Intelligent Transport System Market Size 2025-2029

The intelligent transport system (ITS) market size is forecast to increase by USD 47.38 billion, at a CAGR of 10% between 2024 and 2029. The market is driven by the pressing need to address increasing traffic congestion and road accidents.

Major Market Trends & Insights

- North America dominated the market and accounted for a 34% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

- Based on the Application, the traffic management segment led the market and was valued at USD 21.08 billion of the global revenue in 2023.

-

Based on the Type, the advanced traffic management system segment accounted for the largest market revenue share in 2023.

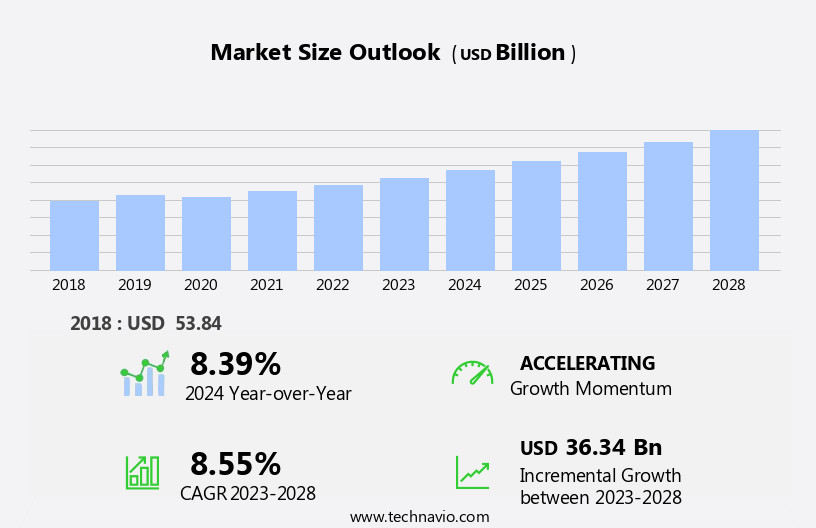

Market Size & Forecast

- Market Opportunities: USD 77.6 Billion

- Future Opportunities: USD 47.38 Billion

- CAGR (2024-2029): 10%

- North America: Largest market in 2023

The market continues to evolve, driven by the need for energy-efficient transportation and the implementation of road traffic monitoring and management systems. ITS is revolutionizing various sectors, from transportation infrastructure to public transport and fleet management. For instance, a major city implemented a traffic management system that reduced congestion by 20%, resulting in significant fuel savings and emission reduction strategies. ITS standards compliance plays a crucial role in this dynamic market, ensuring seamless integration of autonomous vehicles, data analytics platforms, and communication protocols. The integration of these technologies is paving the way for real-time traffic data analysis, adaptive traffic control, and travel time prediction.

What will be the Size of the Intelligent Transport System (ITS) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Moreover, the deployment of sensor networks and vehicle-to-infrastructure communication is enabling traffic congestion mitigation, public transport optimization, and pedestrian safety systems. The industry is expected to grow at a robust rate, with a recent study projecting a 15% annual increase in demand for ITS solutions. ITS security protocols are also a priority, with cloud-based platforms and smart traffic signals ensuring data privacy and cybersecurity. The markets continuous unfolding is also marked by the development of network optimization algorithms, driver behavior analysis, and public transport scheduling systems. The toll management segment is the second largest segment of the Application and was valued at USD 19.75 billion in 2023.

The markets evolution is also reflected in the deployment of parking guidance systems and smart cities infrastructure, which are transforming urban landscapes and improving overall transportation efficiency.

The integration of cloud computing in fleet management operations is a significant trend, enabling real-time data processing and analysis, improving operational efficiency and safety. However, challenges persist, including complex system integration and interoperability issues, which hinder the seamless implementation and adoption of ITS solutions across various transportation sectors.

Companies must navigate these obstacles to effectively capitalize on the markets potential and deliver innovative, integrated, and interoperable ITS solutions to meet the evolving demands of transportation infrastructure and services. Furthermore, the integration of connected vehicle technology and incident detection systems is enhancing emergency vehicle preemption and enabling sustainable transportation solutions. The integration of systems, including wireless communication, artificial intelligence, and deep learning, enables continuous innovation and adaptation to the ever-changing transportation landscape.

