Japan Road Freight Transport Market Size 2024-2028

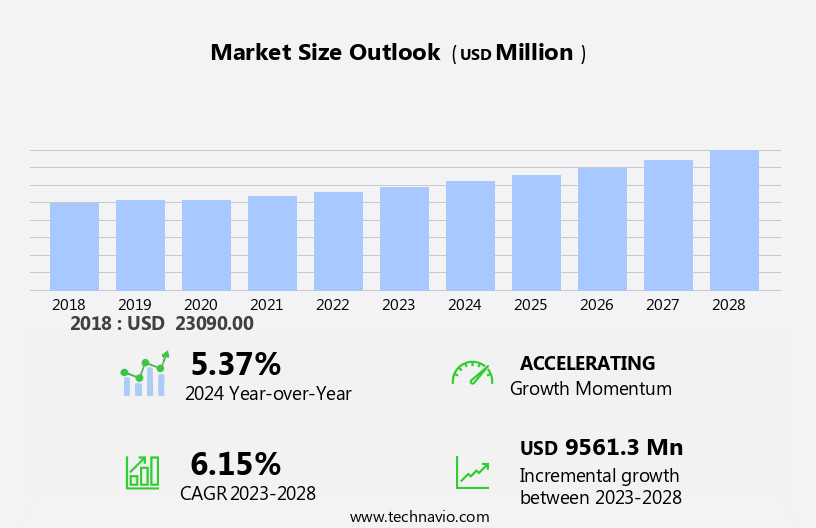

The Japan road freight transport market size is forecast to increase by USD 9.56 billion at a CAGR of 6.15% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. E-commerce and the subsequent rise in last-mile delivery demands are major drivers, leading to an increase in road freight transportation. Additionally, the availability of substitutes, such as sea and air freight, is being outweighed by the convenience and cost-effectiveness of road freight. However, challenges remain, including regulatory issues, infrastructure constraints, and the aging workforce. Despite these challenges, the market is expected to continue its growth trajectory, making it an attractive investment opportunity for businesses looking to expand their logistics operations in Japan.

What will be the size of the Japan Road Freight Transport Market during the forecast period?

- The market is a critical component of the country's logistics sector, facilitating the movement of solid and fluid goods throughout the archipelago. The market encompasses various segments, including long haul and less-than-truck-load (LTL) services for full truckloads and small fleet operators. The network of roads in Japan is extensive, enabling door-to-door service for various industries, such as agriculture, e-commerce, and the CEP (Courier, Express, and Parcel) and VAS (Value-Added Services) sectors.

- Moreover, investment in infrastructure is a significant trend, with real estate developers and the government investing in warehousing space to accommodate the growing demand for efficient storage solutions. The market is also witnessing the increasing adoption of technology, including online payments and automation, to streamline operations and enhance customer service. The light commercial vehicle segment is expected to grow due to the rising demand for flexible and cost-effective transportation solutions. Overall, the road freight market in Japan remains dynamic, driven by the evolving needs of industries and the continuous development of the logistics sector.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Manufacturing

- Automotive

- Consume goods

- Food and beverage

- Others

- Vehicle Type

- Medium and heavy commercial vehicle

- Light commercial vehicle

- Type

- Full truckload

- Less than truckload

- Geography

- Japan

By End-user Insights

- The manufacturing segment is estimated to witness significant growth during the forecast period.

The market plays a pivotal role In the logistics and supply chain sector, particularly for the manufacturing industry. Road freight is utilized for transporting raw materials, finished goods, and components between various production facilities and distribution centers. The demand for road freight services is driven by the need to efficiently move goods from manufacturers to retailers and consumers. This is crucial for Japanese manufacturing enterprises, which often have multiple production sites located in different regions. The transportation of raw materials and components to production facilities is also a significant function of the road freight market. The road sector provides a reliable and efficient means for manufacturers to deliver their products to market, ensuring a steady supply chain.

Get a glance at the market share of various segments Request Free Sample

The manufacturing segment was valued at USD 5.48 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Japan Road Freight Transport Market?

E-commerce and last-mile delivery is the key driver of the market.

- The market is experiencing significant changes due to the rising production and exports in various sectors, including the leading brands In the automotive, electronics, and FMCG industries. Long haul transportation of solid goods, such as raw materials and finished goods, continues to dominate the market. However, the increasing demand for less than truckload (LTL) services and the emergence of small fleet operators catering to the needs of e-commerce deliveries have disrupted traditional business models. Fuel prices and tax hikes have been major challenges for truckers, leading to increased operating costs. The government's initiatives like Bhratamala Pariyojana and Sagarmala projects aim to improve infrastructure and reduce logistics costs.

- Moreover, the regulatory environment is also undergoing changes, with the implementation of BF VI Norms and the Scrappage Policy, which may impact the market dynamics. The logistics sector is witnessing collaboration and strategic alliances between domestic entities and emerging startups to offer door-to-door services and asset-light models. The warehousing sector is also evolving, with companies offering kitting, assembling, and packing services to reduce lead times and improve efficiency. The road sector is expected to remain a critical component of the freight transportation network, with the operation of light commercial vehicles, medium commercial vehicles, and heavy commercial vehicles continuing to be essential for the movement of goods.

What are the market trends shaping the Japan Road Freight Transport Market?

Increase in road freight demand is the upcoming trend In the market.

