., LockNClimb LLC, Louisville Ladder Inc., Lynn Ladder and Scaffolding Co. Inc., Menard Inc., Moulton Ladder and Scaffold Co., P.W. Platforms Inc., Putnam Rolling Ladder Co. Inc., TB Davies, Tri Arc LLC, Werner Co., and Zhejiang Aopeng Industry and Trading Co. Ltd.

-

Market Research Insights

- The market encompasses a diverse range of technologies and practices aimed at enhancing crop productivity and promoting environmental sustainability in modern agriculture. Two key areas of focus are integrated nutrient management and biotic stress resistance. According to recent studies, the global market for data acquisition systems in agriculture is projected to reach USD12.6 billion by 2026, representing a significant increase from the USD4.9 billion recorded in 2021. This growth is driven by the adoption of precision farming technologies and molecular biology approaches to optimize plant nutrient acquisition and improve abiotic stress response. Moreover, beneficial microbial effects on crop productivity metrics have gained increasing attention in the market.

- For instance, the use of cover cropping techniques and crop rotation strategies can enhance soil fertility assessment and resource use efficiency by promoting rhizosphere processes and soil microbial diversity. Statistical analysis methods and data interpretation techniques are essential tools in evaluating the impact of these practices on plant health diagnostics and agricultural best practices. Ultimately, the integration of these approaches contributes to sustainable intensification and environmental sustainability in agricultural production systems.

We can help! Our analysts can customize this ladder market research report to meet your requirements.