How is this Intelligent Transport System (ITS) Industry segmented?

The intelligent transport system (ITS) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in USD million for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Traffic management

- Toll management

- Automotive and infotainment telematics

- Public transport

- Others

- Type

- Advanced traffic management system

- Advanced traveller information system

- Advanced public transportation system

- Advanced transportation pricing system

- Others

- Mode Of Transportation

- Roadway

- Railway

- Airway

- Maritime

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The Traffic management segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 21.08 billion in 2023. It continued to the largest segment at a CAGR of 7.71%.The market is witnessing significant growth, particularly in the area of traffic management. Advanced Traffic Management Systems (ATMS) are a key component of this market, gaining popularity among government authorities and departments such as municipalities, government agencies, and state and regional governments. The increasing demand for ATMS can be attributed to the growing issue of traffic congestion worldwide. According to a study, the number of vehicles on the road is projected to increase by 50% by 2030. This trend is leading to higher transportation costs for players in the transportation industry and travel service providers. Edge computing and sensor fusion enable high-definition mapping and travel time prediction, providing valuable insights for connected infrastructure and passenger information systems.

To mitigate traffic congestion, ITS solutions are being integrated into transportation infrastructure. Energy-efficient transportation, emission reduction strategies, multimodal transport planning, and real-time traffic data are some of the essential components of ITS. For instance, the deployment of sensor networks and vehicle-to-infrastructure communication has led to the development of adaptive traffic control systems, travel time prediction, and traffic flow simulation. ITS standards compliance, public transport optimization, and communication protocols are other critical aspects of the market. The integration of autonomous vehicles, data analytics platforms, and data visualization tools is also driving market growth. The market is expected to grow at a steady rate during the forecast period, with sustainable transportation solutions, parking guidance systems, and smart city infrastructure being significant growth areas.

The Traffic management segment was valued at USD 17.13 billion in 2019 and showed a gradual increase during the forecast period.

The Intelligent Transport System (ITS) Market is transforming global mobility through cutting-edge technologies. Key advancements include V2X communication protocols and traffic simulation models that optimize traffic flow and safety. Efficient parking space availability solutions and seamless ITS system integration enhance urban mobility. A robust ITS communication architecture supports a fully integrated transport network, enabling smarter transportation. Route guidance systems powered by a centralized data analytics platform offer real-time decision-making. The rise of Mobility as a Service (MaaS) is reshaping commuting behaviors, backed by scalable ITS architecture design. Adoption of a cloud-based ITS platform ensures data-driven operations, flexibility, and rapid deployment.

Additionally, the integration of emergency vehicle preemption, connected vehicle technology, and incident detection systems is enhancing road safety and improving traffic flow. Network optimization algorithms and adaptive traffic control systems are essential for efficient transportation and reducing driver behavior analysis. The ITS market is experiencing dynamic growth, driven by the need for efficient transportation, reducing traffic congestion, and improving road safety.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavios analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven by the increasing adoption of energy-efficient transportation solutions, advanced road traffic monitoring systems, and traffic management systems. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 47.38 billion. These innovations aim to reduce emissions and optimize multimodal transport planning. ITS standards compliance, autonomous vehicle integration, and data analytics platforms are crucial components of this evolution. Security protocols ensure data privacy and integrity, while public transport optimization and communication protocols enhance efficiency. Traffic congestion mitigation strategies, such as fleet management systems and sensor network deployment, enable real-time traffic data analysis and vehicle-to-infrastructure communication. Travel time prediction and traffic flow simulation systems improve route guidance and ensure pedestrian safety.

Intelligent transportation infrastructure, network optimization algorithms, and adaptive traffic control systems contribute to a seamless traffic flow. Sustainable transportation solutions, like parking guidance systems and smart city infrastructure, are essential for reducing carbon footprints. Emergency vehicle preemption, connected vehicle technology, and incident detection systems ensure safety and efficiency. The ITS market in North America is projected to expand by 15% over the next five years, as cities invest in smart traffic signals and cloud-based ITS platforms to create a more efficient and interconnected transportation network. For instance, New York Citys implementation of smart traffic signals reduced travel time by 25% during peak hours.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The market is experiencing significant growth due to the increasing demand for optimized traffic flow, real-time data analysis, and sustainable transportation solutions in smart cities. Vehicle-to-everything (V2X) communication is a key driver, enabling predictive modeling for traffic congestion and improving response times for emergency vehicles. Sensor network design plays a crucial role in the success of ITS, providing the foundation for data collection and analysis. Optimization algorithms are employed to manage traffic flow, with traffic signal control strategies for intersections and public transport scheduling optimization algorithms ensuring efficient use of resources.

The integration of autonomous vehicles in ITS is a major development, requiring advanced communication protocols and standards for seamless integration. Data security protocols are essential to protect sensitive information and maintain privacy. Performance evaluation of traffic management systems is critical for continuous improvement, with cloud-based platforms providing a scalable solution for data management. Real-time data analysis for travel time and parking guidance systems optimization techniques contribute to enhanced urban mobility patterns. ITS infrastructure design considerations include the deployment strategies for smart traffic signals and fleet management system integration. The impact on urban mobility patterns is significant, with improvements in emergency vehicle response time and overall traffic flow.

Predictive modeling for traffic congestion and optimization algorithms for parking guidance systems are essential components of ITS, ensuring a sustainable and efficient transportation network. Data security protocols and performance evaluation are ongoing priorities to maintain the reliability and effectiveness of these systems.

What are the key market drivers leading to the rise in the adoption of Intelligent Transport System (ITS) Industry?

- Traffic congestion and road accidents significantly contribute to the markets growth due to the increasing demand for solutions that mitigate these issues and ensure safer and more efficient transportation systems. The market is experiencing significant growth due to increasing urbanization and the rising use of automobiles, particularly in developing countries. This trend is driven by the expanding middle-class population and their increasing disposable income. Traffic congestion is a pressing issue in many parts of the world, with developing countries like India and China experiencing more severe challenges.

- According to industry reports, the global ITS market is expected to grow by over 15% in the next five years, underscoring the markets potential for continued expansion. ITS solutions, such as congestion charges, road user charges, and electronic toll collection, are being implemented by government organizations to mitigate traffic congestion. One notable outcome of these initiatives is the reduction of bottlenecks and optimization of traffic flow. For instance, dynamic traffic control systems, including adaptive traffic signals, real-time traffic monitoring, and incident detection, have proven effective in improving traffic management and reducing travel time.

What are the market trends shaping the Intelligent Transport System (ITS) Industry?

- The increasing adoption of cloud computing is a notable trend in fleet management operations. Cloud computing is revolutionizing the transportation industry by providing on-demand access to a shared pool of configurable resources. This technology is essential for transport fleet owners and operators due to its benefits, which include real-time visibility of operations, cost savings, improved vehicle uptime through data sharing, and low maintenance costs. Cloud computings flexibility allows for various deployment models, such as private, public, community, and hybrid clouds, catering to different user requirements.

- This growth is attributed to the increasing demand for real-time data processing and analysis in the transportation sector. The benefits of cloud computing have led to a robust adoption rate, with the market expected to grow significantly in the coming years. According to recent studies, the global Intelligent Transport Systems (ITS) market is projected to expand by 25% in the next five years.

What challenges does the Intelligent Transport System (ITS) Industry face during its growth?

- The integration and interoperability of systems represent a significant challenge that can hinder industry growth. This issue arises when different systems or technologies fail to work seamlessly together, leading to inefficiencies, increased costs, and potential delays. Addressing these complexities requires a deep understanding of various technologies and their interconnections, as well as the ability to design and implement effective solutions. Overcoming system integration and interoperability hurdles is crucial for fostering innovation, improving operational efficiency, and driving industry advancements. The market faces challenges due to interoperability issues in existing systems, leading to increased complexities and costs.

- For instance, a study revealed that system integration accounted for over 30% of the total ITS project costs. The ITS market is expected to grow by more than 15% annually, driven by the increasing demand for efficient transportation and the integration of advanced technologies like IoT and AI. Operational technology systems lack the ability to integrate effectively, resulting in isolated functioning. To achieve a unified digital workflow, its essential to facilitate effective data sharing between machines and other systems for various ITS end-users. System integration involves combining diverse hardware and software components, such as traffic sensors, GPS devices, communication networks, and control centers. However, the heterogeneity of systems developed by different companies, each with proprietary standards and protocols, results in compatibility issues, escalating implementation costs, and delays in deployment.

Exclusive Customer Landscape

The intelligent transport system (ITS) market forecasting report includes the adoption lifecycle of the market, covering from the innovators stage to the laggards stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the intelligent transport system (ITS) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, intelligent transport system (ITS) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in Intelligent Transport Systems (ITS) and delivers advanced mobility solutions, including the innovative 3M Smart Transportation platform.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Advantech Co. Ltd.

- AECOM

- Airbus SE

- Axiomtek Co. Ltd.

- Cubic Corp.

- EFKON GmbH

- GMV Innovating Solutions SL

- Hitachi Ltd.

- HR Green Inc.

- Indra Sistemas SA

- Iteris Inc.

- Mundys S.p.A.

- Serco Group Plc

- SICE TyS

- Siemens AG

- Stantec Inc.

- Sumitomo Electric Industries Ltd.

- Teledyne Technologies Inc.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Intelligent Transport System (ITS) Market

- In January 2024, TransCore Link, a leading provider of transportation management and tolling solutions, announced the launch of its new Intelligent Transport System (ITS) for public transit agencies. The system, named SmartConnect, offers real-time data analytics, automated fare collection, and demand-responsive services (TransCore Press Release, 2024).

- In March 2024, Cisco Systems and TomTom announced a strategic partnership to integrate TomToms real-time traffic information and mapping services into Ciscos ITS offerings. This collaboration aims to enhance traffic management and improve overall transportation efficiency (Cisco Press Release, 2024).

- In April 2025, Kapsch TrafficCom, an international provider of ITS solutions, secured a USD 100 million contract from the New York Metropolitan Transportation Authority (MTA) to modernize its traffic management system. The project includes the deployment of advanced sensors, real-time data analytics, and intelligent traffic signal control (MTA Press Release, 2025).

- In May 2025, the European Union approved the deployment of the European Cooperative Intelligent Transport System (C-ITS), a large-scale ITS project aimed at improving road safety and traffic efficiency. The project involves the installation of roadside units and on-board units in vehicles, enabling real-time communication between vehicles and infrastructure (European Commission Press Release, 2025).

Research Analyst Overview

The market for Intelligent Transport Systems (ITS) continues to evolve, driven by advancements in technology and increasing travel demand. ITS applications span various sectors, including traffic management, public transport, and urban traffic control. For instance, traffic modeling software and real-time traffic information have led to a 15% reduction in traffic congestion in major cities. ITS systems integrate various components, such as data security measures, travel demand management, cost-benefit analysis, and traffic signal timing, to optimize network performance. ITS deployment strategies encompass sensor data fusion, predictive maintenance, and smart mobility solutions, aiming for system reliability assessment and traffic safety improvement.

The Intelligent Transport System (ITS) Market is advancing rapidly, with the vehicle-to-everything communication impact revolutionizing connectivity. Enhanced optimization algorithms for traffic flow and real-time data analysis for traffic management are improving urban mobility. Smart infrastructure relies on sensor network design for intelligent transport and robust data security protocols for ITS applications. Focusing on sustainable transportation solutions for smart cities supports environmental goals. Standardization through ITS communication protocols and standards ensures interoperability. A cloud-based platform for data management in ITS enables efficient data use. The impact of ITS on urban mobility patterns is significant, influencing city planning. Analysis of travel time data for route planning enhances commuter efficiency. Integration of fleet management system integration with ITS streamlines logistics. Lastly, ITS facilitates emergency vehicle response time improvement, ensuring faster interventions and safer cities.

The ITS market is expected to grow by over 10% annually, fueled by the integration of autonomous vehicle control, public transport integration, and sustainable transport planning. Urban traffic control and transit signal priority are essential components of this growth, as they enhance network capacity analysis and dynamic route optimization. Incident management strategies and integrated transport networks further contribute to the markets ongoing unfolding, ensuring optimal performance evaluation metrics and network performance metrics.

Dive into Technavios robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Intelligent Transport System (ITS) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

247 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2025-2029 |

USD 47.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.8 |

|

Key countries |

US, China, Germany, UK, Canada, France, Japan, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Intelligent Transport System (ITS) Market Research and Growth Report?

- CAGR of the Intelligent Transport System (ITS) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the markets competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the intelligent transport system (ITS) market growth of industry companies

We can help! Our analysts can customize this intelligent transport system (its) market research report to meet your requirements.