- In Japan, the road freight transport market is witnessing significant growth due to rising production and income levels, leading to increased demand for logistics services in various sectors. Long haul transportation of solid and fluid goods, including raw materials, finished goods, and retail products, is a key driver for the market. The emerging e-commerce sector, with its surging demand for door-to-door delivery services, is also fueling growth. The regulatory environment is undergoing changes, with initiatives such as the Bhratamala Pariyojana and Sagarmala projects aimed at improving infrastructure and facilitating cross-border trade. The logistics sector is responding with strategic alliances, digitalization, and automation to meet the evolving needs of domestic entities and emerging startups.

- Furthermore, the road sector is adapting to sustainability initiatives, including the adoption of electric vehicles and reefer trucks, and the implementation of green initiatives. However, challenges such as rising fuel prices, tax hikes, and operating costs for truckers remain. These factors, along with the increasing demand for less-than-truckload (LTL) and full truckload (FTL) services, are shaping the market dynamics. Sectors such as agriculture, fishing and forestry, oil and gas, mining and quarrying, and the FMCG sector are major consumers of road freight transport services. The automotive and mobile phone industries, known for their luxury and high-value products, also rely heavily on the sector.

What challenges does Japan Road Freight Transport Market face during the growth?

Availability of substitutes is a key challenge affecting the market growth.

- The market faces unique challenges due to its heavy reliance on this mode of transportation. With limited alternatives, solid and fluid goods in various sectors such as raw materials, finished goods, retail products, and even exports for leading brands in sectors like automotive, mobile phones, luxury goods, and the FMCG sector, are primarily moved via road. The rising income and production levels in Japan have led to an increase in demand for freight transportation. However, this dependence on road transportation exposes the market to issues like traffic congestion, fuel prices, and tax hikes. The terrain of Japan, consisting of numerous islands with mountainous regions, makes it challenging to utilize alternative modes of transportation like railways or rivers for freight movement.

- In addition, the road sector and logistics sector in Japan are crucial for the operation of domestic entities, emerging startups, and even e-commerce deliveries. The freight rates are influenced by factors such as fuel costs, VAT cuts, and regulatory changes. The regulatory environment, consumer behavior, sustainability initiatives, and infrastructure investments are significant market dynamics shaping the market. Urbanization trends and regulatory changes are driving the need for digitalization, automation, and green initiatives. The e-commerce boom and collaboration logistics are also transforming the market landscape.

Exclusive Japan Road Freight Transport Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Deutsche Post AG

- FedEx Corp.

- FUJITRANS Corp.

- Hankyu Hanshin Holdings Group

- Japan Post Holdings Co. Ltd.

- Kintetsu Group Holdings Co. Ltd.

- kokusai express co. ltd.

- Konoike Transport Co. Ltd.

- LOGISTEED Ltd.

- Mitsubishi Logistics Corp

- Mitsui and Co. Ltd.

- Nichirei Corp.

- Nippon Express Holdings

- Sakai Moving Service Co. Ltd.

- Sankyu Co. Ltd.

- Seino Transportation Co.Ltd.

- SG Holdings Co. Ltd

- United Parcel Service Inc.

- Yamato Transport Co. Ltd.

- YUSEN LOGISTICS CO. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a critical component of the country's logistics sector, facilitating the movement of goods from manufacturers to consumers and supporting various industries, including agriculture, fishing and forestry, oil and gas, mining and quarrying, and the FMCG sector. The market encompasses a range of vehicle classes, including light commercial vehicles, medium commercial vehicles, and heavy commercial vehicles, catering to the diverse needs of domestic entities and emerging startups. The road sector in Japan is characterized by a historic period of regulatory changes and infrastructure investments. The regulatory environment has evolved to prioritize sustainability initiatives and digitalization, with a focus on reducing carbon emissions and improving operational efficiency.

In addition, urbanization trends have led to an increased demand for door-to-door services and collaboration logistics, particularly In the e-commerce sector. The market dynamics of the road freight transport sector are influenced by several factors. The rising production and income levels in Japan have led to an increase in demand for raw materials and finished goods, driving up freight rates. However, fuel prices and tax hikes have put pressure on truckers, leading to higher operating costs. The fuel costs, including petrol prices and diesel price increases, have been a significant concern for small fleet owners and large fleet operators alike. The regulatory changes, such as VAT cuts and the implementation of GST, have had a significant impact on freight transportation and warehousing costs.

Furthermore, oil marketing companies have also influenced the market by affecting fuel prices and domestic gasoline demand. High inflation and economic recovery have further complicated the market landscape, creating both opportunities and challenges for players. The market is a complex ecosystem, with various stakeholders, including freight transportation companies, logistics service providers, and e-commerce platforms. CEP and VAS have emerged as key players In the e-commerce sector, offering seamless delivery solutions and leveraging digitalization and automation to improve efficiency. The market is also witnessing a shift towards an asset-light model, with companies focusing on kitting, assembling, and packing services to reduce overheads.

In addition, the emergence of e-commerce deliveries has led to the growth of less-than-truckload (LTL) and all cargo services, catering to the changing demands of consumers. The regulatory environment and consumer behavior are two critical factors shaping the future of the market. Sustainability initiatives, such as the BHRT and Sagarmala projects, are driving the adoption of green initiatives and technology advancements. The e-commerce boom and cross-border trade are also creating new opportunities for strategic alliances and collaborations between domestic entities and international players. Therefore, the market is a dynamic and evolving landscape, influenced by various factors, including regulatory changes, consumer behavior, and technological advancements. The market is expected to continue to grow, driven by the increasing demand for goods and services, urbanization trends, and the e-commerce boom. Companies that can adapt to the changing market dynamics and leverage technology and sustainability initiatives are likely to thrive in this competitive market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.15% |

|

Market growth 2024-2028 |

USD 9.56 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.37 |

|

Competitive landscape |

Leading Companies, market report , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Japan

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch